This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Santa Clarita California Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out California Unsecured Installment Payment Promissory Note For Fixed Rate?

Regardless of social or occupational standing, filling out legal documents is a regrettable requirement in contemporary society.

Frequently, it is nearly unfeasible for an individual without any legal training to formulate such documents independently, primarily due to the intricate terminology and legal nuances they entail.

This is precisely where US Legal Forms comes into play.

Verify that the template you have selected is applicable for your jurisdiction considering that the regulations of one state or county can differ from another.

Examine the document and review a brief summary (if available) of situations the document can address.

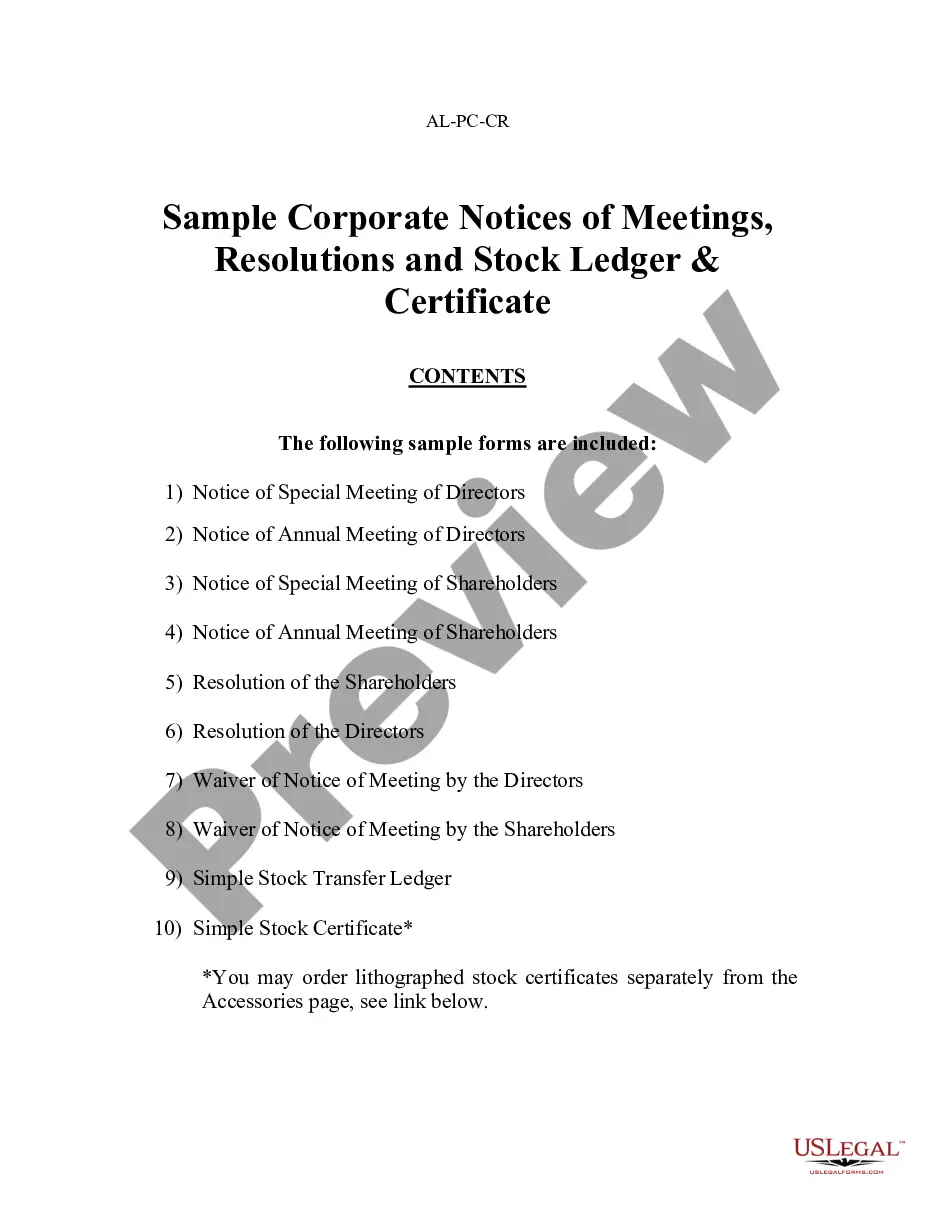

- Our platform provides an extensive collection of over 85,000 ready-to-use state-specific documents suitable for nearly every legal circumstance.

- US Legal Forms also serves as an outstanding tool for associates or legal advisors striving to conserve time by utilizing our DYI papers.

- Whether you need the Santa Clarita California Unsecured Installment Payment Promissory Note for Fixed Rate or any other document that will be accepted in your state or county, with US Legal Forms, everything is easily accessible.

- Here’s how to quickly acquire the Santa Clarita California Unsecured Installment Payment Promissory Note for Fixed Rate using our reliable platform.

- If you are a current subscriber, you can proceed to Log In to your account to retrieve the relevant form.

- However, if you are unfamiliar with our library, make sure to follow these steps before downloading the Santa Clarita California Unsecured Installment Payment Promissory Note for Fixed Rate.

Form popularity

FAQ

The structure of a promissory note generally consists of the heading, borrower and lender information, the principal amount, interest rate, payment schedule, and conditions for default. This organized format makes it easy to understand the financial agreement. Utilizing resources from uslegalforms can help you draft an effective Santa Clarita California Unsecured Installment Payment Promissory Note for Fixed Rate with all necessary components.

While you do not necessarily need a lawyer to create a promissory note, having legal guidance can be advantageous, especially for a Santa Clarita California Unsecured Installment Payment Promissory Note for Fixed Rate. A lawyer can help ensure that the document complies with local laws and adequately protects your interests. Alternatively, using a reliable platform like uslegalforms can simplify the process and provide peace of mind.

Promissory notes do not usually need to be filed with a government office; instead, they should be kept in a safe place. For a Santa Clarita California Unsecured Installment Payment Promissory Note for Fixed Rate, both parties should retain copies for their records. If necessary, these documents can be presented in court if a dispute arises.

Yes, promissory notes are enforceable in California, including Santa Clarita California Unsecured Installment Payment Promissory Note for Fixed Rate. As long as the notes are clear, detailed, and adhere to state laws, they can be legally upheld in court. It is wise to use a standardized template or seek professional guidance to ensure enforceability.

The key difference is in the payment structure. An installment note, like a Santa Clarita California Unsecured Installment Payment Promissory Note for Fixed Rate, typically requires regular payments of both principal and interest over time. In contrast, a standard promissory note may require a lump-sum payment at maturity. This structure can make installment notes more manageable for borrowers.

You can certainly write your own promissory note, and many people do create one for Santa Clarita California Unsecured Installment Payment Promissory Note for Fixed Rate. However, it is essential to ensure that the document meets all legal requirements to be enforceable. Using templates available on platforms like uslegalforms can help you draft an effective and compliant note.

Yes, a promissory note can hold up in court, including Santa Clarita California Unsecured Installment Payment Promissory Note for Fixed Rate. As long as the note is properly executed and contains clear terms, it serves as a binding contract. If disputes arise, a well-drafted note can provide significant support for your case.

A reasonable interest rate for a promissory note can vary based on factors such as market conditions and the borrower's creditworthiness. Typically, rates can range from 5% to 15%, but it's vital to evaluate when setting terms. By considering a Santa Clarita California Unsecured Installment Payment Promissory Note for Fixed Rate, you can ensure that the chosen rate is fair and aligns with current lending standards.

There are several types of promissory notes, including secured and unsecured notes, as well as demand and installment notes. A secured promissory note is backed by collateral, while an unsecured note, like the Santa Clarita California Unsecured Installment Payment Promissory Note for Fixed Rate, does not require collateral. Each type serves unique needs, depending on the terms and agreements made.

The purpose of a promissory note is to create a legal recording of a debt obligation. It outlines the borrower’s promise to repay the lender under specific terms, providing clarity and security for both parties. Utilizing a Santa Clarita California Unsecured Installment Payment Promissory Note for Fixed Rate can help you formalize loans, making future transactions less stressful.