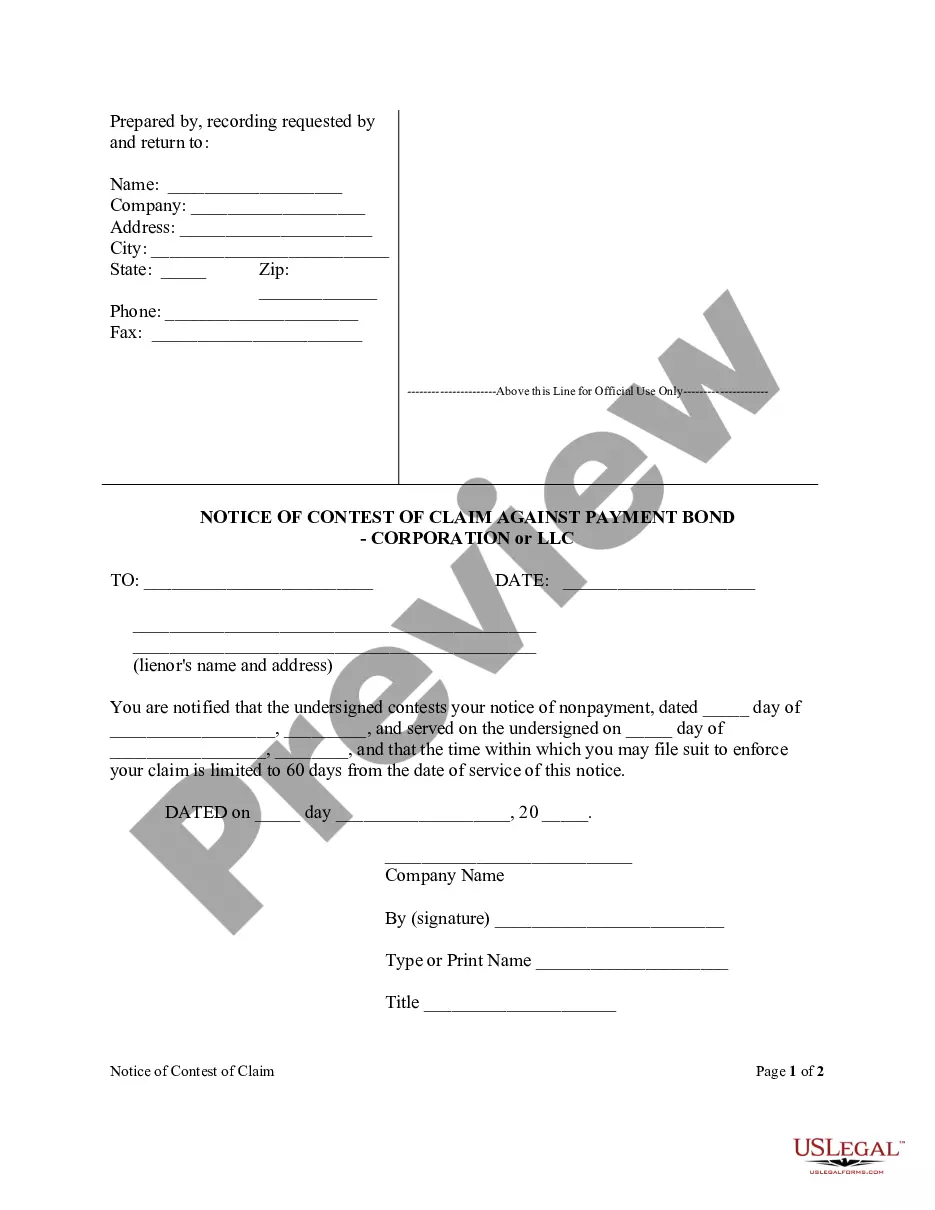

Broward Florida Notice of Contest of Claim Against Payment Bond - Corporation or LLC

Description

How to fill out Florida Notice Of Contest Of Claim Against Payment Bond - Corporation Or LLC?

If you have previously availed yourself of our service, Log In to your account and download the Broward Florida Notice of Contest of Claim Against Payment Bond - Corporation or LLC to your device by clicking the Download button. Ensure that your subscription is current. If it is not, renew it according to your payment arrangement.

If this is your initial interaction with our service, follow these straightforward steps to obtain your document.

You have ongoing access to every document you have purchased: you can find it in your profile under the My documents menu whenever you need to reuse it. Utilize the US Legal Forms service to swiftly locate and save any template for your personal or professional needs!

- Ensure you’ve located the correct document. Review the description and utilize the Preview option, if available, to verify it aligns with your needs. If it does not suit you, employ the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and make a payment. Use your credit card information or the PayPal method to finalize the transaction.

- Obtain your Broward Florida Notice of Contest of Claim Against Payment Bond - Corporation or LLC. Choose the file format for your document and save it to your device.

- Complete your template. Print it or take advantage of professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

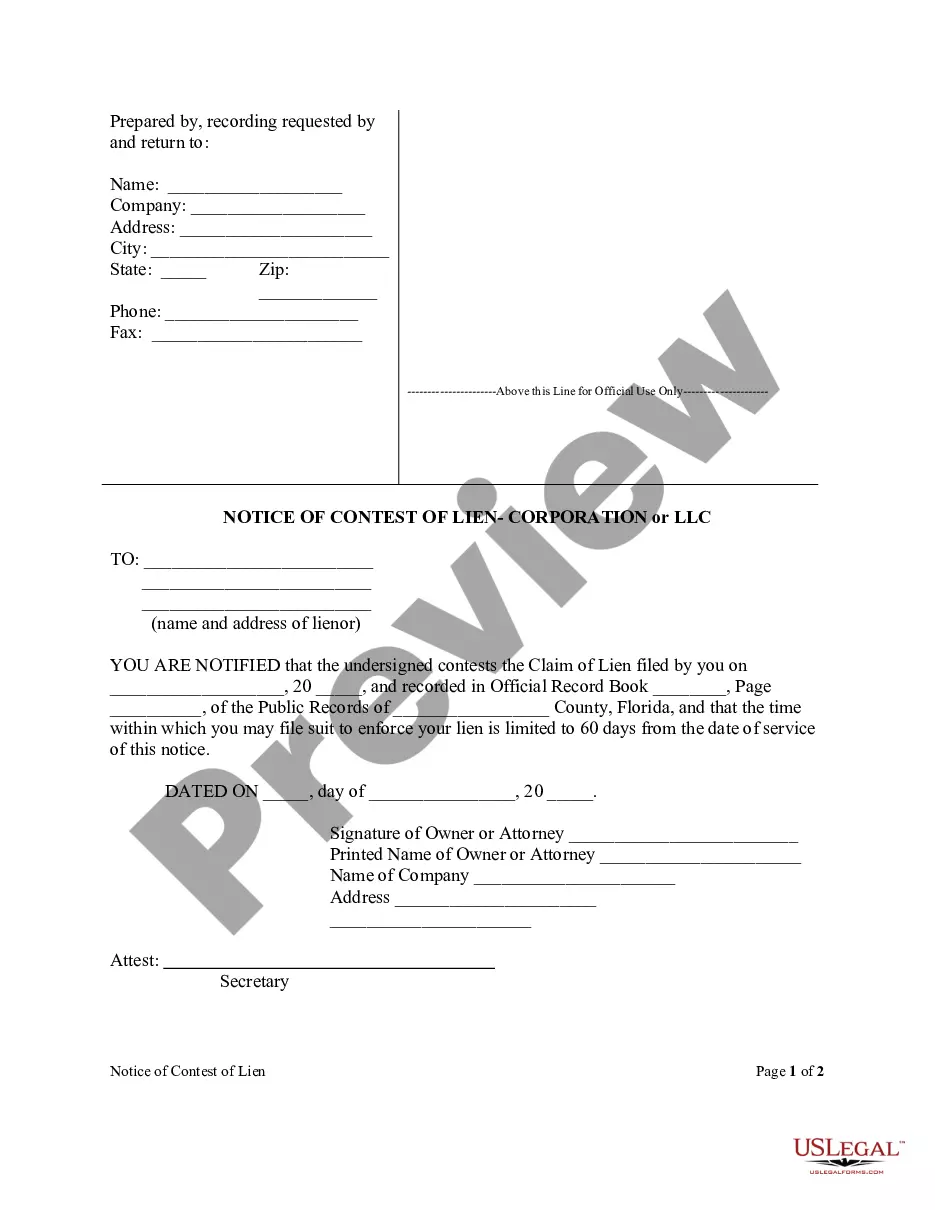

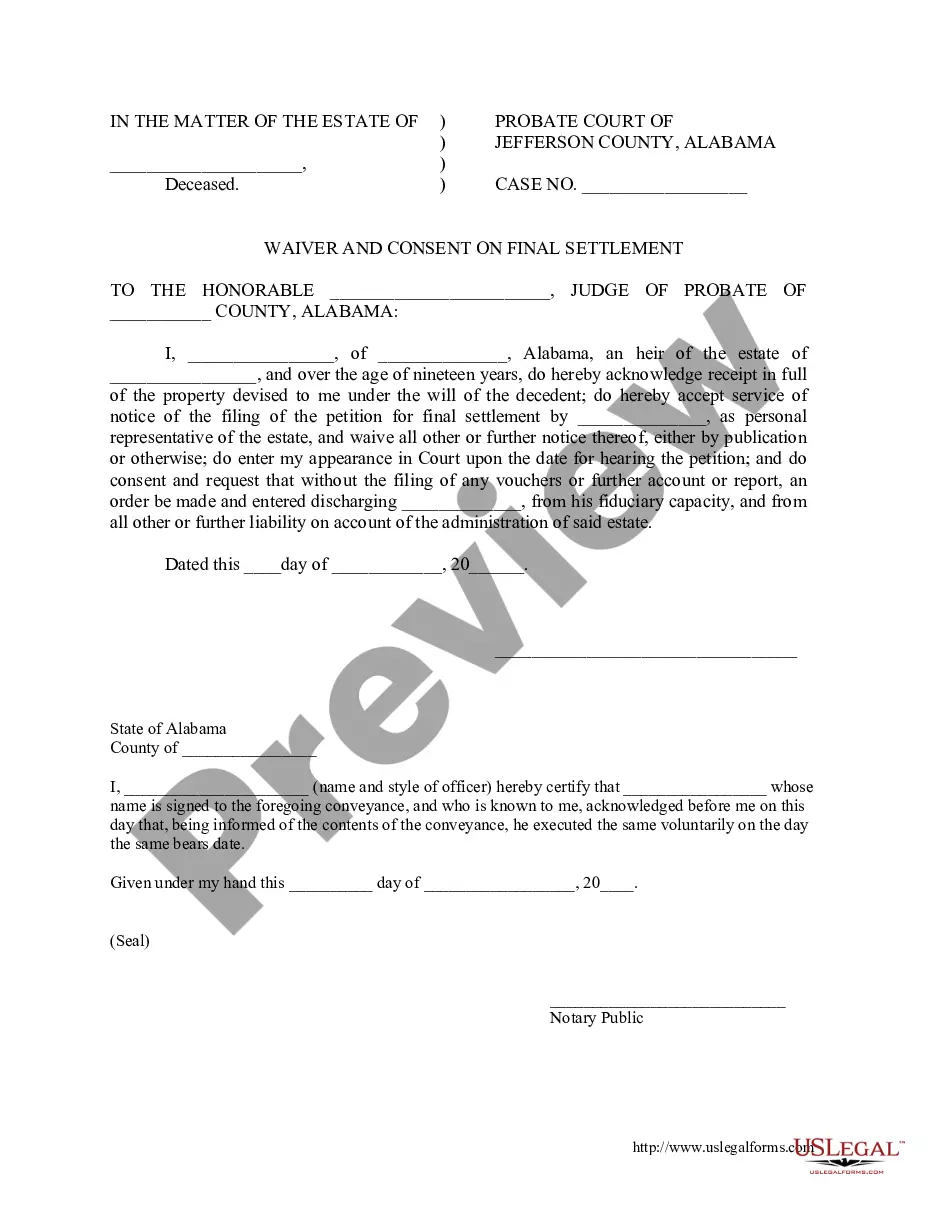

Contesting A Lien An owner has a right to file a Notice of Contest of Lien during the one-year period. Upon the filing of a Notice of Contest of Lien, a lienor must file a lawsuit to enforce the lien within 60 days. Failure of the lienor to timely file a lawsuit renders the lien invalid.

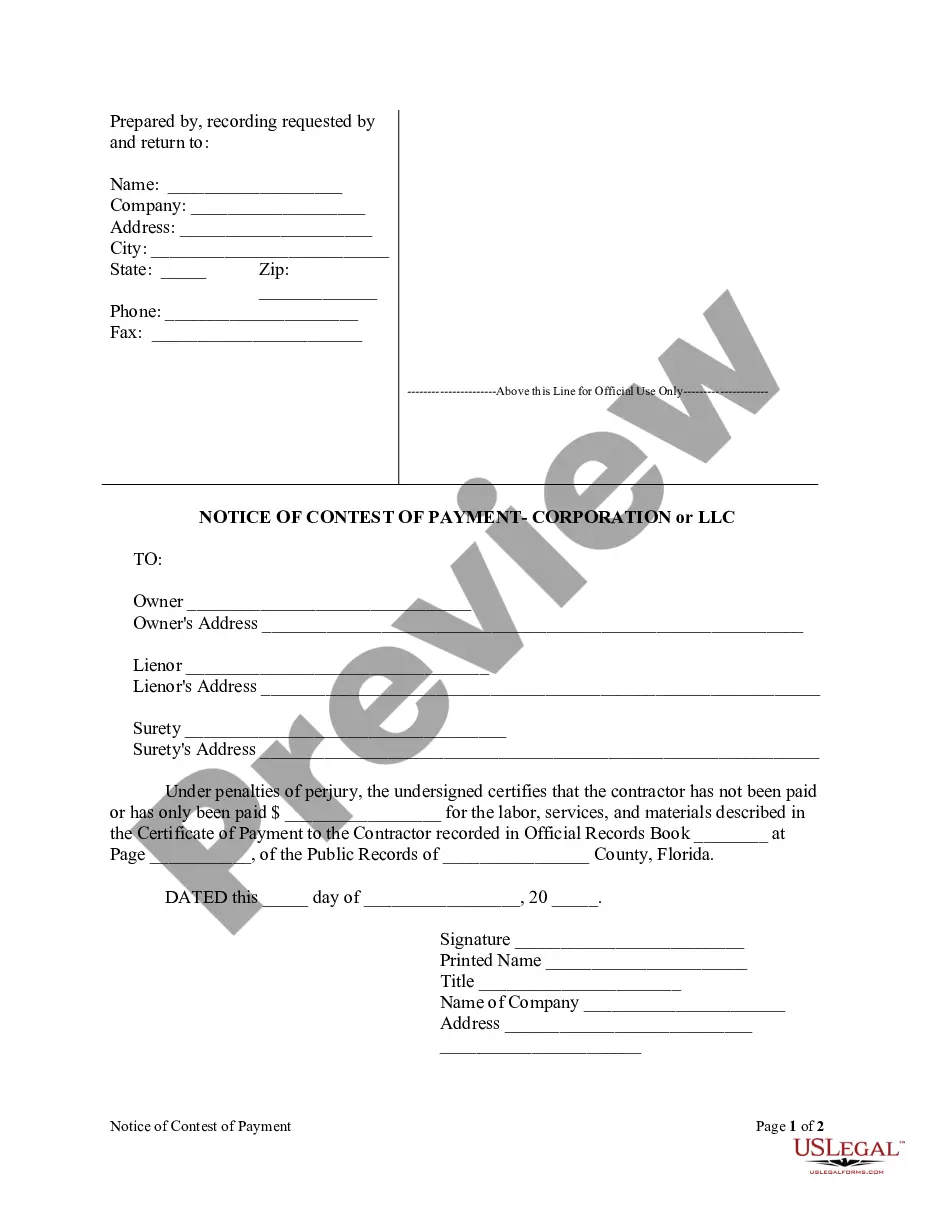

The Payment Bond Claim Process Step 1: Send required notices to protect your bond claim rights.Step 2: Send a Notice of Intent.Step 3: Submit your bond claim.Step 4: Send a Notice of Intent to Proceed Against Bond.Step 5: Enforce your bond claim in court.

A bond claim means the claimant is alleging you haven't fulfilled an obligation of yours that may be covered under the bond. However, genuine disputes occur in business transactions regarding the responsibilities between parties which is why surety companies investigate every claim.

Information You Should Know Liens are valid for five years from the original filing date. Florida law allows judgment liens to be filed a second time to extend the lien's validity five more years. (See s. 55.201-55.209, F.S.)

To remove a lien from your vehicle in Florida, you have to complete your payments. Then the lien holder, whether is an institution like Southeast Toyota Finance or a credit union, will notify electronically notify the Florida DMV that the lien on your vehicle has been released.

A surety bond is a three party guarantee put into place to protect the party requesting the bond and guarantees the performance, ability, honesty and integrity of individuals performing various responsibilities and obligations. The three parties involved are the obligee, principal and surety.

Sign your notice and mail it to the owner via certified mail, return receipt requested or have it personally delivered to the owner. If personally served, you need to receive a signature from an authorize signatory of the owner to prove service was completed.

A Florida mechanics lien must be in the proper format and filed in the county recorder's office in the county where the property is located within the required timeframe. To record a lien in Florida, you will need to bring your completed Claim of Lien form to the recorder's office and pay the filing fee.

How does a surety bond work? At its simplest, a surety bond requires the surety to pay a set amount of money to the obligee if a principal fails to perform a contractual obligation. Obligees are frequently government agencies, but commercial and professional parties can also use surety bonds.

How to File a Bond Claim in Florida Step 1: Obtain a Copy of the Payment Bond.Step 2: Send Notice to Contractor.Step 3: Send Florida Notice of Nonpayment.Step 4: Enforce Your Florida Payment Bond Claim.