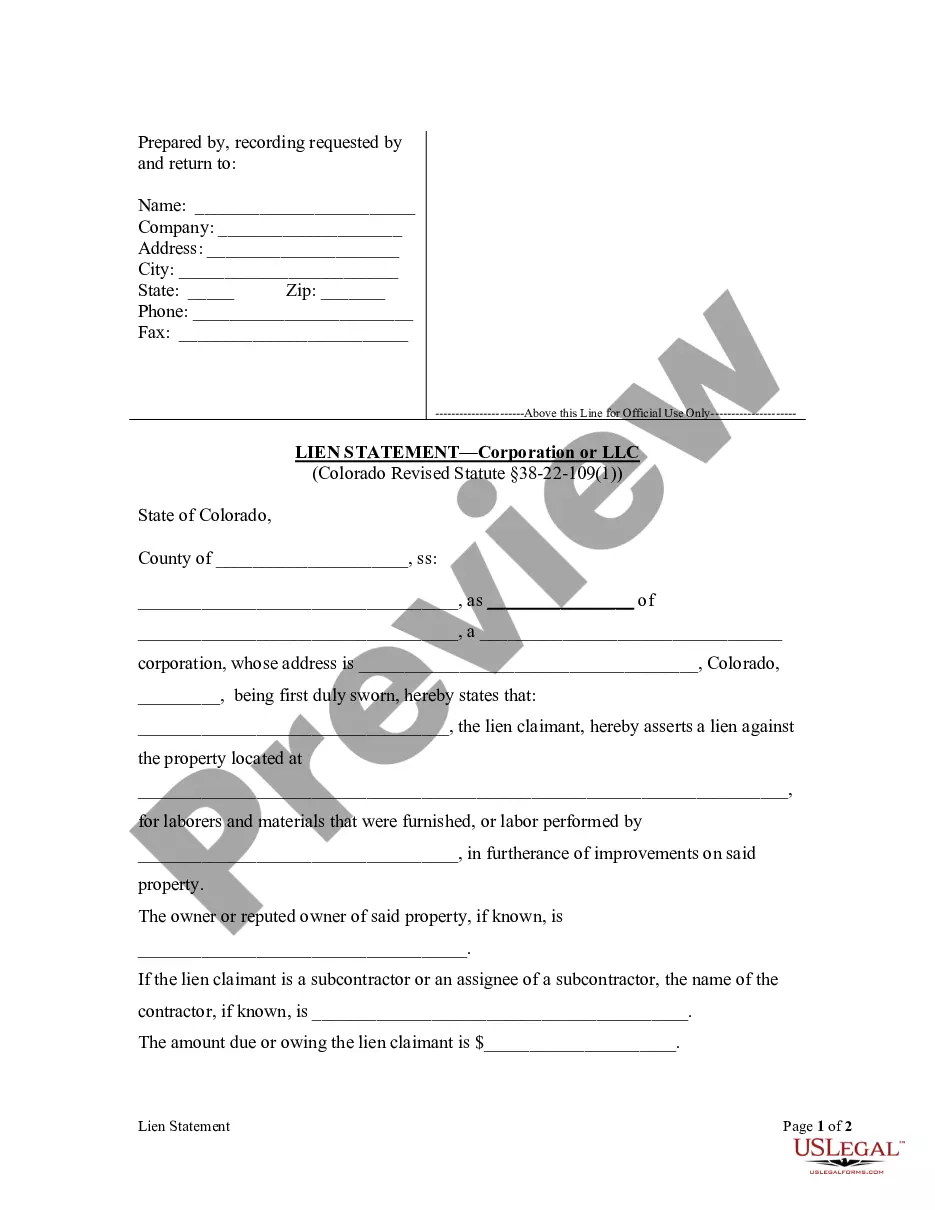

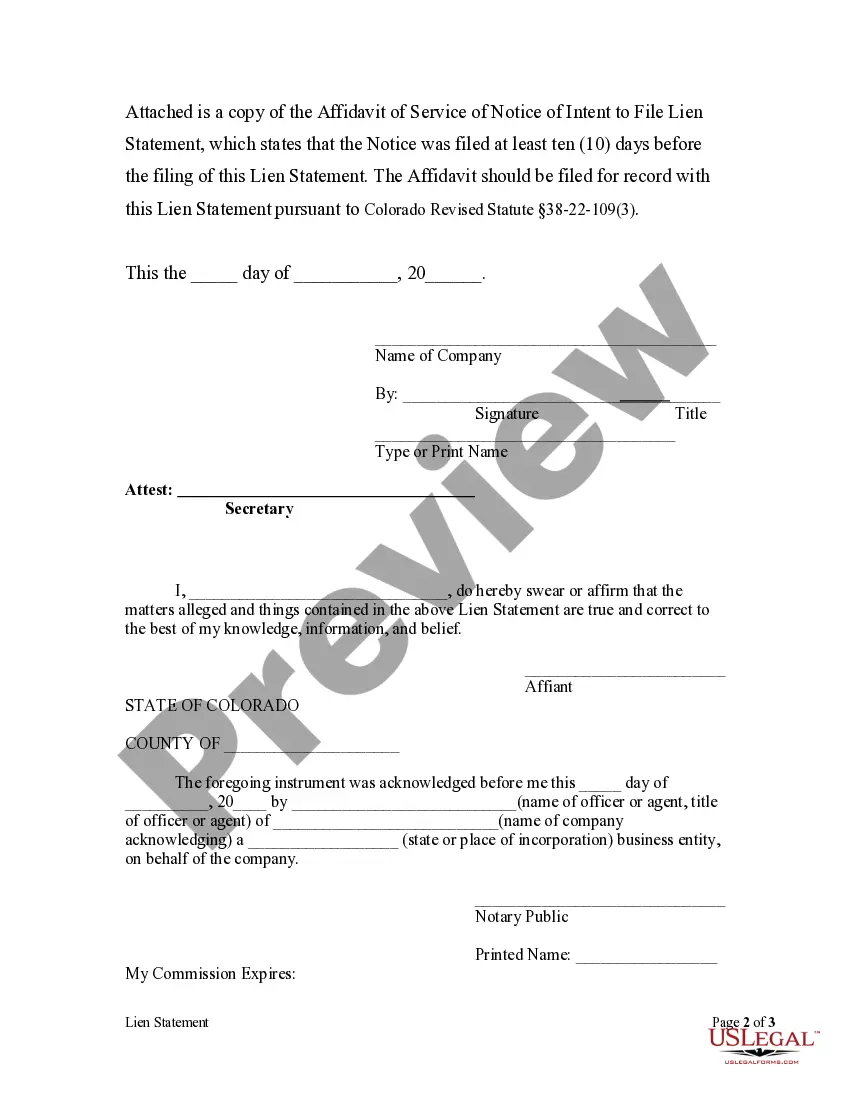

This sworn statement is used by an individual desiring to claim a lien against a piece of property for labor performed or laborers or material furnished. A notice of intent to file a lien must be filed with the county recorder ten days prior to the filing of the lien statement.

Aurora Colorado Lien Statement by Corporation

Description

How to fill out Colorado Lien Statement By Corporation?

If you are seeking a legitimate form template, it’s remarkably challenging to find a superior location than the US Legal Forms website – quite likely the most extensive libraries available online.

Here, you can acquire numerous form samples for corporate and personal uses categorized by types and states, or keywords.

With the excellent search function, obtaining the latest Aurora Colorado Lien Statement by Corporation or LLC is as simple as 1-2-3.

Verify your choice. Click the Buy now button. Then, select your desired pricing plan and provide details to create an account.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

- Furthermore, the validity of each document is verified by a team of proficient attorneys who routinely examine the templates on our site and refresh them based on the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to retrieve the Aurora Colorado Lien Statement by Corporation or LLC is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the instructions below.

- Ensure you have located the form you need. Review its details and utilize the Preview feature to check its contents.

- If it doesn’t meet your requirements, use the Search box at the top of the page to find the appropriate document.

Form popularity

FAQ

In Colorado, a contractor has a specific time frame to file a lien, which is typically within four months after the last work or materials were supplied. This time limit highlights the importance of acting promptly to secure payment. If you fail to file an Aurora Colorado Lien Statement by Corporation within this period, you might lose your right to claim payment. Therefore, understanding the timeline and process is crucial for contractors working in Aurora.

A lien affidavit is a formal document that establishes a claim against a property due to unpaid debts for services or materials. This affidavit serves as public notice and can be vital in protecting your rights. If you're looking to clarify your claim, an Aurora Colorado Lien Statement by Corporation is an essential part of this process.

To file a lien against a corporation, you must gather the corporation's name, address, and the details of the debt owed. Next, complete the appropriate lien form for your jurisdiction, ensuring accuracy in all entries. This filing supports your Aurora Colorado Lien Statement by Corporation and helps secure your claim against the corporation.

Filling out a lien affidavit involves documenting the relevant details of the debt, including property description, amount owed, and claimant information. Be precise and ensure you sign the affidavit as required by local laws. This step is crucial for reinforcing your Aurora Colorado Lien Statement by Corporation.

An example of a lien is when a contractor files a claim against a property after not receiving payment for construction work. This lien ensures that the contractor is legally protected in collecting owed funds. If you're navigating a similar situation, understanding the implications of your Aurora Colorado Lien Statement by Corporation is essential.

A letter of intent for a lien should begin by clearly stating your intention to file a lien due to unpaid work or materials. Include specific details such as the property address, amount owed, and a deadline for payment. Taking these steps helps support your Aurora Colorado Lien Statement by Corporation and informs the property owner of potential actions.

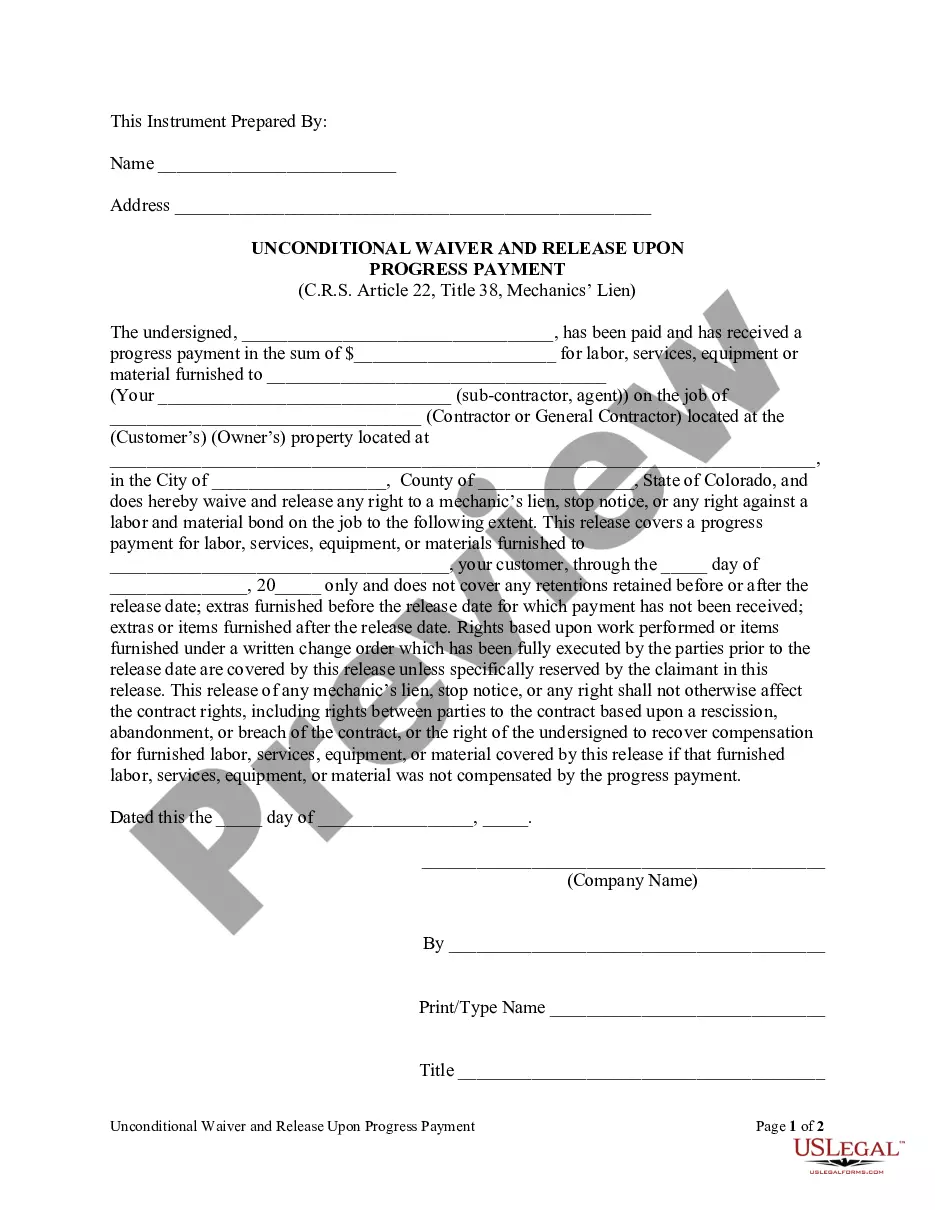

In Colorado, you need a completed lien release form, signed by the lien claimant, to release a lien. Include details such as the project address, lien amount, and date. This process ensures that your Aurora Colorado Lien Statement by Corporation is properly resolved, confirming no further claims exist against the property.

In Wisconsin, a lien typically lasts for a period of five years. However, it can be extended by filing an updated lien statement before the deadline. Understanding the duration helps in managing your obligations related to an Aurora Colorado lien statement by corporation or any other state.

In Colorado, a notice extending the time to file a lien statement is crucial for those needing additional time. This notice allows a creditor to extend the filing deadline under specific circumstances. Knowing this can aid in preparing your Aurora Colorado lien statement by corporation effectively.

To place a lien against a company, you typically need to file a lien statement with the appropriate state authority. Ensure you complete all required forms and provide supporting documents that justify the lien. Consider using USLegalForms for templates to create an effective Aurora Colorado lien statement by corporation.