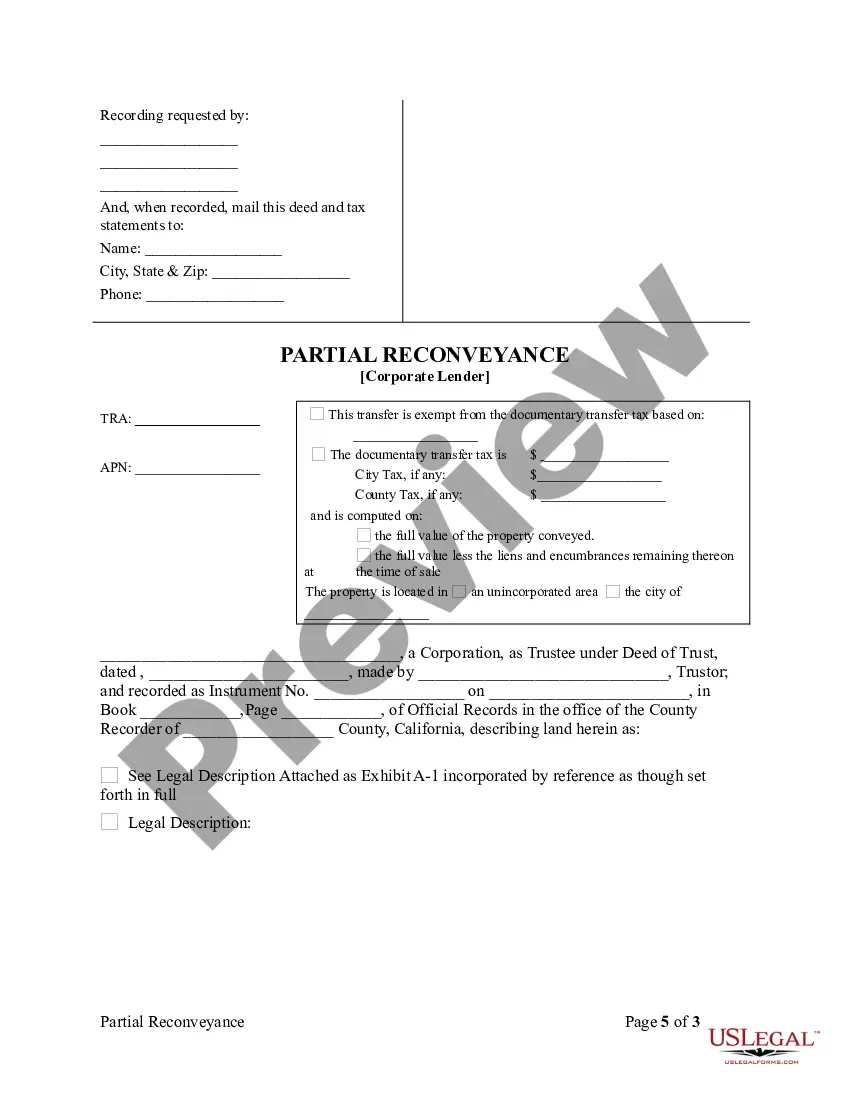

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

San Diego California Partial Release of Property From Deed of Trust for Corporation

Description

How to fill out California Partial Release Of Property From Deed Of Trust For Corporation?

Are you searching for a reliable and affordable source of legal forms to obtain the San Diego California Partial Release of Property From Deed of Trust for Corporation? US Legal Forms is your ideal solution.

Whether you're seeking a straightforward agreement to establish guidelines for living with your partner or a collection of documents to facilitate your separation or divorce through the judiciary, we've got you supported. Our platform provides over 85,000 current legal document templates for individual and business purposes. All templates we provide are not generic and are structured based on the demands of different states and counties.

To retrieve the form, you must Log In to your account, locate the necessary form, and click the Download button adjacent to it. Please be aware that you can download your previously acquired document templates at any time from the My documents section.

Are you a newcomer to our site? Don’t worry. You can create an account with ease, but first, ensure to.

Now you’re ready to register your account. Next, select a subscription plan and move forward to payment. After completing the transaction, download the San Diego California Partial Release of Property From Deed of Trust for Corporation in any provided file format. You can revisit the site whenever you wish and re-download the form at no additional cost.

Acquiring current legal forms has never been simpler. Try US Legal Forms today, and say goodbye to wasting your precious time learning about legal documents online once and for all.

- Verify if the San Diego California Partial Release of Property From Deed of Trust for Corporation aligns with your state and local area regulations.

- Review the form’s description (if available) to determine the intended recipient and purpose of the form.

- Start the search again if the form isn't suitable for your legal needs.

Form popularity

FAQ

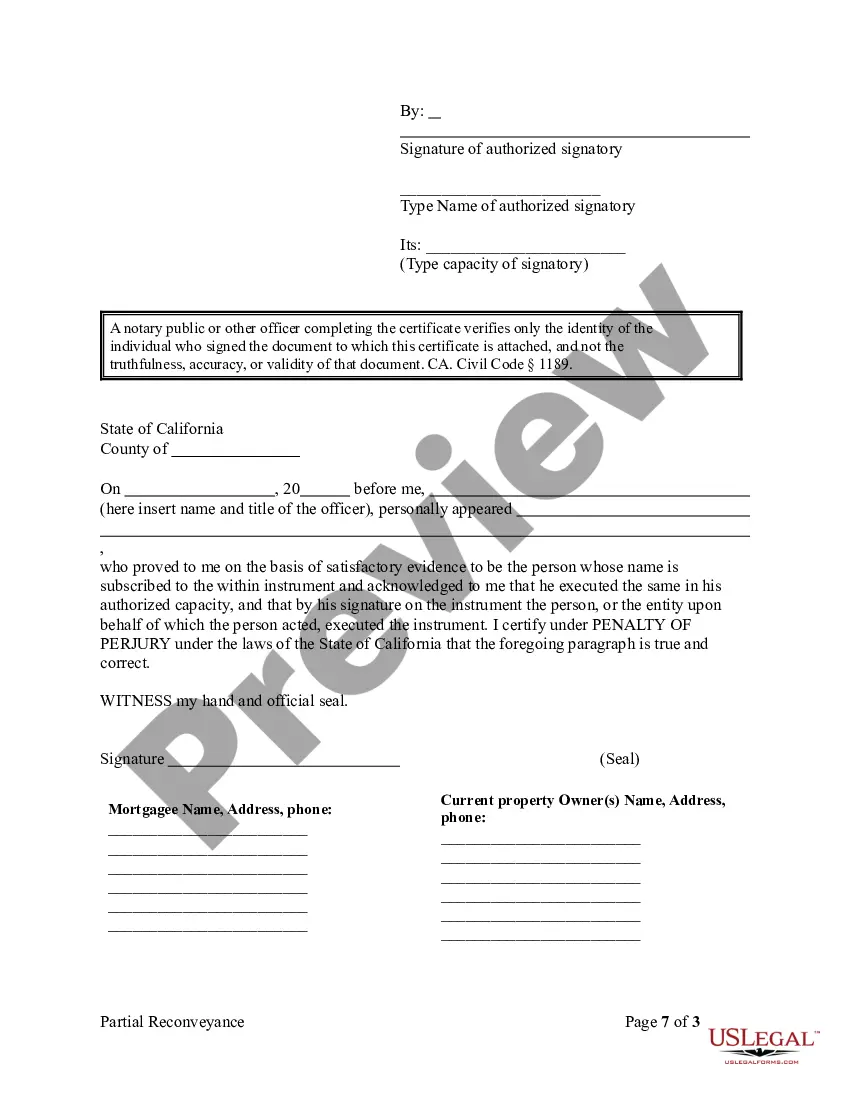

Filing a quitclaim deed in San Diego requires you to first complete the deed form, ensuring it specifies the property and parties involved. Once you have filled out the form, you must sign it in front of a notary public. After notarization, submit the quitclaim deed to the San Diego County Recorder's Office to officially record the document. This process is crucial for anyone involved in the San Diego California Partial Release of Property From Deed of Trust for Corporation, as it ensures clarity in property ownership.

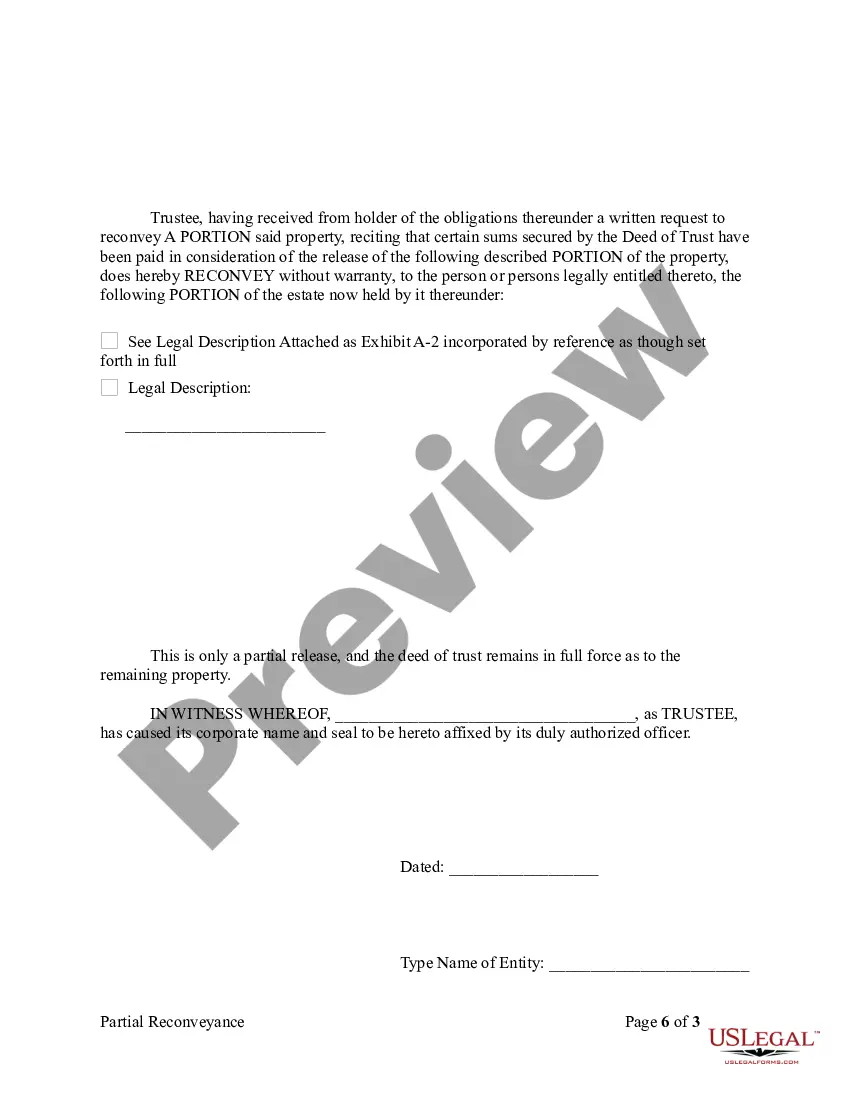

Release on a deed of trust is usually accomplished by preparing a release document that clears the lien on the property. This document must be signed and recorded with the county, proving that the obligations under the deed of trust have been satisfied. Engaging in a San Diego California Partial Release of Property From Deed of Trust for Corporation can streamline this release process, ensuring all necessary steps are legally adhered to.

Transferring property from a trust to an individual in California typically requires the trustee to execute a deed that conveys the property directly to the individual named. This deed must then be recorded with the county to ensure the transfer is recognized legally. A San Diego California Partial Release of Property From Deed of Trust for Corporation can aid in this transfer by outlining the legal processes involved.

To remove a joint owner from your property, you'll generally need both parties to agree and sign a deed that indicates the change. This deed must be properly notarized and submitted to the county recorder. Utilizing a San Diego California Partial Release of Property From Deed of Trust for Corporation can help ensure that all legal obligations are met smoothly.

Removing a co-owner from your title involves preparing a new deed that transfers ownership rights. You must ensure that the co-owner agrees and signs the necessary documents, which should then be filed with the appropriate county office. Engaging in a San Diego California Partial Release of Property From Deed of Trust for Corporation can simplify the process and formalize the change in ownership.

To remove a co-owner from a property deed in California, you can create a quitclaim deed that specifies the co-owner relinquishing their ownership interest. The quitclaim deed needs to be signed and notarized, then recorded at the county clerk's office. This process may relate to a San Diego California Partial Release of Property From Deed of Trust for Corporation, providing clarity in property ownership.

To remove someone from a house deed in California, you typically need to prepare a new deed that conveys the property solely to the remaining owner. Ensure you comply with California laws, which might involve notarizing the new deed and recording it with your local county recorder's office. This process can be part of a San Diego California Partial Release of Property From Deed of Trust for Corporation, helping you streamline ownership transfers.

A quitclaim deed is a legal document used to transfer ownership interest in a property, often from a trust to an individual. This type of deed does not guarantee that the trust owns the property outright; instead, it simply conveys whatever interest the trust holds. Utilizing a quitclaim deed can be an efficient way to complete the transfer, and companies like US Legal Forms provide resources to ensure you understand the intricacies involved, especially in the context of a San Diego California Partial Release of Property From Deed of Trust for Corporation.

Yes, transferring property from a trust to an individual is very much possible in California. The trustee must follow the terms of the trust and execute the appropriate transfer documents, such as a deed. This process ensures the equitable distribution of assets, and US Legal Forms provides the necessary tools to facilitate a smooth transfer. Understanding the San Diego California Partial Release of Property From Deed of Trust for Corporation can help streamline this process.

Transferring property out of a trust in California typically involves a formal process. First, you need to review the trust document for any specific instructions. Then, you may execute a deed to transfer the property from the trust to the desired individual or entity, ensuring all legal requirements are met. Companies like US Legal Forms offer guidance and templates that make this process straightforward, especially for San Diego California Partial Release of Property From Deed of Trust for Corporation.