Jacksonville Florida Secured Promissory Note

Description

How to fill out Florida Secured Promissory Note?

If you’ve utilized our service previously, Log In to your account and download the Jacksonville Florida Secured Promissory Note onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it based on your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have continuous access to every document you have acquired: you can locate it in your profile within the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to effortlessly find and download any template for your personal or professional purposes!

- Verify you’ve found an appropriate document. Read the description and use the Preview feature, if available, to ascertain if it fits your requirements. If it’s not appropriate, use the Search tab above to discover the correct one.

- Acquire the template. Click the Buy Now button and select a monthly or annual subscription option.

- Create an account and process a payment. Input your credit card information or select the PayPal option to finalize the purchase.

- Obtain your Jacksonville Florida Secured Promissory Note. Choose the file format for your document and store it on your device.

- Finalize your document. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

Promissory notes are defined as securities under the Securities Act. However, notes that have a maturity of nine months or less are not considered securities.

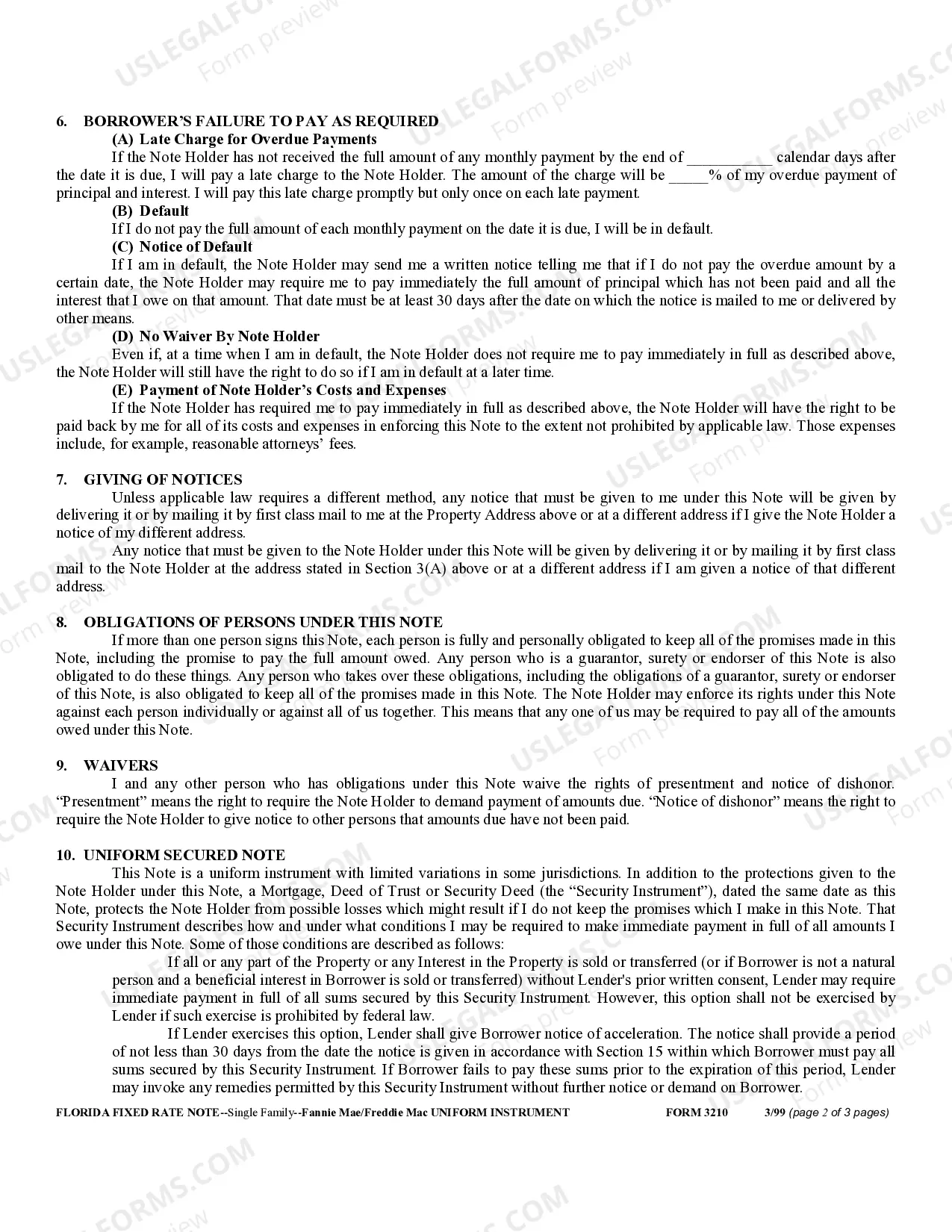

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note can be either secured or unsecured. A secured promissory note in Florida includes some type of collateral (or asset) in the agreement. This means that in the event the borrower fails to repay the loan, the lender can take the asset to satisfy the loan amount.

Legally binding Florida promissory notes must identify all parties, include the promise to pay, state the amount owed, and be signed by all parties.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

This is provided for in Florida 95.11(2)(b) which provides that ?A legal or equitable action on a contract, obligation, or liability founded on a written instrument,? which would include a promissory note, must be commenced within five years. There are various exceptions to this section.

A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

If you have an issue with a personal promissory note being unpaid and cannot come to an alternate agreement with your friend or family member that borrowed the money, legal intervention may be the only option. A local collection lawyer can help you attempt debt collection and file a lawsuit, if necessary.