This form is a Personal Representative's Deed of Distribution where the Grantor is an Individual appointed as personal representative of the estate and the Grantee is the beneficiary entitled to receive the property from the estate. Grantor conveys the described property to Grantee and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving as personal representative to encumber the property. This deed complies with all state statutory laws.

Coral Springs Florida Personal Representative's Deed of Distribution

Description

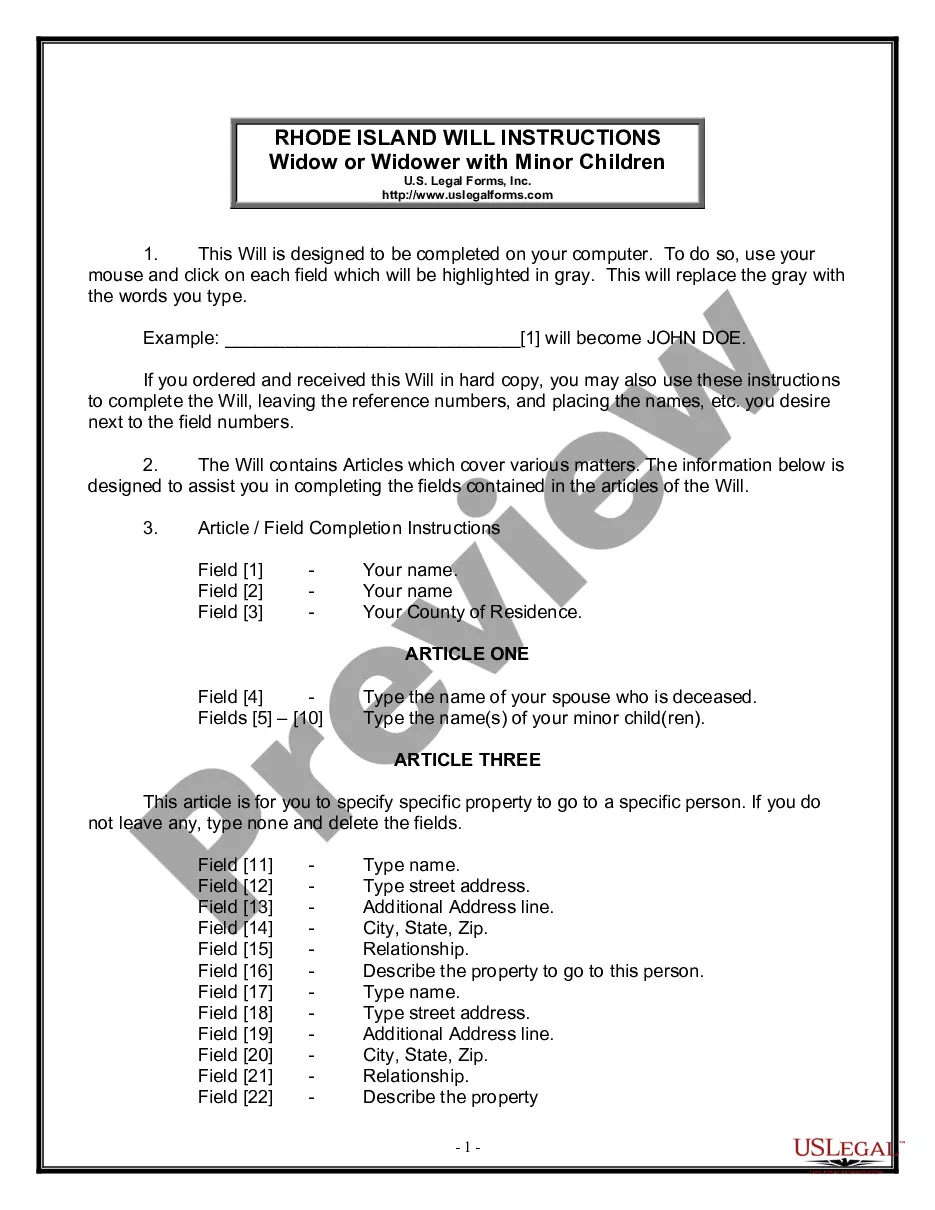

How to fill out Florida Personal Representative's Deed Of Distribution?

Regardless of social or vocational standing, completing law-related paperwork is an unfortunate requirement in today’s workplace.

Often, it is nearly impossible for individuals lacking legal experience to construct such documents from scratch, primarily due to the complicated terminology and legal complexities they entail.

This is where US Legal Forms becomes a valuable resource. Our service provides an extensive collection of over 85,000 ready-to-use state-specific forms suitable for nearly any legal circumstance.

If the form you selected does not meet your requirements, you can restart and search for the appropriate document.

Click Buy now and choose the subscription plan that best fits your needs. Log In with your account details or create a new one from scratch. Select your payment method and proceed to download the Coral Springs Florida Personal Representative's Deed of Distribution once the payment has been completed. You’re all set! Now you can print the document or fill it out online. If you encounter any difficulties accessing your purchased forms, you can easily find them in the My documents section. Regardless of the issue you’re looking to resolve, US Legal Forms has you covered. Give it a try now and witness the benefits.

- Whether you require the Coral Springs Florida Personal Representative's Deed of Distribution or any other document that is acceptable in your state or county, with US Legal Forms, everything is at your disposal.

- Here’s how you can swiftly obtain the Coral Springs Florida Personal Representative's Deed of Distribution using our dependable service.

- If you are an existing client, you can go ahead and Log In to your account to retrieve the required form.

- If you are new to our collection, please ensure that you adhere to the following steps before acquiring the Coral Springs Florida Personal Representative's Deed of Distribution.

- Confirm that the form you have located is appropriate for your region, as the regulations of one state or county may not apply to another.

- Examine the document and review a brief description (if available) of situations for which the document can be utilized.

Form popularity

FAQ

In most instances, there will need to be a court order to transfer the property. And in Florida, that means opening a probate. In Florida, probate is a court proceeding that is filed in the county where the deceased person last resided. The two types of probate are summary and formal.

A distribution deed is another way in which to legally transfer real property when the party who is supposed to receive the property cannot be determined from the decedent's will.

Yes. Florida uses TOD (Transfer-on-Death) and POD (Payable-on-Death) designations which allows the beneficiary (or beneficiaries) to automatically receive the specified asset upon the death of the current owner. TOD designations are often used to transfer the funds in an IRA or brokerage account to a beneficiary.

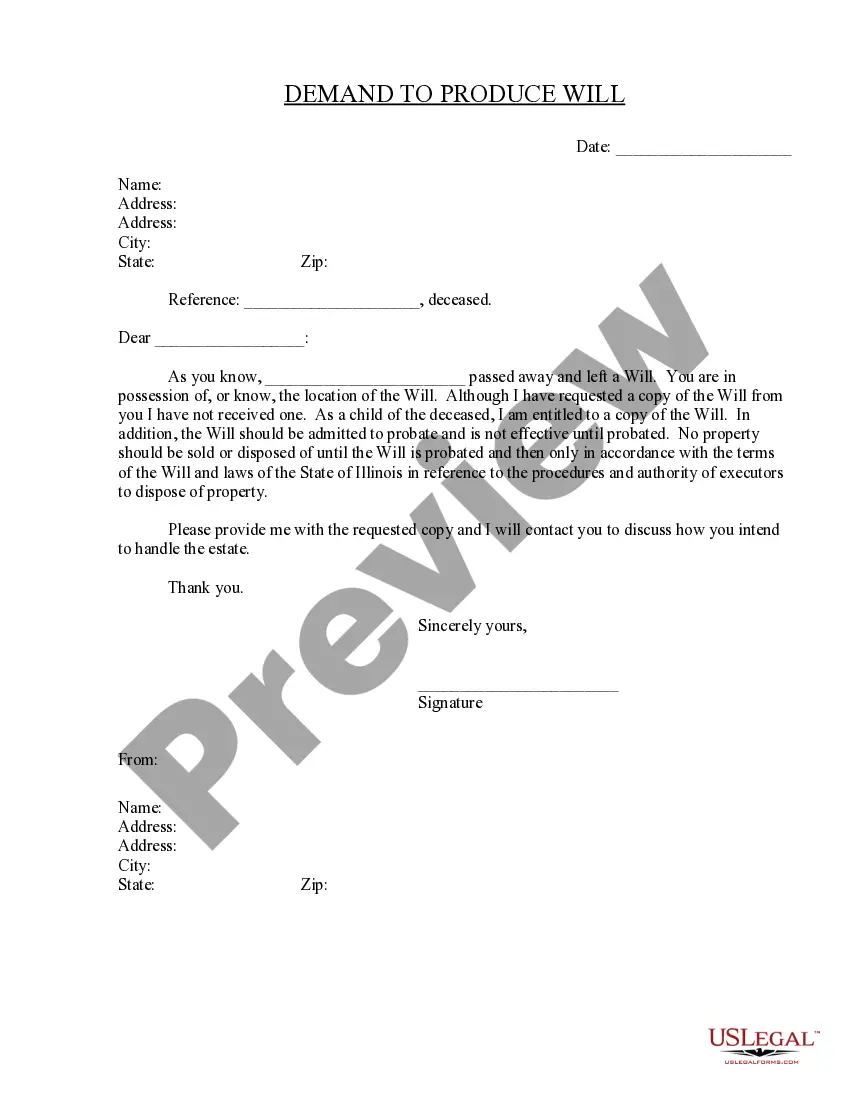

Initiate Probate by Depositing the Original Will Whoever has possession of the Last Will and Testament of the deceased must deposit it with the Florida Probate Court in the county where the person resided within 10 days of learning of their death.

Your surviving spouse inherits everything. If you die with children or other descendants from you and the surviving spouse, and your surviving spouse has descendants from previous relationships. Your surviving spouse inherits half of your intestate property and your descendants inherit the other half.

According to Florida Probate Code 733.612, ?a personal representative, acting reasonably for the benefit of the interested persons, may properly sell, mortgage, or lease any personal property of the estate or any interest in it for cash, credit, or for part cash or part credit, and with or without security for the

(2) Exempt property shall consist of: (a) Household furniture, furnishings, and appliances in the decedent's usual place of abode up to a net value of $20,000 as of the date of death. (b) Two motor vehicles as defined in s.(c) All qualified tuition programs authorized by s.(d) All benefits paid pursuant to s.

Florida Personal Representative's Distributive Deed (intestate) This form is for use by the personal representative of an individual who died without a will. Wills, or last wills and testaments, are estate planning documents used to organize and record how people wish to distribute their assets after death.

This is a set of laws that places relatives of the deceased in order of importance, with spouses and children taking priority. To transfer the property to the beneficiary, the executor or administrator of the estate will need to fill out a document known as an 'Assent' and submit it to the Land Registry.