Port St. Lucie Florida Revocation of Living Trust

Description

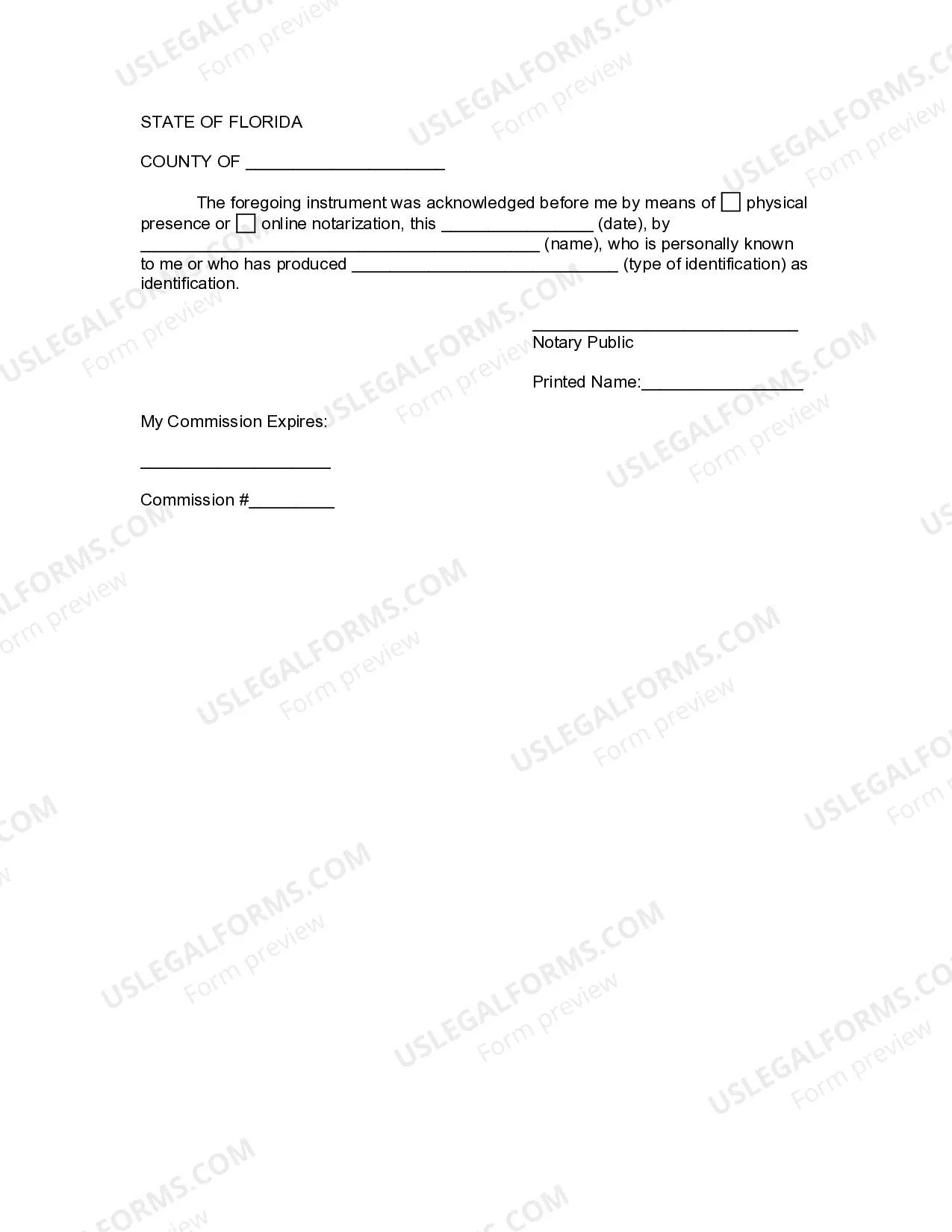

How to fill out Florida Revocation Of Living Trust?

Take advantage of the US Legal Forms and gain instant access to any document you need.

Our efficient platform with a plethora of document templates enables you to discover and acquire nearly any document sample you desire.

You can export, fill out, and sign the Port St. Lucie Florida Revocation of Living Trust within minutes instead of spending hours searching online for a suitable template.

Utilizing our catalog is an excellent approach to enhance the security of your record submission.

- Our qualified legal experts consistently review all documents to ensure that the forms are applicable for a specific state and aligned with updated laws and regulations.

- How can you obtain the Port St. Lucie Florida Revocation of Living Trust? If you possess a subscription, simply Log In to your account.

- The Download button will become visible on all documents you view.

- Additionally, you can access all previously saved documents in the My documents section.

- If you do not have an account yet, follow the instructions below.

Form popularity

FAQ

Yes, you can contest a revocable trust in Florida under specific circumstances. If you believe the trust was created under undue influence, fraud, or if the grantor lacked capacity, you have grounds to contest the trust. Engaging in the Port St. Lucie Florida Revocation of Living Trust process may also involve assessment of the trust’s validity and execution. For assistance, consider using the US Legal Forms platform, which provides resources to help navigate these complexities.

In Florida, a revocable trust does not need to be recorded to be valid. However, for the Port St. Lucie Florida Revocation of Living Trust, it is crucial to maintain clear records and documentation. This helps ensure your wishes are honored and aids in the management of your trust. For effective assistance with trust-related matters, consider exploring the US Legal Forms platform to access essential legal documents and resources.

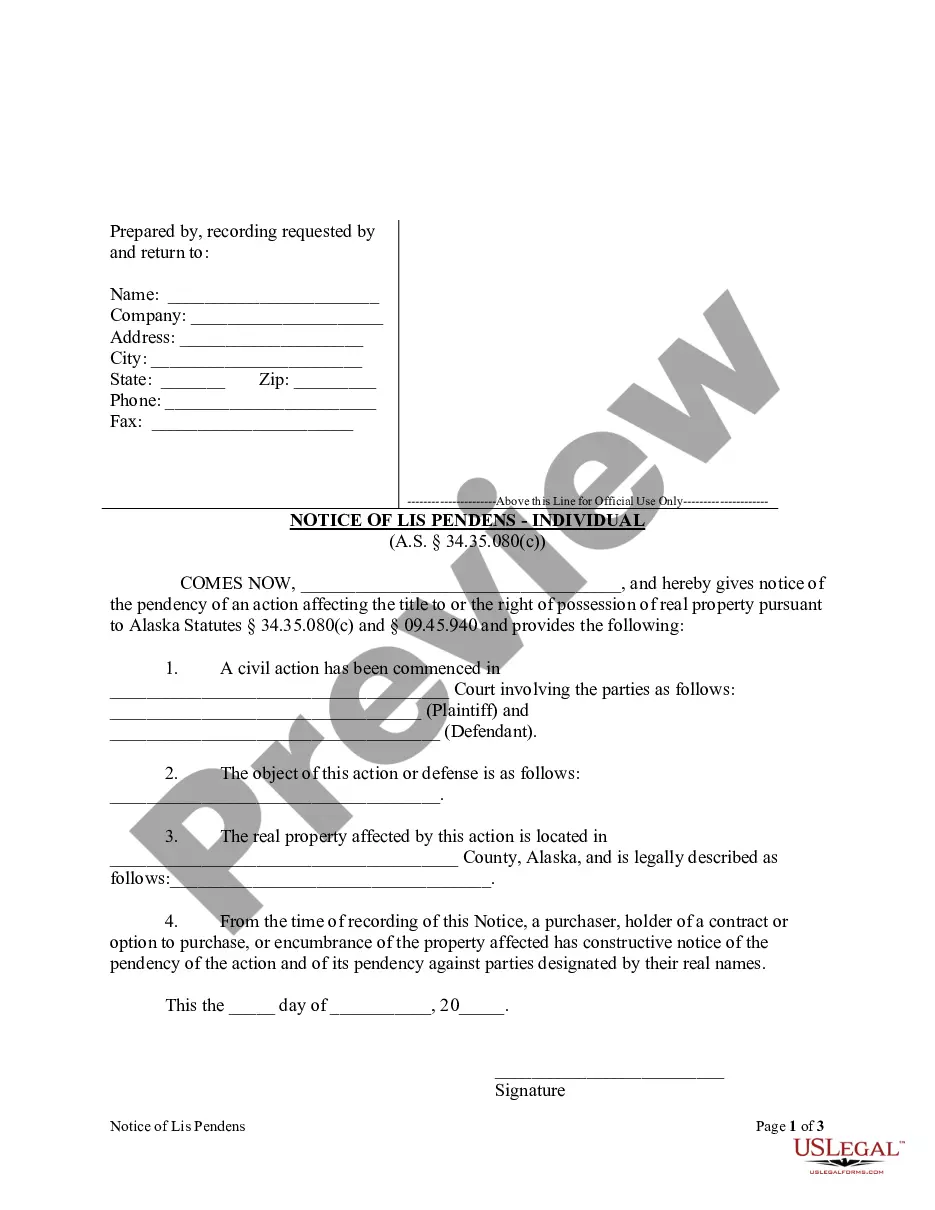

To revoke a living trust in Florida, you must create a formal revocation document or indicate your intention in writing. This documents your desire to terminate the trust and clearly designates the assets' new status. After that, ensure that all trustees and beneficiaries are informed, as this fosters transparency. For assistance during the Port St. Lucie Florida revocation of living trust, you may consider using US Legal Forms to draft the necessary documents correctly.

Generally, a revocable trust does not have to go through probate in Florida. This is because the assets held in a revocable trust are not considered part of your estate at your passing. Therefore, they can be distributed directly to beneficiaries without court intervention. However, for assets not placed within a trust, those may still require probate, affecting the overall management during the Port St. Lucie Florida revocation of living trust.

One of the biggest mistakes parents make when setting up a trust fund is failing to fund it properly. They may create a trust but neglect to transfer assets into it. Without properly funding the trust, it may not achieve its intended purposes, such as protecting assets for future generations. Addressing funding issues is crucial during the Port St. Lucie Florida revocation of living trust to avoid potential troubles down the road.

While it is possible to create a living trust without an attorney, it is highly advisable to consult one in Florida. An attorney can help you navigate complex laws, ensuring your trust meets all legal requirements and operates smoothly. This is particularly important during the Port St. Lucie Florida revocation of living trust, as improper handling may lead to significant complications later. Utilizing platforms like US Legal Forms can also provide guidance throughout this process.

One disadvantage of revocable living trusts in Florida is that they do not provide protection from creditors. If you face financial difficulties, your assets in a revocable trust may still be at risk. Additionally, the process of creating a trust requires time and effort to ensure proper management. While they offer flexibility, you may default to probate if you fail to fund the trust correctly, complicating the Port St. Lucie Florida revocation of living trust process.

No, you do not have to file a revocable trust in Florida, including a Port St. Lucie Florida Revocation of Living Trust. This characteristic allows you to maintain privacy, as the trust details do not become part of the public record. However, it is essential to ensure that any beneficiaries or trustees are aware of the trust’s existence and its terms. Utilizing a platform like US Legal Forms can help you navigate the processes related to trust management.

Generally, a trust does not need to be recorded in Florida, especially when it is revocable. This includes Port St. Lucie Florida Revocation of Living Trust which remains private until it becomes irrevocable. You may want to keep a copy of the trust document in a safe place, and share relevant details with your chosen trustee. If you have specific concerns, reaching out to a legal expert can provide valuable guidance.

Florida does not require individuals to file revocable trusts with the state, which includes a Port St. Lucie Florida Revocation of Living Trust. This means you can manage your trust privately without public disclosure. However, if your trust becomes irrevocable due to death or another event, certain assets may need to be probated. Always review your trust management strategies to avoid potential complications.