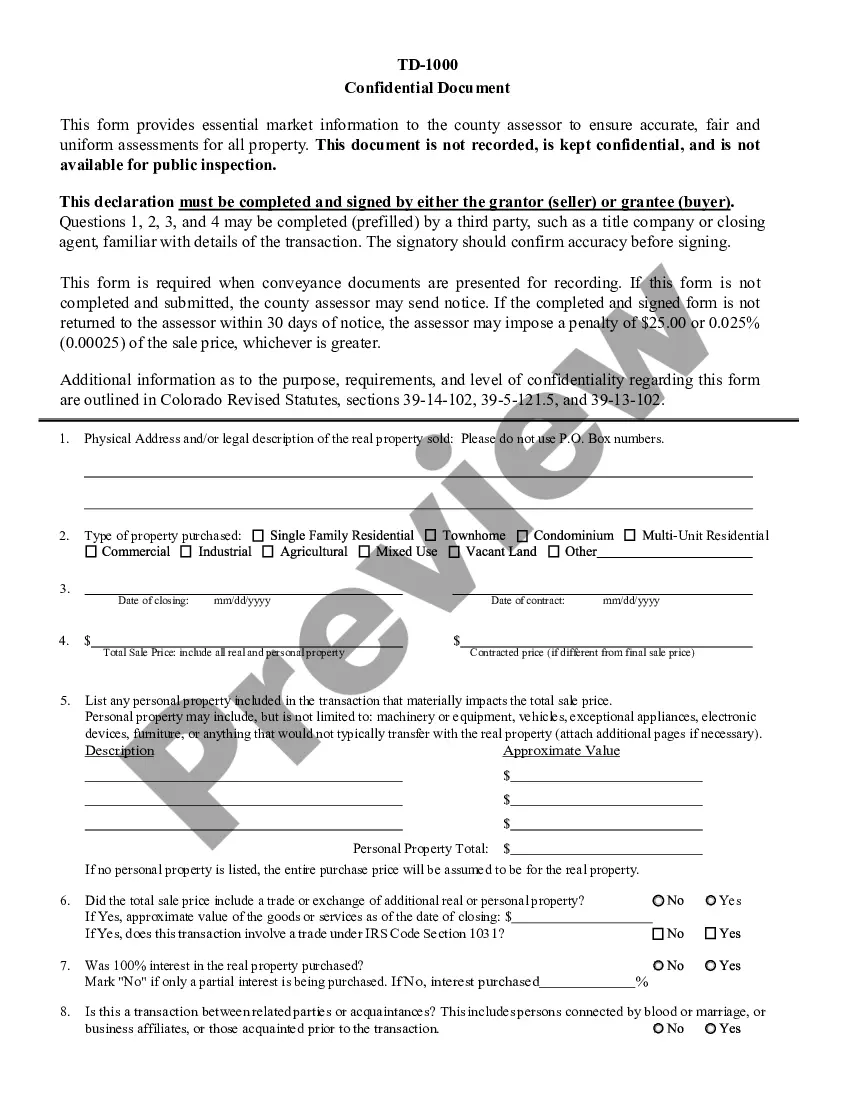

Colorado Real Property Transfer Declaration:

Centennial Colorado Real Property Transfer Declaration

Description

How to fill out Colorado Real Property Transfer Declaration?

If you have previously used our service, Log In to your account and download the Centennial Colorado Real Property Transfer Declaration onto your device by clicking the Download button. Ensure that your subscription is active. If not, renew it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to obtain your file.

You have continual access to every document you have bought: you can find it in your profile within the My documents section whenever you need to reaccess it. Utilize the US Legal Forms service to quickly find and download any template for your personal or business requirements!

- Confirm you’ve located a suitable document. Review the description and utilize the Preview option, if accessible, to verify if it suits your needs. If it doesn’t meet your criteria, use the Search tab above to find the right one.

- Acquire the template. Hit the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and complete a payment. Provide your credit card information or choose the PayPal method to finalize the purchase.

- Retrieve your Centennial Colorado Real Property Transfer Declaration. Select the file format for your document and save it to your device.

- Finalize your document. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

A quitclaim deed and a gift deed serve different purposes in property transfer. A quitclaim deed transfers any rights or claims the grantor may have, without guaranteeing those rights are valid. In contrast, a gift deed specifically indicates that the transfer is a gift, often with no expectation of payment. Understanding these differences is crucial when completing the Centennial Colorado Real Property Transfer Declaration.

Transferring a property deed in Colorado typically requires a legal document known as a deed, which must be signed and notarized. You'll need to record the deed with the county clerk, ensuring that you include the Centennial Colorado Real Property Transfer Declaration. Providing accurate details and documentation helps prevent any issues that may arise during the transfer process.

While a gift deed can simplify the transfer process, it does have disadvantages. One primary concern is that once the deed is executed, you relinquish all control and rights to the property. Additionally, the recipient could face tax implications or complications if they decide to sell the property down the line. Understanding these aspects is vital when considering the Centennial Colorado Real Property Transfer Declaration.

In Colorado, the federal gift tax exemption allows you to gift up to a certain annual exclusion amount without incurring taxes. For 2023, this amount is $17,000 per recipient. It is crucial to understand the implications of gifting if you plan to transfer property, as it may affect how you complete the Centennial Colorado Real Property Transfer Declaration.

Gifting property in Colorado involves preparing a gift deed that outlines the details of the transfer. Once the deed is completed, you must sign it in the presence of a notary. Finally, you need to file the gift deed with the county clerk, along with the Centennial Colorado Real Property Transfer Declaration, to ensure the transaction is legally recognized.

To successfully gift personal property, you must meet three main requirements: intent, delivery, and acceptance. You need to clearly express your intention to gift the property, transfer possession of the property to the recipient, and ensure that the recipient accepts the gift. Overlooking any of these aspects can complicate the process, especially when completing the Centennial Colorado Real Property Transfer Declaration.

The best way to gift property is to use a gift deed, which formally transfers ownership from you to the recipient without financial consideration. It is essential to document the transfer correctly, as this ensures the Centennial Colorado Real Property Transfer Declaration is properly filed. Consulting with an attorney or a real estate professional can also help you navigate any complexities in the process.

The Colorado real property transfer declaration is a mandatory form that details the transfer of property ownership, often required when recording the deed. This declaration informs tax authorities about the transfer’s value and nature. By accurately completing the Centennial Colorado Real Property Transfer Declaration, you help ensure the transfer process runs smoothly and is compliant with local regulations.

In Colorado, certain exemptions apply to real property transfer tax, including transfers between immediate family members, which can simplify the process. Properties transferred as gifts or as part of a divorce settlement may also qualify for exemptions. Understanding these nuances can aid you in effectively completing the Centennial Colorado Real Property Transfer Declaration without incurring unnecessary costs.

To transfer property title to a family member in Colorado, first, draft a deed that specifies the transfer details. After execution, record the deed at your local county clerk and record the Centennial Colorado Real Property Transfer Declaration simultaneously, if required. This step makes the transfer official and protects both parties' interests.