Port St. Lucie Florida Living Trust for individual, Who is Single, Divorced or Widow or Widower with Children

Description

How to fill out Florida Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children?

If you are searching for a legitimate document, it’s difficult to discover a more suitable platform than the US Legal Forms site – one of the largest online collections.

With this collection, you can access thousands of form examples for organizational and personal needs by categories and states, or keywords.

With the superior search function, obtaining the current Port St. Lucie Florida Living Trust for an individual, Who is Single, Divorced, or a Widow or Widower with Children is as simple as 1-2-3.

Obtain the template. Select the format and save it on your device.

Modify as needed. Fill out, revise, print, and sign the obtained Port St. Lucie Florida Living Trust for an individual, Who is Single, Divorced, or a Widow or Widower with Children.

- If you are already familiar with our platform and have a registered account, all you need to obtain the Port St. Lucie Florida Living Trust for an individual, Who is Single, Divorced, or a Widow or Widower with Children is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the instructions provided below.

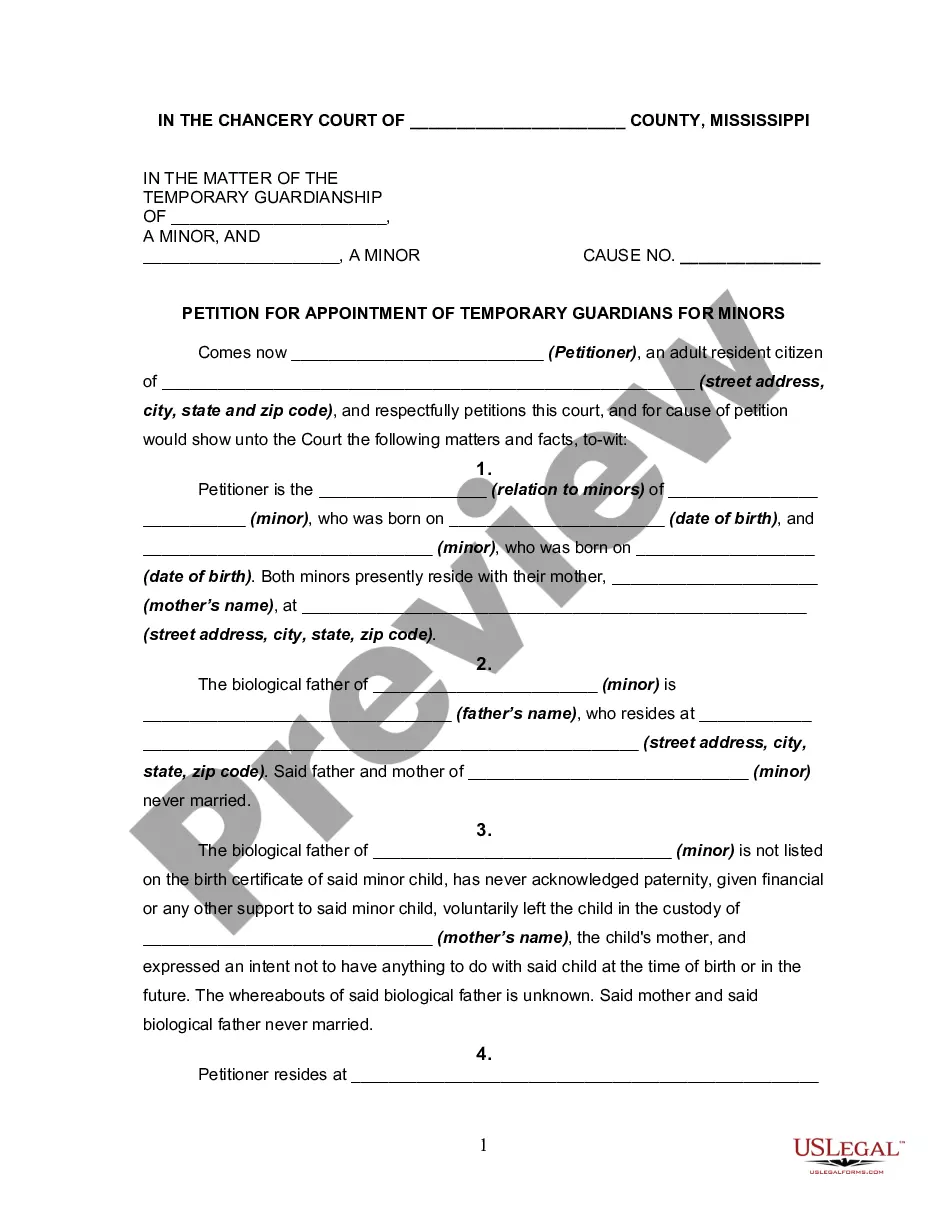

- Ensure you have located the form you need. Review its description and utilize the Preview feature (if available) to check its contents. If it doesn’t satisfy your requirements, use the Search bar at the top of the screen to locate the needed document.

- Confirm your choice. Click the Buy now button. Following that, choose the desired pricing plan and enter your details to set up an account.

- Complete the transaction. Use your credit card or PayPal to finalize the registration process.

Form popularity

FAQ

The disadvantages of a living trust in Florida include the initial expense of setting it up as well as the ongoing maintenance required. Additionally, while a trust can help avoid probate, it does not protect against estate taxes or certain obligations. Some individuals may also find the complexity overwhelming, particularly if they lack experience in estate planning. USLegalForms can help simplify the process, offering resources tailored to setting up a successful Port St. Lucie Florida Living Trust for individuals who are single, divorced, or widowed with children.

One negative aspect of a trust may involve the complexity and associated costs during its establishment. Maintaining a trust requires more responsibility compared to a will, as it demands regular updates and careful management. Additionally, trusts do not typically provide immediate access to funds, which could lead to delays when beneficiaries need support. Addressing these concerns is crucial as you consider a Port St. Lucie Florida Living Trust for individuals who are single, divorced, or widowed with children.

In Florida, trusts can have different designations based on their creation and funding. Generally, if a trust is established by one spouse with separate property, it may not be considered marital property. However, assets added to a trust during the marriage could be classified as marital property. Understanding these nuances is key when setting up a Port St. Lucie Florida Living Trust for individuals who are single, divorced, or widowed with children, so it’s wise to seek legal advice.

Yes, a trust can be a smart financial tool in Florida, particularly for people who are single, divorced, or widowed with children. It can provide for your loved ones efficiently while avoiding the lengthy probate process. A well-structured trust gives you more control over the distribution of your assets, which is vital for ensuring your children are cared for appropriately. Consult resources like USLegalForms to help you determine the right type of trust for your situation.

One of the biggest mistakes parents often make when setting up a trust fund is not clearly defining the terms and conditions of the trust. This can lead to confusion and disputes among heirs, especially for those who are single, divorced, or widowed with children. Furthermore, failing to communicate the purpose of the trust to your children can leave them unprepared to manage their inheritance. Using resources like USLegalForms can help ensure you create a trust that aligns with your family's needs.

While it is not legally required to have an attorney create a living trust in Florida, it is highly recommended, especially for individuals who are single, divorced, or widowed with children. Legal guidance can help ensure that the trust complies with state laws and accurately reflects your wishes. An attorney can also help address specific concerns you may have about your family's financial future. For those seeking easy solutions, USLegalForms offers editable templates to simplify the process.

Writing a living trust in Florida involves several steps, starting with defining your assets and deciding who will manage them. To create a Port St. Lucie Florida Living Trust for individuals who are single, divorced, or widowed with children, you can use online legal services that guide you in drafting the document. Make sure to properly sign and notarize the trust to make it legally binding.

Yes, you can set up a Port St. Lucie Florida Living Trust for individuals who are single, divorced, or widowed with children without an attorney. Many online platforms provide user-friendly tools and resources that guide you through the process. However, consulting with a legal expert is wise if you have complex assets or specific concerns regarding your family situation.

In Florida, co-trustees typically must act jointly unless the trust document states otherwise. This means that major decisions regarding your Port St. Lucie Florida Living Trust for individuals who are single, divorced, or widowed with children should be made together. However, it is essential to specify any differing powers or responsibilities in the trust document to prevent confusion.

Yes, you can prepare your own Port St. Lucie Florida Living Trust for individuals who are single, divorced, or widowed with children. However, it is crucial to understand the legal requirements and ensure you follow the correct procedures. Using online resources or legal forms can simplify this process, providing you with the necessary templates and guidance.