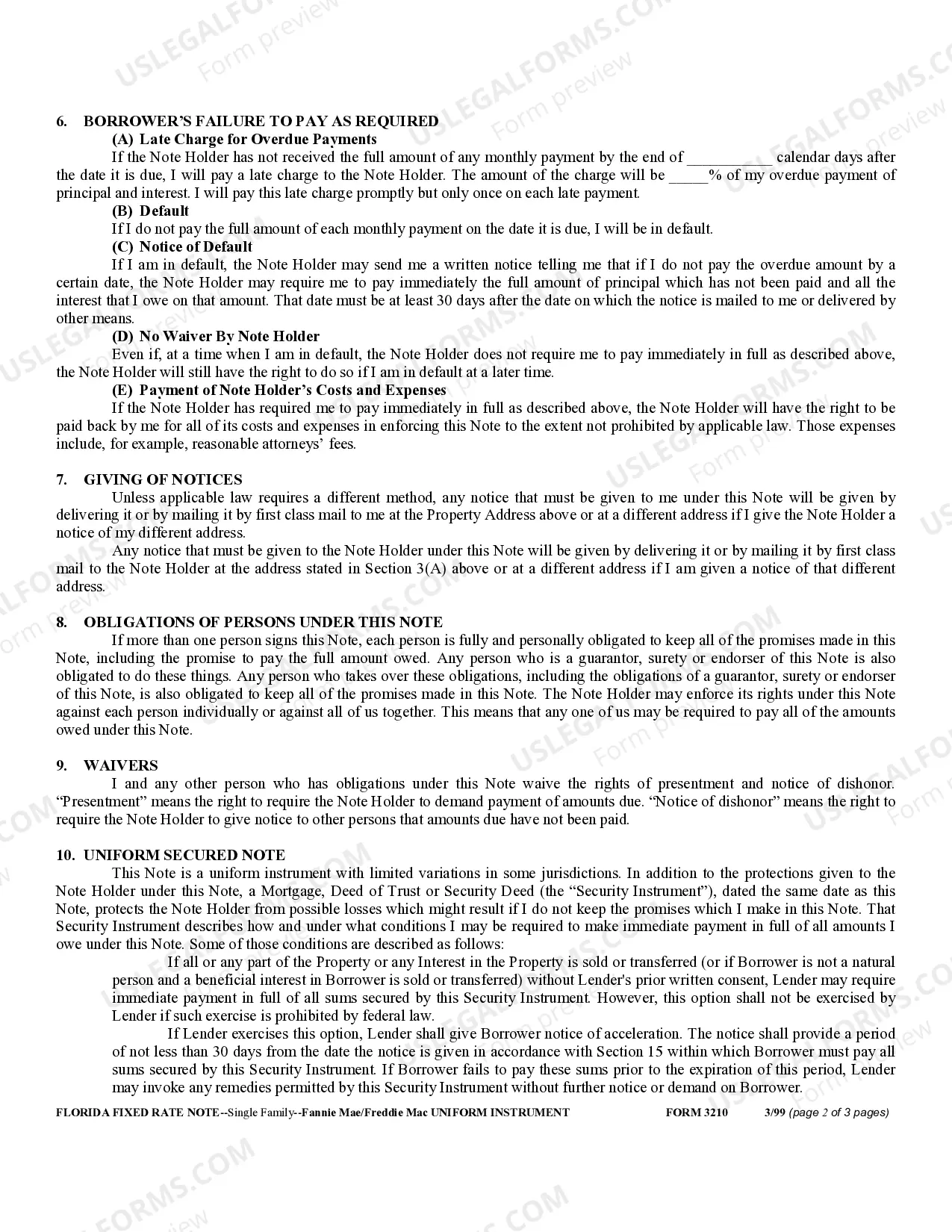

Orlando Florida Secured Promissory Note

Description

How to fill out Florida Secured Promissory Note?

If you’ve previously utilized our service, sign in to your account and download the Orlando Florida Secured Promissory Note to your device by clicking the Download button. Ensure your subscription is active. If not, renew it based on your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have uninterrupted access to all documents you have purchased: you can find it in your profile within the My documents section whenever you wish to use it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or business requirements!

- Confirm you’ve located the appropriate document. Examine the description and use the Preview feature, if available, to verify if it fulfills your requirements. If it is not suitable, use the Search tab above to find the correct one.

- Buy the template. Click the Buy Now button and choose either a monthly or yearly subscription plan.

- Establish an account and process your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Receive your Orlando Florida Secured Promissory Note. Choose the file format for your document and save it to your device.

- Complete your form. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

While notarization is not always a requirement for a secured promissory note in Florida, it is highly recommended. Having your Orlando Florida Secured Promissory Note notarized adds a layer of authenticity and can strengthen its enforceability in case of disputes. It's wise to consult legal advice or use platforms like US Legal Forms to ensure that all legal standards are met.

Yes, you can write your own promissory note, as long as it meets Florida's legal requirements. However, creating an effective note may require careful consideration of the terms and conditions involved. Using a platform like US Legal Forms can simplify this process, guiding you to produce a legally enforceable Orlando Florida Secured Promissory Note.

To obtain your promissory note, you typically create it through a written agreement between the borrower and lender. You can draft this document yourself or use services like US Legal Forms, which provides templates specifically designed for Orlando Florida Secured Promissory Notes. These templates ensure that you meet Florida's legal requirements and make the process straightforward.

Yes, a secured promissory note generally needs to be recorded if it is tied to real estate or other substantial assets. Recording this type of note in Orlando, Florida, gives the borrower and lender legal protection and establishes priority in claims against the collateral. Utilizing platforms like USLegalForms can help you ensure that your Orlando Florida Secured Promissory Note is recorded correctly and effectively.

When it comes to taxes, report any interest income earned from a promissory note on your tax return. This income is typically classified as ordinary income, and you'll need to provide relevant information, such as the amount and duration of interest payments received. Make sure you maintain documentation of your Orlando Florida Secured Promissory Note for accurate reporting and auditing purposes.

Filing a promissory note is not mandatory unless it is secured by real property. If your Orlando Florida Secured Promissory Note involves collateral, filing it adds a layer of protection and establishes a public record of your claim. It is wise to consult legal resources or professionals to confirm if filing is necessary for your specific circumstances.

In most cases, you do not file a promissory note with a government agency; however, if it is secured by real property, you may need to record it with the county clerk. In Orlando, Florida, this would typically involve presenting the note for recording along with any required fees. Filing not only legitimizes your claim but also offers public notice of the obligation described in your Orlando Florida Secured Promissory Note.

Typically, a promissory note itself does not appear on a personal credit report. However, if you default on the agreement or if the lender takes legal action, it can impact your credit rating. It's important to understand this because managing your obligations on an Orlando Florida Secured Promissory Note is essential for maintaining a good credit history.

A promissory note can become invalid in Florida under several conditions. For instance, if it lacks essential elements such as signatures from both parties or clear terms, it can be deemed unenforceable. Additionally, if the note violates state laws or does not meet certain formal requirements, such as being notarized, it may also be considered invalid. It's crucial to properly draft your Orlando Florida Secured Promissory Note to prevent such issues.

Yes, a promissory note remains valid in Orlando, Florida, even if it is not notarized. The essential requirements for validity lie in the content and the signatures of the involved parties. While notarization is not mandatory, it can provide helpful documentation should any issues come up later.