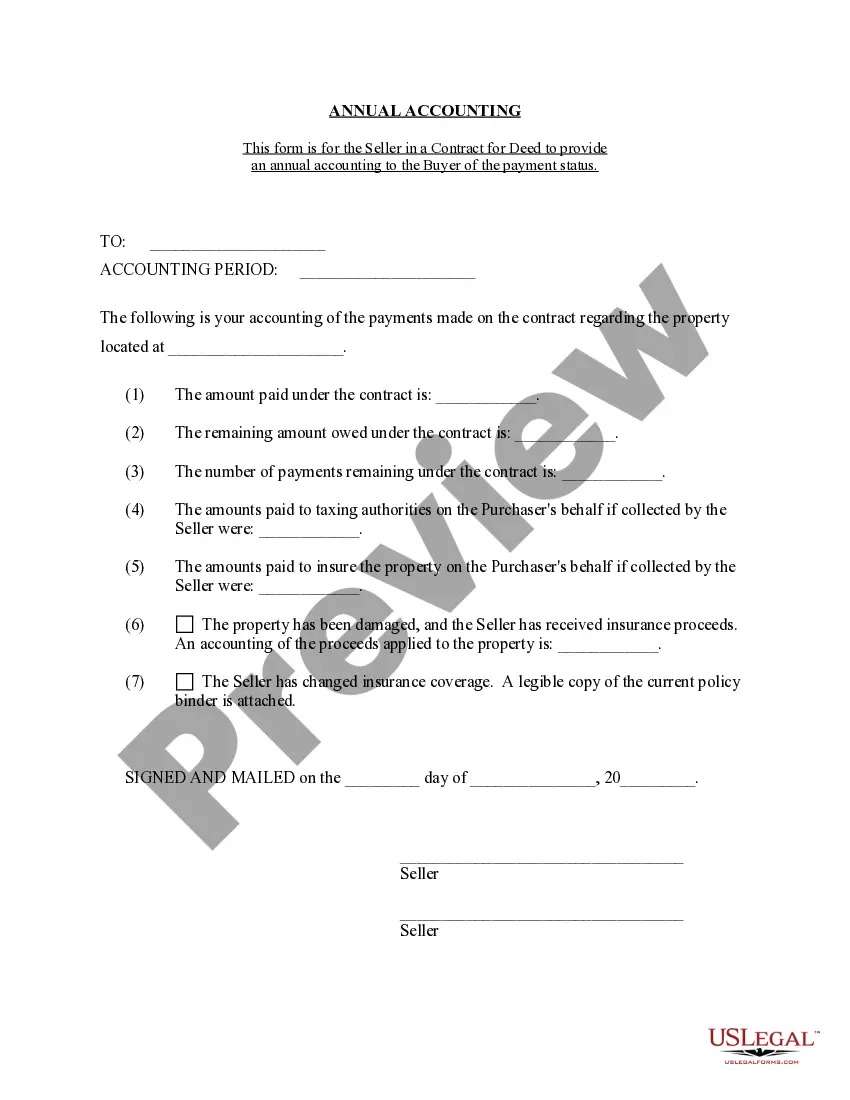

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Davenport Iowa Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Iowa Contract For Deed Seller's Annual Accounting Statement?

Are you searching for a trustworthy and affordable legal documents provider to obtain the Davenport Iowa Contract for Deed Seller's Annual Accounting Statement? US Legal Forms is your ideal choice.

Whether you require a fundamental agreement to establish guidelines for living with your partner or a collection of documents to facilitate your divorce through the legal system, we have you covered.

Our site offers more than 85,000 current legal document templates for both personal and business needs. All templates we provide are not universal and are tailored to meet the demands of specific states and regions.

To acquire the document, you must Log In to your account, locate the desired form, and click the Download button next to it. Please remember that you can download any previously purchased form templates at any time from the My documents section.

If the form isn’t suitable for your particular situation, start the search anew.

Now you can sign up for your account. Then choose the subscription plan and proceed with payment. Once the payment is complete, download the Davenport Iowa Contract for Deed Seller's Annual Accounting Statement in any available format. You can return to the site at any time and redownload the document free of charge.

- Is this your first visit to our platform.

- No problem.

- You can easily create an account, but first, ensure you do the following.

- Verify that the Davenport Iowa Contract for Deed Seller's Annual Accounting Statement meets the laws of your state and locality.

- Review the form’s details (if available) to learn who and what the document applies to.

Form popularity

FAQ

Pros and Cons of a Contract for Deed Pro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.

Disadvantages of Common Law Contracts Contracts cost time and money to write. Whether they're drafted by a lawyer or reviewed by one, or even if they are written by an HR professional, contracts require a good deal of energy and are not an inexpensive undertaking.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

The land contract purchaser takes possession of the real estate and agrees to make installment payments of principal and interest, typically on a monthly basis, until the contract is paid in full or balloons. During the term of the contract, the purchaser has ?equitable title? to the property.

Land contract cons. Higher interest rates ? Since the seller is taking most of the risk, they may insist on a higher interest rate than a traditional mortgage. Ownership is unclear ? The seller retains the property title until the land contract is paid in full.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

The Michigan land contract process is as follows: Most land contracts will require the buyer to make a down payment of 10% or more of the purchase price. Then, the seller will have to make installment payments for a set period of time. The terms can vary, but most agreements are between two and four years.

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

Risk to the Buyer A contract for deed has risk for the buyer. Because the seller keeps legal title to property until the contract price is paid in full, the buyer does not become the owner of the property until he or she completes his payment obligations and receives title from the seller.

The Land Contract or Memorandum must state that the buyer is responsible for paying the property taxes. The Land Contract or Memorandum must be selling the property. Option to buy or lease agreements will not qualify for the homestead and mortgage deductions. The Land Contract or Memorandum must be recorded.