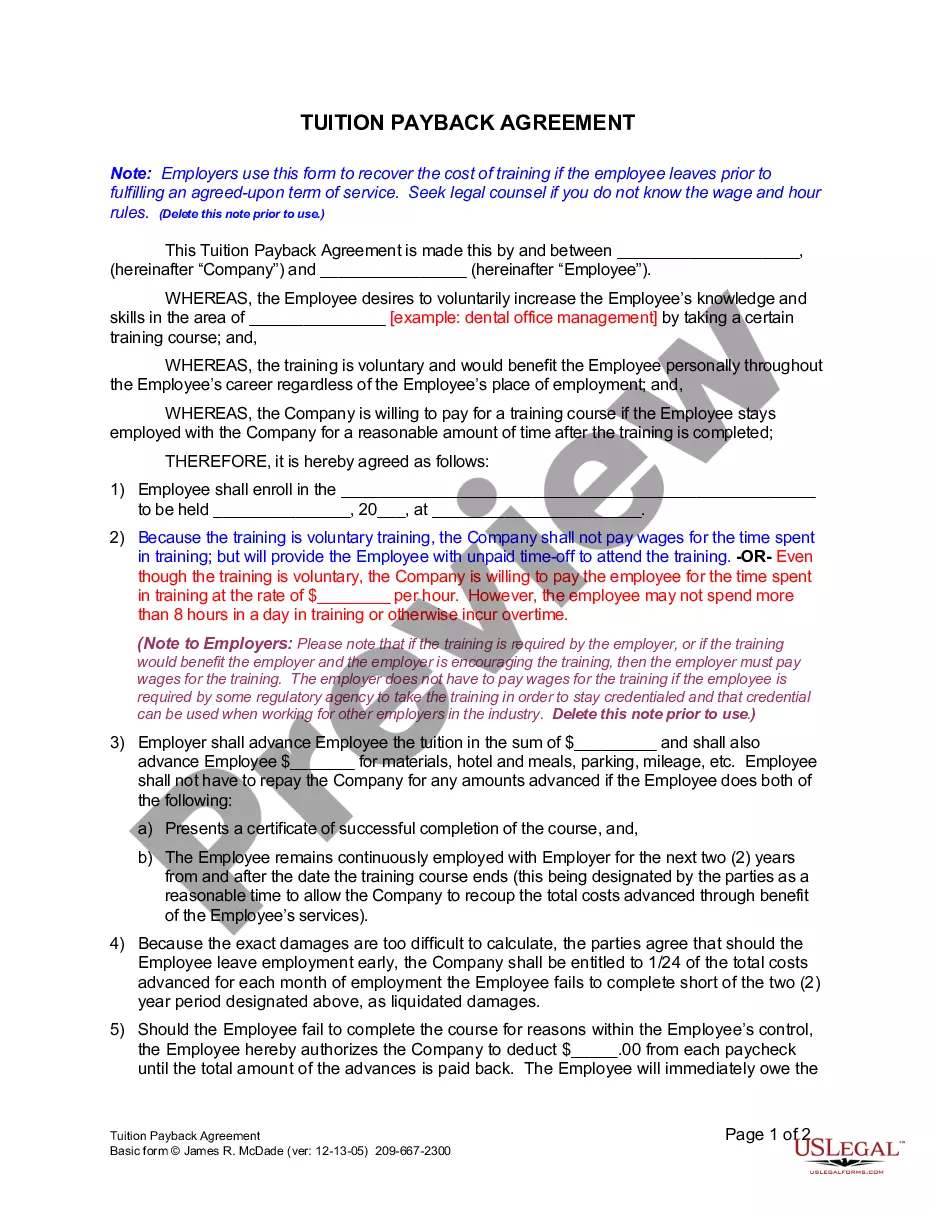

Employers use this form to recover the cost of voluntary training if the employee leaves prior to fulfilling an agreed-upon term of service.

Santa Clara California Tuition Payback Agreement

Description

How to fill out California Tuition Payback Agreement?

Utilize the US Legal Forms and gain immediate access to any form template you require.

Our user-friendly website with a vast array of document samples makes it easy to locate and acquire nearly any document template you will want.

You can save, complete, and authenticate the Santa Clara California Tuition Payback Agreement in merely a few minutes instead of spending hours searching the web for a suitable template.

Employing our collection is an excellent approach to enhance the security of your document filing.

If you haven't created an account yet, follow the instructions below.

Locate the template you want. Ensure it is the document you desire: confirm its title and description, and take advantage of the Preview feature when available. Otherwise, utilize the Search field to find the correct one.

- Our knowledgeable attorneys frequently review all documents to ensure that the templates are applicable for a specific state and adhere to new laws and regulations.

- How can you retrieve the Santa Clara California Tuition Payback Agreement.

- If you possess an account, simply Log In to your profile.

- The Download button will be visible on all documents you examine.

- Moreover, you can access all your previously saved documents in the My documents section.

Form popularity

FAQ

Justifying tuition reimbursement involves demonstrating the value of your educational expenses. Under the Santa Clara California Tuition Payback Agreement, you can highlight how your education enhances your skills and benefits the organization. Provide evidence of course outcomes and tie them back to your role to strengthen your justification.

When asking for tuition reimbursement, make a formal request that clearly states your qualifications and the expenses you are seeking to recover. Reference the Santa Clara California Tuition Payback Agreement, as this may aid in your case. Additionally, consider reaching out to your HR department or educational benefits coordinator for guidance.

To report tuition reimbursement on your taxes, you should first gather your documentation related to the Santa Clara California Tuition Payback Agreement. Generally, these reimbursements may need to be reported as income, but can also qualify for education tax benefits. Consult a tax professional if you are unsure about the procedures and implications.

When writing a request for tuition reimbursement under the Santa Clara California Tuition Payback Agreement, be clear and concise. Start with your details, state the purpose of your request, and outline the costs incurred. Include copies of receipts and any relevant supporting documents to ensure a smooth process.

Yes, training reimbursement agreements are legal in California, including Santa Clara, as long as they comply with state and federal laws. These agreements can outline the terms of reimbursement for training costs, ensuring both employers and employees understand their obligations. To set up a legally sound agreement, you may want to explore solutions from uslegalforms, which can ensure all legal requirements are met.

To get your tuition reimbursement through a Santa Clara California Tuition Payback Agreement, you should start by checking your employer's policy. Typically, you will need to submit proof of payment or enrollment along with any forms required by your organization. After submission, the processing time may vary, so it’s advisable to follow up with your HR department or use uslegalforms for clarity on the process.

Handling employee tuition reimbursement in the framework of a Santa Clara California Tuition Payback Agreement involves clear policies and procedures. First, ensure that eligible employees understand the requirements for reimbursement, including the necessary documentation. Next, create a timeline for submissions and approvals to streamline the process. Finally, consider using a platform like uslegalforms to manage agreements efficiently and minimize confusion.

Tuition reimbursement should be reported accurately according to the IRS guidelines and your company’s procedures. For tax purposes, if the reimbursement is non-taxable, you typically do not need to report it. However, if it is taxable, report it on the employee’s W-2 form, ensuring compliance with the Santa Clara California Tuition Payback Agreement.

Processing tuition reimbursement involves several steps to comply with your Santa Clara California Tuition Payback Agreement. First, review the employee’s submitted expenses and ensure they meet company policy. Next, create a reimbursement request to initiate payment, and finally, record the transaction in your accounting system to maintain accurate financial records.

In the context of taxes, tuition reimbursement should be reported on your employee's W-2 form in Box 1 if it is considered taxable income. For non-taxable reimbursements, you generally do not report it. Always refer to IRS instructions or consult with a tax professional to ensure accurate reporting in line with your Santa Clara California Tuition Payback Agreement.