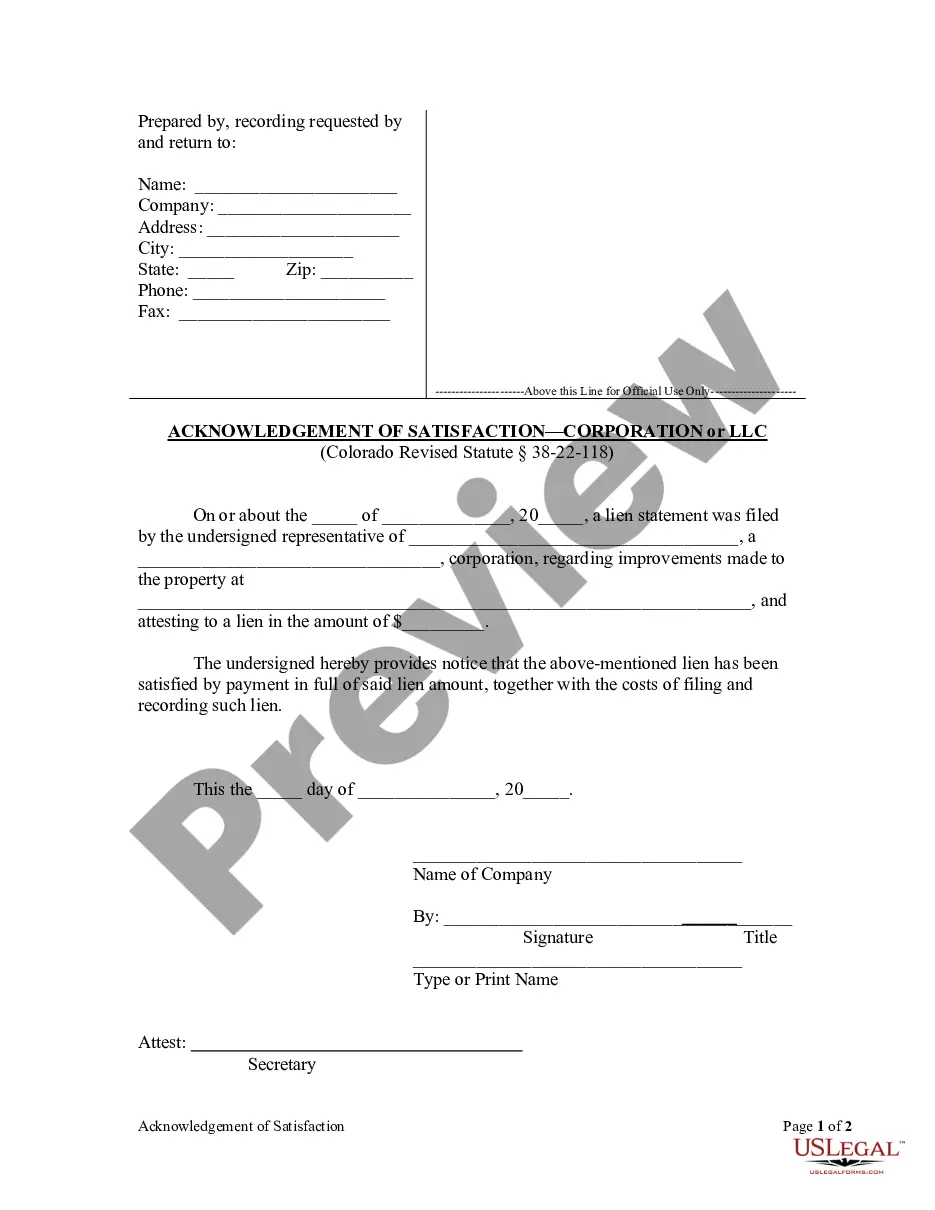

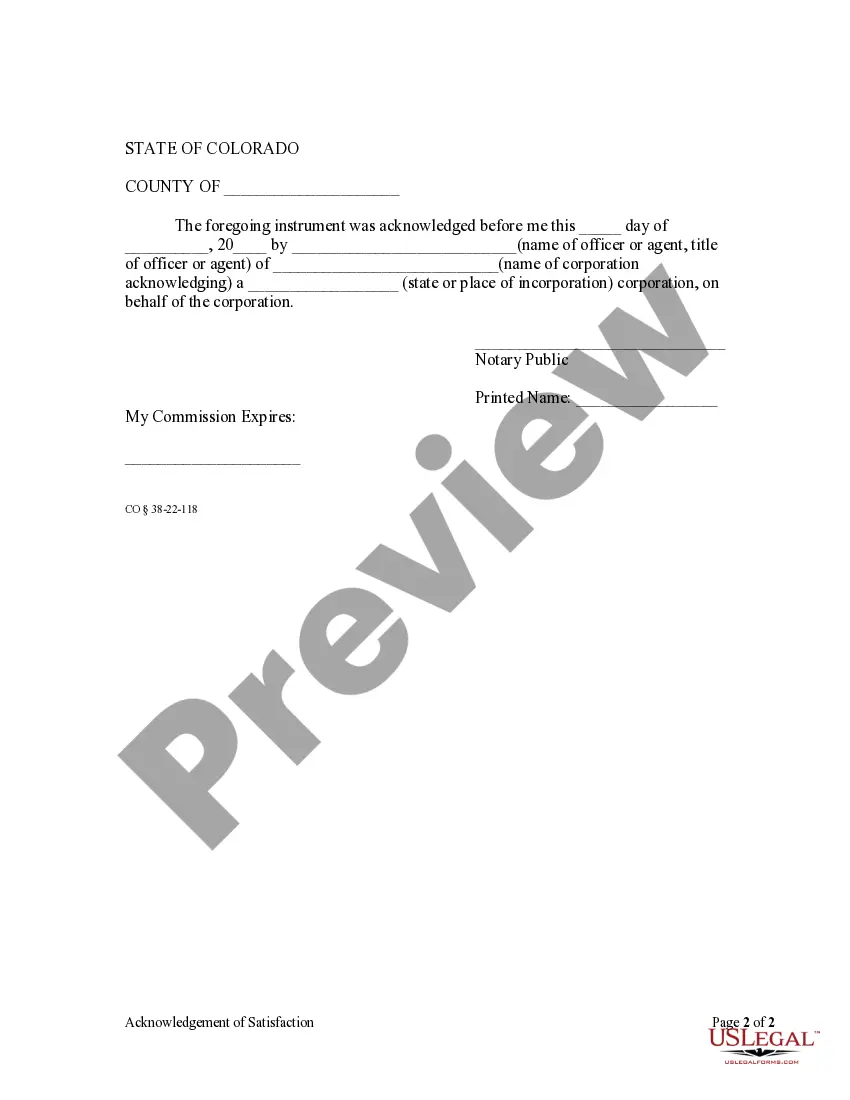

Pursuant to Colorado Revised Statute section 38-22-118, a corporation who has previously filed a lien statement must file an Acknowledgment of Satisfaction after payment in full of the amount attested to in the lien statement, including the cost of filing and recording said lien. Failure to file this acknowledgment within ten (10) days of the request of the property owner to do so may result in a statutory penalty of $10.00 per day being assessed against the lien claimant.

Lakewood Colorado Acknowledgment of Satisfaction of Lien by Corporation

Description

How to fill out Colorado Acknowledgment Of Satisfaction Of Lien By Corporation?

Utilize the US Legal Forms and gain immediate access to any document you require.

Our convenient platform with countless papers simplifies the process of locating and acquiring nearly any document sample you desire.

You can save, complete, and verify the Lakewood Colorado Acknowledgment of Satisfaction of Lien by Corporation or LLC within minutes instead of spending hours online trying to locate the correct template.

Employing our repository is a superb method to enhance the security of your form submissions. Our skilled legal experts routinely assess all documents to ensure that they are suitable for a specific jurisdiction and comply with recent regulations.

If you haven't registered an account yet, follow the steps below.

US Legal Forms is likely one of the largest and most reliable template libraries available online. We are always here to support you with almost any legal task, even if it is merely downloading the Lakewood Colorado Acknowledgment of Satisfaction of Lien by Corporation or LLC.

- How do you acquire the Lakewood Colorado Acknowledgment of Satisfaction of Lien by Corporation or LLC.

- If you already possess an account, just Log In to your profile. The Download button will be activated on all the documents you access.

- Additionally, you can locate all your previously saved documents in the My documents section.

Form popularity

FAQ

Yes, you can put a lien on a corporation if you have a valid claim against it. The lien typically involves filing the necessary documentation with the appropriate county authority. This legal action serves to secure your debt and can impact the corporation's ability to sell or refinance its assets. For more insights and assistance, particularly regarding the Lakewood Colorado Acknowledgment of Satisfaction of Lien by Corporation, use our user-friendly platform.

To file a lien against a corporation, begin by ensuring you have a legitimate claim, supported by proper documentation. Prepare the lien statement and file it with the appropriate county clerk's office. Additionally, ensure that you notify the corporation, as required by law. Our platform provides all the necessary forms and instructions, especially for handling the Lakewood Colorado Acknowledgment of Satisfaction of Lien by Corporation.

Filling out a notice of lien involves accurately completing a form that states your legal claim against the property. Include essential details such as the debtor's name, property description, and the amount owed. Make sure to sign the document before filing it with the appropriate county office. Our platform simplifies this process, offering templates specifically for the Lakewood Colorado Acknowledgment of Satisfaction of Lien by Corporation.

To place a lien, several conditions must be met, such as having a valid debt, a written agreement, and a property interest that can be encumbered. It’s essential to ensure that all paperwork is accurate and filed timely. Understanding these conditions can help protect your financial rights. If you need assistance, our platform outlines the procedures, particularly for the Lakewood Colorado Acknowledgment of Satisfaction of Lien by Corporation.

In Colorado, you typically have six months from the date the debt becomes due to file a lien. After this period, your right to collect through a lien may be compromised. It's crucial to act promptly to secure your interests. For guidance in this process, including the Lakewood Colorado Acknowledgment of Satisfaction of Lien by Corporation, consider using our US Legal Forms platform.

Filing a lawsuit against a corporation involves several steps, starting with determining the appropriate court to file your case. You will need to prepare and file a complaint, detailing your claims against the corporation. After the complaint is filed, ensure you serve the corporation with the court documents. Our platform provides resources that can guide you through the process efficiently, especially related to the Lakewood Colorado Acknowledgment of Satisfaction of Lien by Corporation.

To file a lien with intent in Colorado, you start by preparing a lien statement that includes necessary details like the property description and the amount owed. Once completed, you file this statement with the county clerk and recorder's office where the property is located. This process ensures that your intent to collect on the debt is formally recognized. Using our platform, you can find the forms needed for the Lakewood Colorado Acknowledgment of Satisfaction of Lien by Corporation.

A satisfaction of lien is a formal document that declares a lien has been fulfilled and releases the property from that obligation. In Lakewood, Colorado, the Acknowledgment of Satisfaction of Lien by Corporation is essential for property owners to remove encumbrances on their real estate. This document signals to potential buyers and lenders that the debt associated with the lien has been satisfied. Using the right forms, like those provided by uslegalforms, ensures that you complete the process smoothly and accurately.

To perform a lien search on a company, start by looking at the Secretary of State’s business records in Colorado. You can search by the company name or its identification number, which will show any active liens. If you encounter a lien, consider utilizing the Acknowledgment of Satisfaction of Lien by Corporation from US Legal Forms to handle the matter efficiently.

To check for liens in Colorado, you can search through the Colorado Secretary of State’s online database or visit your local county clerk's office. This search will reveal any active liens filed against your property. If you discover a lien, you may need the Acknowledgment of Satisfaction of Lien by Corporation to address it properly.