This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

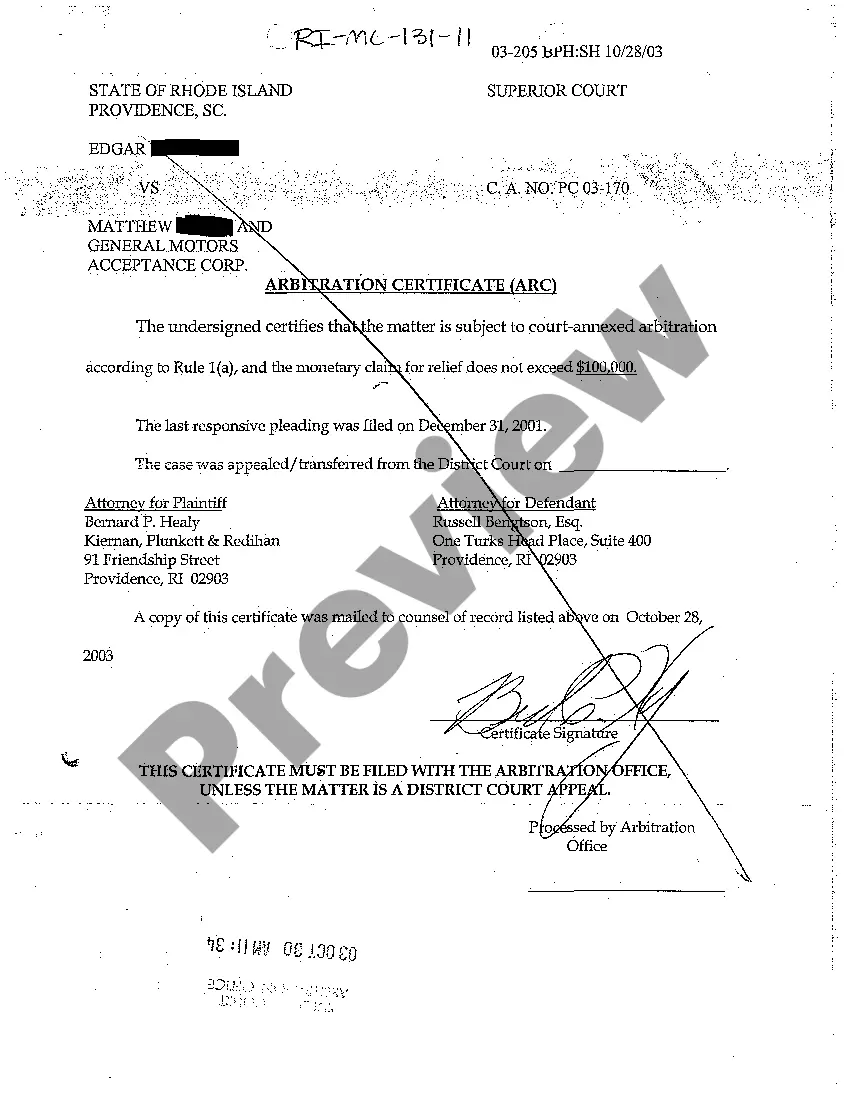

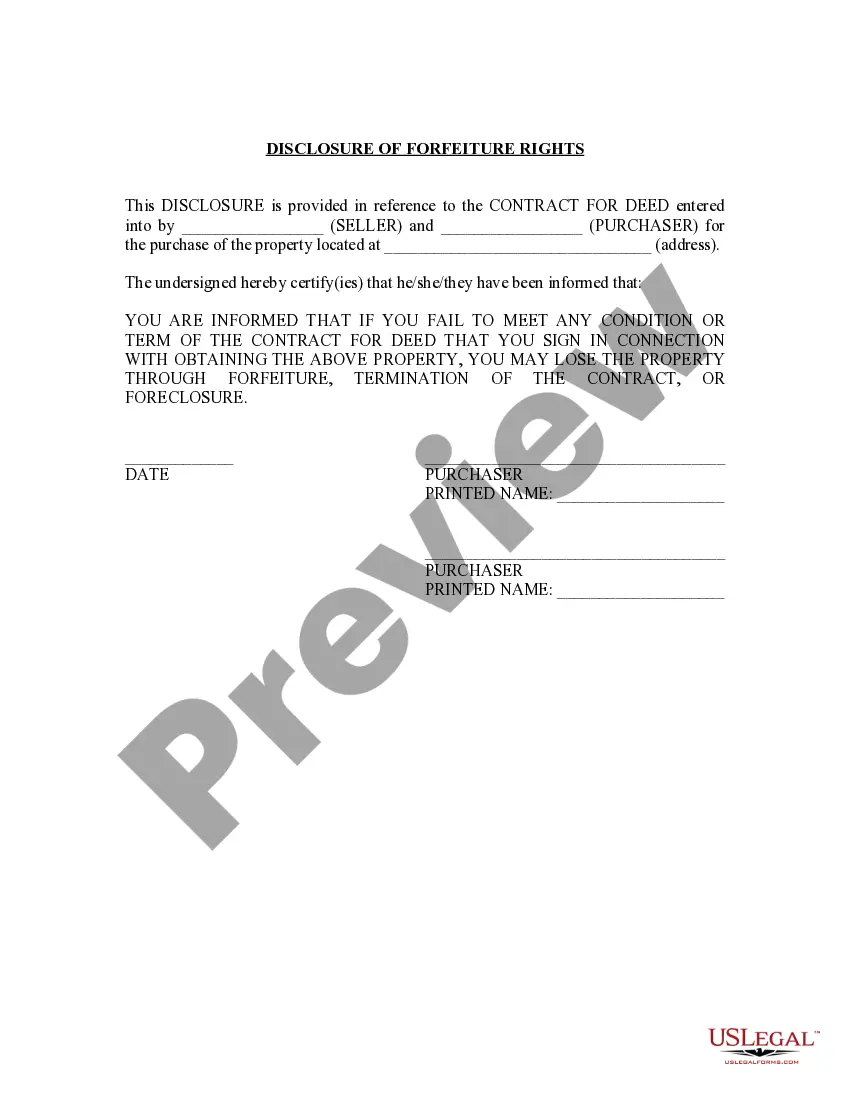

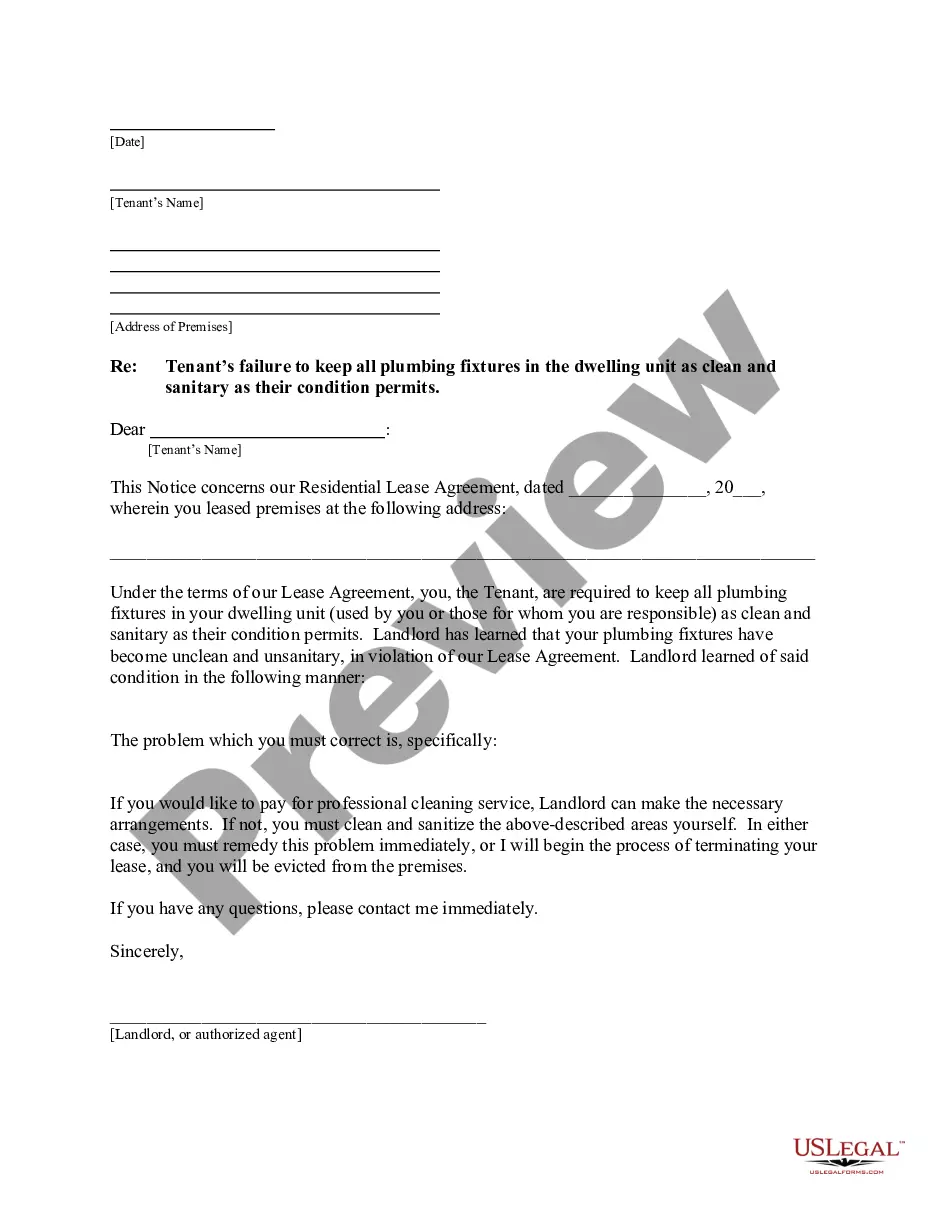

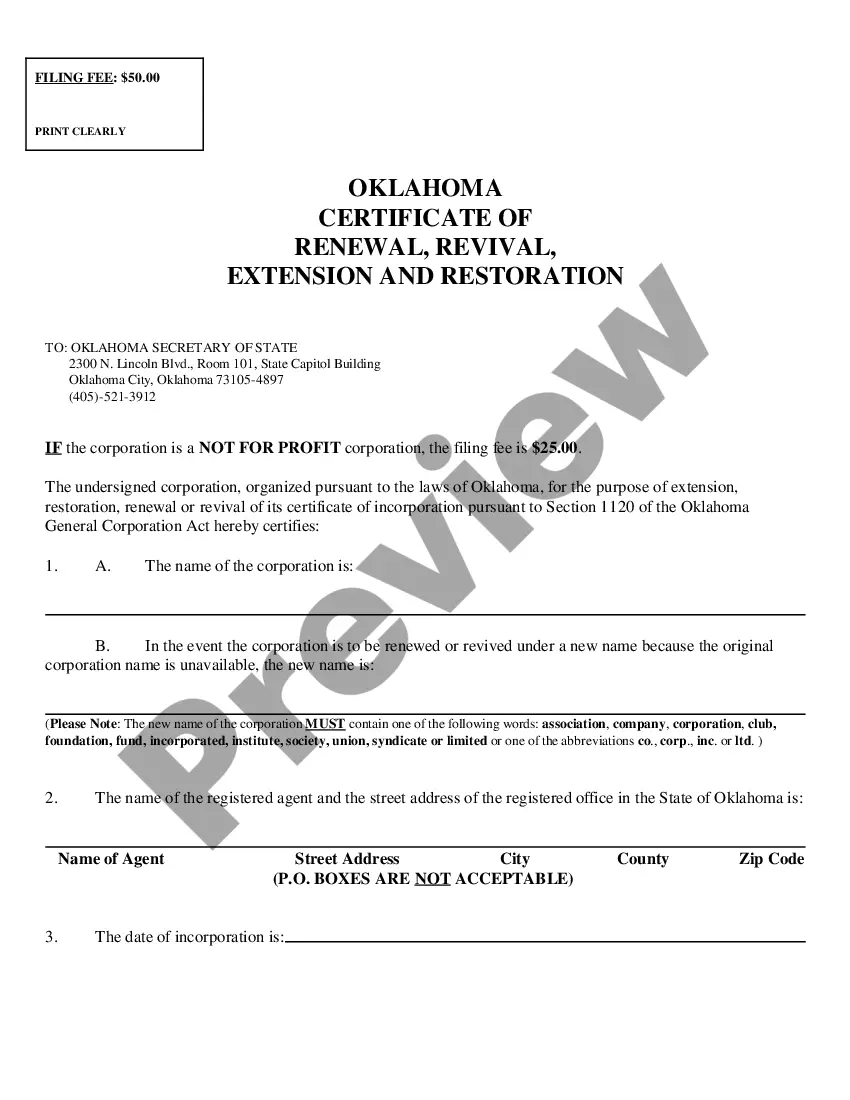

Vallejo California Living Trust for Husband and Wife with One Child

Description

How to fill out California Living Trust For Husband And Wife With One Child?

If you are in search of a pertinent document, it’s unfeasible to locate a more user-friendly platform than the US Legal Forms site – likely the most extensive online collections.

Here you can obtain a vast array of form examples for business and personal uses organized by categories and locations, or keywords.

With our superior search capability, locating the most current Vallejo California Living Trust for Husband and Wife with One Child is as straightforward as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finish the registration process.

Obtain the template. Specify the format and save it on your device. Make alterations. Complete, edit, print, and sign the acquired Vallejo California Living Trust for Husband and Wife with One Child.

- Moreover, the accuracy of each document is validated by a group of expert attorneys who routinely review the templates on our platform and refresh them according to the latest state and county requirements.

- If you are already familiar with our system and possess an account, all you need to obtain the Vallejo California Living Trust for Husband and Wife with One Child is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the steps below.

- Ensure you have accessed the sample you desire. Review its details and utilize the Preview feature to examine its content. If it doesn’t fulfill your requirements, use the Search option at the top of the screen to find the necessary document.

- Verify your choice. Click on the Buy now button. After that, select your preferred subscription plan and provide details to register an account.

Form popularity

FAQ

Creating a Vallejo California Living Trust for Husband and Wife with One Child without a lawyer is possible using online resources. You can find templates and guidance on reputable platforms like US Legal Forms that offer step-by-step instructions. While it's essential to ensure the trust complies with California laws, this approach can save costs while providing the necessary security for your family. Make sure to review and verify all information thoroughly.

If your parents are considering a Vallejo California Living Trust for Husband and Wife with One Child, it may be a wise move for estate planning. A trust can help ensure a smoother transfer of assets, especially if they wish to avoid probate. Moreover, it can offer peace of mind knowing their assets are protected for you and any future heirs. Encourage them to consult with a professional to tailor the trust to their needs.

A potential downfall of a Vallejo California Living Trust for Husband and Wife with One Child is the misconception of simplicity. While trusts simplify estate management, they also require ongoing administration and oversight. You must continually update the trust to reflect changes in your life, such as the birth of another child or changes in financial circumstances. Neglecting to do so could lead to unintended consequences.

While a Vallejo California Living Trust for Husband and Wife with One Child provides numerous benefits, it does have some downsides. One potential drawback is that, unlike a will, a trust does not cover all assets unless specifically included. Moreover, there may be upfront costs associated with creating the trust, which can deter some families. However, using uslegalforms can simplify the process and clarify what should be included, making it easier for you to navigate any complexities.

One significant mistake parents often make when establishing a Vallejo California Living Trust for Husband and Wife with One Child is failing to specify their intentions clearly. Parents may leave vague instructions or assume their wishes are understood, which can lead to disputes later. To avoid this, be precise in outlining how assets should be managed and distributed. Additionally, it's wise to involve a trusted professional, such as those offered by uslegalforms, to ensure your trust reflects your true intentions.

Yes, you can write your own living trust in California, but it requires careful attention to detail to ensure it meets legal requirements. Consider using templates or services from platforms like uslegalforms for guidance. A properly created Vallejo California Living Trust for Husband and Wife with One Child will help protect your assets and provide clear instructions for distribution. However, seeking professional advice may help avoid mistakes and ensure your wishes are fully executed.

A husband and wife can benefit from having a single living trust, especially when it comes to managing assets for a Vallejo California Living Trust for Husband and Wife with One Child. Consolidating assets into one trust can simplify the process of distribution upon passing. However, individual trusts may be beneficial in certain situations, such as protecting separate property or catering to specific estate planning goals. It's wise to consult with a legal expert to determine the best approach for your unique circumstances.