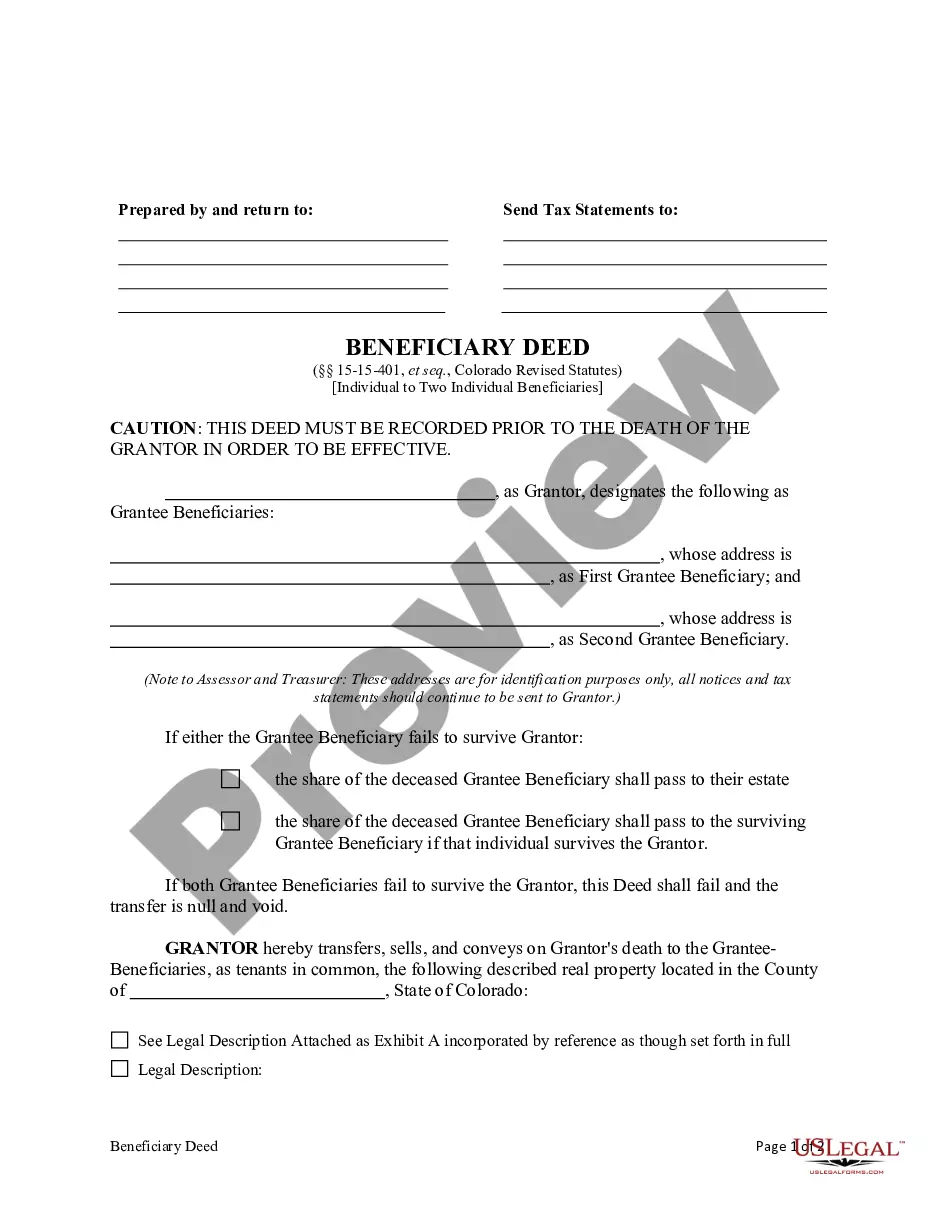

This form is a Beneficiary Deed where the Grantor is an individual and there are two Grantee Beneficiaries. There are NO named Successor Grantee Beneficiaries. Grantor conveys and transfers, upon Grantor's death, to the surviving Grantee Beneficiaries. This Deed is not effective unless recorded prior to Grantor's death. This deed complies with all state statutory laws.

Thornton Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries

Description

How to fill out Colorado Beneficiary Deed - Individual To Two Individuals Without Successor Beneficiaries?

If you are looking for a pertinent form model, it’s challenging to select a more user-friendly service than the US Legal Forms website – one of the most extensive repositories on the web.

With this repository, you can obtain a vast array of form examples for business and personal uses categorized by sectors and areas, or keywords.

With the efficient search feature, acquiring the latest Thornton Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries is as simple as 1-2-3.

Validate your selection. Hit the Buy now button. Then, select your preferred pricing option and provide details to create an account.

Complete the payment. Use your credit card or PayPal account to finish the registration process.

- Furthermore, the relevance of each document is verified by a panel of professional attorneys who routinely review the templates on our platform and refresh them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Thornton Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries is to sign in to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have selected the form you need. Review its description and use the Preview feature (if accessible) to examine its content.

- If it doesn’t meet your requirements, use the Search bar at the top of the page to find the suitable document.

Form popularity

FAQ

Filing a beneficiary deed in Colorado involves preparing the deed correctly and then recording it with the appropriate local government office. You can effectively manage this process by utilizing tools from US Legal Forms to ensure that your Thornton Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries is properly drafted. Always remember to follow specific filing requirements set by your county.

You can obtain a Thornton Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries from a variety of sources. Local law offices often provide these forms, or you can access them online through platforms like US Legal Forms. Using online resources can save you time and ensure that you have the correct and up-to-date documents.

Yes, you can name two beneficiaries on a Thornton Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries. This allows the property to be jointly transferred to both individuals without the complications of a will or probate. Be sure to clearly define how the property will be divided if both beneficiaries survive the grantor.

One disadvantage of a Thornton Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries is that it does not provide protection against creditors. Additionally, if the property has joint ownership, complications may arise among the owners. It's important to weigh these factors against your goals and consider consulting with a professional to ensure this option fits your needs.

While you can fill out a Thornton Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries without a lawyer, having legal guidance can help ensure that all elements are correctly implemented. A lawyer can assist with understanding any complex issues related to your property transfer. Using platforms like uslegalforms can also simplify the process by providing user-friendly templates.

A Thornton Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries generally allows for a straightforward transfer of property, but it may not always evade inheritance tax. This is because inheritance tax laws can vary based on the total value of the estate. It is wise to consult with a tax professional to understand the specific implications for your situation.

To create a valid Thornton Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries, the deed must be in writing and signed by the grantor. Additionally, it must include a clear statement of intent to transfer the property upon the death of the grantor. The deed should also be filed with the county clerk and recorder to ensure that it is legally recognized.

A beneficiary deed itself does not serve as proof of ownership until the original owner passes away. The Thornton Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries becomes effective upon the owner's death, at which point the named beneficiaries can be recognized as owners. Therefore, to establish clear ownership, recording the deed is essential to avoid any disputes about property rights.

While a beneficiary deed can help in avoiding probate, it does not automatically exempt the property from capital gains tax. When the beneficiary eventually sells the inherited property, they may be liable for any capital gains based on the market value at the time of sale. It's advisable to consult a tax professional to understand how the Thornton Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries will affect your specific tax situation.

In most cases, a beneficiary deed does take precedence over a will regarding the property it covers. If the Thornton Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries is in place, the property will automatically pass to the named beneficiaries upon your death, regardless of any conflicting statements in a will. However, it is crucial to ensure that the beneficiary deed is valid to avoid issues in the future.