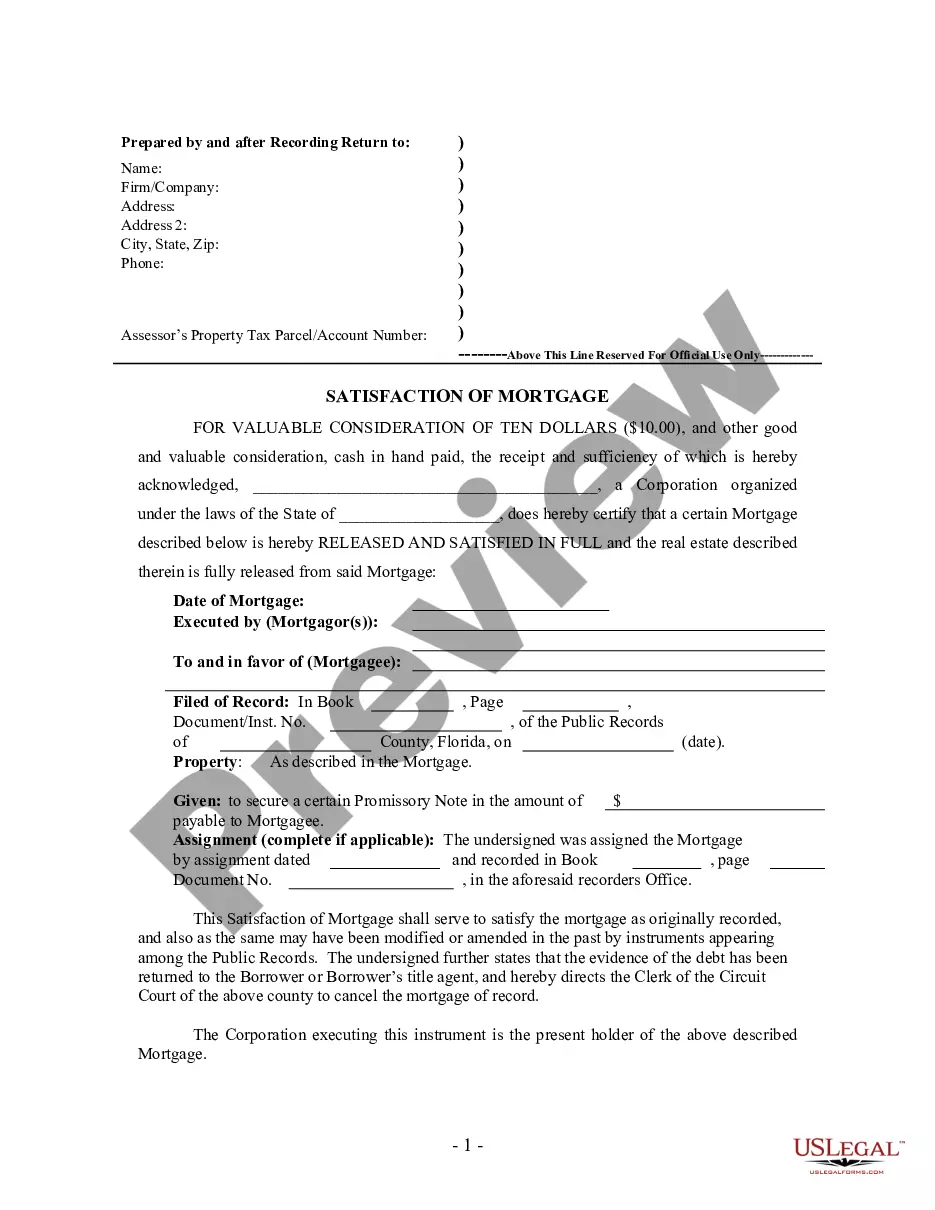

Port St. Lucie Florida Satisfaction, Release or Cancellation of Mortgage by Corporation

Description

How to fill out Florida Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

Locating authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It’s an online reservoir of over 85,000 legal documents for both personal and professional requirements and various real-world circumstances.

All the forms are systematically categorized by application area and jurisdiction domains, making it as simple as pie to search for the Port St. Lucie Florida Satisfaction, Release, or Cancellation of Mortgage by Corporation.

Maintaining documentation tidy and adhering to legal standards is highly significant. Utilize the US Legal Forms library to always have vital document templates for any needs readily available!

- Review the Preview mode and form details. Ensure you’ve selected the right one that fulfills your needs and fully aligns with your local jurisdiction standards.

- Search for an alternate template, if required. If you discover any discrepancy, use the Search tab above to locate the correct one. If it meets your criteria, proceed to the following step.

- Purchase the document. Click on the Buy Now button and select your preferred subscription plan. You need to create an account to gain access to the library’s resources.

- Complete your transaction. Enter your credit card information or use your PayPal account to pay for the service.

- Download the Port St. Lucie Florida Satisfaction, Release, or Cancellation of Mortgage by Corporation. Save the template on your device to proceed with its completion and gain access to it in the My documents section of your profile whenever you need it again.

Form popularity

FAQ

The statute of limitations for mortgage foreclosure in Florida is typically five years. This means that a lender must initiate foreclosure proceedings within five years of the borrower’s default. Understanding this timeline can significantly affect your decisions regarding mortgage payments and legal actions. Knowing the limits can empower you in situations involving Port St. Lucie Florida Satisfaction, Release or Cancellation of Mortgage by Corporation.

To file a complaint against a mortgage company in Florida, you should contact the Florida Office of Financial Regulation directly. They provide a structured process for lodging complaints against licensed mortgage lenders. Make sure to gather all relevant documentation to support your case. This step can greatly aid those seeking Port St. Lucie Florida Satisfaction, Release or Cancellation of Mortgage by Corporation, as it protects consumer rights.

In Florida, mortgage lenders are overseen by the Florida Office of Financial Regulation. This office monitors lending activities to ensure compliance with state and federal laws, providing protections for borrowers. If you have concerns about a lender’s practices, this agency is your point of contact. Understanding the landscape of oversight can help you navigate Port St. Lucie Florida Satisfaction, Release or Cancellation of Mortgage by Corporation more effectively.

Yes, Florida does impose a mortgage recording tax. This tax is calculated based on the amount of the mortgage and is due upon recording the mortgage with the local county clerk. If you're navigating a Port St. Lucie Florida Satisfaction, Release or Cancellation of Mortgage by Corporation, be sure to account for this tax in your financial planning.

A mortgage must be recorded in Florida to be enforceable against third parties. This step also helps prevent potential claims from other creditors and provides transparency in property ownership. Thus, when administering a Port St. Lucie Florida Satisfaction, Release or Cancellation of Mortgage by Corporation, ensure that all mortgages are properly recorded.

Yes, recording a mortgage in Florida is important for protecting both the lender and the borrower. This public recording establishes a legal claim against the property, providing assurance in property transactions. If you're dealing with a Port St. Lucie Florida Satisfaction, Release or Cancellation of Mortgage by Corporation, make sure all documents are recorded to safeguard your rights.

An unrecorded deed can be valid in Florida, but it may pose risks for the property owner. If the deed is not recorded, other parties may not acknowledge the ownership, potentially leading to disputes. Therefore, to avoid complications, it is beneficial to ensure timely documentation for your Port St. Lucie Florida Satisfaction, Release or Cancellation of Mortgage by Corporation.

In Florida, lenders are required to record a satisfaction of mortgage within 60 days after receiving payment in full. This time frame ensures that borrowers can expect timely updates to their property records. If you are managing a Port St. Lucie Florida Satisfaction, Release or Cancellation of Mortgage by Corporation, it’s essential to monitor this timeline and follow up with your lender if needed.

Yes, mortgages are public record in Florida. This means that anyone can access the records filed with the county clerk. Such records may include details about the mortgage as well as any subsequent satisfaction, release, or cancellation of the mortgage. Understanding this can help you navigate your Port St. Lucie Florida Satisfaction, Release or Cancellation of Mortgage by Corporation more effectively.

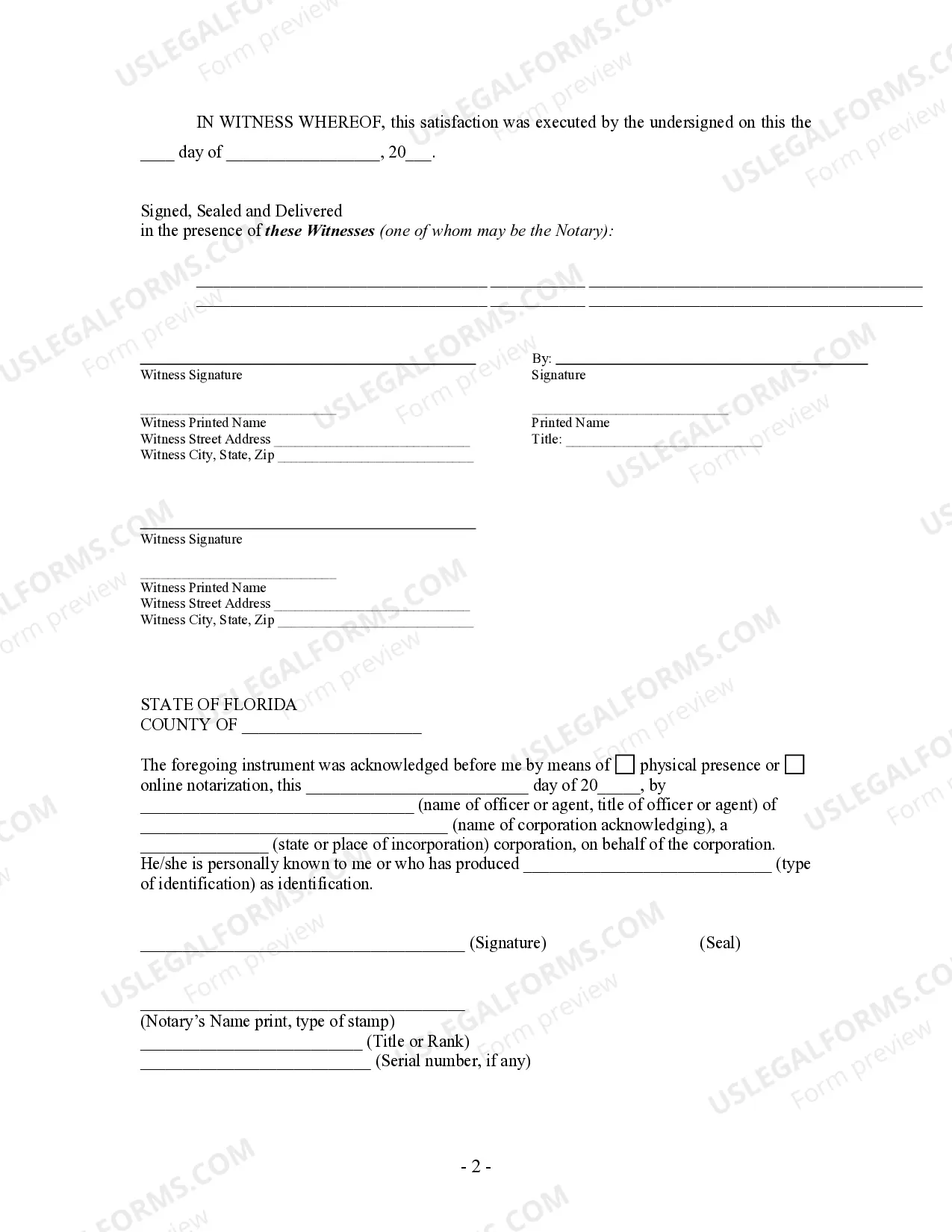

In Florida, a satisfaction of a mortgage typically does need to be notarized. This notarization ensures that the document is legally binding and can be recorded properly. Without notarization, the satisfaction may not hold up in court or during a property transaction. Therefore, if you’re working on a Port St. Lucie Florida Satisfaction, Release or Cancellation of Mortgage by Corporation, consider having your document notarized.