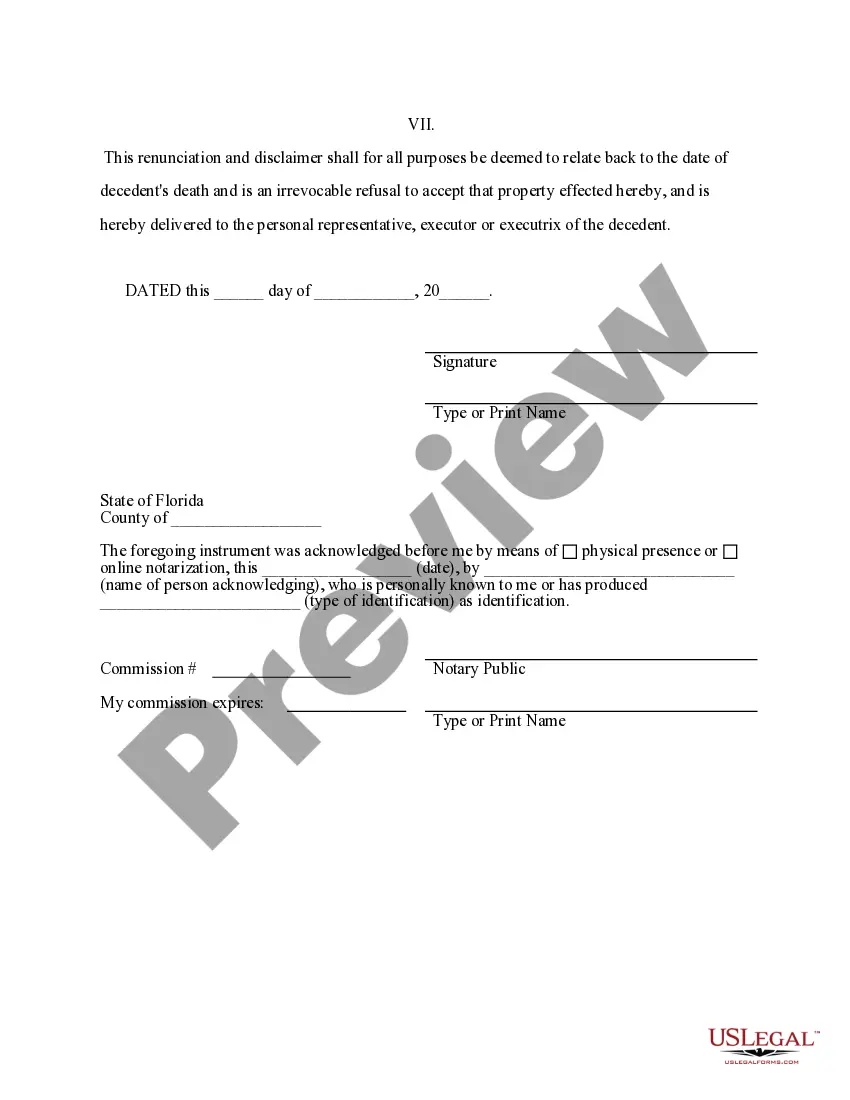

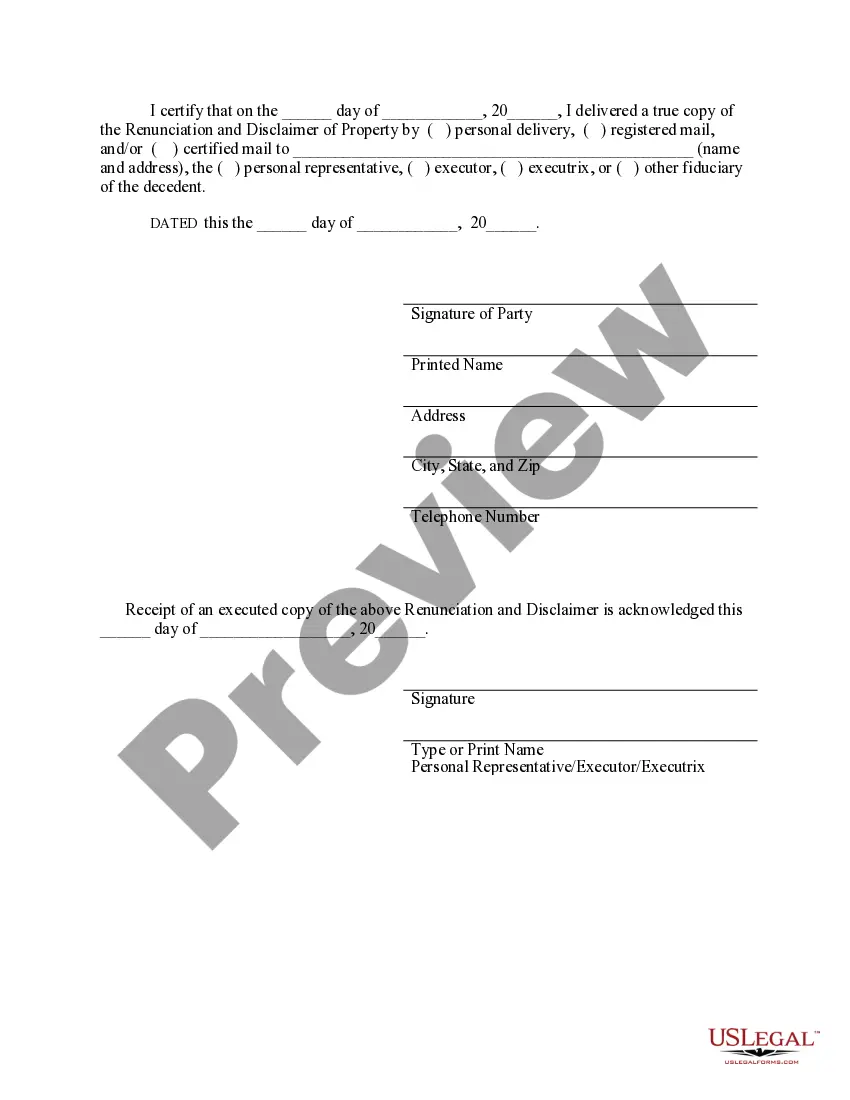

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Jacksonville Florida Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Florida Renunciation And Disclaimer Of Property Received By Intestate Succession?

If you are searching for an appropriate form template, it’s unattainable to discover a superior service than the US Legal Forms website – likely the most extensive online repositories.

With this collection, you can locate thousands of form examples for corporate and individual use by classifications and regions, or keywords.

With our sophisticated search feature, acquiring the latest Jacksonville Florida Renunciation And Disclaimer of Property obtained through Intestate Succession is as straightforward as 1-2-3.

Complete the financial transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the file format and store it on your device. Edit as necessary. Complete, modify, print, and sign the acquired Jacksonville Florida Renunciation And Disclaimer of Property received by Intestate Succession.

- Additionally, the pertinence of each document is verified by a team of proficient attorneys who routinely review the templates on our platform and refresh them according to the latest state and county requirements.

- If you are already aware of our platform and possess an account, all you need to do to obtain the Jacksonville Florida Renunciation And Disclaimer of Property received by Intestate Succession is to Log In to your user profile and click the Download button.

- If this is your initial use of US Legal Forms, simply adhere to the instructions outlined below.

- Ensure you have located the sample you need. Review its description and utilize the Preview feature to assess its content. If it doesn’t fulfill your requirements, use the Search box at the top of the screen to find the desired document.

- Verify your selection. Click the Buy now button. Then, select the desired subscription plan and provide information to create an account.

Form popularity

FAQ

Florida law allows a person to disclaim interests in Probate and in some circumstances can help a debtor avoid paying their share of an inheritance to creditors. To be effective, the disclaimer must be in writing, witnessed and recorded in the same manner as a deed and the original must be filed. Fla. Stat.

Description. The Uniform Disclaimer of Property Interests Act (UDPIA) provides definite, tax-sensitive rules governing refusals to accept transfers of property by gift or inheritance, and identifying who takes the gift in the event of disclaimer.

A disclaimer trust is an estate planning technique in which a married couple incorporates an irrevocable trust in their planning, which is funded only if the surviving spouse chooses to ?disclaim,? or refuse to accept, the outright distribution of certain assets following the deceased spouse's death.

How to Make a Disclaimer Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate?usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.Do not accept any benefit from the property you're disclaiming.

One way for an asset to avoid gift tax liability is if it is a qualified disclaimed gift. The government does not consider a gift or inheritance to be a gift, and it subject to the gift tax if the original recipient refused or disclaimed it.

You disclaim the assets within nine months of the death of the person you inherited them from. (There's an exception for minor beneficiaries; they have until nine months after they reach the age of majority to disclaim.) You receive no benefits from the proceeds of the assets you're disclaiming.

Whatever, the reason, Florida law does not force a person to take what is left to them in a will, and a person who wishes to renounce or disclaim inherited property may do so.

As explained above, a disclaimer avoids the gift, so that it never takes effect. In contrast, a renunciation amounts to a disposition of property by the beneficiary. This may have tax consequences.

It's borrowed directly from the Anglo-French word disclaimer. Disclaimer is the noun form of the verb disclaim, which in its most general sense means ?to disavow? or ?to disown.? It uses the prefix dis- to indicate a reversal or negation.