An AB trust is a trust created by a married couple to avoid probate and minimize federal estate tax. An AB trust is created by each spouse placing property into a trust and naming someone other than his or her spouse as the final beneficiary of that trust. Upon the death of the first spouse, the surviving spouse does not own the assets in that spouse's trust outright, but has a limited power over the assets in accordance with the terms of the trust. Such powers may include the right to receive interest or income earned by the trust, to use the trust property during his or her lifetime, e.g. to live in a house, and/or to use the trust principal for his or her health, education, or support. Upon the death of the second spouse, the trust passes to the final beneficiary of the trust. For estate tax purposes, the trust is included in the first, but not the second, spouse's estate and therefore, avoids double taxation.

Tampa Florida Marital Deduction Trust - Trust A and Bypass Trust B

Description

How to fill out Florida Marital Deduction Trust - Trust A And Bypass Trust B?

Regardless of social or professional standing, the process of completing legal documents is an unfortunate requirement in today's society.

Frequently, it’s nearly unfeasible for an individual lacking any legal knowledge to create such documents from the ground up, primarily due to the complicated terminology and legal subtleties they encompass.

This is where US Legal Forms proves to be beneficial.

Confirm that the template you’ve selected is relevant to your area since the laws of one state or county may not apply to another.

Review the document and check a brief overview (if available) of situations for which the paper can be utilized.

- Our platform provides an extensive collection of over 85,000 ready-to-use state-specific documents suitable for nearly every legal situation.

- US Legal Forms is also a fantastic tool for associates or legal advisers seeking to save time with our DIY forms.

- Regardless of whether you require the Tampa Florida Marital Deduction Trust - Trust A and Bypass Trust B or any other document valid in your jurisdiction, US Legal Forms makes everything readily accessible.

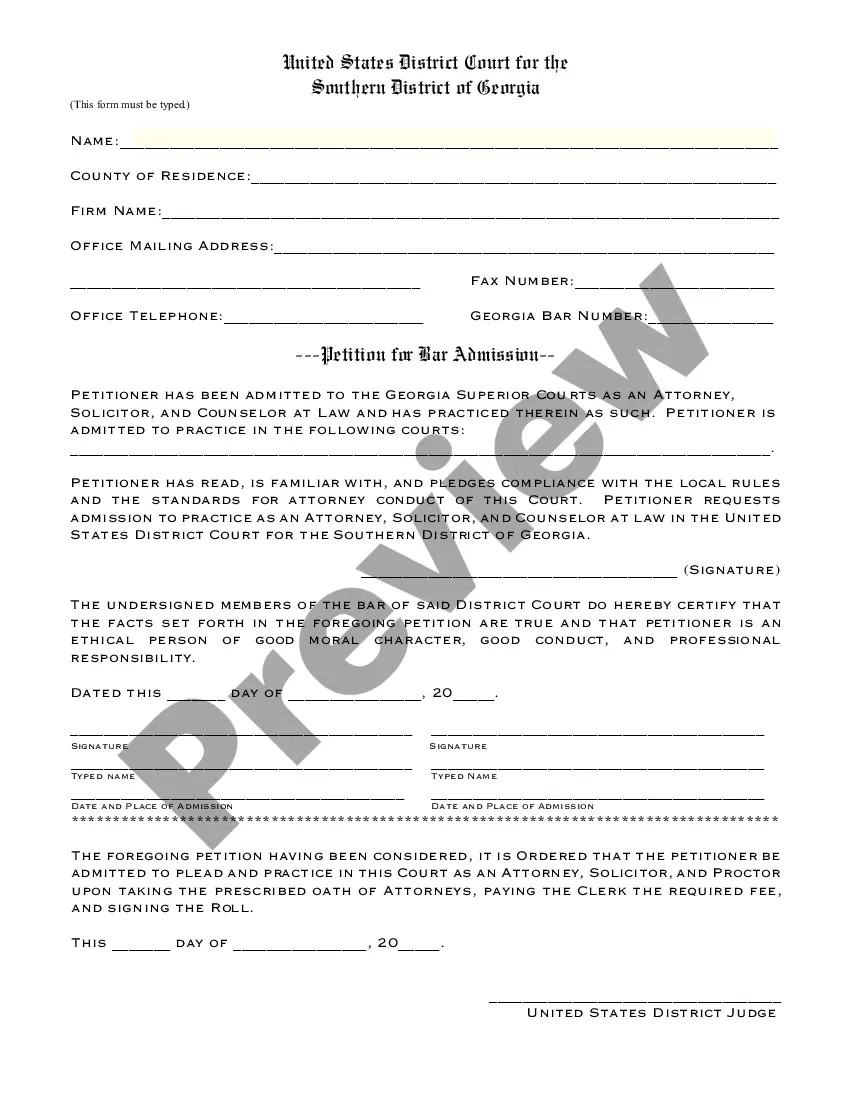

- Here’s how to obtain the Tampa Florida Marital Deduction Trust - Trust A and Bypass Trust B in just minutes using our reliable platform.

- If you're already a customer, feel free to Log In to your account to access the correct form.

- However, if you are new to our collection, ensure to follow these steps before downloading the Tampa Florida Marital Deduction Trust - Trust A and Bypass Trust B.

Form popularity

FAQ

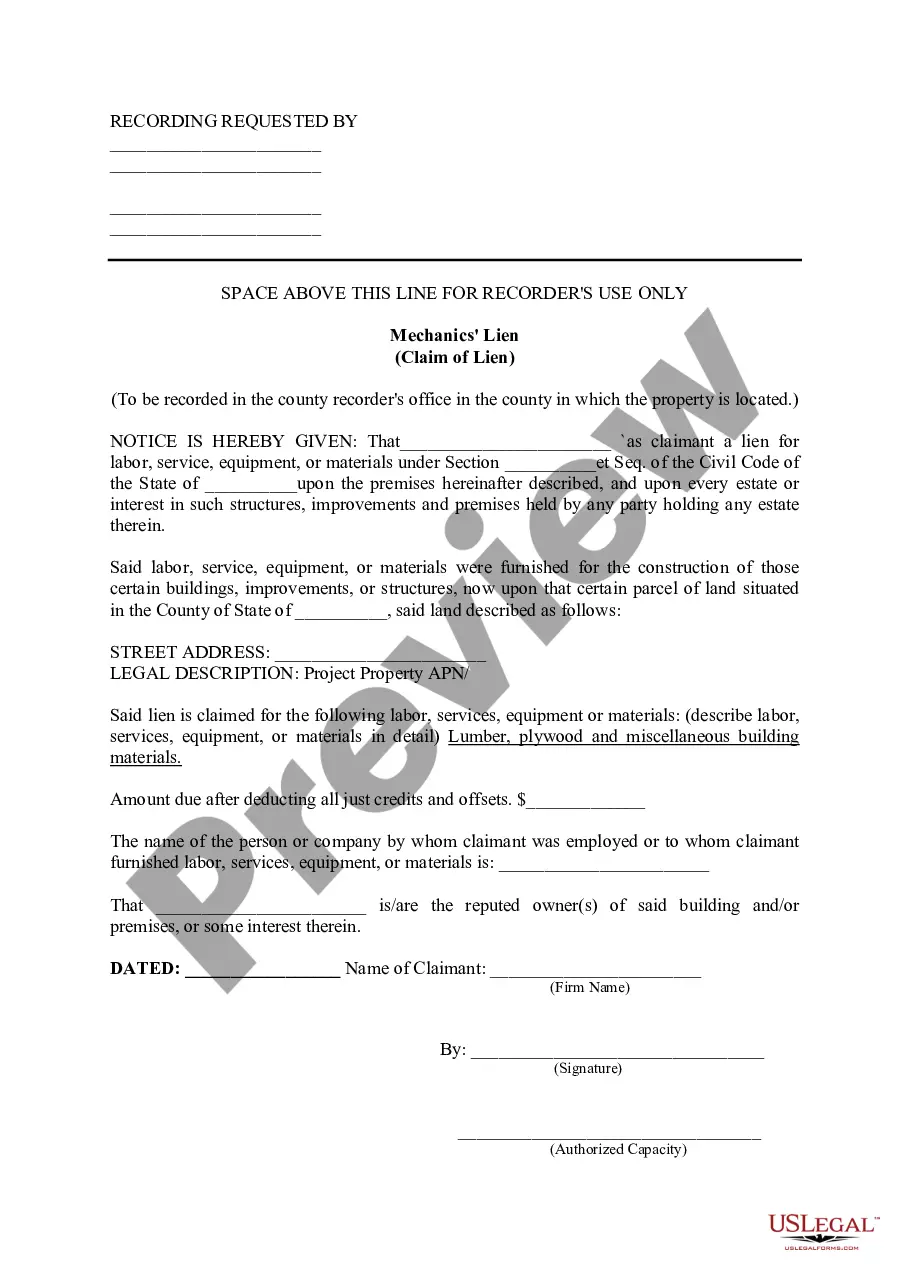

In Florida, whether a trust is considered marital property often depends on the specifics of the trust and when it was created. If the assets were placed in the trust during the marriage, they may be viewed as marital property, potentially affecting division in a divorce. On the other hand, trusts established before the marriage typically retain their separate status. To better understand how this applies to your situation, particularly with the Tampa Florida Marital Deduction Trust - Trust A and Bypass Trust B, consulting with a legal expert is advisable.

Setting up a bypass trust involves several steps, beginning with drafting the trust document, which outlines the trust's terms and beneficiaries. You will need to identify and transfer assets into the trust, as well as designate a trustee to manage it. Utilizing platforms like uslegalforms can streamline the process of creating a Tampa Florida Marital Deduction Trust - Trust A and Bypass Trust B, ensuring that your intentions are clearly expressed and legally binding.

Marriage does not automatically override a trust in Florida. Trusts are legal documents that specify how assets should be managed and distributed, regardless of changes in marital status. However, a spouse may have certain rights to the trust assets depending on the type of trust, like the Tampa Florida Marital Deduction Trust - Trust A and Bypass Trust B. To navigate these nuances, seeking professional legal advice can be beneficial.

In Florida, a spouse cannot simply override a trust without proper legal authority. Trusts, including the Tampa Florida Marital Deduction Trust - Trust A and Bypass Trust B, are designed to manage and distribute assets according to specific terms. However, a spouse can contest certain aspects of the trust in court, depending on their rights and the nature of the trust. It's essential to consult with a legal expert to understand your options.

The main disadvantage of a bypass trust is its complexity and maintenance requirements. Establishing a bypass trust might lead to oversight costs, management needs, and additional tax filings. Potential clients should weigh these factors against the benefits of a Tampa Florida Marital Deduction Trust - Trust A and Bypass Trust B for better clarity on their estate planning goals.

Yes, a bypass trust is often required to file a tax return if it generates taxable income. This filing typically involves IRS Form 1041, and understanding this requirement is crucial for effective estate planning. When considering a Tampa Florida Marital Deduction Trust - Trust A and Bypass Trust B, it is advisable to consult with a tax professional for guidance.

Pass-through trusts are generally not taxed at the trust level; instead, income passes directly to beneficiaries. As a result, beneficiaries report this income on their tax returns. Understanding the taxation of pass-through trusts, especially in the context of a Tampa Florida Marital Deduction Trust - Trust A and Bypass Trust B, can help in effective tax planning.

Trusts can indeed qualify for the marital deduction if they meet specific criteria, primarily allowing for tax-efficient transfer of assets. A Tampa Florida Marital Deduction Trust allows the surviving spouse to benefit from the trust without immediate tax implications. It is important to structure the trust correctly, ensuring it aligns with legal requirements for such deductions.

Trusts often need to file tax returns depending on their structure. For example, a Tampa Florida Marital Deduction Trust, whether it is Trust A or Bypass Trust B, may have different filing requirements. Trusts that generate income typically must file Form 1041 with the IRS. It's crucial to consult a tax professional to understand your specific obligations.

One major disadvantage of a bypass trust, or Trust B, is the complexity it adds to estate planning. Setting up and maintaining the trust requires careful management and legal guidance. Additionally, there may be limitations on how the surviving spouse can access the trust’s assets, which could pose financial challenges. Understanding these aspects within a Tampa Florida Marital Deduction Trust framework can guide you in making informed decisions.