Tallahassee Florida Quitclaim Deed for Trustee to Beneficiary

Description

How to fill out Florida Quitclaim Deed For Trustee To Beneficiary?

If you are looking for a legitimate form template, it’s challenging to find a more suitable location than the US Legal Forms website – arguably the most extensive collections available online.

Here, you can discover a vast array of templates for both organizational and personal use, sorted by categories and regions, or keywords.

With the enhanced search functionality, obtaining the latest Tallahassee Florida Quitclaim Deed for Trustee to Beneficiary is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finish the registration process.

Retrieve the form. Select the file format and save it to your device. Modify it. Fill out, amend, print, and sign the acquired Tallahassee Florida Quitclaim Deed for Trustee to Beneficiary. Each form you store in your profile has no expiration date and belongs to you indefinitely. You can access them via the My documents section, so if you wish to obtain an extra copy for alteration or printing, feel free to return and export it anytime.

- Additionally, the accuracy of each document is verified by a team of qualified lawyers who regularly assess the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to do to obtain the Tallahassee Florida Quitclaim Deed for Trustee to Beneficiary is to Log In to your profile and click the Download button.

- If this is your first time using US Legal Forms, just follow the instructions below.

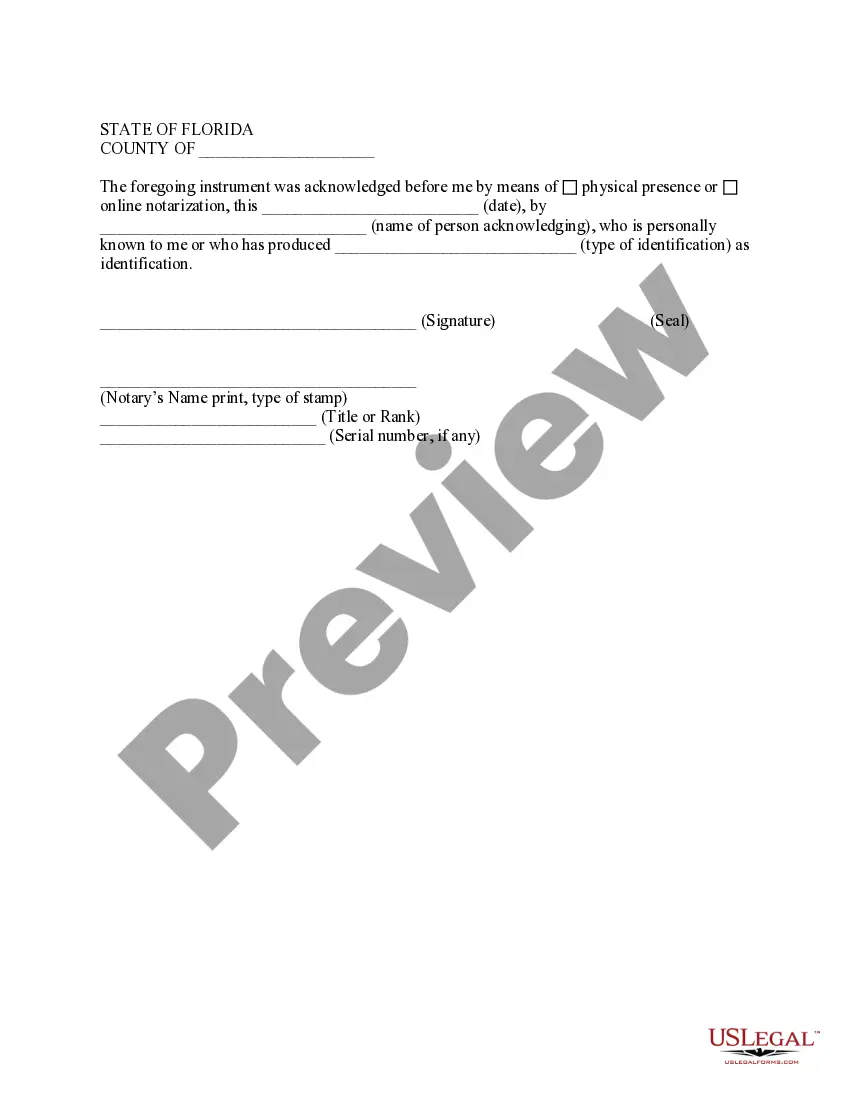

- Ensure you have located the form you require. Review its details and use the Preview feature to examine its content. If it doesn’t fulfill your requirements, take advantage of the Search option at the top of the page to find the necessary document.

- Confirm your selection. Click on the Buy now button. Then, choose your preferred subscription plan and provide the necessary information to register for an account.

Form popularity

FAQ

Yes, Florida recognizes beneficiary deeds, which allow property owners to designate beneficiaries who will inherit the property upon the owner's death. This can simplify the transfer process, similar to a Tallahassee Florida Quitclaim Deed for Trustee to Beneficiary. However, it's important to understand the specific legal implications and requirements of beneficiary deeds, as they differ from traditional methods of transferring property.

While you can create a quitclaim deed in Florida without a lawyer, it is often advisable to consult with one, especially if the situation involves a Tallahassee Florida Quitclaim Deed for Trustee to Beneficiary. A qualified attorney can ensure that the deed complies with Florida laws and that all correct parties are involved. This can help prevent future disputes and ensure the smooth transfer of property ownership.

One disadvantage of a lady bird deed in Florida is that it may not offer the same level of protection from creditors as a regular trust. In some cases, a Tallahassee Florida Quitclaim Deed for Trustee to Beneficiary might be a more suitable option if your goal is to avoid probate while maintaining more control over asset distribution. Additionally, if the grantor needs to sell the property in the future, a lady bird deed might complicate the process.

To transfer a deed after death in Florida, you typically need to gather the deceased's property documents and obtain a death certificate. If the property is held in a trust, you can execute a Tallahassee Florida Quitclaim Deed for Trustee to Beneficiary to transfer ownership directly to the beneficiaries. If not, you may need to go through probate, unless the property is jointly owned or otherwise exempt.

Yes, you can file a quitclaim deed yourself in Florida. However, it is essential to ensure that the deed is filled out correctly and meets state requirements. The USLegalForms platform offers user-friendly templates for creating a Tallahassee Florida Quitclaim Deed for Trustee to Beneficiary, making this a manageable task for individuals who prefer to handle it independently.

The best way to transfer property title between family members is typically through a quitclaim deed. This deed allows for the straightforward transfer of property rights, such as in a Tallahassee Florida Quitclaim Deed for Trustee to Beneficiary. It's crucial to make sure that the deed is appropriately recorded in the county where the property is located to protect the new owner's interest.

While it's not a legal requirement to have a lawyer to transfer a deed in Florida, seeking legal advice can be beneficial in complex situations. If you choose to utilize a Tallahassee Florida Quitclaim Deed for Trustee to Beneficiary, the USLegalForms platform provides accessible resources that guide you through the process. This option can help ensure that all requirements are met without the immediate need for legal representation.

To transfer the deed of a house when someone dies in Florida, the executor or trustee should prepare a quitclaim deed. This quitclaim deed should clearly identify the deceased, the property, and the beneficiary receiving the property. Utilizing the Tallahassee Florida Quitclaim Deed for Trustee to Beneficiary can streamline this process, making it easier for families navigating estate matters.

The best way to transfer property after death is often through a quitclaim deed, specifically a Tallahassee Florida Quitclaim Deed for Trustee to Beneficiary. This method simplifies the process, allowing the trustee to quickly convey the property title to the beneficiaries. You may consider using the USLegalForms platform to create and file the necessary paperwork correctly.

Transferring ownership of a house in Florida after death typically involves the use of a quitclaim deed. In this case, the trustee of the estate can execute a Tallahassee Florida Quitclaim Deed for Trustee to Beneficiary, effectively transferring the property to the rightful beneficiary. It’s essential to ensure that the deed is properly executed and recorded to avoid any future disputes regarding the ownership.