Orange Florida Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Florida Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Regardless of one's social or occupational rank, completing legal documents is a regrettable requirement in today’s work atmosphere.

Often, it’s nearly impossible for someone lacking legal education to create these types of documents from the beginning, primarily due to the intricate terminology and legal subtleties they contain.

This is where US Legal Forms can come to the rescue.

Ensure that the form you have selected is applicable in your region, as regulations from one state or county may not be valid in another.

Review the form and read a brief description (if available) of the situations the document can address.

- Our platform offers an extensive collection of over 85,000 ready-to-use forms specific to each state that can be applied to nearly any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors seeking to enhance their efficiency with our DIY documents.

- Whether you require the Orange Florida Satisfaction, Release, or Cancellation of Mortgage by Individual, or any other documentation recognized in your jurisdiction, US Legal Forms places everything at your disposal.

- Here’s how you can quickly obtain the Orange Florida Satisfaction, Release, or Cancellation of Mortgage by Individual using our reliable platform.

- If you are already a member, you can go ahead and Log In to your account to retrieve the necessary form.

- However, if you are a newcomer to our service, please ensure to follow these instructions before downloading the Orange Florida Satisfaction, Release, or Cancellation of Mortgage by Individual.

Form popularity

FAQ

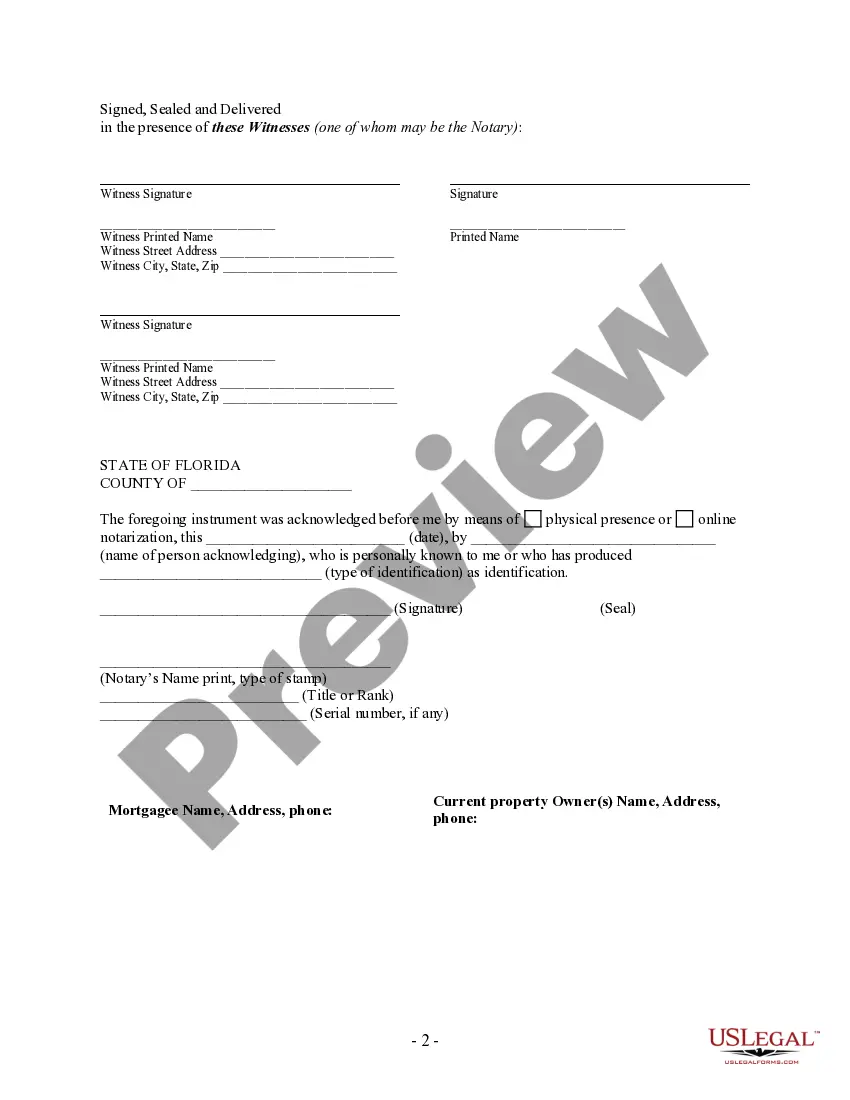

Yes, a satisfaction of mortgage often needs to be notarized to ensure its validity. Notarization helps prevent fraud and confirms that the signatures on the satisfaction document are legitimate. To facilitate this process, uslegalforms can provide the necessary templates and information so your Orange Florida Satisfaction, Release or Cancellation of Mortgage by Individual is legally sound and recognized by the appropriate authorities.

Yes, in Florida, a Satisfaction of Mortgage generally needs to be notarized. This ensures the document is valid and recognized by local authorities. To streamline this process, consider utilizing US Legal Forms for templates that comply with Orange Florida Satisfaction, Release or Cancellation of Mortgage by Individual requirements. Proper notarization reinforces your rights and the legality of the satisfaction.

In Florida, most mortgage documents must be signed and notarized to ensure their legality. This means you will need a notary public to witness your signing of the mortgage. This requirement helps protect both the lender and the borrower, supporting the principles behind Orange Florida Satisfaction, Release or Cancellation of Mortgage by Individual. Always confirm with local laws to ensure compliance.

Statute 475.41 in Florida involves the regulations governing real estate appraisers, particularly in relation to valid practices and penalties. While not directly related to mortgage satisfaction, it indirectly affects the broader real estate landscape that includes mortgage processes. In the context of Orange Florida Satisfaction, Release or Cancellation of Mortgage by Individual, being aware of relevant statutes can enhance your overall understanding of property transactions.

To obtain a satisfaction of mortgage in Florida, certain requirements must be met, including the provision of a completed satisfaction form and payment of any applicable fees. These requirements help clarify the mortgage discharge process and protect all parties involved. For those tackling an Orange Florida Satisfaction, Release or Cancellation of Mortgage by Individual, familiarizing yourself with these requirements is essential.

Yes, a satisfaction of a mortgage in Florida generally needs to be notarized before it can be filed. This notarization serves as an official confirmation of the document's authenticity, providing greater security for both parties. When navigating the complexities of an Orange Florida Satisfaction, Release or Cancellation of Mortgage by Individual, ensuring that your documentation is notarized can streamline the process.

Statute 627.427 in Florida primarily addresses the insurance industry, detailing standards for policy provisions regarding mortgage satisfaction. Importantly, it sets expectations for insurers concerning the release of mortgages upon the payment. If you are engaged in an Orange Florida Satisfaction, Release or Cancellation of Mortgage by Individual, this statute is important in ensuring transparency in recovery efforts.

To obtain a mortgage satisfaction letter, contact your lender directly. Request this document in writing, and provide any necessary information about your mortgage account. Having this letter is crucial for the Orange Florida Satisfaction, Release or Cancellation of Mortgage by Individual, as it serves as proof that you've fulfilled your mortgage obligations.

Statute 695 in Florida relates to the recording of instruments that affect real property. It outlines the requirements for documents, like mortgages and satisfactions, to be legally recognized. Understanding this statute is vital when dealing with the Orange Florida Satisfaction, Release or Cancellation of Mortgage by Individual. It helps clarify how and when these documents should be filed.