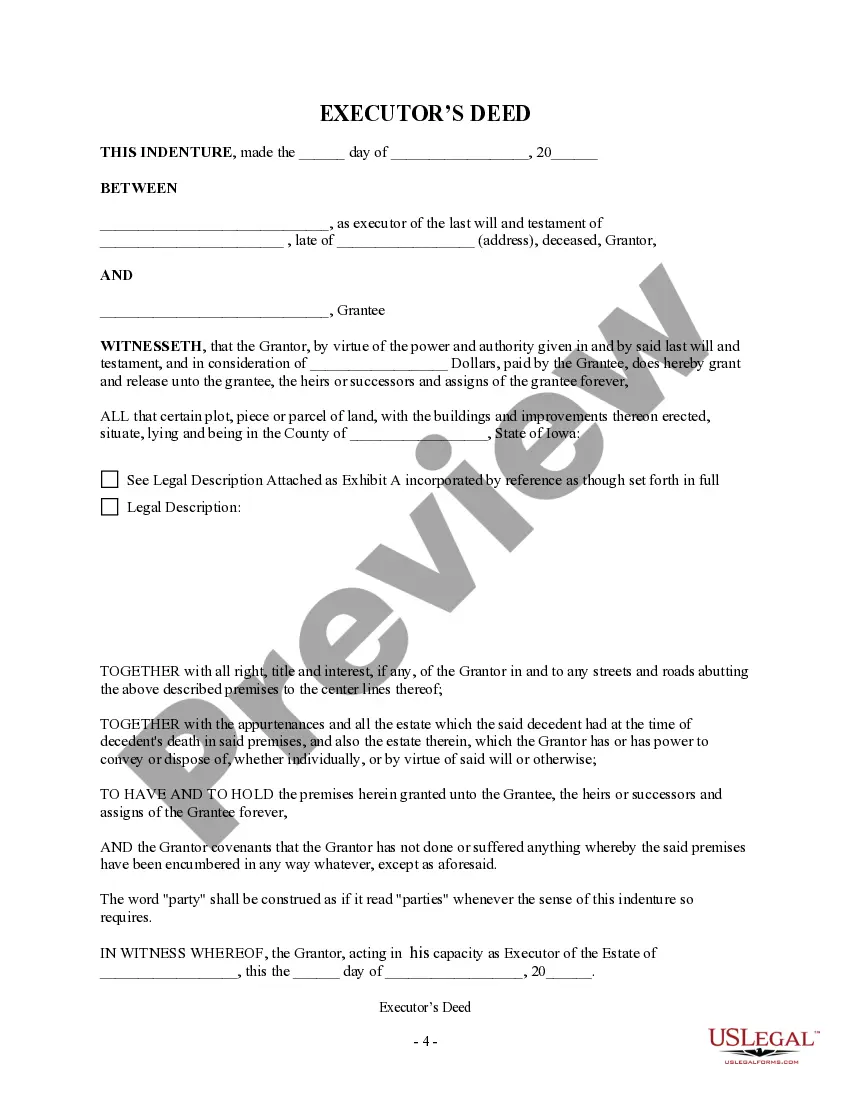

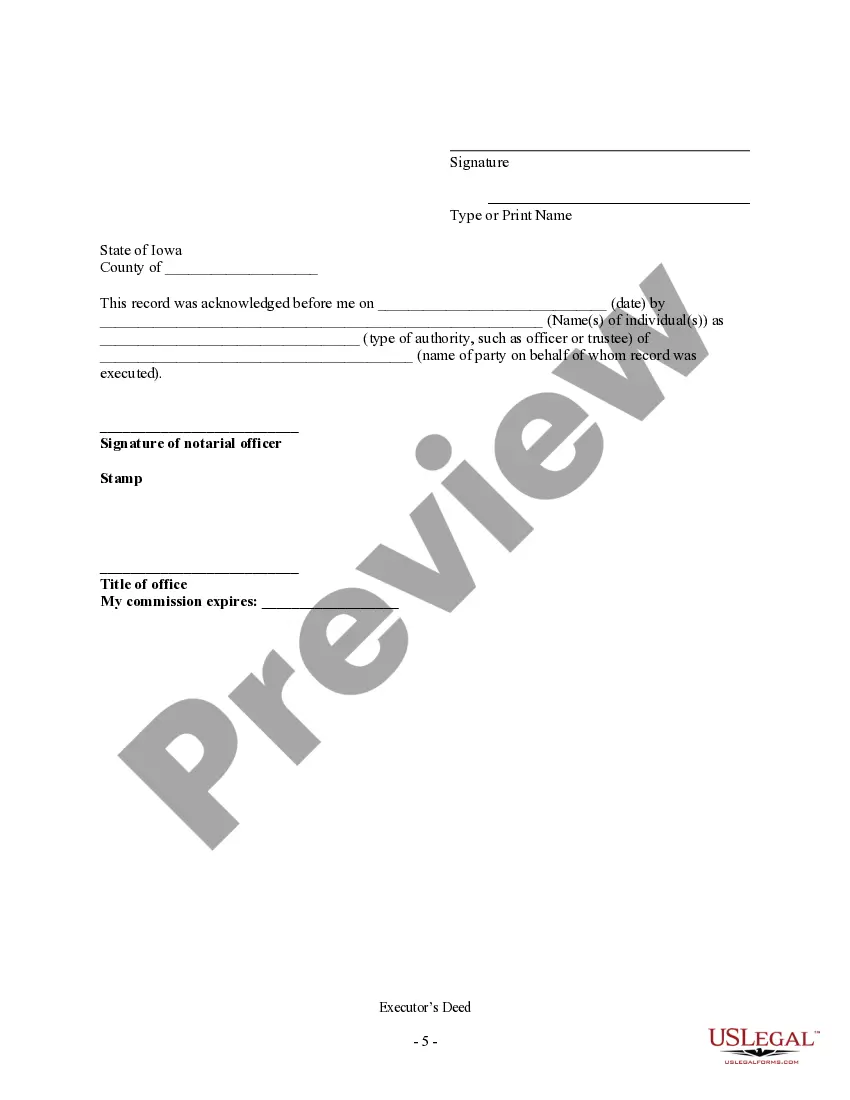

This form is an Executor's Deed where the grantor is the executor of an estate and the Grantee is an individual. Grantor conveys the described property to the grantee. \This deed complies with all state statutory laws.

Cedar Rapids Iowa Executor's Deed — Executor to Individual is a legal document used to transfer property from the executor of an estate to an individual beneficiary. It is an important part of the probate process in Cedar Rapids, Iowa. An Executor's Deed grants the executor the authority to sell or transfer the property to the intended recipient, who can be a family member, friend, or any individual designated as a beneficiary in the deceased's will. The executor is the person appointed by the court to administer the estate of the deceased person and is responsible for settling the outstanding debts and distributing the assets according to the instructions outlined in the will or by state law in the absence of a will. In Cedar Rapids, Iowa, there are several types of Executor's Deeds that may be used depending on the circumstances: 1. Executor's Deed with Full Authority: This type of deed is granted when the executor has full authority over the estate and can sell or transfer the property without any restrictions or limitations. 2. Executor's Deed with Limited Authority: In some cases, the executor may have restrictions or limitations on their authority to sell or transfer the property. This could be due to legal disputes, pending claims, or other unresolved matters that need to be resolved before the transfer can take place. 3. Executor's Deed in Lieu of Probate: This type of deed is used when the property in question is exempt from the probate process. It allows for a faster and more simplified transfer of ownership without going through the full probate procedure. 4. Executor's Deed with Court Confirmation: In certain situations, the executor may need to seek court confirmation before transferring the property to an individual. This could be necessary if there are concerns about the validity of the will or if there are disputes among the beneficiaries. Regardless of the specific type, the Cedar Rapids Iowa Executor's Deed — Executor to Individual is a crucial legal document that ensures the lawful transfer of property from an estate to an individual beneficiary. It provides clarity and protection for all parties involved and helps facilitate the proper distribution of assets.