This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Palmdale California Living Trust for Husband and Wife with One Child

Description

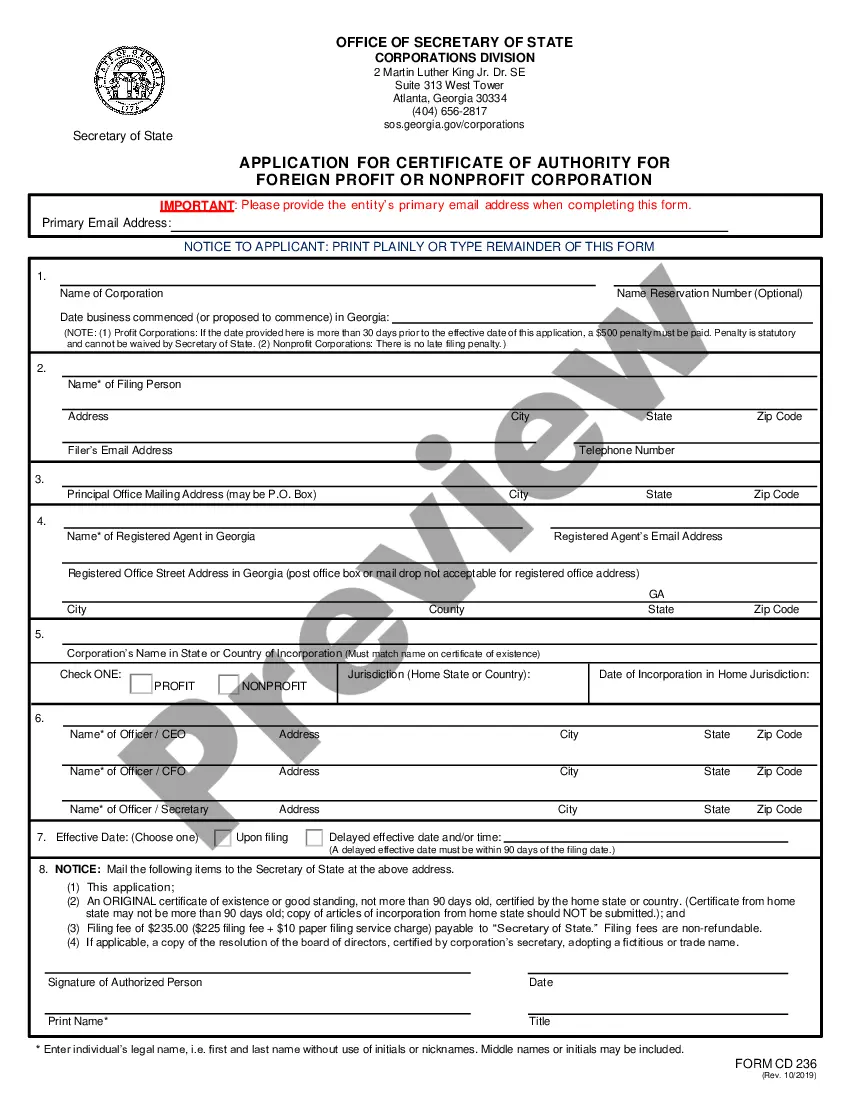

How to fill out California Living Trust For Husband And Wife With One Child?

We consistently endeavor to minimize or avert legal complications when handling intricate legal or financial issues.

To achieve this, we seek attorney services that are typically very costly.

However, not every legal issue is equally intricate; many can be managed independently.

US Legal Forms is an online compilation of current DIY legal forms encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button next to it. If you have misplaced the document, you can always retrieve it again from within the My documents tab.

- Our library empowers you to manage your issues independently without seeking legal advice.

- We offer access to legal document templates that are not always readily accessible.

- Our templates are specific to states and localities, significantly simplifying the search process.

- Utilize US Legal Forms whenever you need to locate and download the Palmdale California Living Trust for Husband and Wife with One Child or any other document swiftly and securely.

Form popularity

FAQ

While trust funds offer several benefits, there can be drawbacks as well. For instance, the process of setting up a Palmdale California Living Trust for Husband and Wife with One Child may come with fees and administrative responsibilities. Furthermore, beneficiaries may face restrictions that complicate access to their inheritance, which could lead to dissatisfaction.

If your parents want to simplify asset transfer and avoid probate, a trust could be a solid choice. A Palmdale California Living Trust for Husband and Wife with One Child can help protect their assets and provide clarity for future generations. Consulting with a professional can guide them toward the best decision for their specific situation.

Setting up a trust, such as a Palmdale California Living Trust for Husband and Wife with One Child, can present pitfalls like underfunding or improper structure. Trusts that fail to include all intended assets may not provide the intended benefits. Additionally, misunderstanding tax implications can lead to unexpected costs down the line.

Yes, you can write your own living trust in California. However, it is advisable to use a professional service or platform, like uslegalforms, to ensure your Palmdale California Living Trust for Husband and Wife with One Child complies with state laws. Complications can arise from minor errors, so expert guidance can save you future headaches.

One downside of a family trust, such as a Palmdale California Living Trust for Husband and Wife with One Child, is that it may involve complexities in management. Trusts require ongoing maintenance, including accounting and record-keeping. Additionally, if not properly funded, your assets can remain outside the trust, defeating its purpose.

Yes, a married couple should consider having a living trust for several reasons. It can help streamline the asset transfer process and offer peace of mind knowing that their child's future is secure. A well-structured Palmdale California Living Trust for Husband and Wife with One Child can make these transitions smoother and less complicated in times of grief.

Suze Orman emphasizes the importance of having a living trust to manage and protect assets effectively. She believes that living trusts provide flexibility and avoid the pitfalls of probate, which can be time-consuming and costly. A Palmdale California Living Trust for Husband and Wife with One Child fits well into her advice, ensuring that families can securely pass on assets.

Having separate living trusts can be beneficial for a husband and wife. It allows both partners to manage their assets according to their unique preferences and ensures that their child’s inheritance is clear and direct. This approach can be highly effective through a Palmdale California Living Trust for Husband and Wife with One Child.

Joint trusts can create issues when one spouse passes away, as they can turn an estate into a complex situation during probate. This often means delays and additional costs. Additionally, a Palmdale California Living Trust for Husband and Wife with One Child can maintain clarity and ease of management for the surviving spouse.

Husbands and wives might choose separate trusts for various reasons. Individual trusts can offer more control over assets and ensure that each partner's wishes are honored distinctly. Furthermore, a Palmdale California Living Trust for Husband and Wife with One Child can simplify the distribution of assets, especially in complex family situations.