This form is a Grant Deed where the grantor(s) retains a life estate in the described property.

Vista California Grant Deed - Parents to Child with Reservation of Life Estate

Description

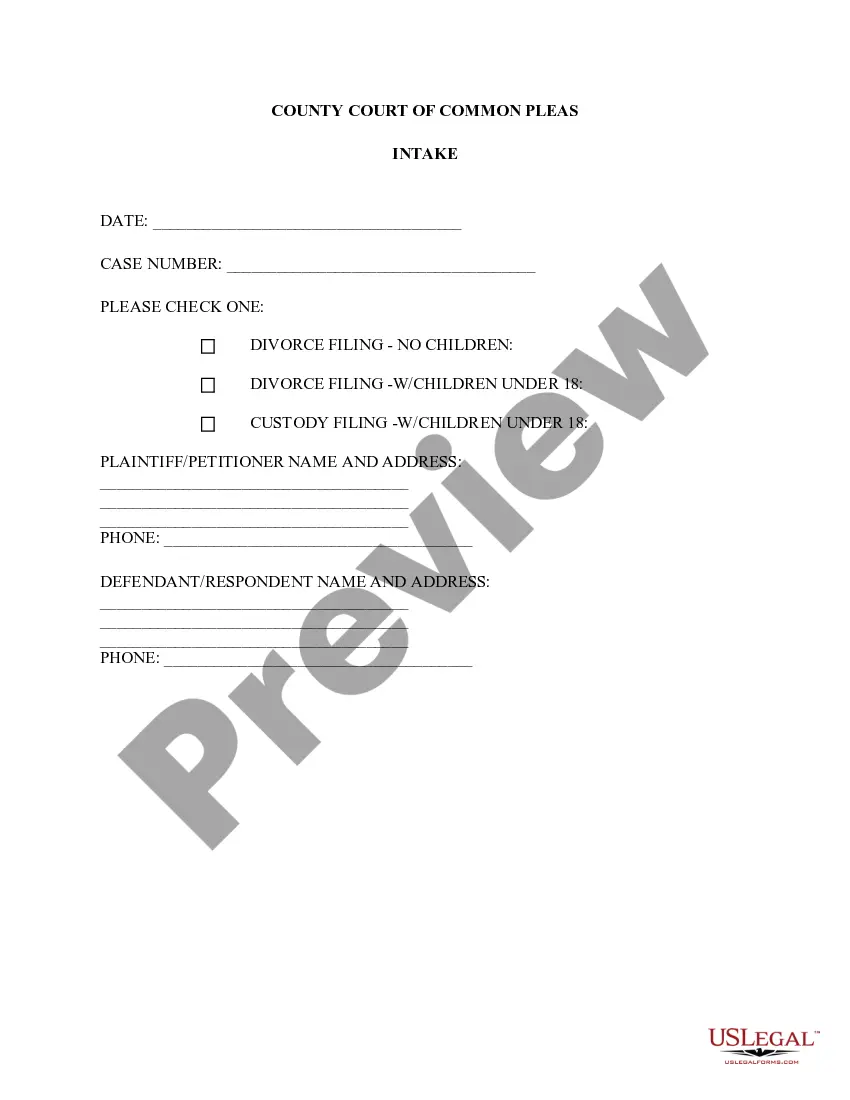

How to fill out California Grant Deed - Parents To Child With Reservation Of Life Estate?

Irrespective of social or occupational standing, completing legal paperwork is an unfortunate requirement in today's corporate landscape.

Frequently, it’s nearly unfeasible for an individual lacking legal expertise to draft these types of documents from scratch, primarily due to the intricate terminology and legal nuances they involve.

This is where US Legal Forms comes to the aid.

Confirm that the form you’ve located is tailored to your area because the regulations of one state or county do not apply to another.

Review the document and read a brief summary (if available) of situations the document can be utilized for.

- Our platform provides an extensive collection of over 85,000 ready-to-use state-specific documents suitable for nearly any legal situation.

- US Legal Forms is also an excellent tool for partners or legal advisors who seek to improve their efficiency using our DIY forms.

- Whether you need the Vista California Grant Deed - Parents to Child with Reservation of Life Estate or any other document valid in your jurisdiction, US Legal Forms makes everything accessible.

- Here's how you can quickly obtain the Vista California Grant Deed - Parents to Child with Reservation of Life Estate using our reliable platform.

- If you are already a customer, simply Log In to your account to retrieve the required form.

- However, if you are new to our platform, make sure to follow these steps before downloading the Vista California Grant Deed - Parents to Child with Reservation of Life Estate.

Form popularity

FAQ

To transfer property from a parent to a child in California, you can use a Vista California Grant Deed - Parents to Child with Reservation of Life Estate. This deed allows the parent to retain the right to live in the property until their passing. It is a straightforward process, but you should ensure proper documentation and recording with the county. Using a trusted service like US Legal Forms can help you navigate this transaction smoothly and ensure that all legal requirements are met.

Selling a house that is in a life estate can be complex, but it is possible. With a Vista California Grant Deed - Parents to Child with Reservation of Life Estate, the life tenant retains rights to live in the property but cannot sell it without consent from the remainderman. Therefore, clear communication and potentially reaching an agreement with the remainderman are necessary steps before proceeding with a sale.

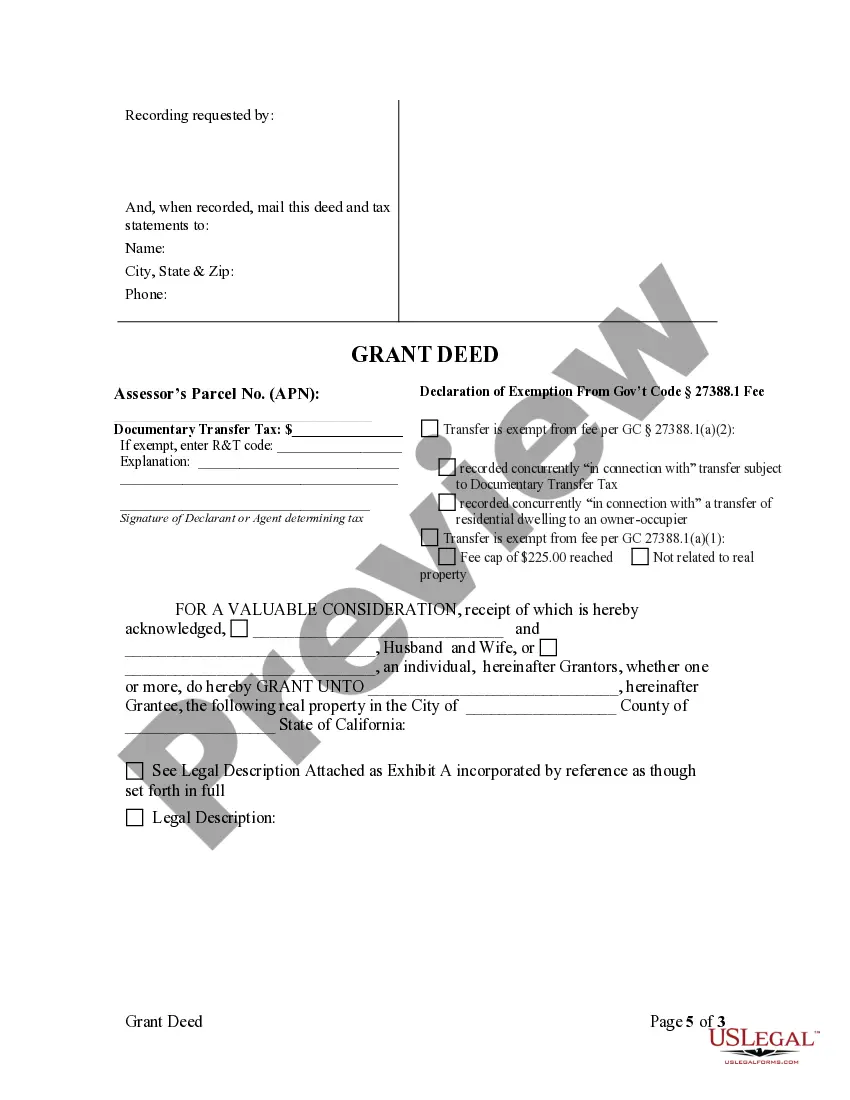

Filling out a California grant deed, including a Vista California Grant Deed - Parents to Child with Reservation of Life Estate, involves several steps. First, you need to include the names of the grantor and grantee accurately. Next, provide a legal description of the property and specify the type of estate you are granting, such as a life estate. It's essential to ensure all information is correct and clear to avoid issues in property transfer.

The primary difference between a life estate deed and a transfer on death deed lies in the timing of ownership transfer. A life estate deed, like the Vista California Grant Deed - Parents to Child with Reservation of Life Estate, grants ownership during your life but allows the child to inherit upon your passing. In contrast, a transfer on death deed simply directs how the property should be transferred upon your death without giving any rights to the beneficiary until that time.

A life estate deed, such as a Vista California Grant Deed - Parents to Child with Reservation of Life Estate, does not override a will. Instead, it allows you to transfer property to beneficiaries while retaining certain rights during your lifetime. For instance, you maintain the right to live in the property until death. Therefore, a life estate deed can coexist with a will but should be clearly outlined to avoid confusion.

For individuals involved in a Vista California Grant Deed - Parents to Child with Reservation of Life Estate, the remainderman may face tax implications when the life tenant passes. The property typically transfers to the remainderman at a stepped-up basis, meaning they might owe less in capital gains taxes upon selling. However, understanding these tax nuances is essential, and consulting with a tax professional can provide clarity on personal circumstances.

While it is possible to sell a home with a life estate deed, the process includes some complexities. The life tenant may sell their interest, but they cannot sell the property outright without the remainderman's agreement. This means that potential buyers might face limitations, so it’s wise to understand the specifics of the Vista California Grant Deed - Parents to Child with Reservation of Life Estate before proceeding.

A life estate, such as the Vista California Grant Deed - Parents to Child with Reservation of Life Estate, has some drawbacks. The life tenant cannot dispose of the property without the remainderman's consent. Additionally, if the life tenant incurs debts, creditors may claim against the property, potentially putting it at risk. It's crucial to weigh these factors before committing to a life estate arrangement.

The life estate rule in California stipulates that a life estate terminates upon the death of the life tenant, at which point ownership passes to the remainderman. Life tenants can live on the property and exercise several rights, but they cannot alter or destroy the property in ways that would harm the remainderman's interest. If you're interested in setting up a life estate with careful stipulations, consulting legal resources like the Vista California Grant Deed - Parents to Child with Reservation of Life Estate can provide clarity and guidance.

A reserving life estate deed allows property owners to transfer ownership while retaining the right to use the property for the rest of their lives. This kind of deed is beneficial for parents who wish to pass property to their children but want to maintain living rights. If you're considering this option, the Vista California Grant Deed - Parents to Child with Reservation of Life Estate can help structure your plan effectively.