This Living Trust for Individual as Single, Divorced or Widow(er) with No Children form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Oceanside California Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children

Description

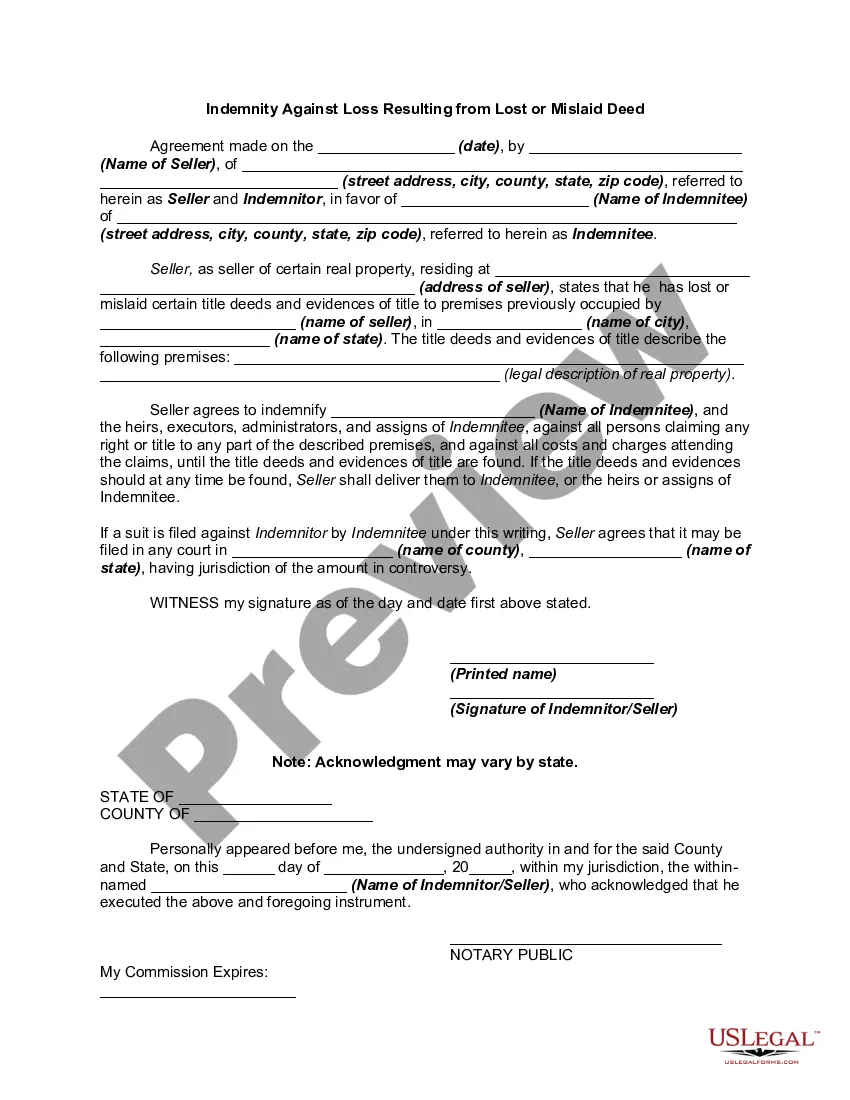

How to fill out California Living Trust For Individual As Single, Divorced Or Widow (or Widower) With No Children?

If you are in need of a legitimate form template, it’s hard to find a superior platform compared to the US Legal Forms site – arguably the most extensive online collections.

With this collection, you can discover a vast array of templates for business and personal use, categorized by types and regions, or keywords.

Utilizing our enhanced search feature, acquiring the latest Oceanside California Living Trust for Individual as Single, Divorced, or Widow (or Widower) without Children is as simple as 1-2-3.

Obtain the form. Specify the format and download it to your device.

Edit the document. Fill in, amend, print, and sign the acquired Oceanside California Living Trust for Individual as Single, Divorced, or Widow (or Widower) without Children.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Oceanside California Living Trust for Individual as Single, Divorced, or Widow (or Widower) without Children is to Log In to your profile and select the Download option.

- If you are utilizing US Legal Forms for the first time, just adhere to the guidelines outlined below.

- Ensure you have located the template you need. Review its details and use the Preview function to view its contents. If it doesn’t suit your needs, use the Search option at the top of the page to find the required file.

- Confirm your selection. Click the Buy now button. Then, select your desired pricing plan and enter information to register for an account.

- Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

Yes, you can write your own living trust in California, including an Oceanside California Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children. However, drafting a living trust requires attention to detail to ensure it complies with California laws. It is advisable to consider using a reliable platform like uslegalforms, which offers templates and guidance to simplify the process. This way, you can create a legally sound trust that reflects your wishes and provides peace of mind.

A properly structured Oceanside California Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children can provide some protection for assets during a divorce in California. However, its effectiveness depends on several factors, including when the trust was established and how assets were funded into it. It's essential to have clarity on how your trust interacts with community property laws. Uslegalforms offers resources that can help you understand asset protection strategies in California divorce cases.

If you get divorced, your Oceanside California Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children may need revisions to reflect your new circumstances. Generally, a divorce can invalidate certain provisions of a living trust if they were created during the marriage. It’s important to review your trust documents with an attorney to ensure that they align with your wishes post-divorce. Consulting platforms like uslegalforms can guide you in updating your trust for your new situation.

One negative aspect of an Oceanside California Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children is the potential costs involved in setting it up and maintaining it. While a trust simplifies asset management, initial legal fees and ongoing administrative tasks can add up over time. Moreover, if not properly structured, a trust may not protect all assets as intended. It's crucial to seek professional guidance to ensure it meets your needs.

When considering an Oceanside California Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children, one major mistake is neglecting to clearly define their intentions around the trust. Parents often fail to communicate their decisions and the reasons behind them to beneficiaries. This lack of transparency can lead to confusion and disputes in the future. Proper guidance, such as that offered by UsLegalForms, can help avoid this pitfall.

A single person may benefit from an Oceanside California Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children to manage their assets efficiently. This trust allows for a smooth transfer of property upon death, avoiding the lengthy probate process. Additionally, it provides peace of mind, ensuring that specific wishes regarding asset distribution are honored. It's a proactive approach to secure one's interests and simplify future decisions.

For a single person, a revocable living trust is often the best option, as it allows for the management of assets during life and provides clear instructions for distribution after death. This trust type offers flexibility and avoids the probating process. Setting up an Oceanside California Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children ensures your individual circumstances are taken into account, giving you peace of mind.

The best type of trust often depends on individual circumstances and goals. For those who are single, divorced, or widowed with no children, a revocable living trust is usually a great choice, as it provides flexibility and control over your assets. An Oceanside California Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children can offer you a solid framework for effective estate planning.

There is no one-size-fits-all answer to the best trust for avoiding taxes, as it largely depends on your specific financial situation. However, certain trusts, such as irrevocable trusts, can help minimize tax liabilities by removing assets from your taxable estate. It is wise to consult with a financial advisor when considering an Oceanside California Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children to align your estate plan with your tax strategies.

To create a living trust in California, you will typically need documentation outlining your assets, including property deeds, bank statements, and any investment accounts. Additionally, a trust document must be drafted to specify how you want your assets managed and distributed. Using a service like uslegalforms can simplify the process, particularly for setting up an Oceanside California Living Trust for Individual as Single, Divorced or Widow (or Widower) with No Children.