This is an official form from the Colorado State Judicial Branch, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Colorado statutes and law.

Fort Collins Colorado Instructions For Appealing Property Tax Assessments With The District Court

Description

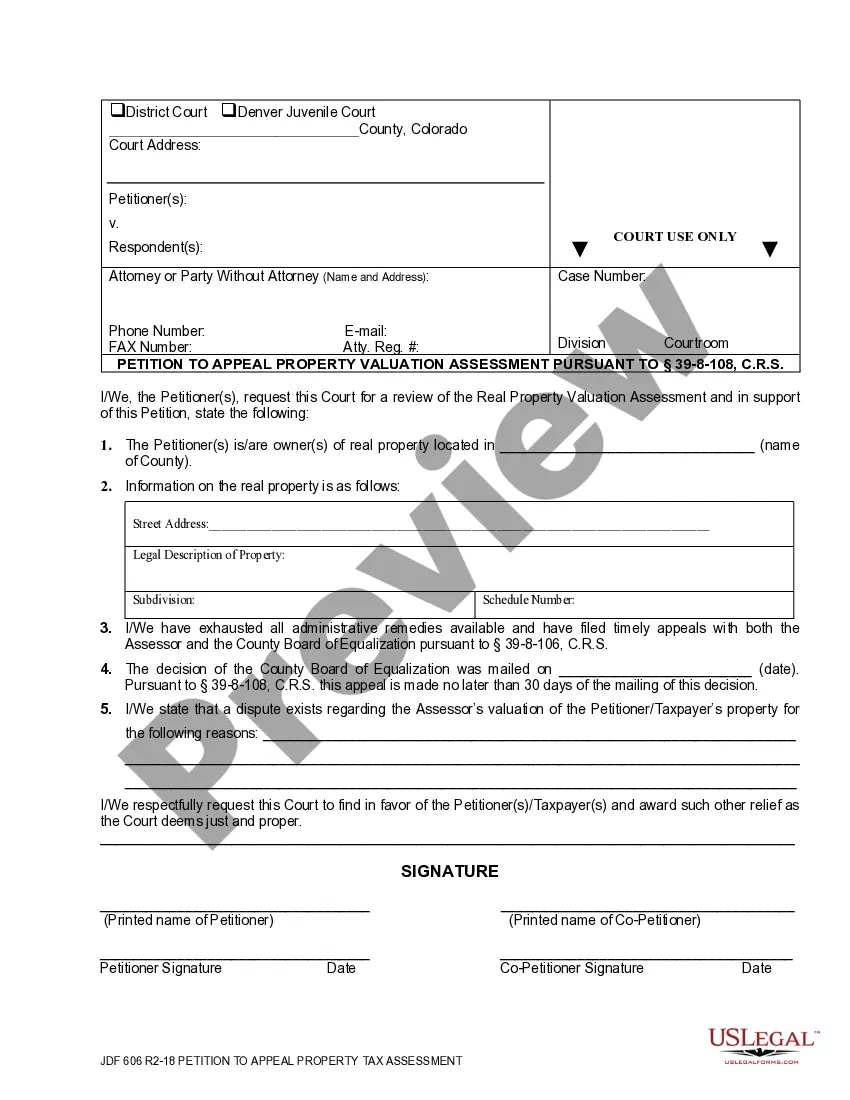

How to fill out Colorado Instructions For Appealing Property Tax Assessments With The District Court?

If you have previously employed our service, sign in to your account and download the Fort Collins Colorado Instructions For Contesting Property Tax Assessments With The District Court onto your device by clicking the Download button. Ensure that your subscription is active. If it is not, renew it following your payment plan.

If this is your initial interaction with our service, adhere to these straightforward steps to acquire your document.

You have ongoing access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to utilize it again. Take advantage of the US Legal Forms service to efficiently locate and store any template for your personal or professional needs!

- Confirm you’ve found an appropriate document. Review the description and utilize the Preview option, if accessible, to verify if it suits your needs. If it does not suit you, utilize the Search tab above to find the right one.

- Purchase the template. Press the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Input your credit card information or select the PayPal option to finalize the transaction.

- Retrieve your Fort Collins Colorado Instructions For Contesting Property Tax Assessments With The District Court. Choose the file format for your document and store it on your device.

- Complete your form. Print it or utilize professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

To protest property taxes in Larimer County, begin by submitting a written protest to the Larimer County Assessor. Include evidence like photographs or appraisals that highlight your property’s value issues. If you’re still unsatisfied with the outcome, consider advancing your case to the district court, utilizing the Fort Collins Colorado Instructions For Appealing Property Tax Assessments With The District Court to navigate the legal process effectively.

Appealing property taxes in Colorado involves filing a formal protest with your county assessor’s office. You must provide valid reasons for your appeal, supported by data such as recent sales of comparable properties. After the initial protest, you may take further steps by challenging the assessment in court, following the Fort Collins Colorado Instructions For Appealing Property Tax Assessments With The District Court for precise guidelines.

To win a property tax appeal, start by gathering evidence that supports your claim. You should compare your property’s assessed value with similar properties in Fort Collins, Colorado. Next, prepare a strong case with documentation showing discrepancies. Following the Fort Collins Colorado Instructions For Appealing Property Tax Assessments With The District Court can guide you through this process.

The best reason to protest property taxes is when your property has been assessed at a value that does not accurately reflect its market value. By demonstrating this discrepancy, you can appeal your assessment and potentially reduce your tax burden. Following the Fort Collins Colorado Instructions For Appealing Property Tax Assessments With The District Court can strengthen your case further. Consider using uslegalforms to find resources and assistance that make the process simpler.

Writing a protest letter for taxes involves clearly stating your case and supporting it with relevant facts. Begin with a polite introduction, then outline the reasons for your appeal concisely. Make sure to follow the Fort Collins Colorado Instructions For Appealing Property Tax Assessments With The District Court to format your letter correctly. Using uslegalforms can provide you with templates and guidance to streamline this process.

To win a property tax appeal, you must gather strong evidence that supports your case. Start by reviewing your property assessment details and identifying any discrepancies. You can then present this information using the Fort Collins Colorado Instructions For Appealing Property Tax Assessments With The District Court. Utilizing platforms like uslegalforms can help you prepare the necessary documentation effectively.

Winning a tax assessment appeal involves presenting a strong case supported by credible evidence. Utilize comparable sales, expert testimonials, and comprehensive appraisal reports to build your argument. By reviewing the Fort Collins Colorado Instructions For Appealing Property Tax Assessments With The District Court, you will gain insights that can significantly enhance your chances of winning your appeal.

To win a property tax assessment appeal, prepare thoroughly by gathering evidence that supports your claim. Present factual data clearly during your hearing, and ensure you understand the specific criteria used in similar cases. By following the Fort Collins Colorado Instructions For Appealing Property Tax Assessments With The District Court, you position yourself more favorably for a successful outcome.

One common reason a property owner may protest the assessment of their property is believing that the assessed value exceeds the market value. If the property value does not align with the selling prices of similar homes, it can be a strong basis for a protest. Referencing the Fort Collins Colorado Instructions For Appealing Property Tax Assessments With The District Court can aid you in substantiating your claim.

To challenge your property tax assessment in Colorado, begin by filing a formal appeal with your local assessor’s office. Collect supporting documentation that justifies your position, such as market trends and property valuations. Using the Fort Collins Colorado Instructions For Appealing Property Tax Assessments With The District Court, you can streamline your appeal process and ensure all necessary steps are taken.