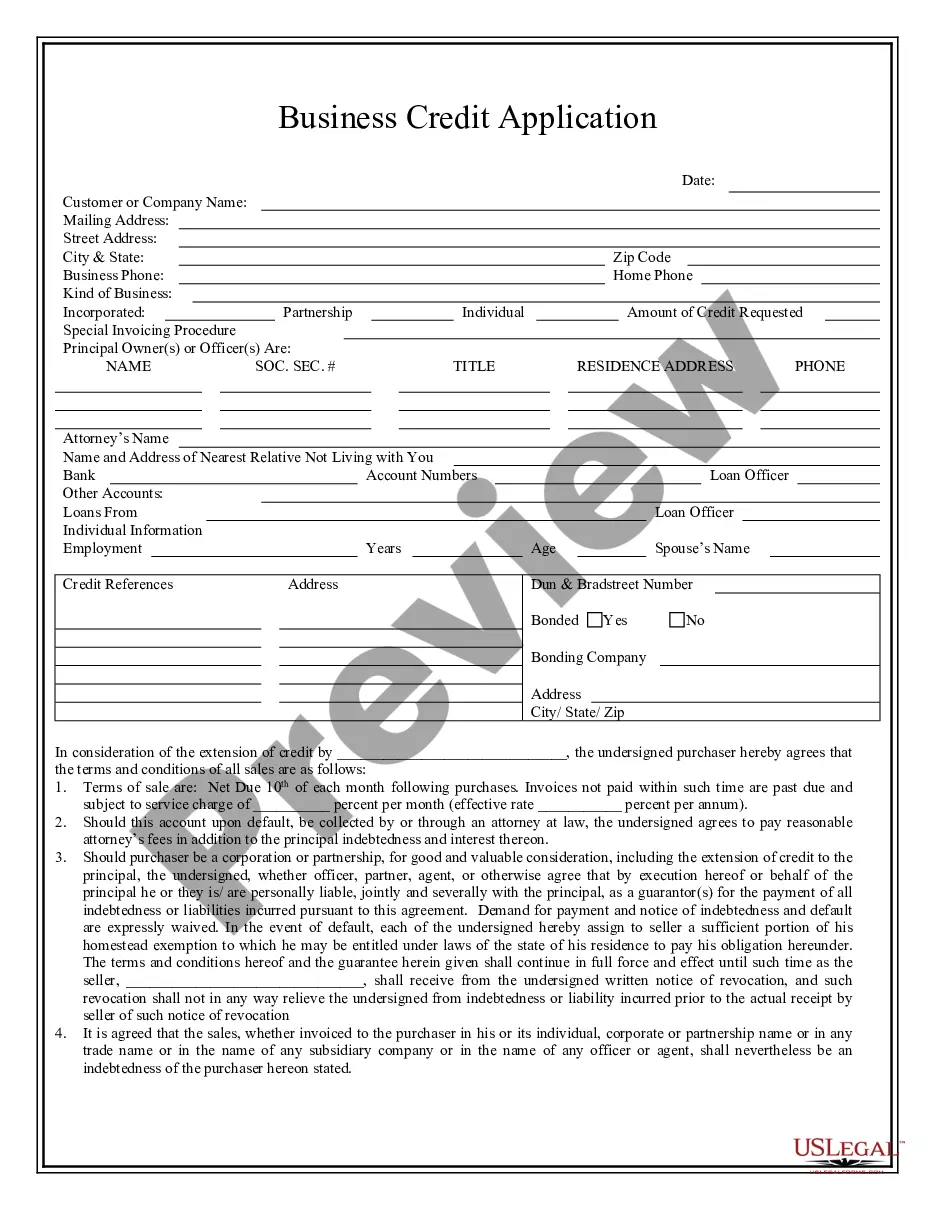

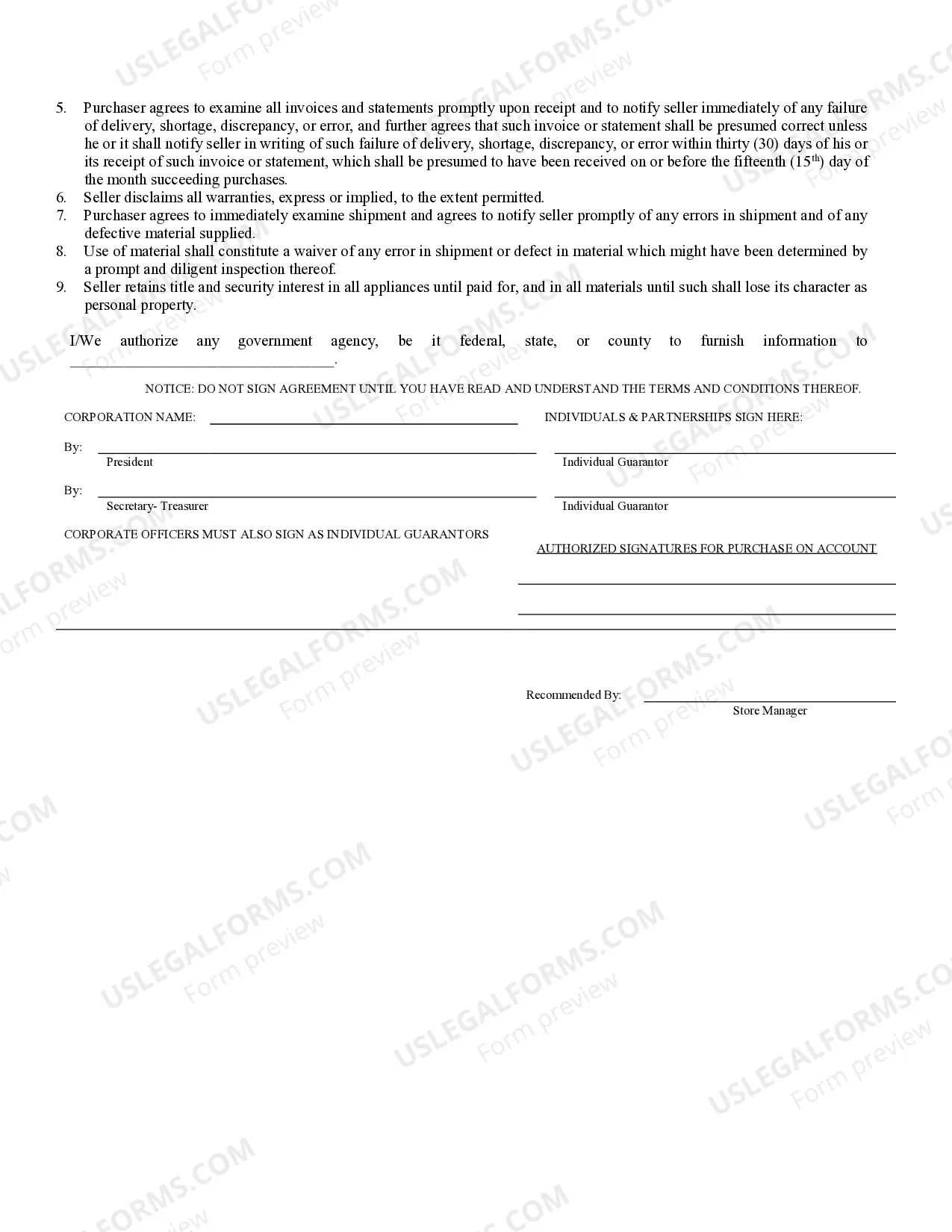

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Savannah Georgia Business Credit Application

Description

How to fill out Georgia Business Credit Application?

If you are looking for a legitimate form template, it’s incredibly difficult to select a more user-friendly platform than the US Legal Forms website – one of the most extensive online collections.

With this collection, you can locate a vast number of document samples for business and personal purposes sorted by types and states, or keywords.

Thanks to the efficient search feature, finding the latest Savannah Georgia Business Credit Application is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Specify the file format and save it to your device.

- Furthermore, the validity of each document is verified by a team of experienced lawyers who routinely review the templates on our site and update them in line with the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to acquire the Savannah Georgia Business Credit Application is to Log In to your profile and click the Download button.

- If this is your first time using US Legal Forms, simply follow the instructions below.

- Ensure you have located the sample you need. Review its details and use the Preview option (if available) to examine its contents. If it doesn’t meet your requirements, make use of the Search feature located at the top of the page to find the appropriate document.

- Confirm your choice. Click the Buy now button. Then, select your preferred subscription plan and enter your information to create an account.

Form popularity

FAQ

Yes, in Georgia, most small businesses need a license or permit to operate legally. The requirements can vary by county or municipality, so it's important to check local laws. For those applying for a Savannah Georgia Business Credit Application, having the correct licenses demonstrates credibility to lenders. Our services can help you understand and navigate these requirements efficiently.

Yes, New York requires businesses to obtain various licenses depending on the type of work they do. Whether you're starting a restaurant, a retail store, or any other type of business, you'll need to research your specific licensing needs. If you're also considering a Savannah Georgia Business Credit Application, having the right licenses in place in New York can strengthen your business overall. Our platform provides valuable insights to assist you.

A business permit is typically required for particular activities and ensures they meet local regulations. In contrast, a business license allows you to conduct general business activities within your location. For your Savannah Georgia Business Credit Application, knowing these differences will aid you in navigating your compliance requirements. Use our resources to simplify the process and ensure you have the correct documents.

The key difference lies in their purpose: a permit is typically needed for a specific action or event, such as construction or signage, while a license is broader and indicates that a person or business meets certain qualifications to operate. When preparing your Savannah Georgia Business Credit Application, clarifying these distinctions can help you gather the right documentation. Our platform can assist you in identifying the necessary licenses and permits for your specific business needs.

A business license allows you to operate your business legally within a certain jurisdiction, while a business permit grants permission for specific activities, such as building renovations or health inspections. To ensure a smooth process for your Savannah Georgia Business Credit Application, it's crucial to understand both. The requirements for licenses and permits vary by city and state, so always check local regulations for compliance.

The small business credit guarantee program in Georgia aims to enhance access to credit for small businesses. By facilitating the Savannah Georgia Business Credit Application, this program reduces the risk for lenders. It provides guarantees on loans, making it easier for small enterprises to secure the funding they need. This support can help you grow your business and create jobs in your community.

To obtain business credit, start by establishing a strong business entity and ensuring that your business is registered properly. Next, gather essential financial documents, such as your business plan and revenue projections. Then, complete the Savannah Georgia Business Credit Application available through uslegalforms. This application guides you through the process of accessing financial resources tailored to your business needs.

Registering a business in Georgia involves several steps, including choosing a business structure and naming your business. You can begin the process by filing your formation documents with the Georgia Secretary of State's office. Additionally, ensure you obtain any required licenses or permits, and consider visiting uslegalforms for guidance on the paperwork involved in your Savannah Georgia Business Credit Application.

To complete a Savannah Georgia Business Credit Application, start by gathering all required documents, such as your business registration and tax identification information. Fill in the application clearly and accurately, detailing your personal and business information. Finally, review the application to ensure every aspect is filled out before submission.

Yes, you can include expected income on your Savannah Georgia Business Credit Application, especially if your business is new or seasonal. Make sure to provide a realistic estimate based on your business plan and any relevant financial projections. However, be mindful that lenders may require proof of established revenue for higher credit limits.