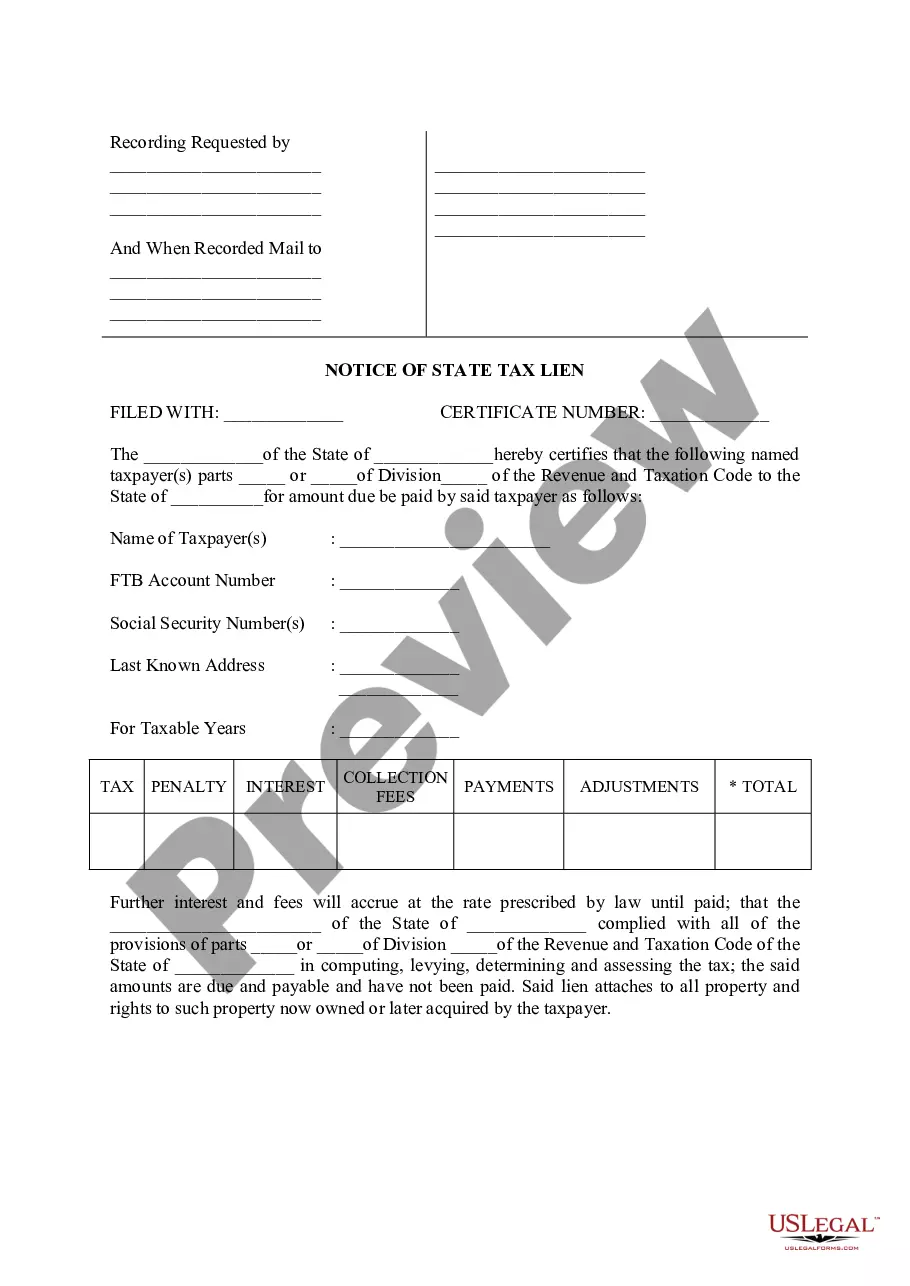

Long Beach California Notice of State Tax Lien

Description

How to fill out California Notice Of State Tax Lien?

Utilize the US Legal Forms to gain instant access to any document you desire.

Our user-friendly platform, boasting a vast array of documents, simplifies the process of locating and acquiring virtually any document sample you seek.

You can download, complete, and validate the Long Beach California Notice of State Tax Lien in mere minutes, rather than spending countless hours surfing the web for an appropriate template.

Using our catalog is an excellent method to enhance the security of your form submissions. Our knowledgeable attorneys routinely review all documents to ensure that the forms are suitable for a specific jurisdiction and adhere to current regulations and statutes.

Access the page with the template you require. Ensure that it is the document you are looking for: check its title and description, and use the Preview option if it is available. Alternatively, utilize the Search bar to find the correct one.

Initiate the downloading process. Click Buy Now and select the pricing plan that suits you best. Then, register for an account and complete your purchase using a credit card or PayPal.

- How can you acquire the Long Beach California Notice of State Tax Lien.

- If you already possess a subscription, simply Log In to your account. The Download option will be activated on all templates you view. Additionally, you can access all previously saved documents in the My documents section.

- If you haven't yet created an account, follow the instructions outlined below.

Form popularity

FAQ

A state tax lien is the government's legal claim against your property when you don't pay your tax debt in full. Your property includes real estate, personal property and other financial assets.

Under California Revenue and Taxation Code Section 19255, the statute of limitations to collect unpaid state tax debts is 20 years from the assessment date, but there are situations that may extend the period or allow debts to remain due and payable. The stakes are particularly high in criminal tax prosecution cases.

Los Angeles County Registrar-Recorder/County Clerk website at lavote.net/home/records/real-estate-records/general-info or calling (800) 201-8999.

Pay the full amount due Once you have paid, the FTB will record a certificate of release in the office of the county recorder where the lien was recorded and will also file the release with the California Secretary of State within 40 days.

California state tax liens are recorded at the request of various governmental agencies. For questions about a state tax lien, contact the appropriate agency directly: Board of Equalization (916) 445-1122? Employment Development Department (916) 464-2669.

A lien expires 10 years from the date of recording or filing, unless we extend it. If we extend the lien, we will send a new Notice of State Tax Lien and record or file it with the county recorder or California Secretary of State. We will not release expired liens.

California state tax liens are recorded at the request of various governmental agencies. For questions about a state tax lien, contact the appropriate agency directly: Board of Equalization (916) 445-1122? Employment Development Department (916) 464-2669.

The issuance of a Notice of State Tax Lien (NSTL) is a protective action taken by us to encumber property that could be used to satisfy delinquent liabilities owed to the state of California and to secure a position of priority among other creditors.

A lien expires 10 years from the date of recording or filing, unless we extend it. If we extend the lien, we will send a new Notice of State Tax Lien and record or file it with the county recorder or California Secretary of State. We will not release expired liens.