Title: Understanding the Thornton Colorado Exclusion of Uncompensated Officials for Workers' Compensation Keywords: Thornton Colorado, exclusion, uncompensated officials, workers' compensation Introduction: The Thornton Colorado Exclusion of Uncompensated Officials for Workers' Compensation is a legal provision that addresses the eligibility of unpaid officials for workers' compensation benefits. This exclusion aims to outline the criteria under which certain officials, who do not receive compensation for their services, may be exempt from coverage. Types of Thornton Colorado Exclusion of Uncompensated Officials for Workers' Compensation: 1. Volunteer Officials: The exclusion encompasses unpaid positions held by volunteers who perform official duties for public entities, such as local government bodies or non-profit organizations. These positions could include volunteer board members, commissioners, committee members, or other officials who are not financially compensated. 2. Non-Profit Officials: This type of exclusion applies to officials serving in unpaid positions within non-profit organizations based in Thornton, Colorado. It distinguishes between employees who receive compensation for their work and officials who voluntarily contribute their time and expertise without any financial remuneration. 3. Municipal Government Officials: The Thornton Colorado Exclusion of Uncompensated Officials for Workers' Compensation also covers unpaid officials serving within the municipal government structure. This category typically includes officials holding positions within city councils, planning commissions, advisory boards, and other similar roles where no financial compensation is provided. Eligibility Criteria: To benefit from the Thornton Colorado Exclusion of Uncompensated Officials for Workers' Compensation, certain criteria must be met. These criteria often include: 1. Voluntary Status: Applicants must clearly demonstrate that their official position is strictly voluntary and unpaid, with no financial reimbursements or benefits tied to their role. 2. Non-Predominant Work: The position held by the applicant should not constitute their primary or predominant occupation, indicating that the official role does not surpass other income-generating activities. 3. Direct or Indirect Government Affiliation: In most cases, the excluded officials must serve within the public sector or have a direct or indirect affiliation with governmental entities or non-profit organizations recognized by local authorities. 4. Compliance with Statutory Requirements: Officials seeking exclusion from workers' compensation coverage must fulfill any additional statutory requirements set forth by the state of Colorado or the city of Thornton. Conclusion: The Thornton Colorado Exclusion of Uncompensated Officials for Workers' Compensation is designed to delineate the terms under which unpaid officials in various capacities may be exempt from the obligation of workers' compensation coverage. By identifying different categories of exclusion, such as volunteer officials, non-profit officials, and municipal government officials, this provision ensures that officials who genuinely contribute their services without financial compensation can continue their roles without the burden of workers' compensation expenses.

Thornton Colorado Exclusion of Uncompensated Officials for Workers' Compensation

Description

How to fill out Thornton Colorado Exclusion Of Uncompensated Officials For Workers' Compensation?

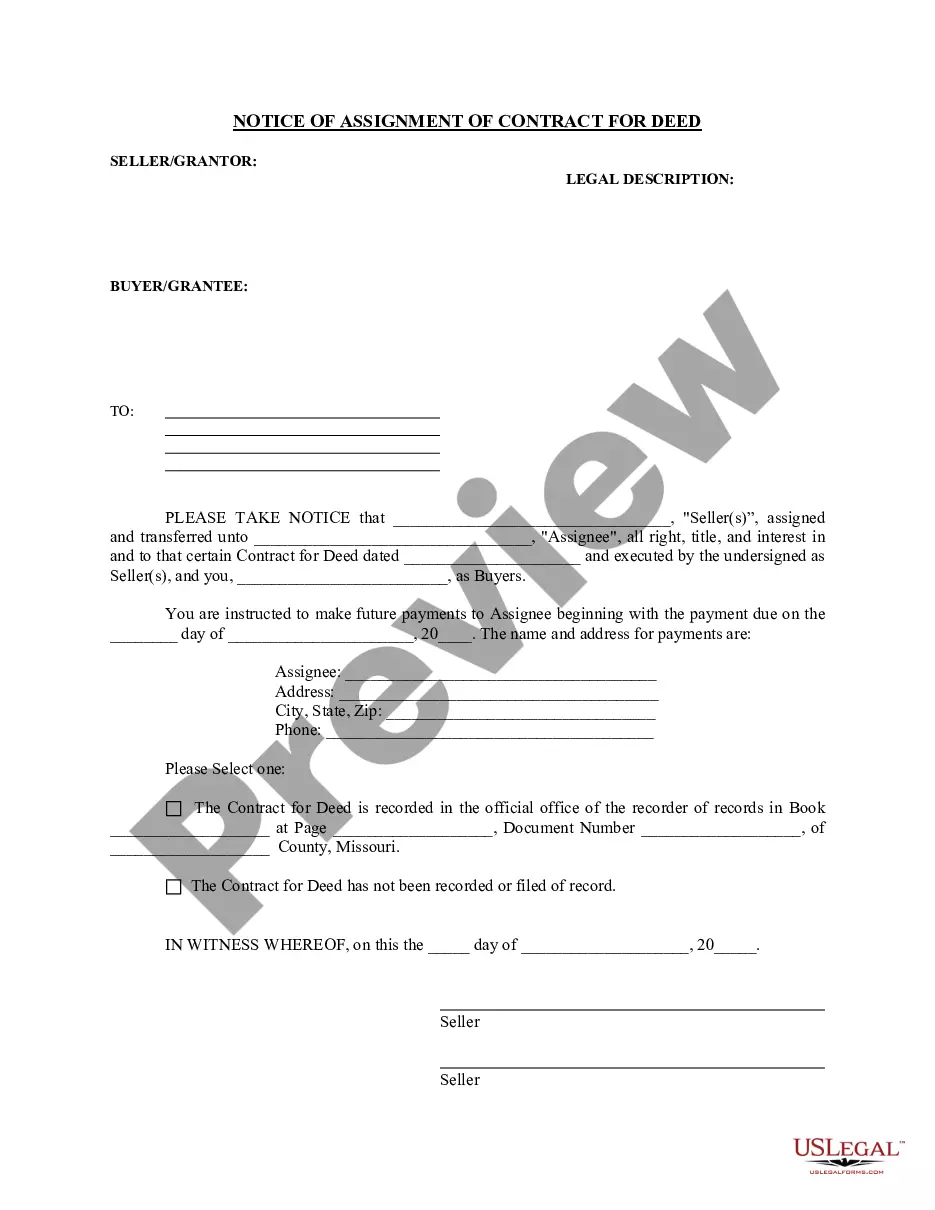

Do you require a reliable and budget-friendly provider of legal documents to obtain the Thornton Colorado Exclusion of Uncompensated Officials for Workers' Compensation? US Legal Forms is your ideal choice.

Whether you seek a simple agreement to establish rules for living together with your partner or a collection of forms to facilitate your separation or divorce through the legal system, we are here to assist you. Our platform boasts over 85,000 current legal document templates for personal and business needs. All templates we offer aren’t generic and are tailored according to the specifications of particular states and regions.

To download the document, you must Log In, locate the desired template, and click the Download button next to it. Please remember that you can access your previously purchased form templates at any time in the My documents section.

Is this your first visit to our site? No need to worry. You can create an account within minutes, but first, ensure to do the following: Check if the Thornton Colorado Exclusion of Uncompensated Officials for Workers' Compensation adheres to the laws of your state and locality. Review the form’s specifics (if available) to determine who and what the form is suitable for. Restart the search if the template does not meet your legal requirements.

Try US Legal Forms today and stop wasting hours scouring the internet for legal documents.

- Now you can register your account.

- Then select your subscription option and proceed to payment.

- Once the payment is finalized, download the Thornton Colorado Exclusion of Uncompensated Officials for Workers' Compensation in any format you prefer.

- You can revisit the website whenever needed and redownload the form without incurring any additional charges.

- Finding current legal forms has never been simpler.

Form popularity

FAQ

Starting a Business in Colorado ?If you have one or more employees working for you in Colorado, you must have workers' compensation insurance and maintain it at all times. This applies to all employers, regardless of whether the employees are part-time, full-time, or family members.

Exemptions include: people covered under other workers' compensation acts, such as railroad workers, longshoremen and federal employees; domestic servants (coverage is optional); agricultural workers who work fewer than 30 days or earn less than $1,200 in a calendar year from one employer; and employees who have

Colorado is an NCCI state like most other states. This means that NCCI oversees employers' experience modifiers and collects all data for the state including claims, class codes, premiums, and payroll. They analyze this data and make annual recommendations to carriers and to the CO Department of Insurance.

According to prescription, anyone who employs one or more part- or full time workers must register with the Compensation Fund and pay annual assessment fees. The Compensation Fund is a trust fund that is controlled by the Compensation Commissioner and employer contributes to the Compensation Fund.

These states are: California, Delaware, Indiana, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Carolina, Pennsylvania, and Wisconsin.

Workers' compensation insurance is required for all employers operating in Colorado, with a few limited exceptions listed on our Independent Contractors and Coverage Exemptions page. If you do not have workers' compensation insurance, you can be fined up to $500 for every day you are uninsured.

Generally, nope. If your business is a sole proprietorship, single-member LLC, or partnership, and you don't have employees, California law usually doesn't require you to have a workers' comp policy.

Workers' compensation in Colorado applies to all employees, both part-time and full-time. Employees are eligible for workers' comp benefits whether they are paid an hourly wage or salary. Workers' comp does not, however, apply to independent contractors and the self-employed under Colorado law.

This is a list of the Non-NCCI States: California. Delaware. Indiana. Massachusetts. Michigan. Minnesota. New Jersey. New York.