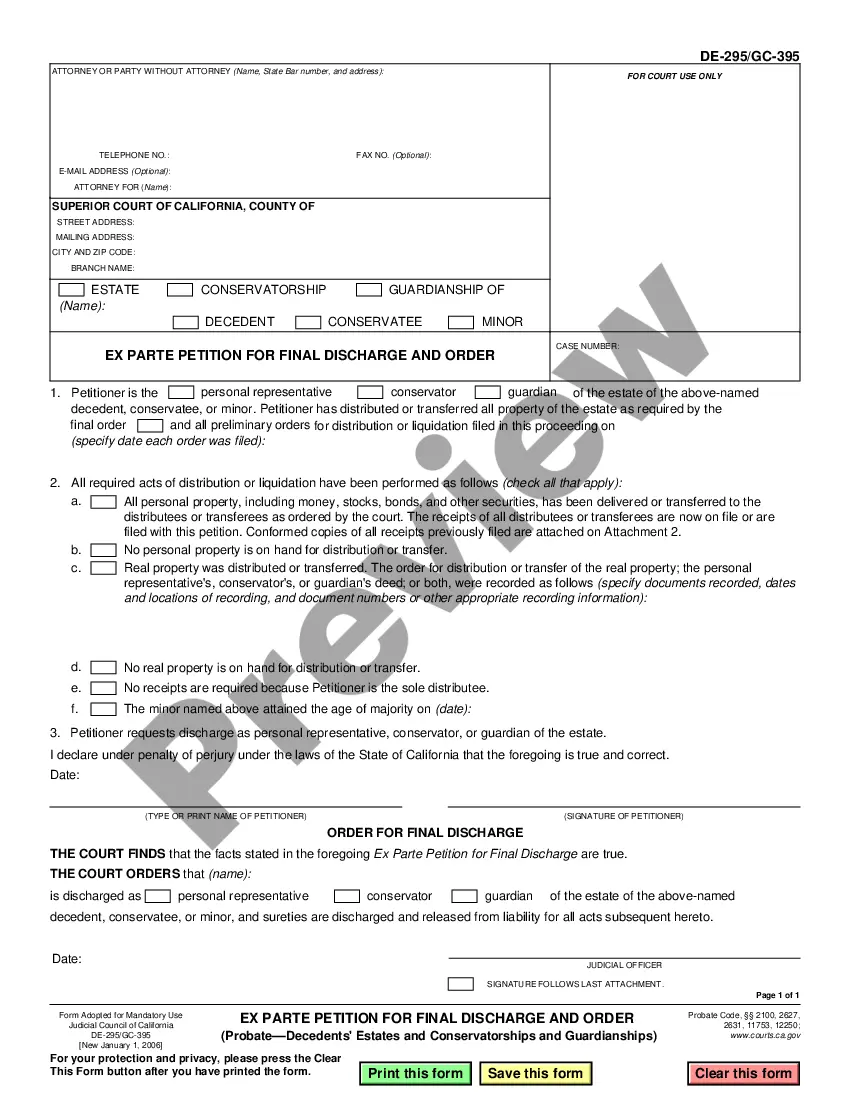

This model form, an Ex Parte Petition for Final Discharge and Order, is used in a Probate matter. It can be easily completed by filling in the blanks and/or adapted to fit your specific facts and circumstances.

Fullerton California Ex Parte Petition for Final Discharge and Order

Description

How to fill out California Ex Parte Petition For Final Discharge And Order?

If you are looking for an appropriate form template, it’s unattainable to discover a more user-friendly service than the US Legal Forms website – likely the most comprehensive collections available online.

With this collection, you can obtain numerous document examples for business and personal needs categorized by type and region, or keywords.

With our sophisticated search capability, locating the latest Fullerton California Ex Parte Petition for Final Discharge and Order is as straightforward as 1-2-3.

Execute the payment. Utilize your credit card or PayPal account to finish the registration process.

Obtain the template. Select the format and save it to your device.

- Furthermore, the relevance of each document is validated by a team of experienced attorneys who routinely review the templates on our platform and refresh them according to the latest state and county requirements.

- If you are already familiar with our system and possess an account, all you need to do to retrieve the Fullerton California Ex Parte Petition for Final Discharge and Order is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the instructions below.

- Ensure you have located the template you need. Examine its details and utilize the Preview feature (if available) to review its contents. If it falls short of your expectations, use the Search box at the top of the page to find the desired document.

- Validate your selection. Click the Buy now button. Then, choose your preferred subscription plan and provide the necessary information to create an account.

Form popularity

FAQ

To file an ex parte response regarding the Fullerton California Ex Parte Petition for Final Discharge and Order, you need to prepare your documents carefully. Start by outlining your objections or comments regarding the petition, and make sure to follow the local court rules. Once your response is complete, file it with the court along with any required fees. Utilizing platforms like USLegalForms can simplify this process by providing resourceful templates and guidance tailored to your needs.

In the context of the Fullerton California Ex Parte Petition for Final Discharge and Order, the petitioner is typically the executor or administrator of the estate. This individual is responsible for managing the estate's assets and ensuring that all debts and taxes are settled. By filing the petition, the petitioner seeks final approval to distribute the remaining assets to the beneficiaries. It is crucial that the petitioner follows all legal procedures to avoid delays in the distribution process.

An example of an ex parte motion might involve a request for a temporary restraining order to prevent an individual from causing harm or committing an act that could affect another party's interests. Such motions are filed when there is an immediate threat or urgency involved. If you are considering a Fullerton California Ex Parte Petition for Final Discharge and Order, this example illustrates the types of situations that might require such rapid legal action.

The rule of court ex parte refers to the legal provisions that allow a party to receive orders or make requests to the court without the presence or knowledge of the other party, especially in urgent matters. This rule ensures that necessary precautions can be taken quickly to protect rights or property. When filing a Fullerton California Ex Parte Petition for Final Discharge and Order, adhering to this rule can make the process smoother.

In simple terms, ex parte refers to actions taken in court by one party without the other party present. This method is typically used in urgent situations where waiting for a scheduled hearing could result in significant harm. For those looking to file a Fullerton California Ex Parte Petition for Final Discharge and Order, understanding this concept is vital for navigating the legal landscape effectively.

The ex parte rule allows parties to seek court orders without notifying the other party in instances where immediate action is necessary. This procedure is designed to protect parties from potential harm while ensuring that the judicial process can respond swiftly. In matters concerning a Fullerton California Ex Parte Petition for Final Discharge and Order, this rule becomes crucial when time constraints exist.

Individuals may seek an ex parte order when they require immediate relief from a court due to urgent circumstances. For instance, if someone needs to prevent harm, secure property, or address time-sensitive issues, a Fullerton California Ex Parte Petition for Final Discharge and Order can expedite the process. This type of order bypasses normal notice requirements to address situations that cannot wait for a standard hearing.

Filing a response to an ex parte requires you to prepare a written document that addresses the issues raised in the original petition. Your response should clearly convey your position regarding the Fullerton California Ex Parte Petition for Final Discharge and Order. It is important to submit your response by the deadline set by the court to avoid any legal consequences. Utilizing resources from uslegalforms can help guide you through this process efficiently.

An ex parte notice must include details such as the nature of the order sought and the grounds for urgency. This notice serves as a written communication to the court to inform them of your Fullerton California Ex Parte Petition for Final Discharge and Order. Usually, this notice must also provide information about when the request will be presented in court. Ensuring the notice is complete and timely is essential for a smooth process.

An ex parte request may be denied for several reasons, including insufficient evidence, lack of urgency, or failure to follow proper procedures. In the context of a Fullerton California Ex Parte Petition for Final Discharge and Order, the court must be convinced that immediate action is warranted. If the petition does not clearly demonstrate this, the judge may deny the request. It is wise to carefully prepare your petition to improve your chances of approval.