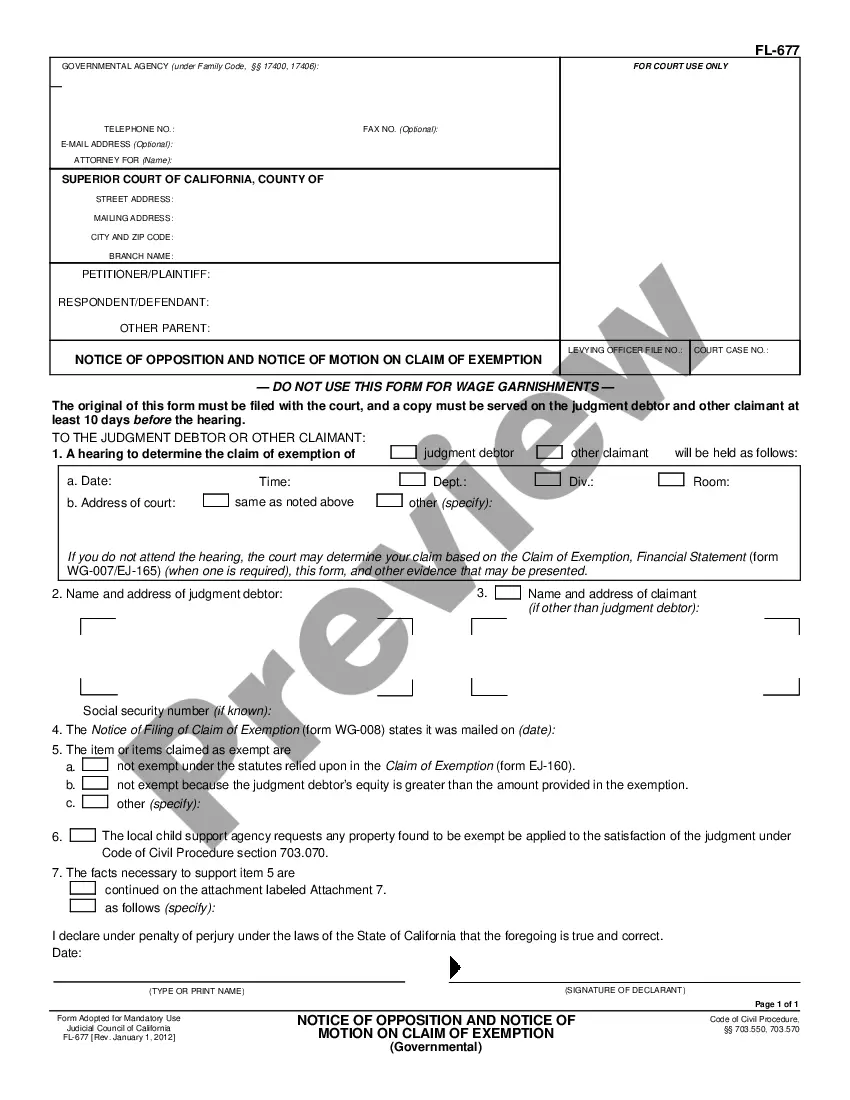

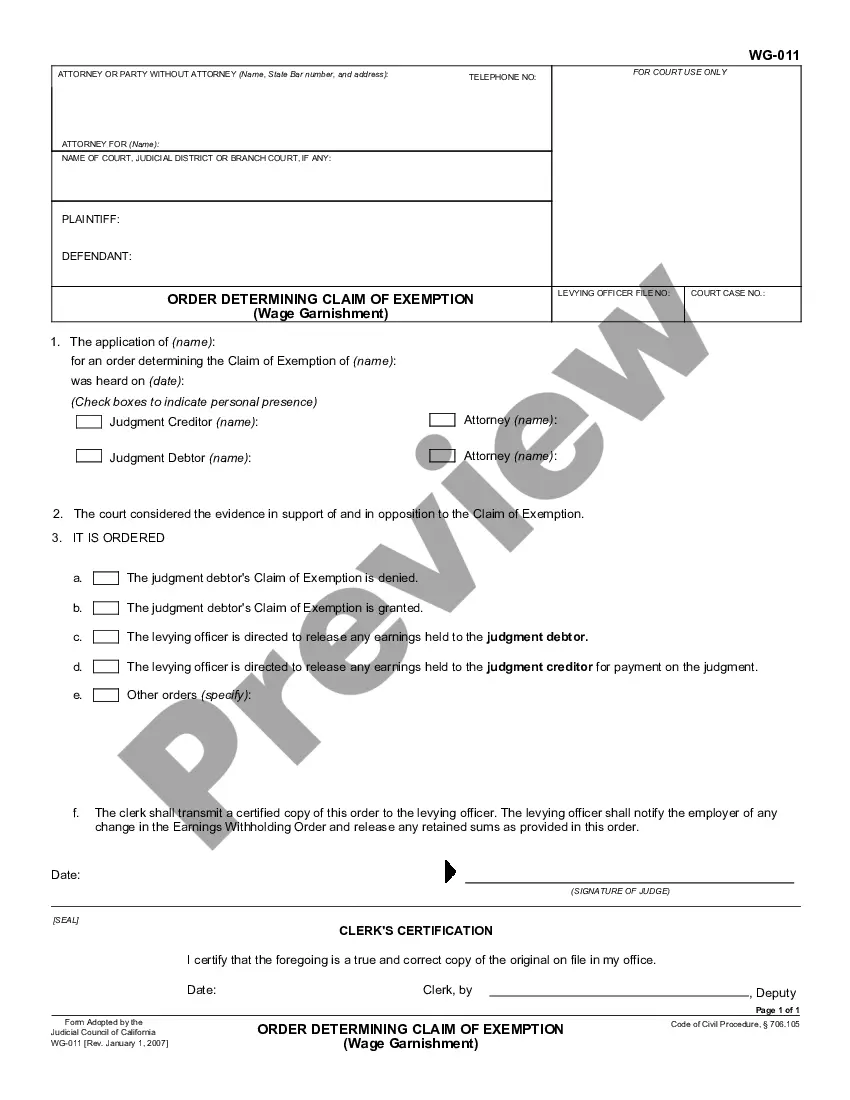

This is an official California Judicial Council family law form, which may be used in domestic litigation in California. Enter the information as indicated on the form and file with the court as appropriate.

Modesto California Order Determining Claim of Exemption or Third-Party Claim Governmental

Description

How to fill out California Order Determining Claim Of Exemption Or Third-Party Claim Governmental?

We consistently strive to lessen or evade legal repercussions when navigating intricate legal or financial situations.

To achieve this, we enlist legal assistance services that, generally speaking, can be quite costly.

Nonetheless, not all legal issues are equally intricate.

The majority can be handled independently.

Leverage US Legal Forms whenever you need to locate and download the Modesto California Order Determining Claim of Exemption or Third-Party Claim Governmental or any other form swiftly and securely.

- US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions.

- Our collection empowers you to manage your affairs without the need for an attorney's expertise.

- We offer access to legal form templates that are not always widely accessible.

- Our templates are tailored to specific states and regions, which greatly eases the search process.

Form popularity

FAQ

In California, funds that are exempt from garnishment include social security benefits, unemployment benefits, and disability payments. Additionally, certain retirement accounts and pensions are also protected under state laws. Filing a Modesto California Order Determining Claim of Exemption or Third-Party Claim Governmental can further assist in safeguarding these funds. It's important to familiarize yourself with these exemptions to ensure you have access to necessary resources.

In California, certain assets are exempt from judgment collection, allowing individuals to safeguard their essential property. This includes personal property such as household goods, vehicles of limited value, and retirement accounts. Utilizing a Modesto California Order Determining Claim of Exemption or Third-Party Claim Governmental can help clarify which assets you can protect. Knowing these exemptions is crucial for maintaining financial stability.

The new garnishment law in California introduces stricter guidelines that affect how creditors can pursue wage garnishments. This includes regulations surrounding the Modesto California Order Determining Claim of Exemption or Third-Party Claim Governmental, which allow debtors to protect a portion of their income. The legislation emphasizes transparency and informs consumers about their rights. Being aware of these changes can help you better manage your finances.

An exempt bank account in California is an account that holds funds protected from creditors through a Modesto California Order Determining Claim of Exemption or Third-Party Claim Governmental. Generally, these accounts may include social security benefits, disability payments, and certain retirement funds. Understanding exemptions can help ensure you keep essential funds accessible, even during financial struggles. You should regularly review your account to ensure compliance with state regulations.

To avoid wage garnishment in California, consider filing a Modesto California Order Determining Claim of Exemption or Third-Party Claim Governmental. You can proactively negotiate payment plans with creditors or seek financial counseling. Additionally, understanding your rights under California law can help you prevent unwarranted garnishments. Always keep your financial documents organized to support your claim.

Filing exempt in California involves submitting a formal request to the appropriate court or government agency. You will need to prepare your exemption documentation carefully, ensuring it meets legal requirements. Utilizing platforms like USLegalForms can greatly simplify this process by providing templates and detailed instructions about the Modesto California Order Determining Claim of Exemption or Third-Party Claim Governmental.

To apply for tax exemption in California, you must complete an application form specific to the type of exemption you're seeking. You should gather supporting documents that substantiate your claim and submit everything to the appropriate tax authority. The USLegalForms platform can help streamline this process along with providing resources about the Modesto California Order Determining Claim of Exemption or Third-Party Claim Governmental.

The duration for processing an exemption in California can vary significantly based on your specific situation and the court's workload. Generally, once your Claim of Exemption is filed, the court may take several weeks to review your documents and issue a determination. It's essential to check with the court for their timelines related to the Modesto California Order Determining Claim of Exemption or Third-Party Claim Governmental.

To file a claim of exemption in California, you need to prepare a Claim of Exemption form. This form should clearly state the reason for your exemption, along with any necessary supporting documentation. After filling it out, you must file it with the court and serve copies to the relevant parties. For assistance, consider using the USLegalForms platform, which provides guidance on the Modesto California Order Determining Claim of Exemption or Third-Party Claim Governmental.

To file for a homeowners exemption in California, begin by collecting necessary documents that establish your ownership and residency. You can complete the application form through your county assessor's office or visit US Legal Forms for a streamlined process. Once you fill out the application, submit it to your local assessor before the deadline for the exemption to take effect. Doing so can enhance your eligibility for benefits related to the Modesto California Order Determining Claim of Exemption or Third-Party Claim Governmental.