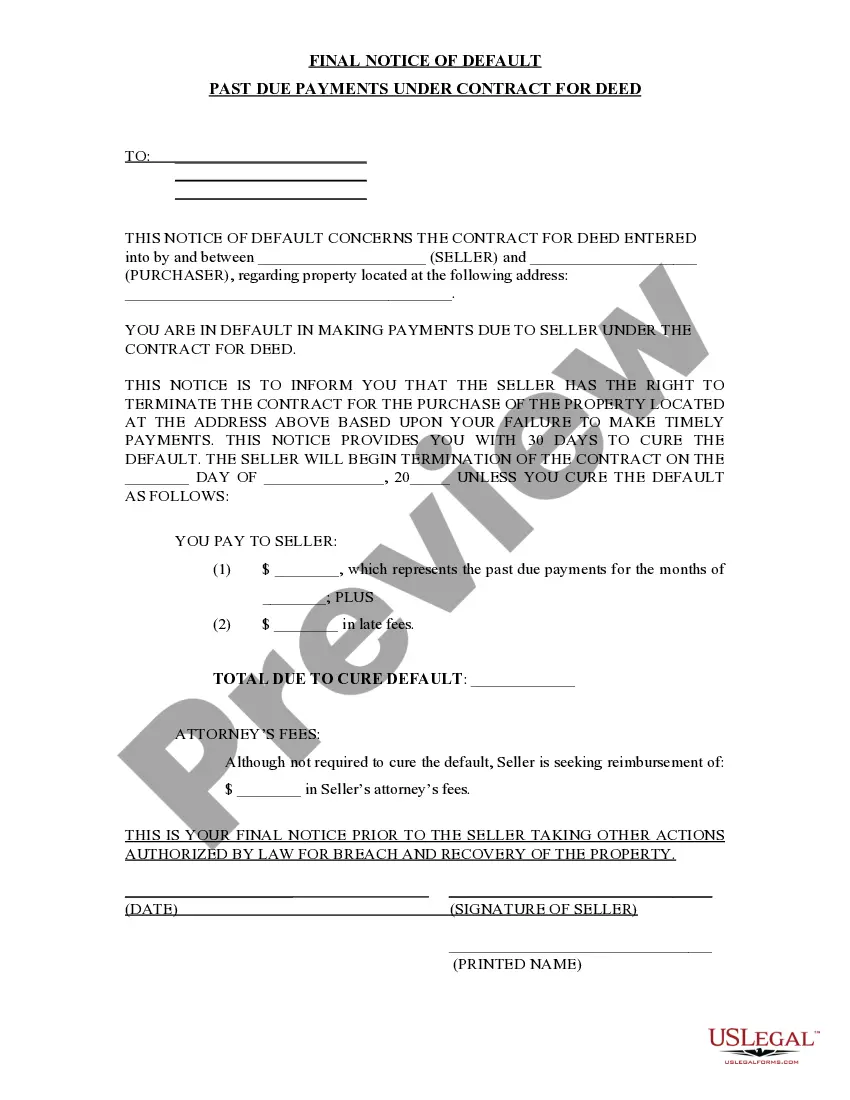

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Davenport Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Iowa Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Are you seeking a trustworthy and cost-effective provider of legal forms to purchase the Davenport Iowa Final Notice of Default for Outstanding Payments related to the Contract for Deed? US Legal Forms is your perfect choice.

Whether you need a simple agreement to establish rules for living with your partner or a bundle of forms to facilitate your separation or divorce proceedings through the court, we have you covered. Our site offers more than 85,000 current legal document templates for personal and commercial application. All templates we provide are not generic and tailored to meet the specifications of different states and counties.

To access your document, you must Log In to your account, locate the desired form, and click the Download button next to it. Please remember, you can download your previously acquired form templates at any time in the My documents section.

Is this your first time visiting our site? No problem. You can create an account easily, but before you do that, make sure to.

Now you can register for your account. Then select a subscription plan and proceed with the payment. Once the payment is completed, download the Davenport Iowa Final Notice of Default for Outstanding Payments related to the Contract for Deed in any available file format. You can return to the website whenever needed and redownload the document at no additional cost.

Finding current legal forms has never been simpler. Try US Legal Forms today, and eliminate the hassle of spending hours researching legal documentation online once and for all.

- Verify if the Davenport Iowa Final Notice of Default for Outstanding Payments related to Contract for Deed adheres to the laws of your state and locality.

- Review the form’s description (if available) to determine who and what the document is designed for.

- Start the search again if the form does not fit your legal needs.

Form popularity

FAQ

A request notice default refers to an official notification indicating that a borrower has defaulted on payments, specifically in the context of a Contract for Deed. In Davenport, Iowa, a Final Notice of Default for Past Due Payments is crucial for both buyers and sellers to understand their rights and obligations. This notice serves as a formal step in the process, giving all parties a chance to resolve outstanding payments before further legal action occurs. Utilizing platforms like US Legal Forms can help you navigate these notifications and ensure you follow the correct procedures.

A deed is a legal document that officially transfers property ownership from one party to another. In contrast, a contract for deed serves as a payment agreement where the buyer makes gradual payments to the seller while the seller retains legal title until full payment is made. This distinction is significant in Davenport, Iowa, especially when dealing with situations like a Final Notice of Default for Past Due Payments in connection with Contract for Deed, where clarity on ownership and responsibilities is crucial.

A notice of default is not the same as foreclosure; rather, it is an early warning signal indicating that payments are overdue. Foreclosure is a legal process that follows a notice of default if the debt remains unresolved. Understanding the distinction is essential, especially if you receive a Davenport Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed, as timely action can prevent foreclosure.

People often choose contracts for deed as an alternative method for purchasing property, especially if they face challenges obtaining traditional financing. This approach allows buyers to secure a home while making payments directly to the seller over time. In places like Davenport, Iowa, understanding the implications of a Final Notice of Default for Past Due Payments in connection with Contract for Deed is important to ensure a smooth process.

In a contract for deed, the buyer is typically responsible for paying property taxes. This arrangement gives the buyer the benefits of ownership, such as the ability to claim tax deductions. However, it also emphasizes the need for the buyer to stay current on bills, especially in Davenport, Iowa, to prevent a Final Notice of Default for Past Due Payments in connection with Contract for Deed.

A notice of default on a land contract is a formal communication that indicates the buyer has failed to make required payments. This notification serves as an alert about overdue amounts, typically emphasizing that timely resolution is necessary. In Davenport, Iowa, receiving a Final Notice of Default for Past Due Payments in connection with Contract for Deed means it’s crucial to act quickly to avoid further complications.

To issue a notice of default, you should first confirm that the borrower has missed payments according to the terms of the contract. Next, prepare the Davenport Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed, making sure to include all necessary information. Finally, deliver the notice to the borrower via certified mail or another formal method to ensure proper documentation of receipt.

A notice of default usually appears as a formal letter or document that outlines the details of the payment issue. For a Davenport Iowa Final Notice of Default for Past Due Payments related to a Contract for Deed, it typically includes sections detailing the amount overdue, payment history, and instructions for following up. The format tends to be straightforward, with clear headings and bullet points for easy reading.

To write a notice of default, start by clearly stating the nature of the default, including payment details. Make sure to reference the Davenport Iowa Final Notice of Default for Past Due Payments in connection with Contract for Deed to ensure clarity about the situation. Include a specific timeframe for the borrower to address the default and highlight the consequences of non-compliance, such as potential legal action.

When a contract for deed is in default, the seller must follow a legal process to regain possession and equitable title to the property. This involves issuing a Davenport Iowa Final Notice of Default for Past Due Payments, which alerts the buyer to the default and often provides a timeline to rectify the situation. If the buyer fails to respond or make payments, the seller may then initiate eviction proceedings, according to state laws.