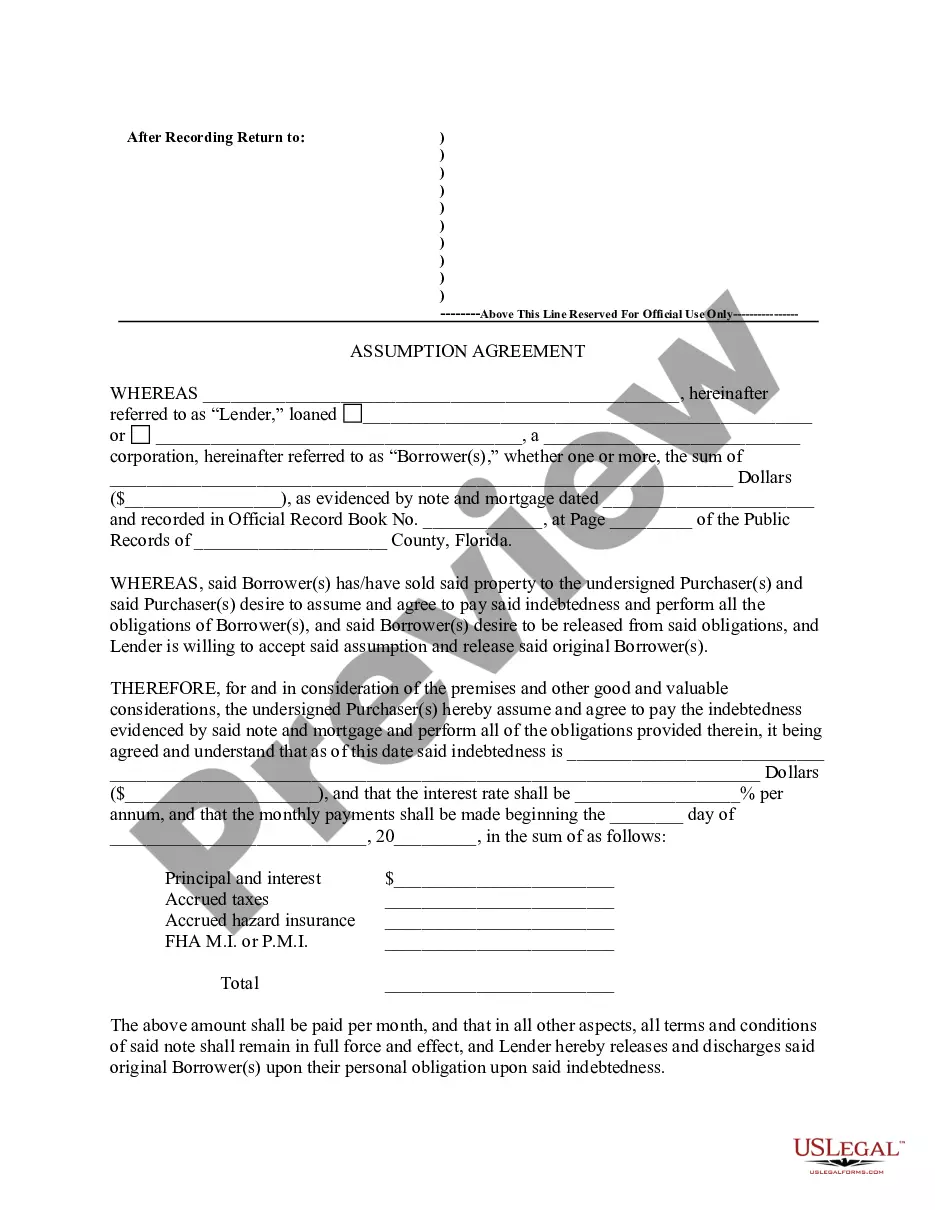

Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Florida Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

In case you have previously employed our service, sign in to your account and download the Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors onto your device by selecting the Download button. Ensure your subscription is active. If not, renew it based on your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have acquired: you can find it in your profile under the My documents section whenever you need to reuse it. Make use of the US Legal Forms service to quickly locate and download any template for your personal or professional requirements!

- Confirm you've located the appropriate document. Browse through the description and use the Preview feature, if available, to determine if it satisfies your requirements. If it doesn't suit you, utilize the Search tab above to find the correct one.

- Buy the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and finalize your payment. Use your credit card details or the PayPal method to complete the purchase.

- Acquire your Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors. Select the file format for your document and save it to your device.

- Complete your form. Print it out or utilize professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

The release of liability, part of the Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, is a legal clause that removes the original borrower from financial responsibility after a mortgage is assumed by another party. This protection is crucial for someone wishing to exit the mortgage without any remaining obligations. Understanding this release can help both parties feel secure in the arrangement.

The duration of the mortgage assumption process can vary depending on the lender and the complexity of the agreement, but it generally takes from a few days to several weeks. It involves submitting your application and waiting for lender approval of the Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors. Staying in close contact with your lender can help you stay updated on the status.

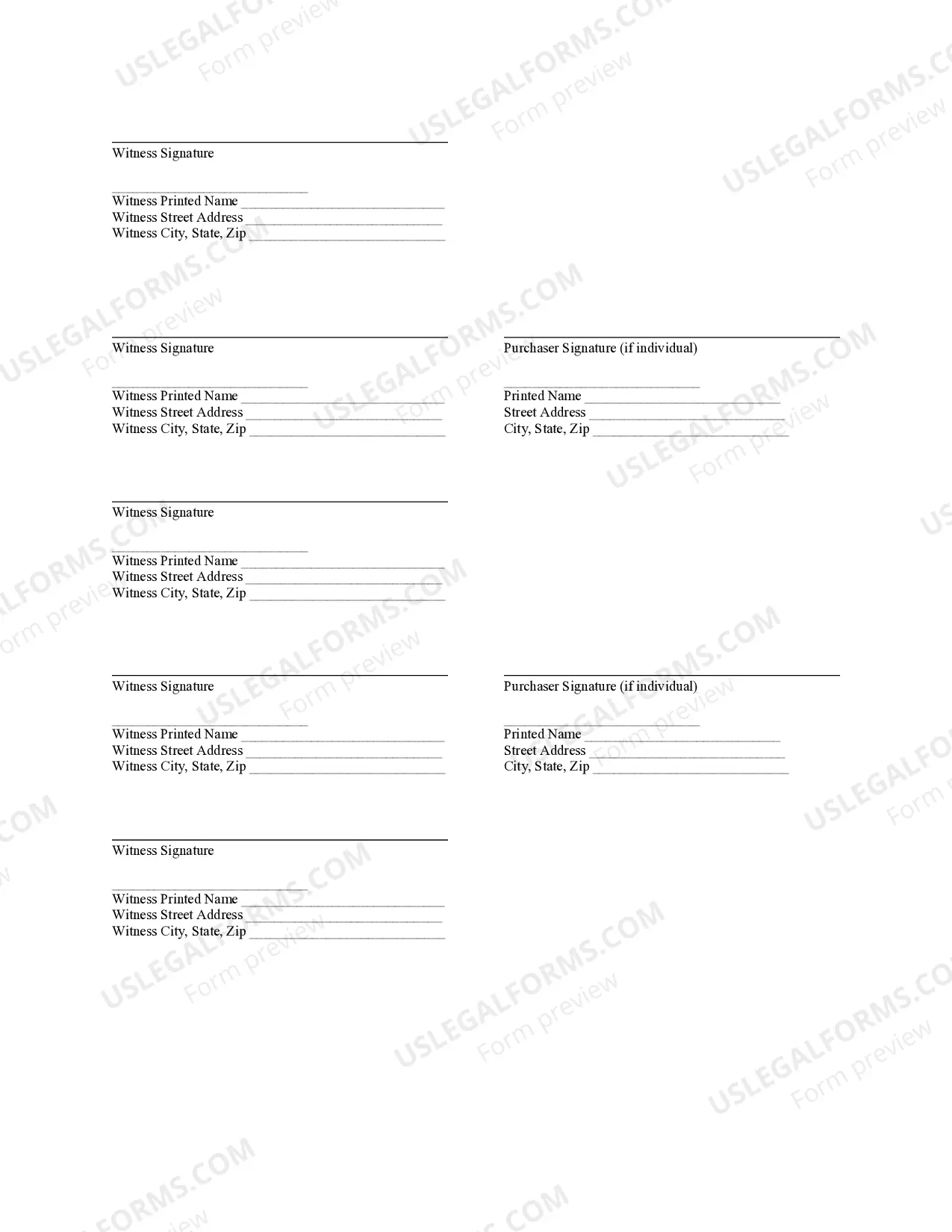

Transferring a mortgage to another person usually involves obtaining approval from the lender through a Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors. The prospective borrower must demonstrate their ability to meet the mortgage's terms. Both parties should ensure they fully understand the implications of this transfer before proceeding.

To remove someone from a mortgage without refinancing, you typically need to complete a Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors. This legal document allows you to assume full responsibility for the mortgage, while the lender evaluates your creditworthiness. It’s important to ensure that the person being removed consents to this process and signs the necessary documents.

The documentary stamp tax is assessed when a mortgage is documented, including during assumptions in Florida. This tax is based on the total amount of the mortgage being assumed. With the Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors, understanding this tax helps you prepare for all financial obligations associated with the assumption. It is wise to consult a professional or use a trusted platform like USLegalForms to navigate these calculations correctly.

A mortgage assumption occurs when a buyer takes over the mortgage payments from the original borrower. For example, if a homeowner sells their property and the buyer assumes the existing mortgage, the lender may allow this under specific conditions. Understanding the implications of this arrangement is key, especially in a Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors. US Legal Forms can offer guidance on how to formalize this process.

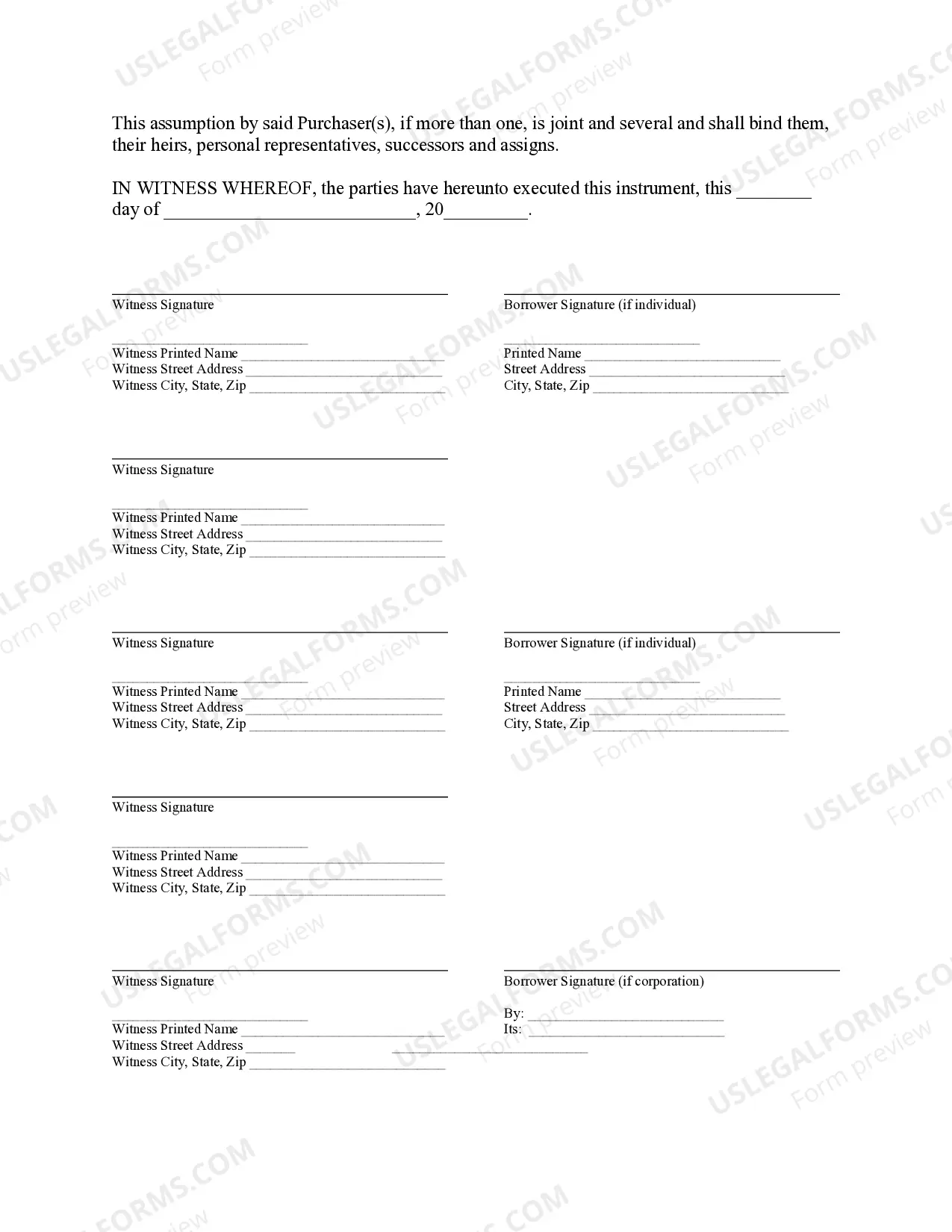

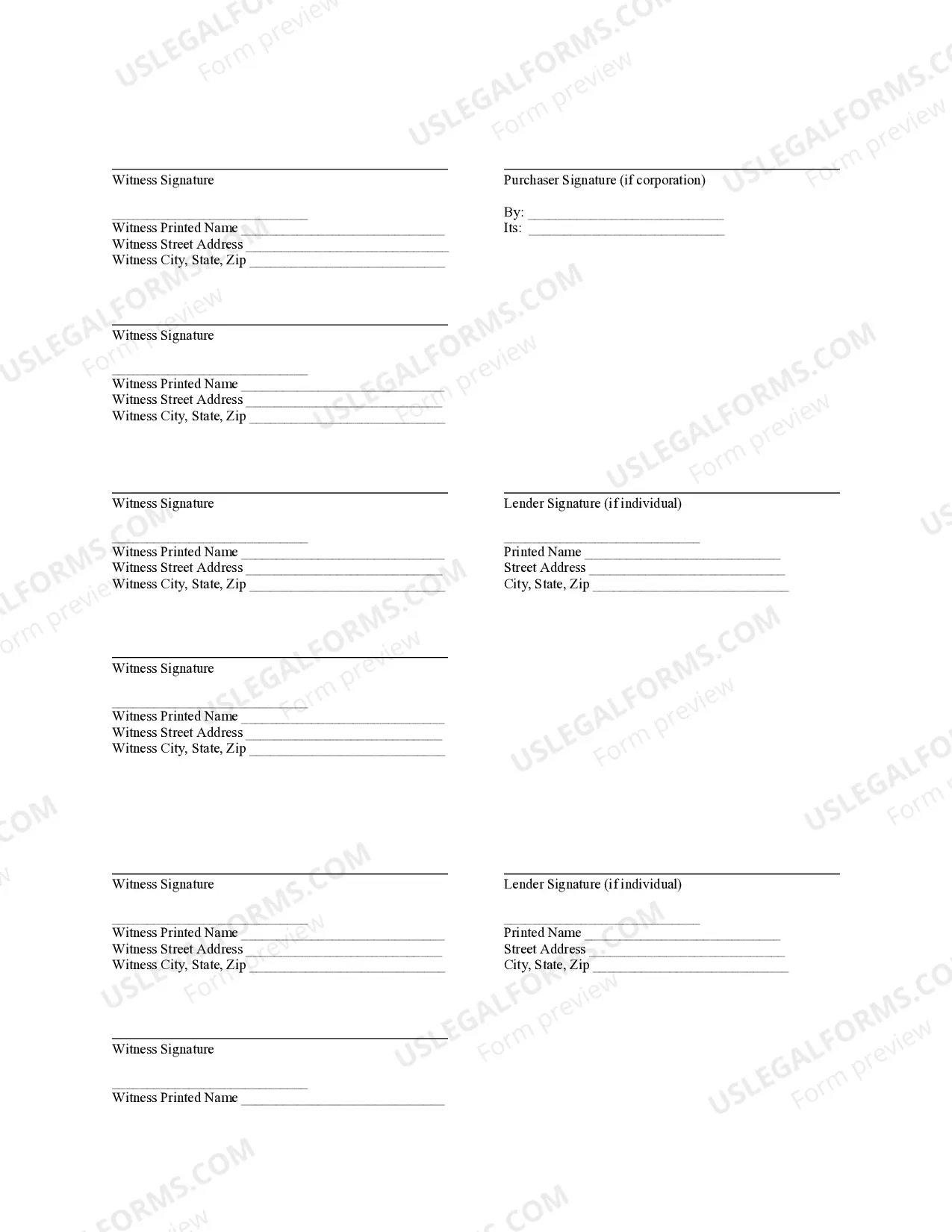

Yes, in Florida a mortgage must be notarized to be enforceable. This notary verification protects both parties involved in the transaction by confirming identities. It also plays a vital role in the Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors. When in doubt, platforms like US Legal Forms can guide you through the notarization requirements.

Yes, in Florida, a satisfaction of mortgage must be notarized. This notarization ensures that the document is officially recognized and valid in legal terms. If you are unsure about the notarization process, consider using the services of US Legal Forms for assistance. This can be particularly helpful when navigating the Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors.

To file a satisfaction of mortgage in Florida, you must complete the satisfaction form and submit it to the county clerk's office where the mortgage was recorded. Ensure that the original mortgage document is referenced in the filing. Utilizing resources like US Legal Forms can simplify this process. This helps in dealing with tasks like the Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors.

In Florida, a satisfaction of mortgage does not require a witness. However, it is crucial to ensure that the proper procedures are followed to avoid any legal issues. Using a professional platform, such as US Legal Forms, can provide guidance on complying with the state's requirements. This can facilitate a smoother process when handling a Tallahassee Florida Assumption Agreement of Mortgage and Release of Original Mortgagors.