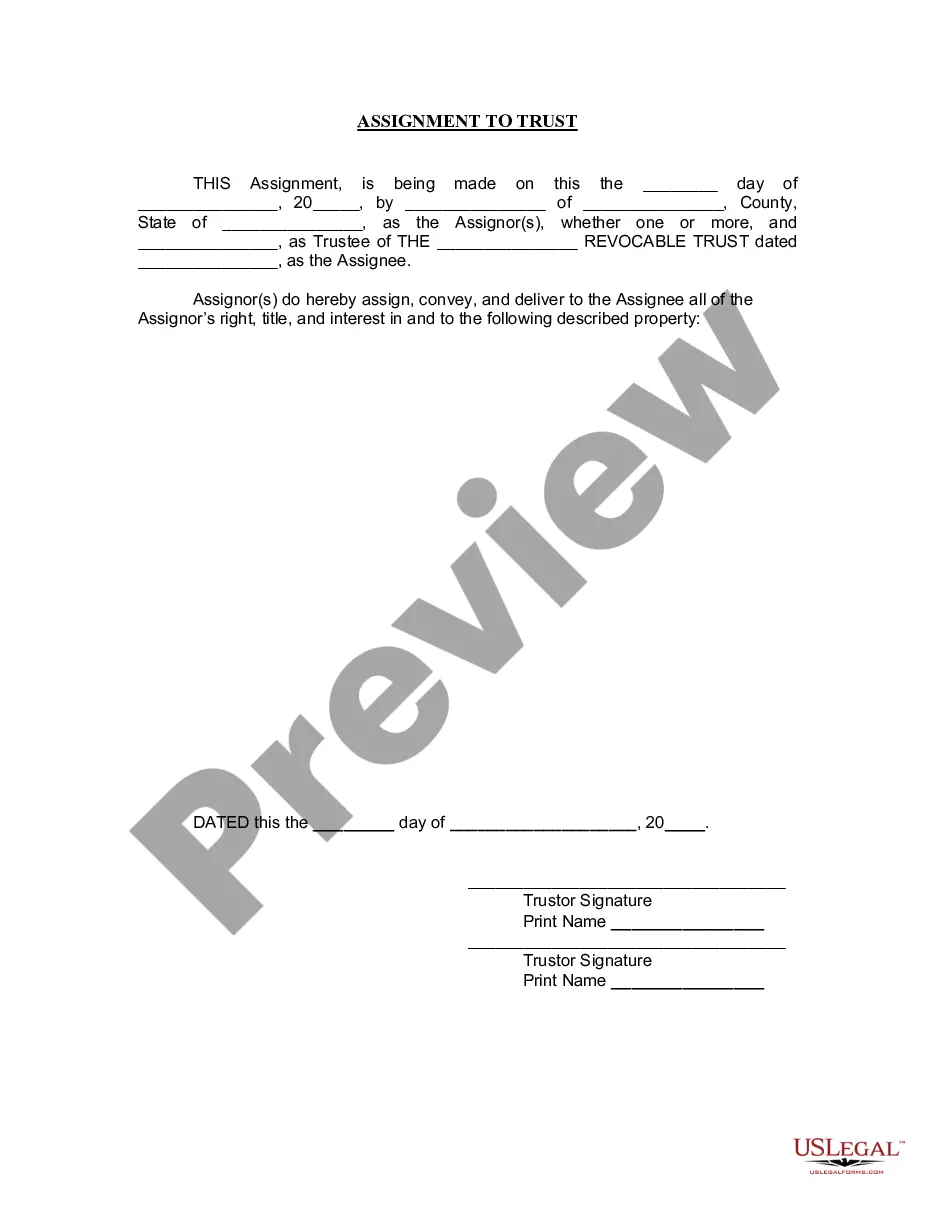

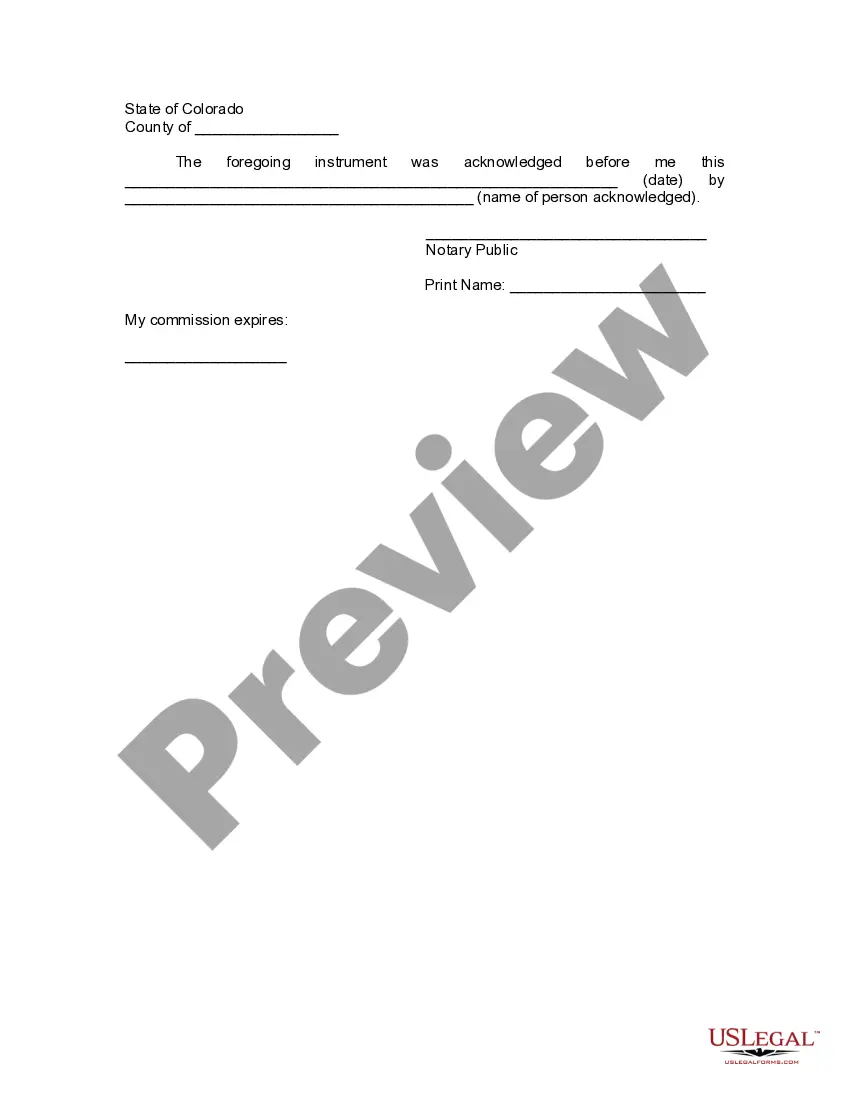

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Thornton Colorado Assignment to Living Trust

Description

How to fill out Colorado Assignment To Living Trust?

If you are seeking a pertinent form template, it’s challenging to select a more suitable platform than the US Legal Forms site – likely the largest online repositories.

Here you can discover a vast selection of form samples for business and personal use by categories and states, or keywords.

With the excellent search feature, locating the latest Thornton Colorado Assignment to Living Trust is as straightforward as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration procedure.

Obtain the form. Select the file format and download it to your device.

- Moreover, the accuracy of every document is confirmed by a team of experienced attorneys who routinely examine the templates on our site and update them according to the most recent state and county guidelines.

- If you are already familiar with our platform and have an account, all you need to do to obtain the Thornton Colorado Assignment to Living Trust is to sign in to your account and click the Download button.

- If you are accessing US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have opened the required form. Read its description and use the Preview feature (if available) to view its contents. If it doesn’t fulfill your needs, use the Search option at the top of the page to find the suitable record.

- Confirm your choice. Click the Buy now button. Then, select your desired pricing plan and enter your details to create an account.

Form popularity

FAQ

One disadvantage of a Thornton Colorado Assignment to Living Trust is the upfront costs. Establishing a trust may require legal fees and other expenses, which can be a barrier for some. Additionally, once property is placed in a trust, you may lose some control over it since the trust dictates how it is managed. It is also essential to maintain proper records and comply with ongoing legal requirements, which can be cumbersome for some individuals.

The main disadvantage of a family trust is the potential for family conflicts. When establishing a Thornton Colorado Assignment to Living Trust, differing opinions among family members regarding asset distribution can lead to disputes. It's vital to foster open communication and seek guidance from professionals to ensure that everyone understands the trust's intentions and terms.

A major disadvantage of a trust is the complexity involved in its management. While the Thornton Colorado Assignment to Living Trust offers control over asset distribution, it often requires ongoing administration, such as filing tax returns or maintaining records. This complexity can be overwhelming for some individuals, prompting the need for professional assistance.

Deciding whether to place assets in a trust, such as a Thornton Colorado Assignment to Living Trust, depends on individual circumstances. Trusts can provide benefits like avoiding probate and protecting assets, but they also come with responsibilities. Encouraging your parents to consult a financial advisor or attorney can help them assess their specific needs and make an informed decision.

One significant mistake parents make while establishing a trust fund is failing to communicate their intentions and plans with their children. Transparency is crucial, especially with a Thornton Colorado Assignment to Living Trust, as it can help prevent misunderstandings and disputes later on. Additionally, parents sometimes neglect to update the trust as their circumstances change, which can result in unintended consequences.

Deciding whether to place your house in a trust in Colorado is a personal choice that depends on your circumstances. A living trust can help your heirs avoid the lengthy probate process and manage your assets effectively. If you are considering a Thornton Colorado Assignment to Living Trust, it is advisable to consult legal professionals or resources like USLegalForms for tailored guidance.

To transfer property into a living trust in Colorado, you begin by drafting a living trust agreement. Once the trust is created, you will need to execute and record a form of deed that changes the property's title from your name to that of the living trust. Using resources like USLegalForms can simplify this process, ensuring you complete the transfer accurately in line with Colorado laws.

There are several disadvantages to placing your house in a trust, especially in Thornton, Colorado. One of the main concerns is the potential loss of control, as you must follow the terms set forth in the trust document. Furthermore, there may be costs involved in transferring the property, including recording fees and possible tax implications, which can affect your financial situation.

To transfer your property to a living trust in Colorado, you must first create the trust document and name yourself as the trustee. Next, you will typically need to record a new deed with the county clerk and recorder, transferring the property from your name to the trust's name. This ensures that your Thornton Colorado Assignment to Living Trust effectively holds your property, allowing it to avoid probate.