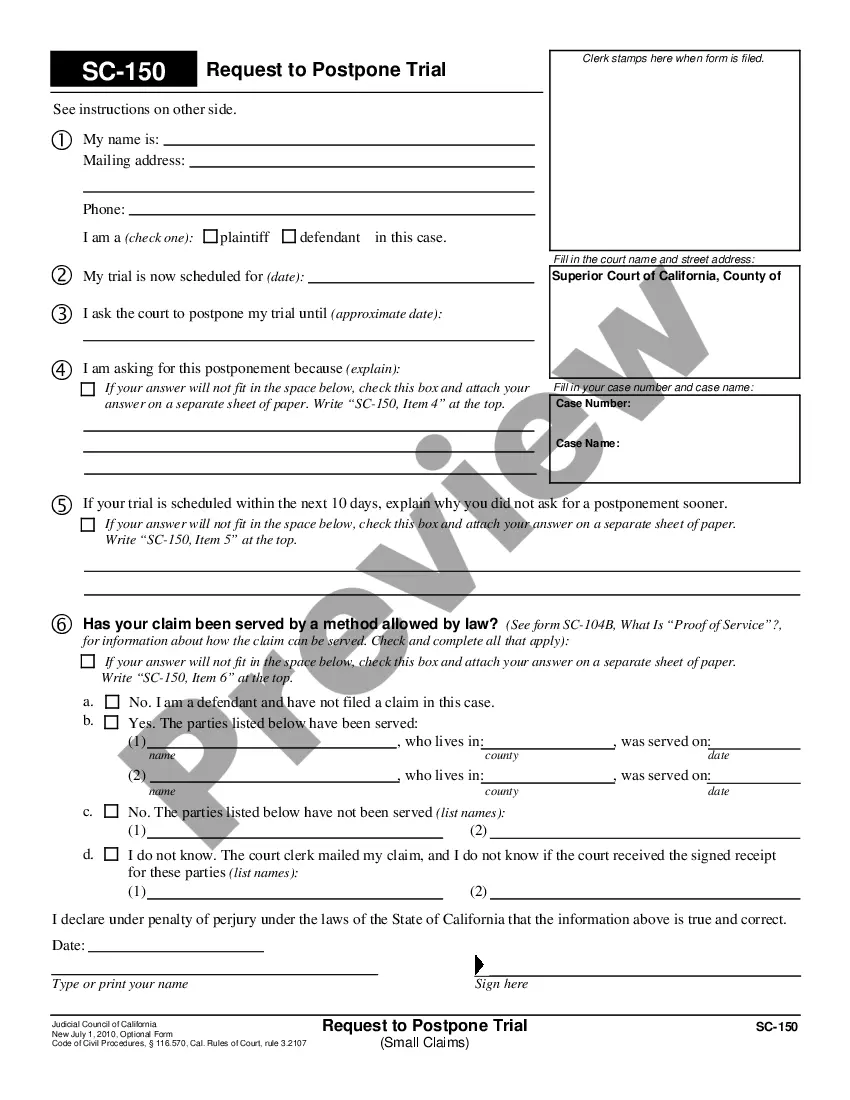

Included in your package are the following forms:

1. A Simple Partnership Agreement;

2. A Sample Complex Partnership Agreement

3. A Buy Sell Agreement between Partners in a Partnership;

4. A Profit – Loss Statement; and

5. An Agreement for the Dissolution of a Partnership.

Purchase this package and save up to 40% over purchasing the forms separately!