Employers use this form to reinforce with an employee his or her need to return Company property and to obtain authorization for making deductions from an employee's paycheck.

Carlsbad California Advance Authorization for Pay Deduction

Description

How to fill out California Advance Authorization For Pay Deduction?

Leverage US Legal Forms to gain immediate access to any sample form you need.

Our efficient platform, which hosts a vast array of documents, streamlines the process of locating and obtaining nearly any document sample you desire.

You can download, fill out, and sign the Carlsbad California Advance Authorization for Pay Deduction in mere minutes, avoiding hours of online searching for an appropriate template.

Utilizing our library is an excellent method to enhance the security of your form submissions. Our skilled attorneys routinely review all documents to confirm that the forms meet state-specific requirements and adhere to current laws and regulations.

If you do not possess an account yet, adhere to the instructions outlined below.

Our company prides itself on being one of the largest and most reliable document libraries available online. We are always eager to support you in any legal matter, including merely downloading the Carlsbad California Advance Authorization for Pay Deduction.

- How can you access the Carlsbad California Advance Authorization for Pay Deduction.

- If you hold a subscription, simply Log In to your account. The Download button will be activated for all the documents you view.

- Additionally, you can retrieve all previously saved files from the My documents section.

Form popularity

FAQ

Authorization for payroll deduction is the process by which you allow your employer to take specified amounts from your paycheck for set purposes. This authorization protects both you and your employer by creating a clear record of the deductions you agree to. Understanding this authorization is vital for securing your financial interests in Carlsbad California, especially when utilizing platforms like US Legal Forms for further assistance.

Yes, an employer can make deductions from a final paycheck in California, but there are restrictions. Employers can deduct amounts that you authorized or are legally required to withhold, such as taxes or contributions to benefits. Consult a reliable source like US Legal Forms for guidance on what deductions are permissible in Carlsbad, California.

Your employer can deduct certain amounts from your paycheck, but only with your authorization. Deductions may include taxes, benefits, or payments for any agreed-upon services. It’s essential to review your payroll deduction agreement and stay informed about what can be legally deducted in Carlsbad, California.

The authorization for payroll deduction form in California is a document used to grant your employer permission to deduct specific amounts from your paycheck. This form outlines the purpose of the deduction, whether it's for health insurance, retirement contributions, or other services. Utilizing resources like US Legal Forms can help you understand this process better and ensure compliance with state regulations in Carlsbad.

A payroll deduction agreement is a contract between you and your employer that specifies the amounts deducted from your paycheck for various purposes. This agreement ensures transparency and establishes consent for deductions that may include benefits, savings plans, or other financial obligations. In Carlsbad California, understanding this agreement is crucial for managing your finances effectively.

Under California law, an employer may lawfully deduct the following from an employee's wages: Deductions that are required of the employer by federal or state law, such as income taxes or garnishments.

What are payroll deductions? Income tax. Social security tax. 401(k) contributions. Wage garnishments.Child support payments.

Rules for making deductions from your pay Your employer is not allowed to make a deduction from your pay or wages unless: it is required or allowed by law, for example National Insurance, income tax or student loan repayments. you agree in writing to a deduction. your contract of employment says they can.

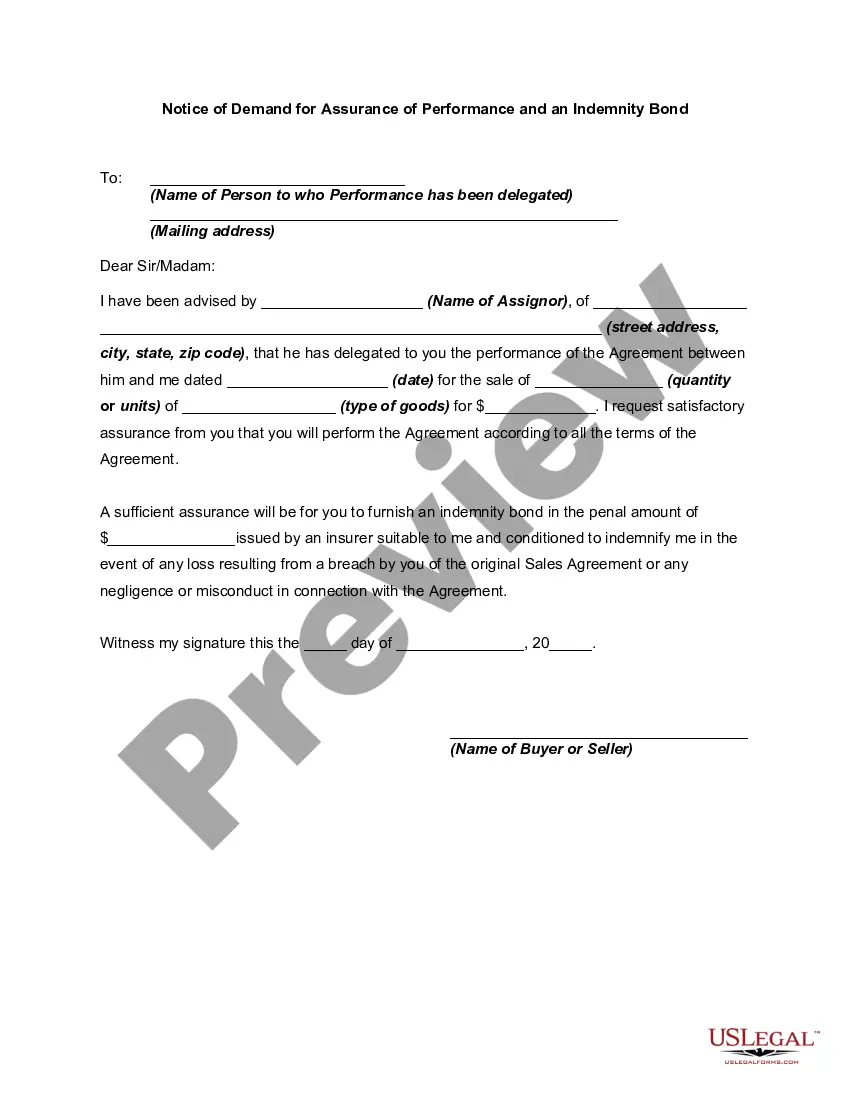

Payroll Deduction Authorization Form means the form or other document designated by the Company as the required evidence of an Employee's election to make voluntary cash contributions through an automatic payroll deduction mechanism.

Advance deduction on payslip This is where an amount gets removed from an employee/worker's payslip to cover money previously advanced to them. This type of action is commonplace for retail clerks, loan officers, and sales jobs.