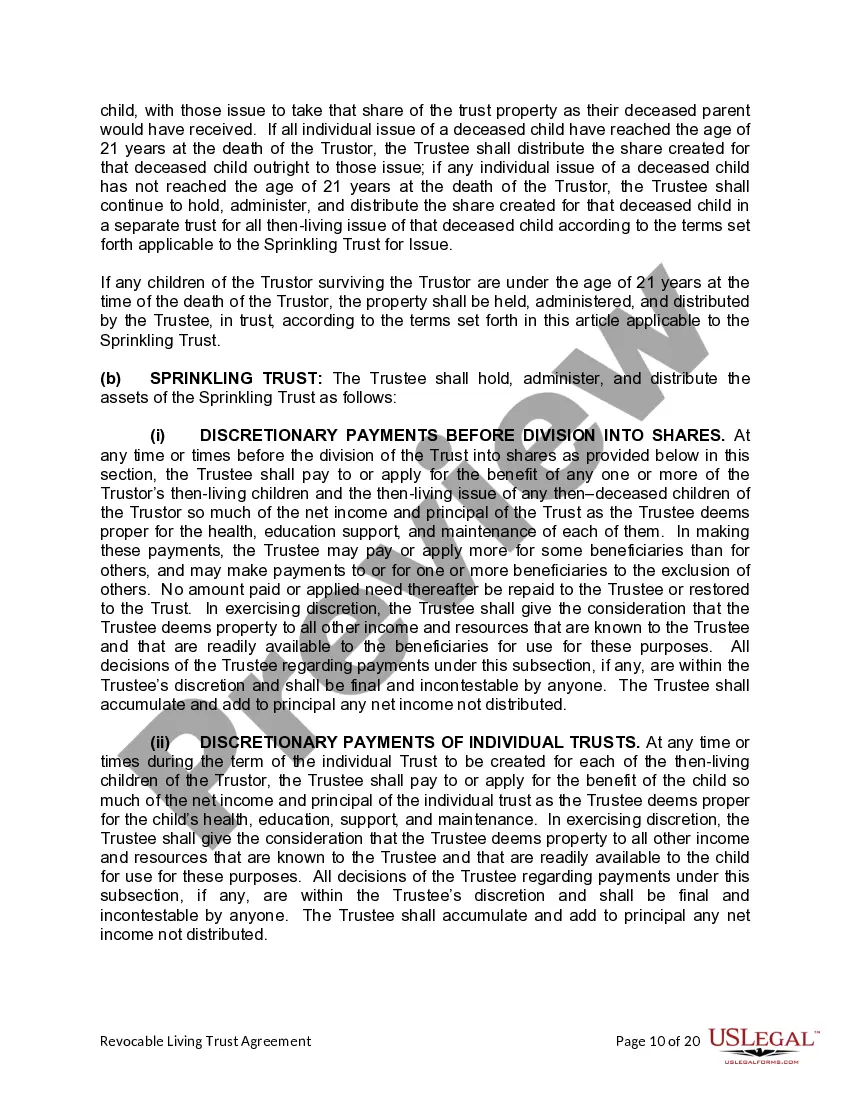

This form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with one or more children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Fort Collins Colorado Living Trust for individual, Who is Single, Divorced or Widow or Widower with Children

Description

How to fill out Colorado Living Trust For Individual, Who Is Single, Divorced Or Widow Or Widower With Children?

Are you in need of a reliable and budget-friendly legal forms provider to obtain the Fort Collins Colorado Living Trust for an individual who is Single, Divorced, or a Widow or Widower with Children? US Legal Forms is your ideal option.

Whether you need a simple agreement to establish rules for living together with your partner or a collection of forms to progress your separation or divorce through the court system, we have you covered. Our platform provides over 85,000 current legal document templates for both personal and business purposes. All templates available are tailored specifically to meet the demands of certain states and regions.

To acquire the form, you must Log In to your account, locate the required template, and click the Download button adjacent to it. Remember that you can retrieve your previously purchased document templates at any time from the My documents section.

Are you unfamiliar with our website? No problem. You can create an account with ease, but first, be sure to do the following: Verify that the Fort Collins Colorado Living Trust for an individual who is Single, Divorced, or a Widow or Widower with Children complies with the statutes of your state and local jurisdiction. Examine the form’s description (if available) to determine who and what the form is intended for. Restart your search if the template does not fit your legal circumstances.

Try US Legal Forms today and put an end to the hours wasted researching legal documents online.

- Now, you can create your account.

- Then, choose the subscription plan and proceed with payment.

- Once your payment is processed, download the Fort Collins Colorado Living Trust for an individual who is Single, Divorced, or a Widow or Widower with Children in any offered file format.

- You may revisit the website at any time and redownload the form without incurring additional costs.

- Finding current legal forms has never been simpler.

Form popularity

FAQ

When one spouse dies, the living trust, specifically a Fort Collins Colorado Living Trust for individuals who are single, divorced, or widowed with children, ensures the smooth transition of assets. The deceased spouse's assets held in the trust typically transfer to the surviving spouse or directly to the children, depending on the trust's terms. This process helps avoid probate, providing peace of mind and quicker access to assets for your loved ones. By using a living trust, you can control how and when your estate is distributed, making it a flexible and beneficial solution.

Creating a living trust by yourself starts with gathering necessary documents and determining how you want to distribute your assets. You will outline your wishes in a written document and then sign it according to Colorado law. Resources like uslegalforms can provide you with templates and guidance to successfully establish your Fort Collins Colorado Living Trust for individuals who are single, divorced, or widowed with children.

Filling out a living trust involves detailing your assets, naming beneficiaries, and designating a trustee. Each section of the trust document must be filled out clearly and accurately. By following the templates available through uslegalforms, you can efficiently create your Fort Collins Colorado Living Trust for individuals who are single, divorced, or widowed with children, ensuring all essential information is included.

Absolutely, you can write your own living trust in Colorado. However, you must follow the state laws to create a valid trust document. Utilizing a service like uslegalforms can help guide you through the process, making it easier to establish your Fort Collins Colorado Living Trust for individuals who are single, divorced, or widowed with children.

Yes, you can write your own trust in Colorado. It's important to understand the legal requirements, such as including specific language to validate your trust. By using a self-help resource or platform like uslegalforms, you can ensure that your Fort Collins Colorado Living Trust for individuals who are single, divorced, or widowed with children meets all legal standards.

In Colorado, a trust must have a grantor, a trustee, and identifiable beneficiaries to be valid. For a Fort Collins Colorado Living Trust for individuals who are single, divorced, or widows or widowers with children, it's crucial to clearly state the terms and include a detailed list of assets. Additionally, having the trust document in writing and signed by the grantor is essential for it to be legally enforceable.

One of the biggest mistakes parents make when setting up a trust fund is not clearly defining the terms of the trust. This can lead to confusion and potential disputes among beneficiaries, especially in a Fort Collins Colorado Living Trust for individuals who are single, divorced, or widows or widowers with children. Taking the time to specify your wishes can prevent issues and ensure your children are supported according to your intentions.

When one spouse dies, a living trust may continue to operate as designated in the trust document. The surviving spouse typically retains control over the Fort Collins Colorado Living Trust for individuals who are single, divorced, or widows or widowers with children, allowing for seamless management of assets. This continuity helps prevent family disputes and ensures that your children are cared for without major disruptions.

To create a trust in Colorado, you need to be at least 18 years old and of sound mind. Additionally, the Fort Collins Colorado Living Trust for individuals who are single, divorced, or widows or widowers with children requires that you outline clear terms and appoint a reliable trustee. Ensuring these qualifications is vital to establishing a trust that meets your family's needs and provides security for your children.

Establishing a trust in Colorado requires you to create a legal document that outlines your wishes for asset distribution. This typically involves selecting a trustee, identifying beneficiaries, and determining what assets you want to place in the Fort Collins Colorado Living Trust for individuals who are single, divorced, or widows or widowers with children. You may find it beneficial to consult an attorney or utilize services like USLegalForms to guide you through the process efficiently.