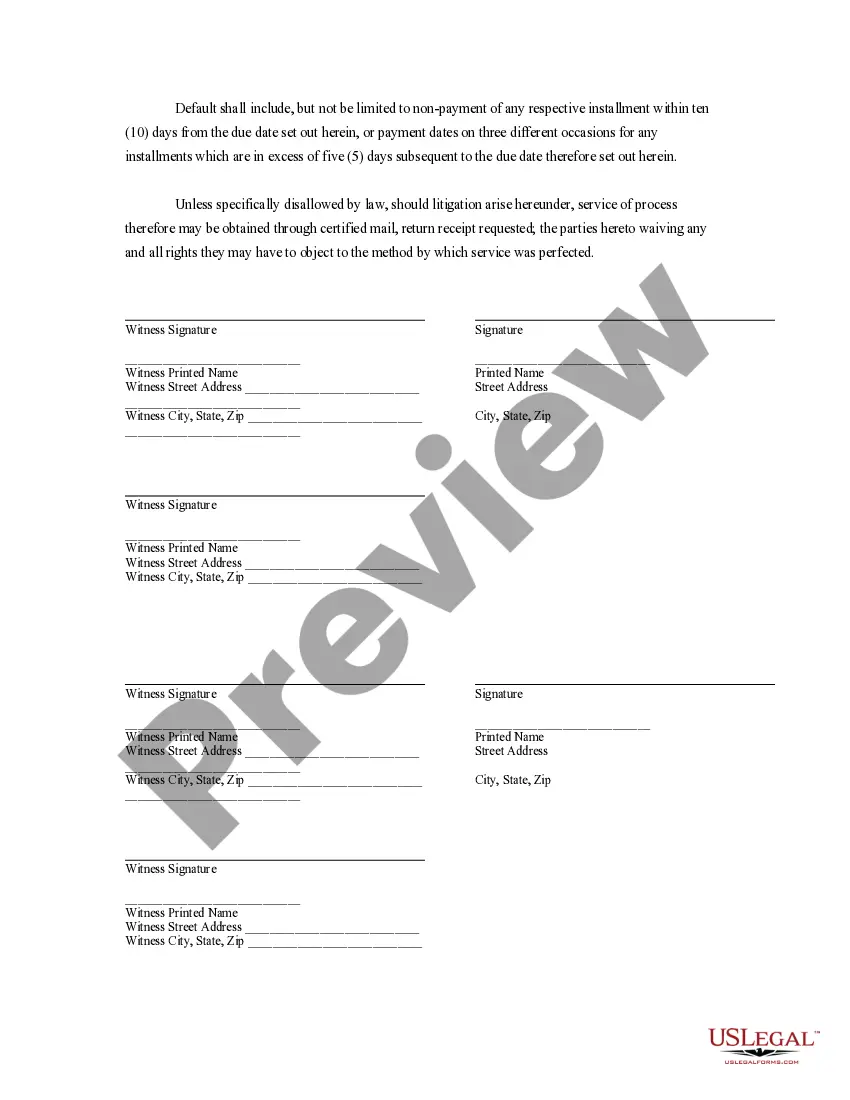

Mortgage Note: This is a general mortgage note to be used when purchasing real estate. It outlines the Seller and Buyer's individual obligations, as well as the interest rate associated with the loan, and/or mortgage note. This form is available in both Word and Rich Text formats.

Tampa Florida Mortgage Note

Description

How to fill out Florida Mortgage Note?

Utilize the US Legal Forms to gain instant access to any form example you need.

Our advantageous platform with a vast collection of templates streamlines the process of locating and obtaining virtually any document example required.

You can download, complete, and sign the Tampa Florida Mortgage Note in minutes instead of spending hours searching online for the appropriate template.

Employing our catalog is an excellent method to enhance the security of your document submissions.

The Download option will be available on all documents you view.

Moreover, you can find all previously saved documents in the My documents section.

- Our experienced attorneys routinely evaluate all documents to ensure that the templates are suitable for a specific state and adhere to new laws and regulations.

- How can you acquire the Tampa Florida Mortgage Note.

- If you have a membership, simply Log In to your account.

Form popularity

FAQ

Requesting a copy of your mortgage promissory note involves contacting your lender or servicer. They usually have processes in place to handle these requests and can provide your Tampa Florida Mortgage Note quickly. If you're uncertain about the procedure, US Legal Forms can guide you through getting the necessary documents promptly. Clarity and organization can enhance your experience.

To get a copy of your mortgage note, reach out to your mortgage lender. Most lenders can provide a duplicate of your Tampa Florida Mortgage Note upon request, often via email or standard mail. If you have any difficulties during this process, consider using platforms like US Legal Forms that specialize in providing legal documents and templates. They can help ensure you receive the right documentation.

Accessing your mortgage note typically involves contacting your mortgage lender's customer service. They may require certain information from you to verify your identity before granting access. If you use a service like US Legal Forms, they can assist in streamlining your request for the Tampa Florida Mortgage Note. An organized approach will help you retrieve your document efficiently.

To obtain your mortgage promissory note, start by contacting your lender or servicer directly. They can provide you with the required documentation, including your Tampa Florida Mortgage Note. If your mortgage has been sold, you may need to reach out to the new holder of your note for access. Keeping good records will help in this process.

Several factors can lead to a promissory note being deemed invalid in Florida. These include lack of mutual consent, absence of a definite amount, or unclear terms regarding repayment. Particularly for a Tampa Florida Mortgage Note, ensure all aspects are clearly articulated to avoid invalidation. Consulting with a legal professional or using platforms like uslegalforms can help ensure that your note meets all necessary legal requirements.

Florida law does not mandate notarization for a promissory note to be valid. Nonetheless, for a Tampa Florida Mortgage Note, notarization can reinforce legal standing and clarity between lenders and borrowers. It is often recommended, as it adds an extra layer of security against future disputes. Choosing to have your note notarized can enhance confidence in your financial agreements.

To find your mortgage note, start by checking with your lender, as they typically hold this document. If your Tampa Florida Mortgage Note has been sold or transferred, the current mortgage servicer should also have this information. Additionally, you can visit your local county clerk's office for public records associated with your property. Utilizing uslegalforms can streamline the process of obtaining necessary documents and forms related to your mortgage.

A promissory note can still be valid in Florida even if it is not notarized. The key factors for validity include mutual agreement and clear terms between parties involved. However, when handling a Tampa Florida Mortgage Note, opting for notarization can prevent disputes and protect all parties by providing a clear legal record. It is advisable to consider notarization to ensure smooth transactions and peace of mind.

Yes, mortgage notes are generally considered public record in Florida. This means that anyone can access these documents through county clerk offices, making them available for verification and due diligence. If you are dealing with a Tampa Florida Mortgage Note, you can easily research public records for information about the property's financial obligations. This transparency can support buyer confidence and trust in the mortgage process.

In Florida, promissory notes do not legally require notarization to be valid. However, having a Tampa Florida Mortgage Note notarized can enhance its credibility and provide additional legal protection. It's a good practice to consider notarization, especially for significant financial transactions, as it helps establish the authenticity of the document. This can be particularly beneficial for both lenders and borrowers.