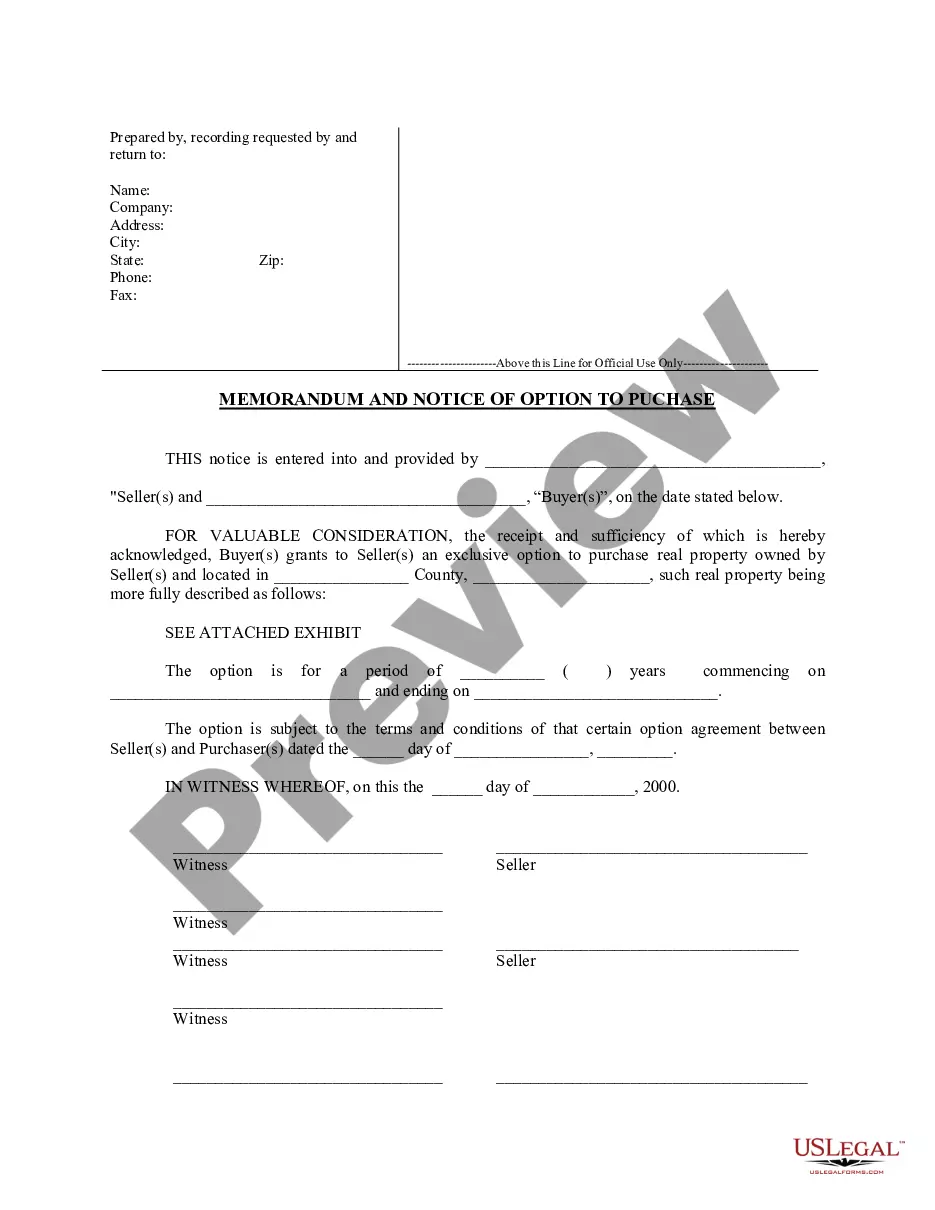

Cape Coral Florida Application for Self-Insurance

Description

How to fill out Florida Application For Self-Insurance?

We consistently endeavor to reduce or thwart legal harm when engaging with intricate law-related or financial matters.

To achieve this, we seek legal assistance from attorneys, which are typically quite costly.

However, not every legal issue is quite as intricate.

Many of them can be managed independently.

Utilize US Legal Forms whenever you need to quickly and securely find and download the Cape Coral Florida Application for Self-Insurance or any other document. Simply Log In to your account and click the Get button beside it. If you misplace the document, you can always retrieve it again from the My documents tab.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform empowers you to handle your affairs autonomously without the requirement of consulting an attorney.

- We offer access to legal template documents that are not always readily available.

- Our templates are specific to states and regions, which greatly simplifies the search process.

Form popularity

FAQ

Yes, you can self-insure a car in Florida if you fulfill the criteria established by state law. To self-insure, you need to prove that you have enough financial resources to handle any liabilities resulting from accidents. Completing the Cape Coral Florida Application for Self-Insurance is crucial in this process, as it provides the state with the information needed to evaluate your eligibility for self-insurance.

The statute of self-insurance in Florida allows individuals and companies to self-insure their vehicles under certain conditions. This statute typically applies to owners who can demonstrate substantial financial ability to cover potential damages. If you are considering this option, it’s essential to understand the legal requirements and documentation needed, such as the Cape Coral Florida Application for Self-Insurance, which outlines the necessary steps.

In Florida, you cannot legally own or operate a vehicle without insurance. However, you have the option to apply for a self-insurance plan if you meet specific financial criteria. This allows you to use your financial resources to cover any potential liabilities rather than purchasing a traditional insurance policy. For those interested, the Cape Coral Florida Application for Self-Insurance can guide you through this process.

Yes, you can be self-insured in Florida for various types of insurance, including auto and home insurance. However, you must provide proof of financial stability to the state. Completing the Cape Coral Florida Application for Self-Insurance helps streamline this process, ensuring you secure the necessary documentation without hassle while protecting your assets effectively.

Self-insuring your home in Florida can be a smart choice if you have substantial savings and can handle potential losses. This option allows for greater control over your finances, but it does carry risks, as unexpected damages could be costly. Utilizing resources like the Cape Coral Florida Application for Self-Insurance can guide you through the process, ensuring you understand the benefits and implications of self-insurance.

Yes, you can self-insure your vehicle in Florida, but you must meet specific financial requirements. You need to demonstrate sufficient assets to cover potential liabilities that could arise from accidents or damages. By completing the Cape Coral Florida Application for Self-Insurance, you can formalize your intent and ensure compliance with state regulations.

To become an independent insurance agent in Florida, you need to first complete pre-licensing education and pass the state exam. After obtaining your license, seek out opportunities to work with various insurance companies, allowing you to offer a range of products. Additionally, consider utilizing platforms like US Legal Forms to navigate the Cape Coral Florida Application for Self-Insurance, helping you understand the necessary forms and requirements effectively.

To become self-insured in Florida, start by assessing your financial situation and understanding associated risks. Next, set aside sufficient funds to cover potential claims. Finally, completing the Cape Coral Florida application for self-insurance is essential to meet state requirements, ensuring your approach aligns with local regulations.

Disadvantages of insurance include premium costs, potential for claim denials, and detailed paperwork. Insurance policies can also limit coverage options while requiring additional fees for better protection. In contrast, the Cape Coral Florida application for self-insurance offers an alternative to traditional insurance, allowing you to tailor your financial strategies directly.

Self-service options can lead to misunderstandings or errors due to a lack of professional oversight. Users may struggle with complex processes without guidance, resulting in inefficiencies or mistakes. If you are exploring the Cape Coral Florida application for self-insurance, having support from platforms like uslegalforms can alleviate these challenges.