This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Warranty Deed in Lieu of Foreclosure, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Broward Florida Warranty Deed in Lieu of Foreclosure

Description

How to fill out Florida Warranty Deed In Lieu Of Foreclosure?

Regardless of one's social or professional rank, filling out law-related documents is an unfortunate requirement in the modern world.

Frequently, it’s nearly impossible for an individual without a legal background to draft such paperwork from scratch, primarily because of the intricate vocabulary and legal subtleties involved.

This is where US Legal Forms proves to be invaluable. Our platform provides an extensive library comprising over 85,000 ready-to-use state-specific forms that cater to nearly every legal scenario.

If the form you've chosen does not meet your requirements, you can start over and search for the correct document.

Click Buy now and select the subscription plan that fits you best, using your credentials or registering anew. Choose the payment method and proceed to download the Broward Florida Warranty Deed in Lieu of Foreclosure once the payment is completed.

- If you need the Broward Florida Warranty Deed in Lieu of Foreclosure or any other document that is valid in your area, with US Legal Forms, everything is accessible.

- Here's how you can obtain the Broward Florida Warranty Deed in Lieu of Foreclosure within minutes using our reliable platform.

- If you are already a registered user, simply Log In to your account to download the necessary document.

- If you are new to our collection, ensure you follow these instructions before downloading the Broward Florida Warranty Deed in Lieu of Foreclosure.

- Confirm that the template you’ve selected is appropriate for your region since the regulations of one state or county do not apply to another.

- Examine the document and review a brief overview (if available) of situations where the form can be utilized.

Form popularity

FAQ

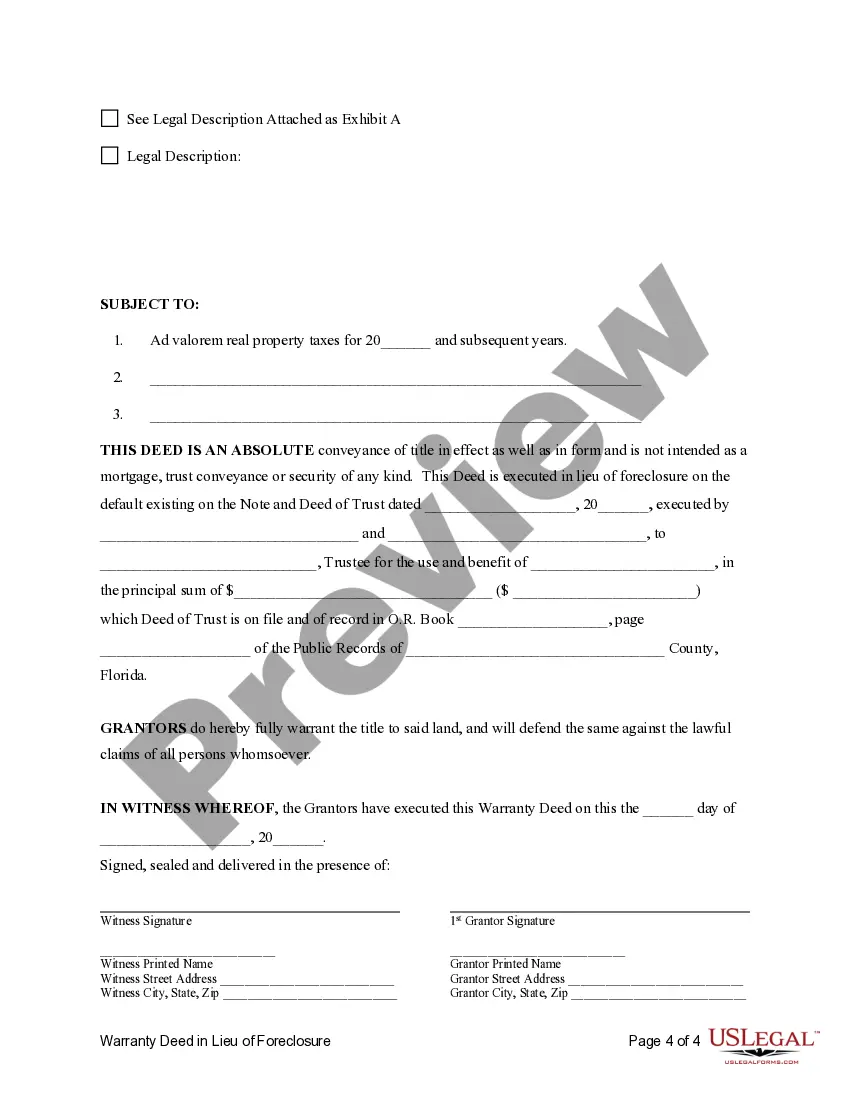

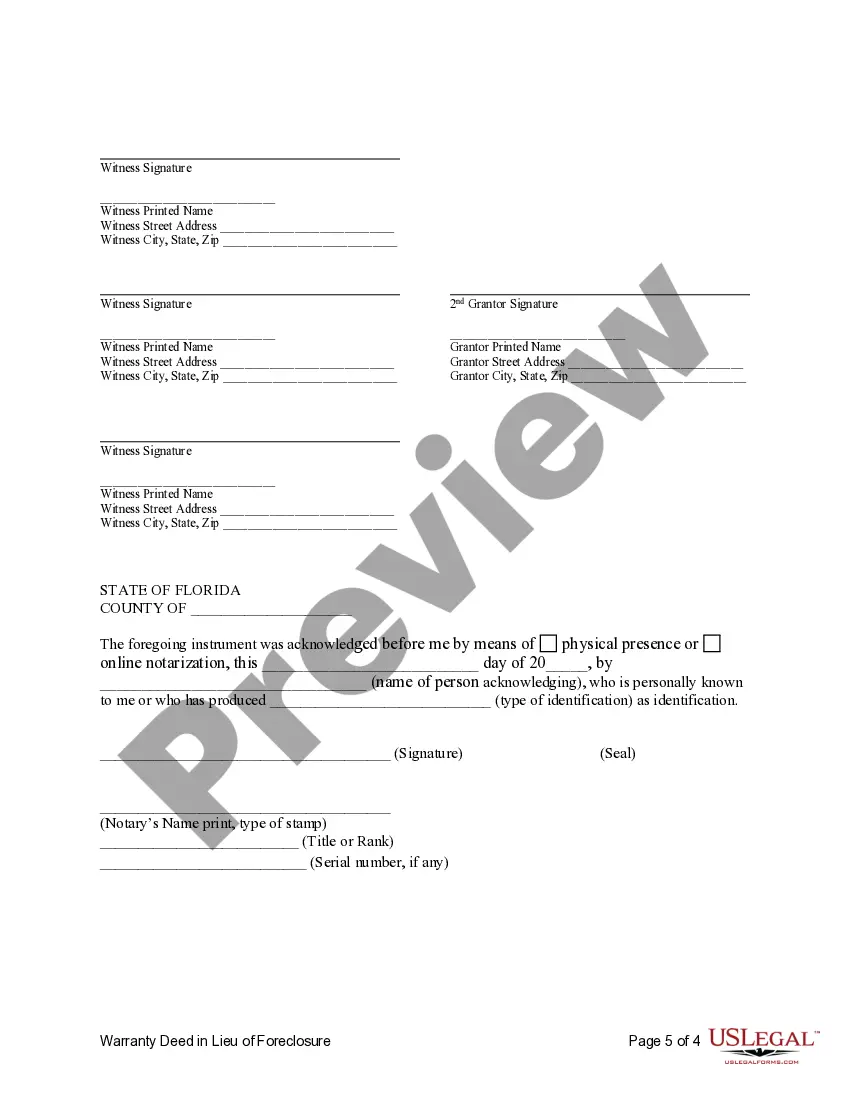

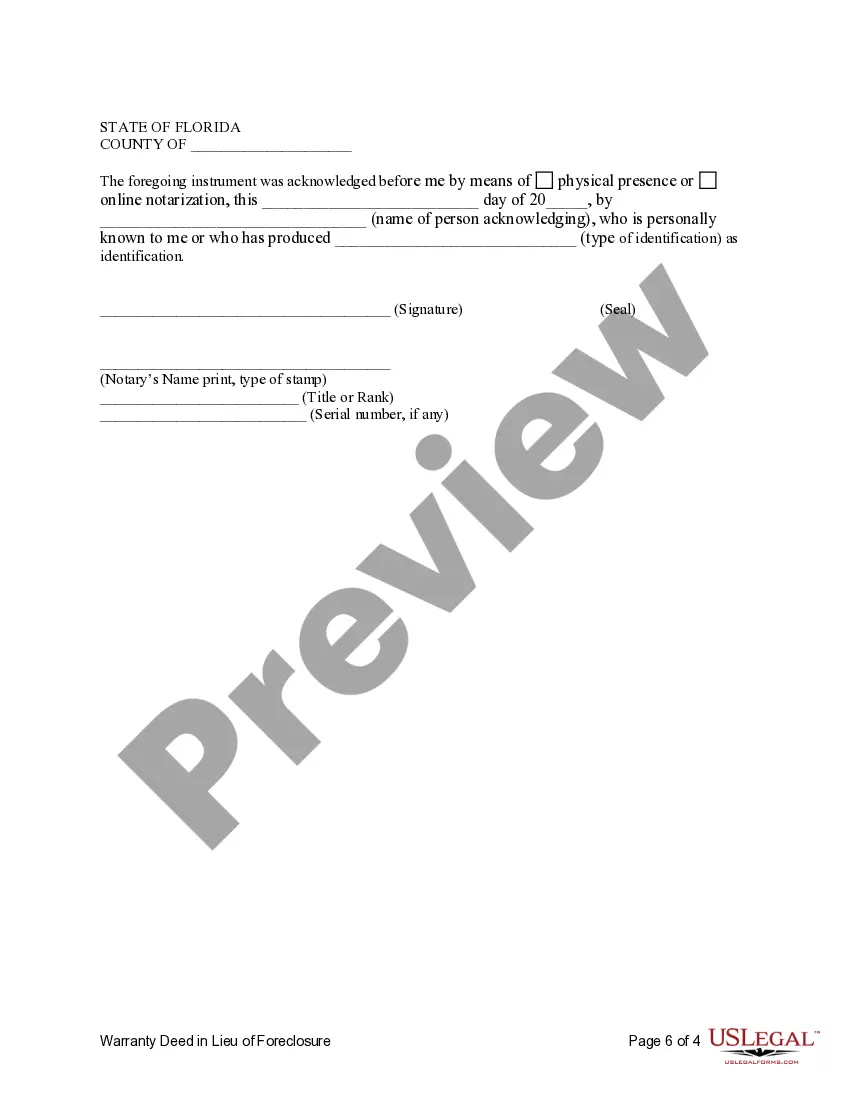

Filing a deed in lieu of foreclosure requires several steps. First, you need to prepare the deed, ensuring it complies with state laws. Once prepared, you file it with your county's clerk office, which records the Broward Florida Warranty Deed in Lieu of Foreclosure. Additionally, maintaining communication with your lender is vital throughout this process to ensure that all agreements are honored and conditions are met.

One of the main disadvantages of a deed in lieu of foreclosure is its potential impact on your credit score. It could also result in a deficiency judgment if the property value is less than what is owed, which may leave you responsible for the difference. Moreover, it may not completely relieve you of all obligations under the mortgage agreement. Therefore, it's essential to carefully consider these factors when dealing with a Broward Florida Warranty Deed in Lieu of Foreclosure.

The time it takes to process a deed in lieu of foreclosure can vary, but typically it may take several weeks to a few months. Initially, you will need to negotiate terms with your lender, which can influence the timeline. Once agreed upon and filed, the clerk’s office will process the Broward Florida Warranty Deed in Lieu of Foreclosure, which may take additional time. Keeping in close contact with your lender can expedite the process.

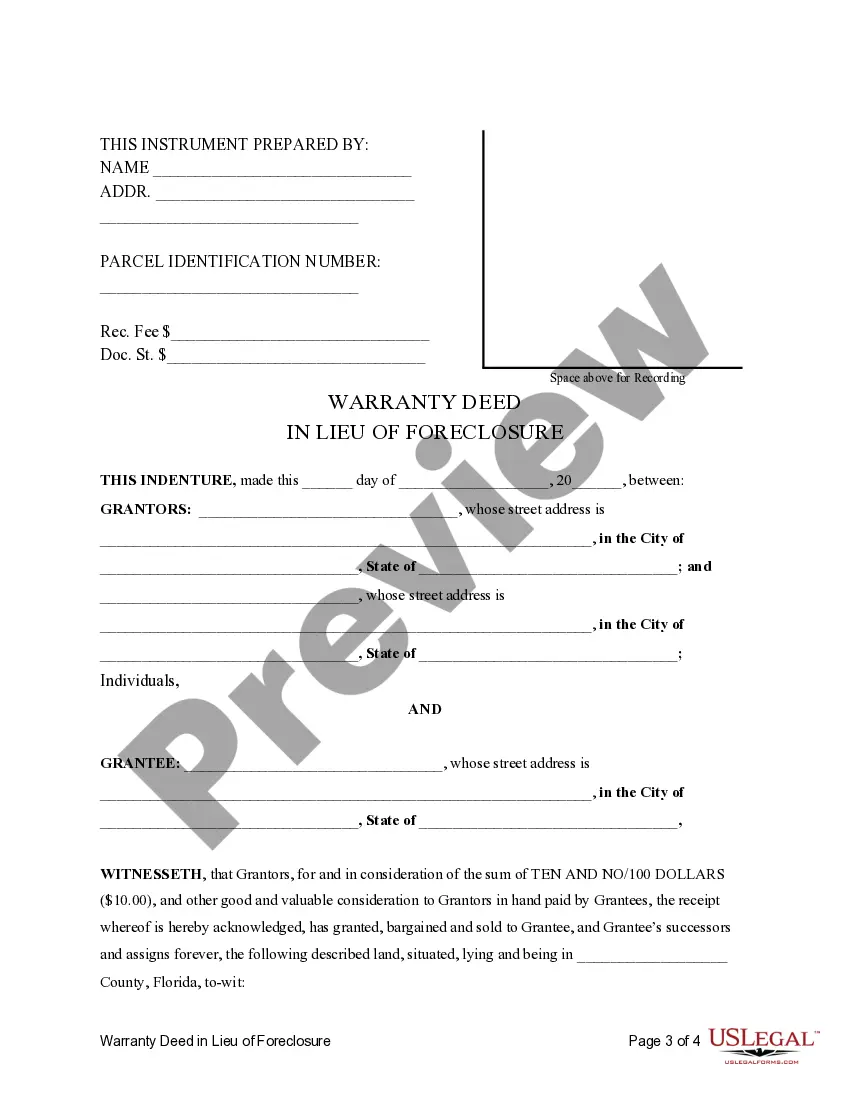

To file a deed in lieu of foreclosure, you must first complete the deed with the required information, including property details and the signature of all parties involved. Next, submit this deed to your county's clerk office for recording. This step is crucial as it legalizes the transfer and updates public records to reflect the Broward Florida Warranty Deed in Lieu of Foreclosure. Make sure you also communicate with your lender throughout this process for any specific requirements they may have.

When writing a deed in lieu of foreclosure letter, start by clearly identifying yourself and the property in question. Next, express your intention to transfer the property to the lender through a deed in lieu of foreclosure. It's also helpful to include any relevant circumstances that led to this decision, ensuring it aligns with the requirements for a Broward Florida Warranty Deed in Lieu of Foreclosure. This will facilitate communication with your lender and help ensure a smoother process.

To get a copy of your warranty deed in Florida, you should contact the county clerk's office where the property is located. They maintain records of all property transactions, including warranty deeds. You can request a copy in person or through their online portal, making sure to have necessary details like the property address and parcel number. This process ensures you have the official documentation related to your Broward Florida Warranty Deed in Lieu of Foreclosure.

A lender might accept a deed in lieu of foreclosure as a strategic measure to reduce costs and expedite property recovery. By opting for a Broward Florida Warranty Deed in Lieu of Foreclosure, lenders can avoid the complications and expenses associated with traditional foreclosure. This approach can also help preserve the lender's resources and provide a more amicable resolution for the homeowner.

In Florida, a deed in lieu of foreclosure is a legal arrangement where a homeowner voluntarily transfers ownership of their property back to the lender to resolve mortgage defaults. This process, referred to as a Broward Florida Warranty Deed in Lieu of Foreclosure, helps both the borrower and the lender avoid the drawn-out foreclosure process. It's a cooperative solution that allows both parties to move on more quickly.

The main disadvantage for lenders accepting a deed in lieu of foreclosure involves the potential for outstanding liens or claims against the property. When utilizing a Broward Florida Warranty Deed in Lieu of Foreclosure, lenders must ensure the property's title is clear, as they could still be held responsible for certain debts. Therefore, thorough due diligence is essential before proceeding with this option.

Lenders favor a deed in lieu of foreclosure because it simplifies the process and reduces costs associated with foreclosure proceedings. By accepting a Broward Florida Warranty Deed in Lieu of Foreclosure, lenders can regain ownership of the property without the usual legal complications and public scrutiny. This not only expedites property recovery but also helps maintain the lender's reputation in the market.