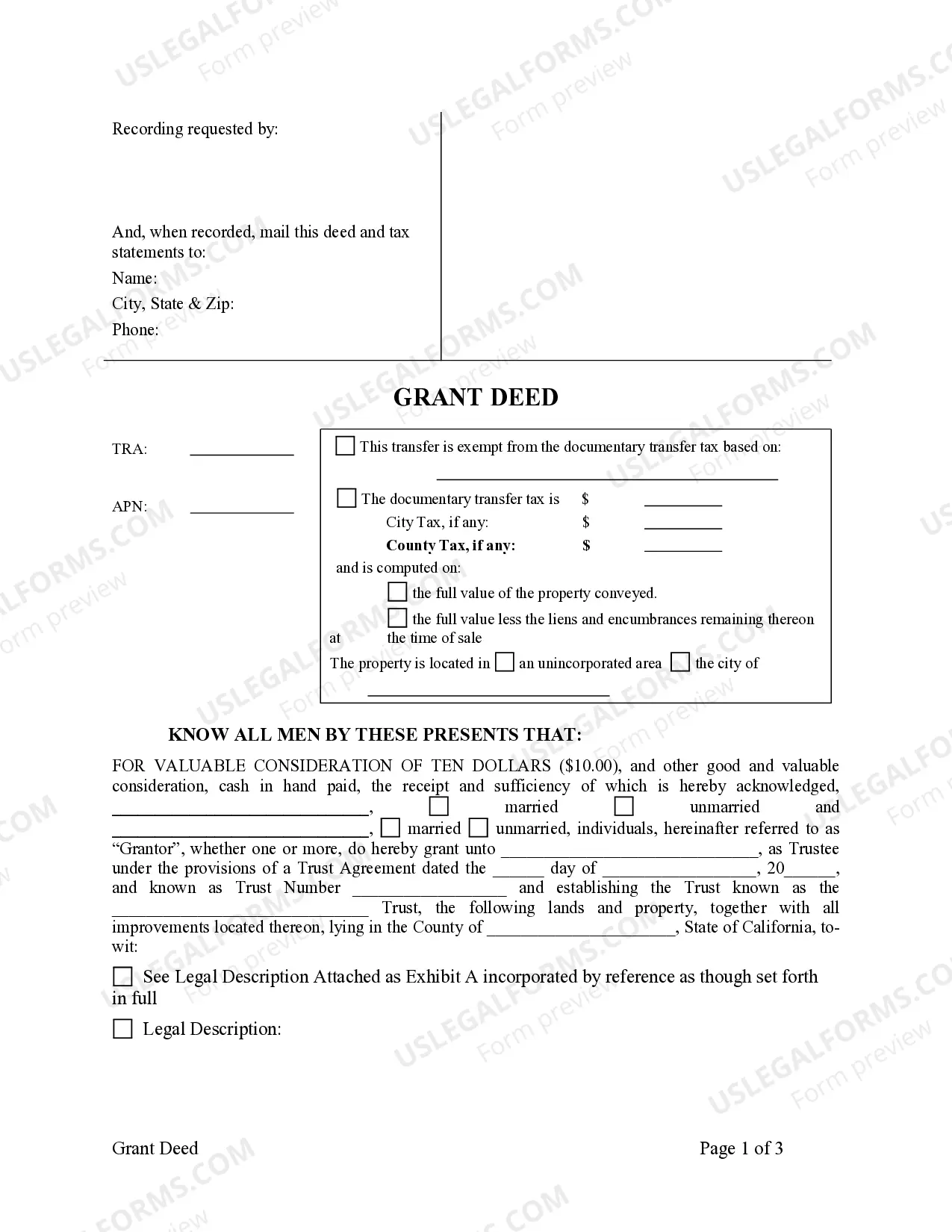

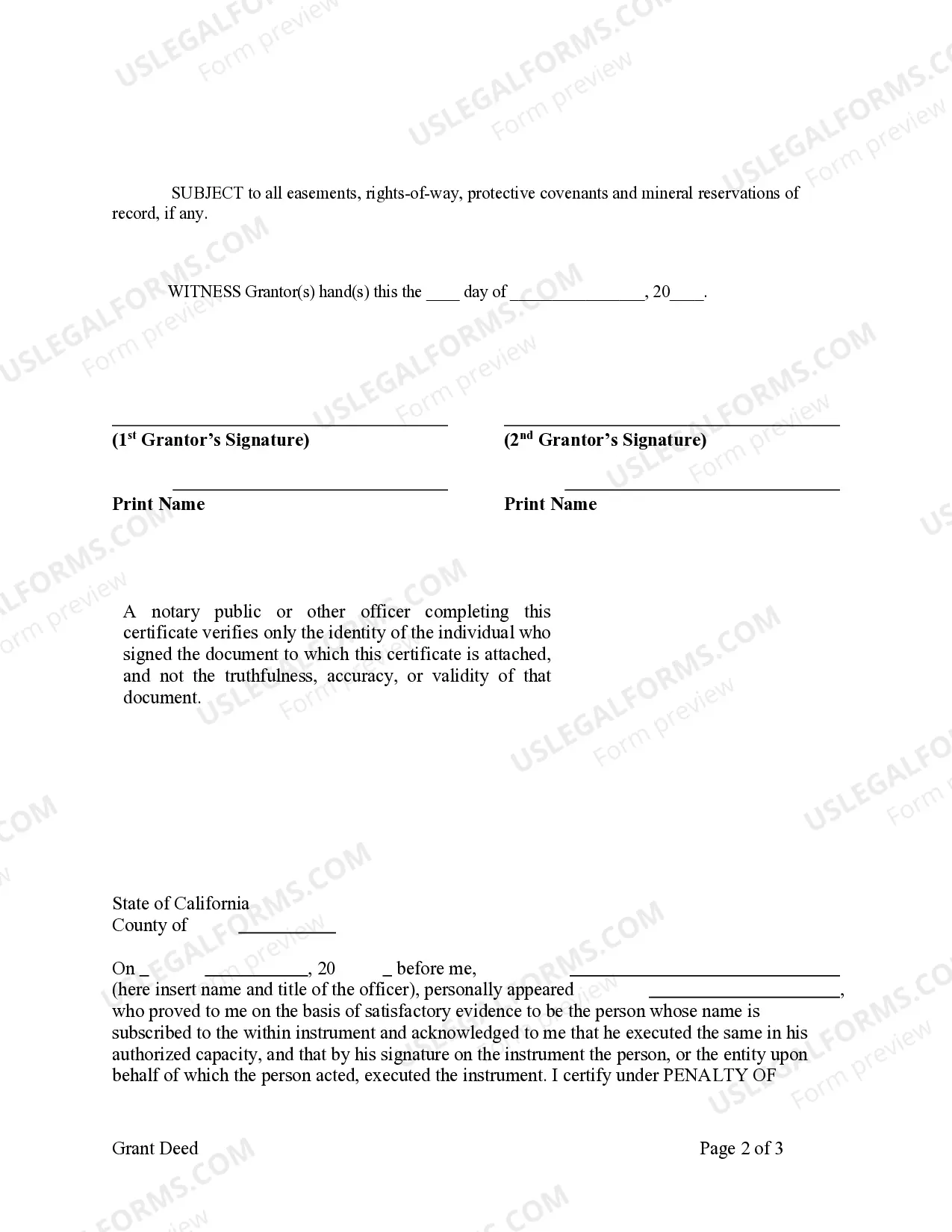

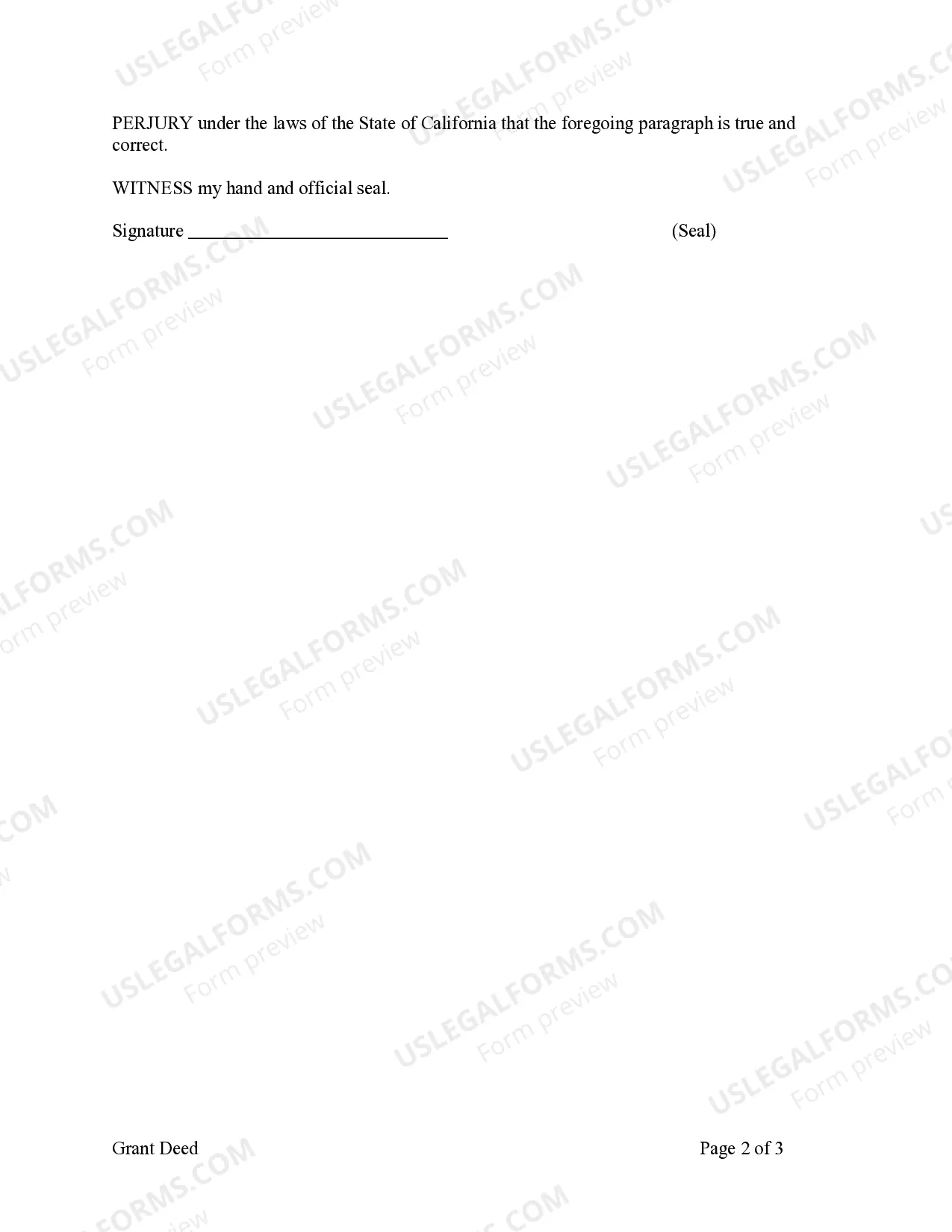

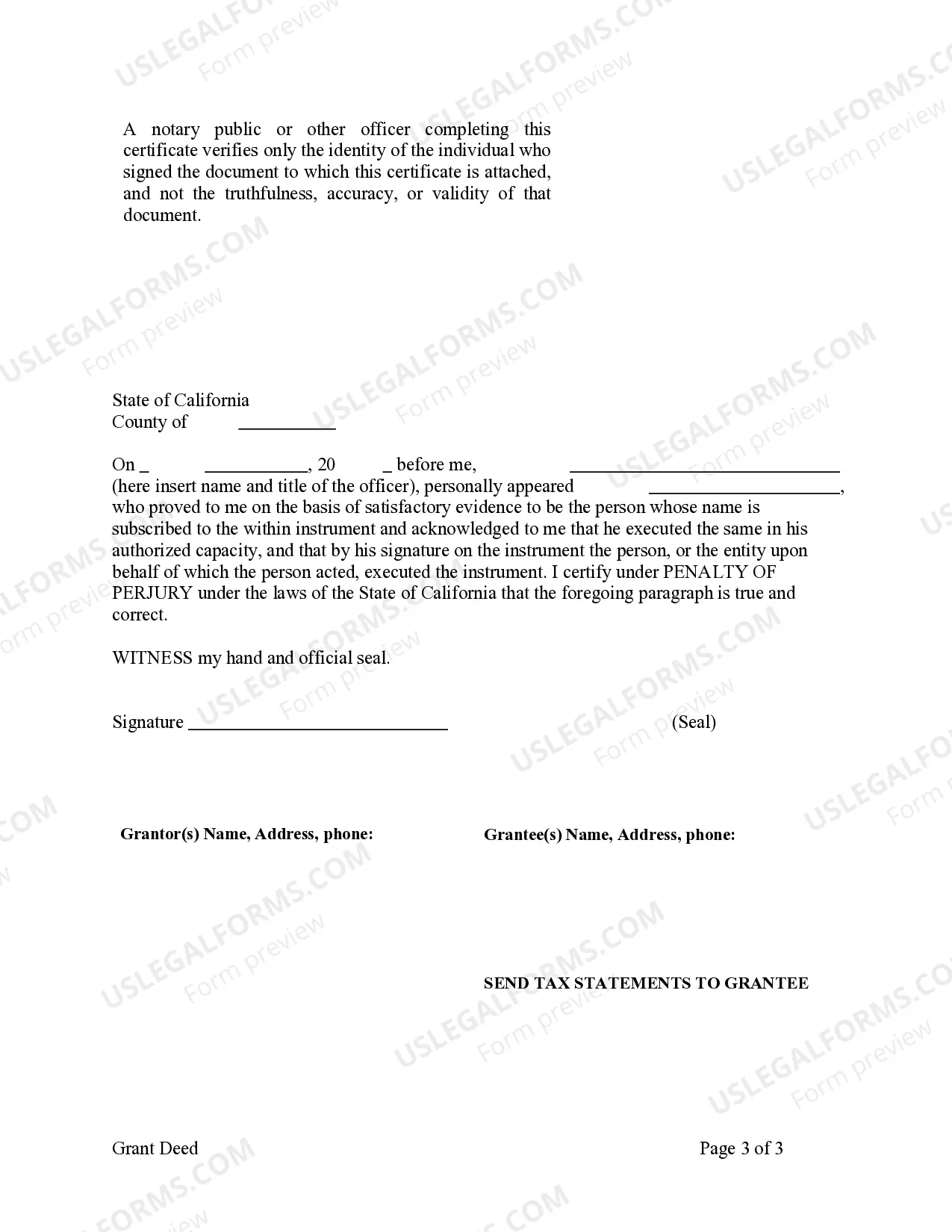

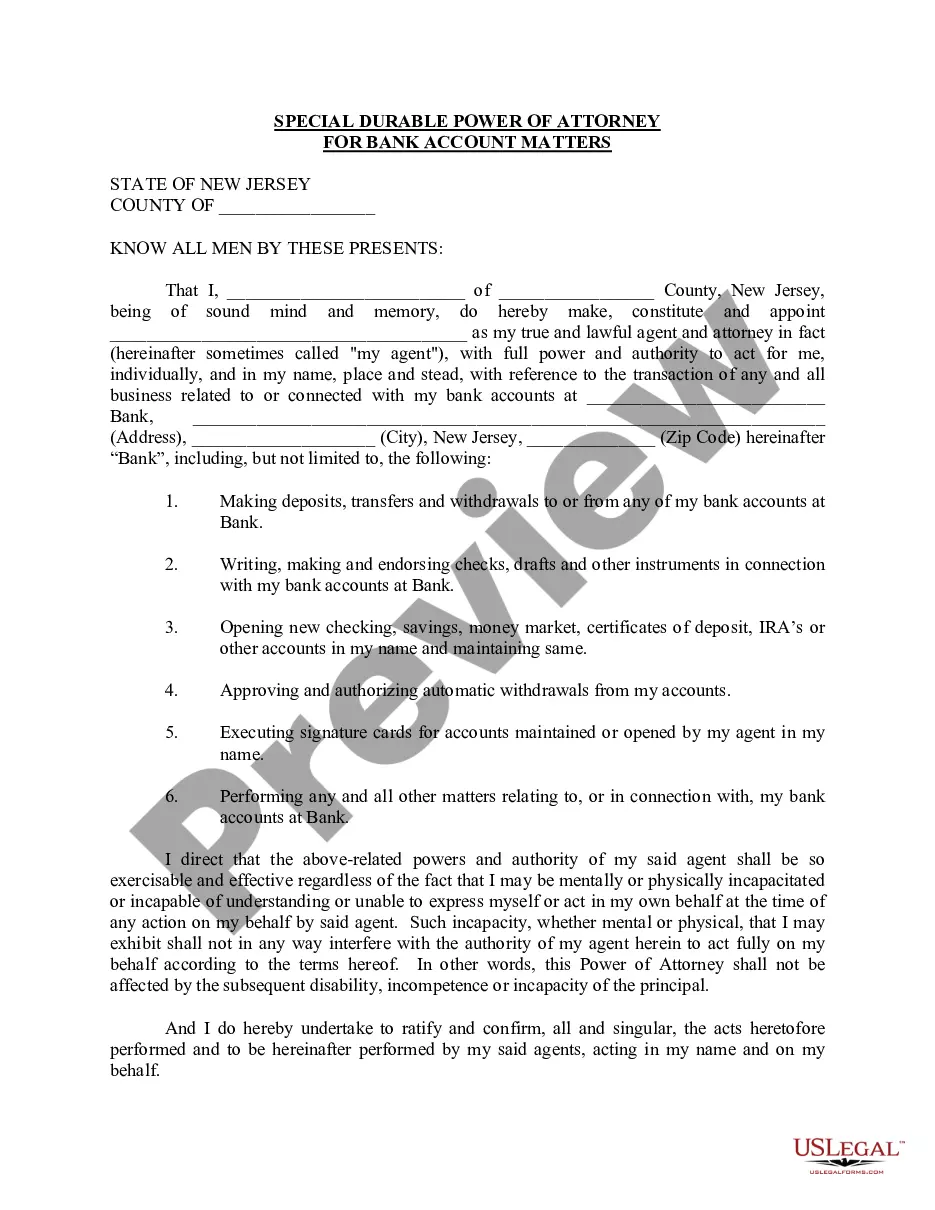

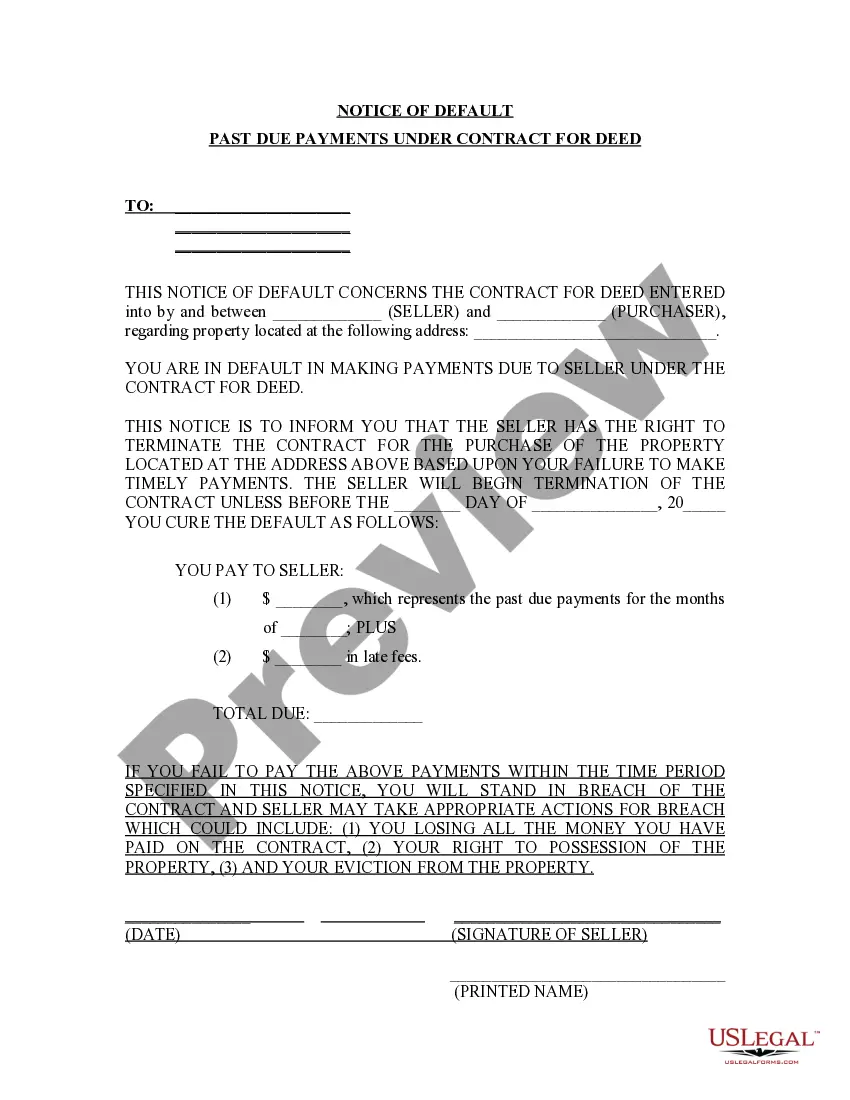

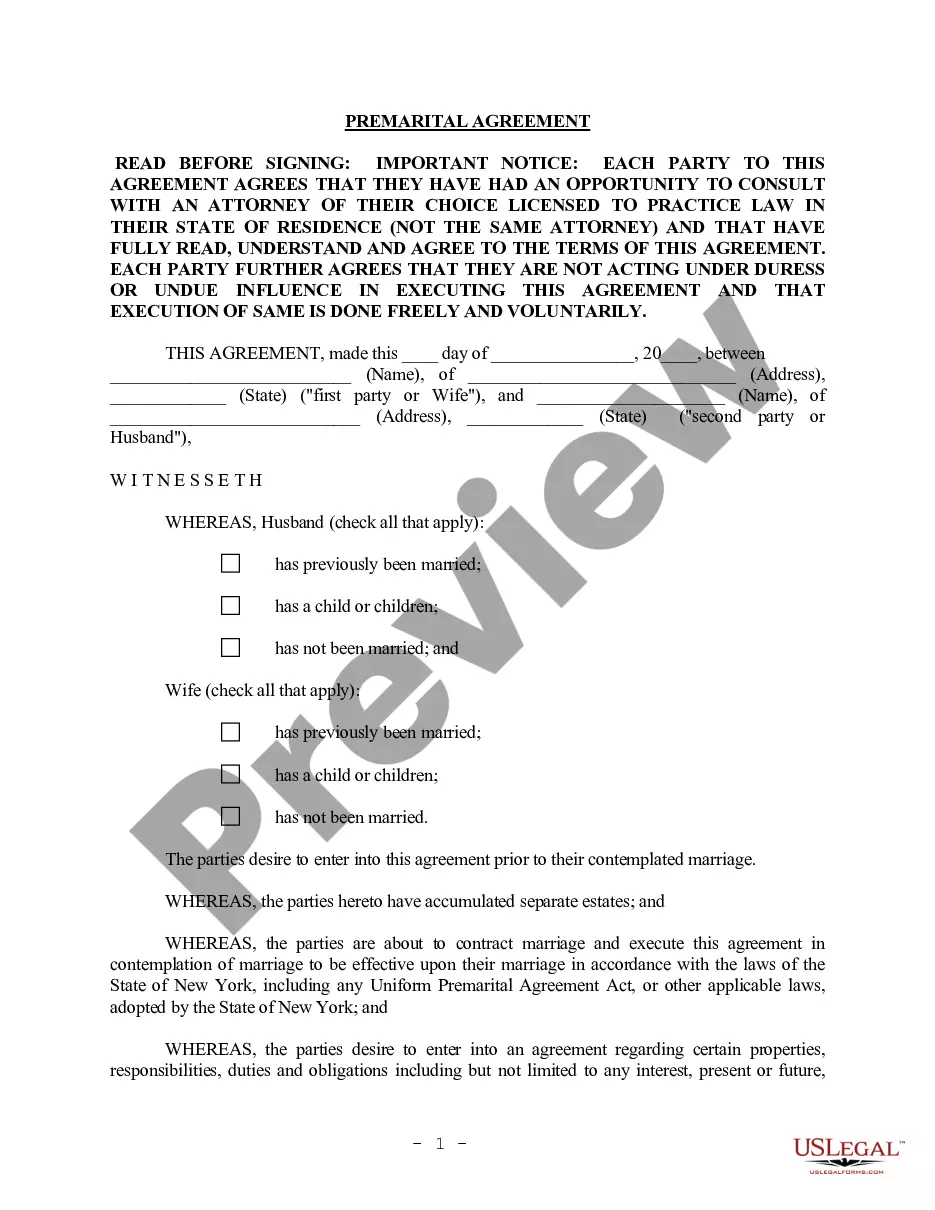

This form is a Grant Deed where the grantors are two individuals and the grantee is a trust.

Anaheim California Grant Deed - Two Individuals to a Trust

Description

How to fill out California Grant Deed - Two Individuals To A Trust?

If you are searching for a legitimate form template, it’s hard to find a superior platform than the US Legal Forms site – likely the most extensive libraries available on the internet.

Here you can discover a vast array of form samples for organizational and personal needs categorized by type and region, or by keywords.

Using our enhanced search option, obtaining the most current Anaheim California Grant Deed - Two Individuals to a Trust is as simple as 1-2-3.

Acquire the form. Choose the format and store it on your device.

Edit. Fill in, modify, print, and sign the downloaded Anaheim California Grant Deed - Two Individuals to a Trust.

- If you are already familiar with our platform and have an active account, simply Log In to your profile and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the instructions outlined below.

- Ensure you have located the form you need. Review its description and utilize the Preview feature to examine its content. If it doesn’t fulfill your needs, use the Search box at the top of the page to find the correct document.

- Validate your selection. Click the Buy now button. Following that, choose your desired pricing plan and enter your information to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

Saclaw.org/deed-of-trust. A deed of trust, also called a trust deed, is the functional equivalent of a mortgage. It does not transfer the ownership of real property, as the typical deed does. Like a mortgage, a trust deed makes a piece of real property security (collateral) for a loan.

You'll need to transfer an interest by writing up another deed with the person's name on it. In California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances. Each one has its own requirements and works best in different circumstances.

Adding a family member to the deed as a joint owner for no consideration is considered a gift of 50% of the property's fair market value for tax purposes. If the value of the gift exceeds the annual exclusion limit ($16,000 for 2022) the donor will need to file a gift tax return (via Form 709) to report the transfer.

California mainly uses two types of deeds: the ?grant deed? and the ?quitclaim deed.? Most other deeds you will see, such as the common ?interspousal transfer deed,? are versions of grant or quitclaim deeds customized for specific circumstances.

You'll need to transfer an interest by writing up another deed with the person's name on it. In California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances. Each one has its own requirements and works best in different circumstances.

ACTION TO CONSIDER: To avoid property tax reassessment, do not transfer real property from individuals to a legal entity unless the individuals have the same proportionate interest in the legal entity as they did in the real property.

Deed. Deeds are valuable to buyers because they provide certain protections regarding the sale of property. A grant deed is a deed that ?grants? certain promises to the buyer: The property has not already been transferred to someone else.

While California does not require grant deeds to be recorded, almost all of them are in order to protect the grantee from any later transfer of the same property. As long as the grant deed is recorded, any potential purchaser would be on notice of the earlier sale to a new owner.

Grant Deeds are used to transfer title of real property. This is done at the time of purchase and can be later recorded to add or remove individual's names after purchase.

A grant deed is a transaction between two people or entities without securing the property as collateral. A deed of trust is used by mortgage companies when a homeowner takes out a loan against the property.