Miami-Dade Florida Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Florida Non-Foreign Affidavit Under IRC 1445?

Regardless of social or professional standing, finalizing law-related paperwork is a regrettable requirement in the current professional landscape.

Frequently, it’s virtually unfeasible for individuals without a legal background to create such documents from scratch, primarily due to the complex terminology and legal intricacies involved.

This is where US Legal Forms can come to the rescue.

Make certain the template you found is suitable for your locality, as the rules of one state or county do not apply to another.

You are all set! Now, you can either print the document or fill it out online. If you encounter any difficulties finding your purchased forms, you can conveniently find them in the My documents section.

- Our platform provides an extensive collection of over 85,000 ready-to-use documents specific to each state that cater to nearly any legal situation.

- US Legal Forms also acts as an excellent resource for associates or legal advisors who wish to conserve time by using our DIY documents.

- Regardless of whether you require the Miami-Dade Florida Non-Foreign Affidavit Under IRC 1445 or any other document that is valid in your region, with US Legal Forms, everything is at your disposal.

- Here’s how you can effortlessly obtain the Miami-Dade Florida Non-Foreign Affidavit Under IRC 1445 using our dependable platform.

- If you are already a current customer, feel free to Log In to your account to access the correct form.

- However, if you are new to our collection, please ensure to follow these steps before acquiring the Miami-Dade Florida Non-Foreign Affidavit Under IRC 1445.

Form popularity

FAQ

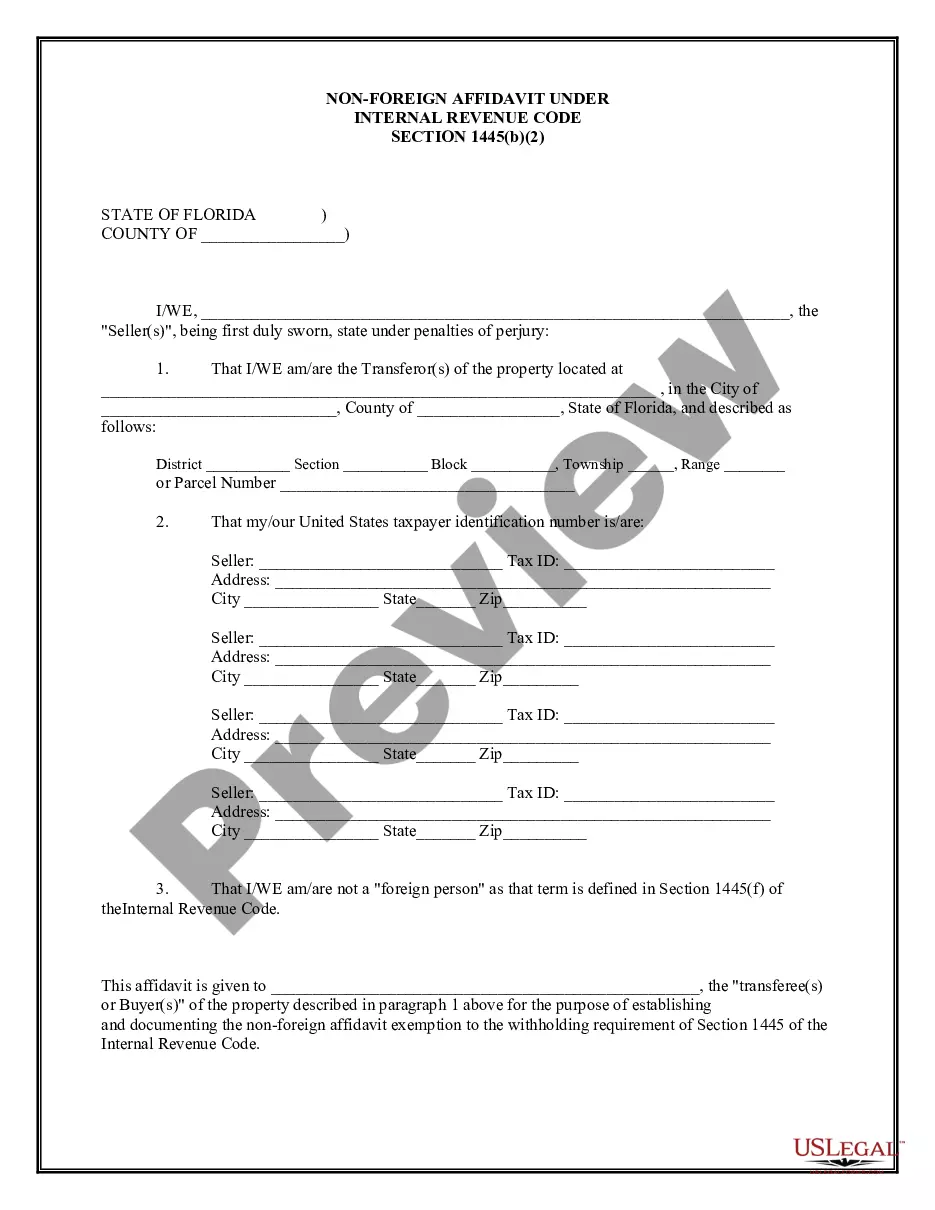

Section 1445 of the IRC governs the taxation of foreign entities involved in the sale of U.S. real estate. It specifically outlines the requirements for withholding tax on sales by foreign sellers. A critical part of this process is completing the Miami-Dade Florida Non-Foreign Affidavit Under IRC 1445. This section ensures that foreign sellers fulfill their tax obligations, while buyers protect themselves from potential liabilities.

The primary purpose of the FIRPTA Affidavit is to clarify the foreign or non-foreign status of a real estate seller. This distinction determines whether tax withholding is required during a property transaction. When acquiring property in Miami-Dade, submitting a valid Miami-Dade Florida Non-Foreign Affidavit Under IRC 1445 protects buyers from unexpected tax liabilities. It also ensures compliance with IRS regulations concerning foreign investment.

The FIRPTA Affidavit is typically provided by the seller of the property in question. This affidavit confirms whether the seller is a foreign investor or a non-foreign person under U.S. tax laws. In Miami-Dade, real estate professionals and lawyers often facilitate this process, ensuring that the necessary Miami-Dade Florida Non-Foreign Affidavit Under IRC 1445 is completed properly. Utilizing platforms like US Legal Forms can streamline the affidavit preparation.

IRS Notice 1445 relates to the Foreign Investment in Real Property Tax Act, or FIRPTA. This notice is crucial for transactions involving foreign sellers of U.S. real estate. It informs buyers about their obligations under the Miami-Dade Florida Non-Foreign Affidavit Under IRC 1445, ensuring proper withholding of taxes. Understanding Notice 1445 helps maintain compliance with federal tax laws.

For buyers in Florida, FIRPTA represents the Foreign Investment in Real Property Tax Act, which affects transactions involving foreign sellers. Understanding FIRPTA means being aware of potential withholding taxes unless proper documentation, like a Miami-Dade Florida Non-Foreign Affidavit Under IRC 1445, is provided. This knowledge is crucial for buyers, as it helps them avoid unexpected costs and ensures compliance with federal regulations.

To avoid FIRPTA withholding in Florida, buyers should ensure they obtain a Miami-Dade Florida Non-Foreign Affidavit Under IRC 1445 from the seller. This affidavit confirms the seller is not a foreign person, thus exempting the transaction from withholding. Additionally, it's vital for buyers to consult with legal experts or platforms like uSlegalForms to ensure compliance and ease throughout the process.

To file a FIRPTA certificate, you need to complete IRS Form 8288-B, which is the application for withholding certificate. In the context of a Miami-Dade Florida Non-Foreign Affidavit Under IRC 1445, providing this certificate can demonstrate that the seller is not a foreign entity. Accurately filling out this form ensures that you follow regulations and can help facilitate a smoother transaction.

The FIRPTA certificate should be mailed to the Internal Revenue Service (IRS) office that handles your geographic area. It is crucial to address it accurately to avoid delays in processing. Include the completed Miami-Dade Florida Non-Foreign Affidavit Under IRC 1445 alongside your FIRPTA certificate to ensure compliance with all IRS requirements. Double-checking the mailing address is advisable before sending any documents.

The payer, usually the buyer or the entity making payments to a foreign vendor, is responsible for withholding taxes on payments made to foreign persons. This requirement is outlined under U.S. tax law and applies to various transactions, including real estate deals. Utilizing tools such as the Miami-Dade Florida Non-Foreign Affidavit Under IRC 1445 can aid in determining when withholding is necessary. Being proactive in understanding these obligations is essential.

In general, real estate salespersons are responsible for paying their own taxes, including any income generated from commissions. These taxes are not related to FIRPTA and typically fall solely on the individual agent. However, proper documentation and compliance with IRS regulations should be maintained, especially when engaging in transactions involving foreign clients. Staying informed will help protect your financial interests.