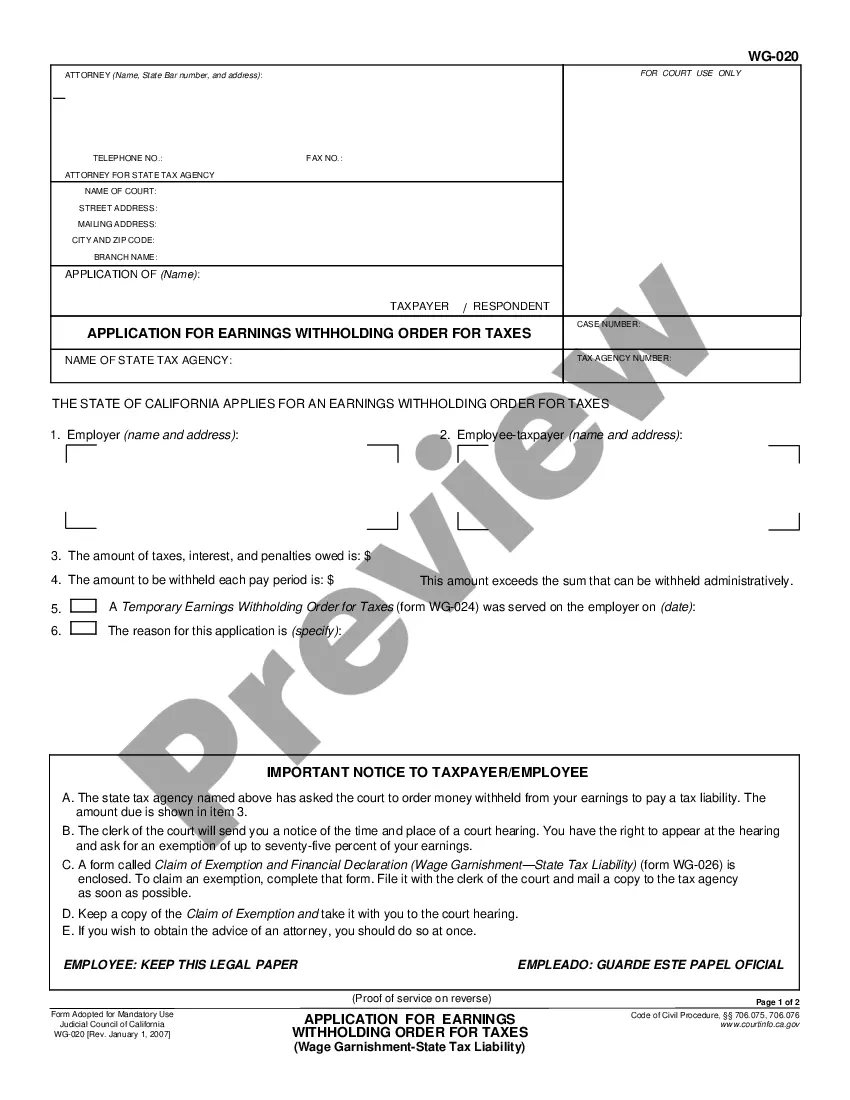

Earnings Withholding Order for Support: This is an Earnings Withhoding Order which is sent to the Judgement Debtor's Employer. The Order relays to the Employer that he/she is to abide by the Order, and garnish the wages of the Employee. It further directs the Employer of where to send the garnished wages.

Santa Ana California Earnings Withholding Order for Support

Description

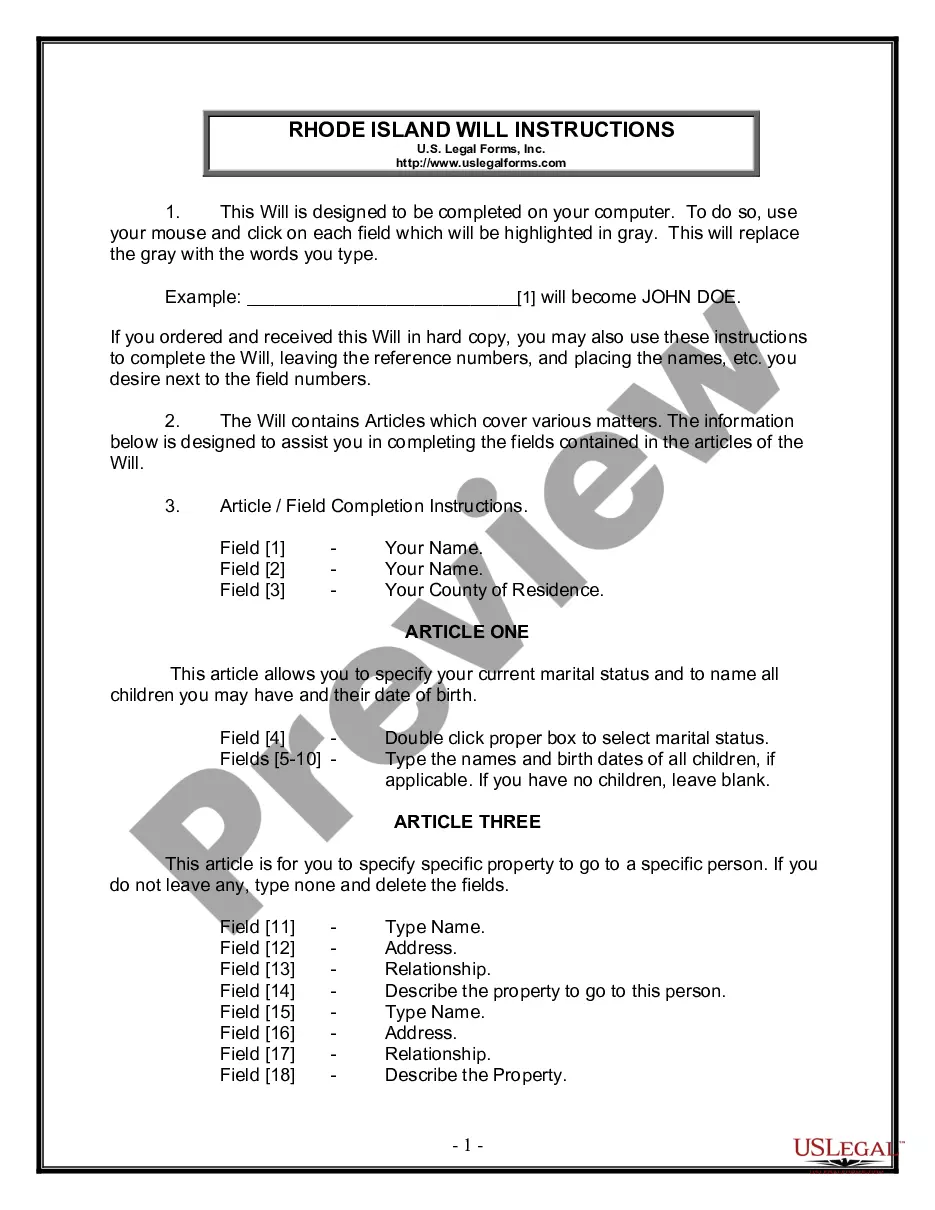

How to fill out California Earnings Withholding Order For Support?

If you have previously utilized our service, Log In to your account and download the Santa Ana California Earnings Withholding Order for Support onto your device by selecting the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your initial encounter with our service, adhere to these straightforward steps to obtain your document.

You have perpetual access to every document you have acquired: you can locate it in your profile under the My documents menu whenever you need to use it again. Take advantage of the US Legal Forms service to effortlessly find and store any template for your personal or professional requirements!

- Verify that you have located an appropriate document. Browse the description and utilize the Preview feature, if available, to determine if it fulfills your requirements. If it is not suitable, utilize the Search tab above to find the correct one.

- Purchase the template. Hit the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and proceed with the payment. Input your credit card information or opt for PayPal to finalize the transaction.

- Obtain your Santa Ana California Earnings Withholding Order for Support. Choose the file format for your document and store it on your device.

- Finalize your sample. Print it or utilize professional online editors to complete and electronically sign it.

Form popularity

FAQ

In Texas, wage garnishment for child support is not automatic but requires a court order. The state may issue a Santa Ana California Earnings Withholding Order for Support to begin the garnishment process, ensuring that custodial parents receive the support they need. It is essential to navigate the legal steps carefully to establish effective support payments.

An earnings withholding order for court-ordered debt refers to a legal directive that allows for garnishment of wages to cover outstanding debts, including child support obligations. This order is enforced through the Santa Ana California Earnings Withholding Order for Support, ensuring that payments are automatically deducted from the debtor's paycheck. Adhering to this order is vital for maintaining financial responsibility.

To calculate disposable earnings for garnishment, you first determine your gross income and then subtract necessary deductions such as taxes and health insurance. The remaining amount is what is considered disposable for the Santa Ana California Earnings Withholding Order for Support. Understanding this calculation is crucial, as it affects the amount that can be garnished for support obligations.

Employers generally cannot refuse to garnish wages once a valid Santa Ana California Earnings Withholding Order for Support is in place. The order is a legal document that mandates compliance with wage garnishment. If your employer expresses concerns, it is advisable to clarify the legal requirements, as failure to comply could lead to penalties.

When an employer does not garnish wages for child support, it can create financial hardships for the receiving parent. The Santa Ana California Earnings Withholding Order for Support is a legal obligation, and ignoring it can result in legal consequences for the employer. Custodial parents should consider seeking legal assistance to enforce the order and ensure timely payments.

If an employer fails to garnish wages for child support, the custodial parent may experience a delay in receiving payments. This situation can lead to penalties for the employer if they do not comply with the Santa Ana California Earnings Withholding Order for Support. It's important for custodial parents to report non-compliance, as they may seek legal recourse to ensure support is provided.

Employers cannot ignore a child support order; doing so can result in serious legal consequences. If an employer fails to comply with a Santa Ana California Earnings Withholding Order for Support, they may face penalties or be held in contempt of court. Understanding one's obligations under the law is crucial for both employees and employers when it comes to enforcing child support.

In California, an earnings withholding order is a legal mechanism used to collect child support directly from a parent's paycheck. This order mandates that a specified amount is withheld from earnings before the employee receives their paycheck. For anyone dealing with a Santa Ana California Earnings Withholding Order for Support, it streamlines payment and reduces the risk of missed payments.

If an employer does not withhold child support as required, they can be held liable for the missed payments and face legal issues. This non-compliance can lead to penalties and complications for both the employer and the employee. If you find yourself affected by a Santa Ana California earnings withholding order for support, consider reaching out for guidance to address this effectively.

You may have received an earnings withholding order due to unpaid or back child support. This legal document is issued to ensure that payments are made directly from your income, promoting accountability. If you're in Santa Ana, understanding this order's purpose can help you prioritize your financial obligations and maintain compliance.