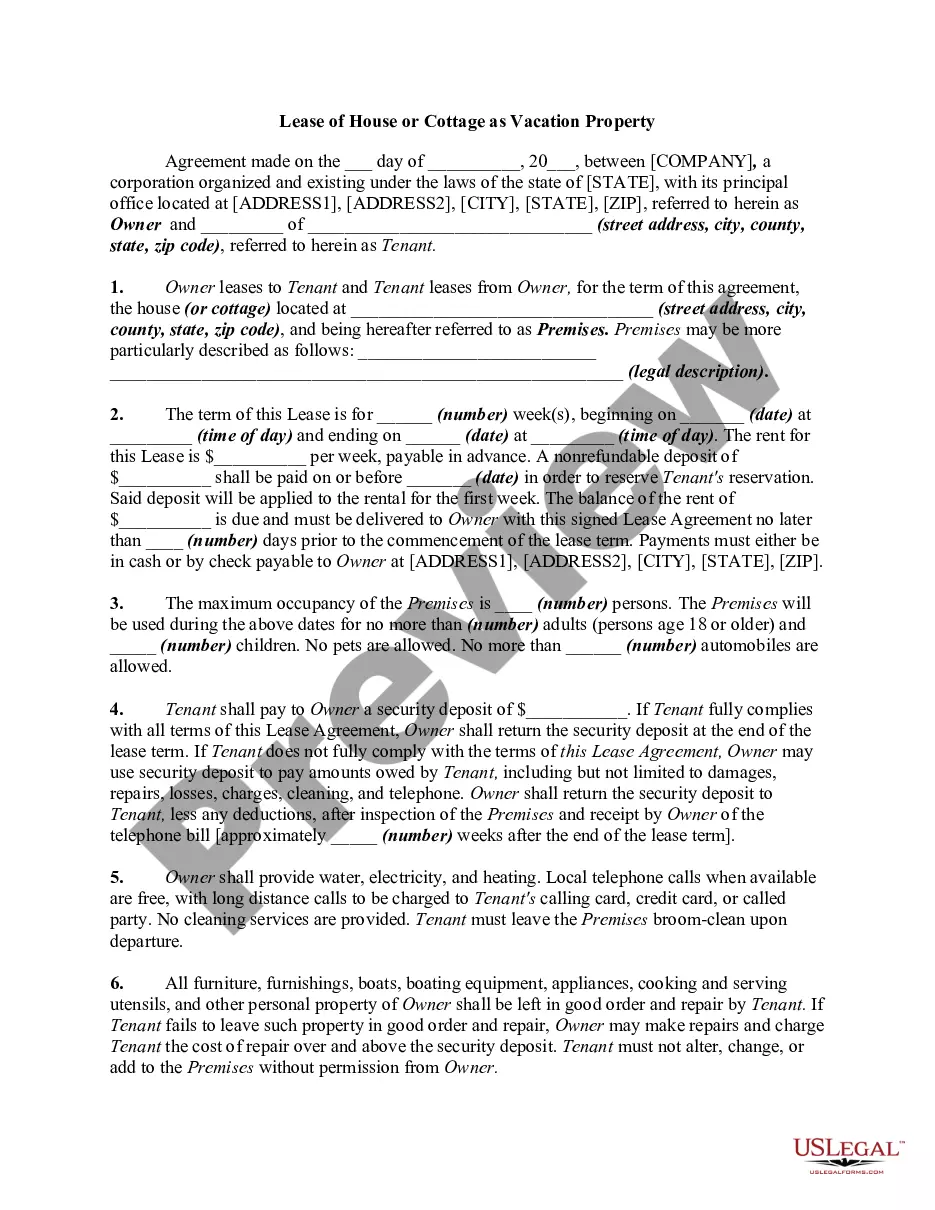

This Living Trust form is a living trust prepared for your State. It is for a Husband and Wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Palmdale California Living Trust for Husband and Wife with No Children

Description

How to fill out California Living Trust For Husband And Wife With No Children?

Are you in search of a reliable and budget-friendly legal documents provider to acquire the Palmdale California Living Trust for Spouses with No Offspring? US Legal Forms is your prime option.

Whether you need a basic agreement to establish guidelines for living with your significant other or a collection of documents to facilitate your separation or divorce through the judicial system, we have you covered. Our platform offers over 85,000 current legal document templates for personal and corporate purposes. All templates available to you are not generic but tailored based on the specifications of particular states and counties.

To obtain the document, you must Log In, find the desired form, and click the Download button next to it. Please be aware that you can download your previously acquired form templates at any time from the My documents section.

Is it your first time visiting our site? No problem. You can easily create an account, but first, ensure that you do the following.

Now you can proceed to register your account. Then choose a subscription plan and move forward to payment. Once payment is completed, download the Palmdale California Living Trust for Spouses with No Offspring in any available file format. You can return to the site whenever needed and redownload the document at no additional cost.

Locating current legal documents has never been simpler. Try US Legal Forms today, and put an end to wasting hours researching legal paperwork online for good.

- Verify that the Palmdale California Living Trust for Spouses with No Offspring meets the regulations of your state and locality.

- Review the form's specifications (if available) to understand who and what the document suits.

- Restart the search if the form is not appropriate for your legal situation.

Form popularity

FAQ

Husband and wife may choose separate trusts to address personal financial goals, differing asset categories, or specific beneficiary wishes. This approach can help maintain individuality while still protecting each other's interests. The Palmdale California Living Trust for Husband and Wife with No Children allows for this flexibility, ensuring both partners can create a plan that aligns with their values and circumstances.

Yes, a living trust can benefit married couples by simplifying the transfer of assets upon death and avoiding probate. A Palmdale California Living Trust for Husband and Wife with No Children offers a structured way to manage your estate, ensuring that your wishes are met without unnecessary legal hurdles. This trust provides peace of mind, knowing your loved ones are taken care of.

Suze Orman emphasizes the importance of trust as a means of protecting assets and ensuring a secure future for families. She often suggests that couples, including those with no children, should consider a living trust, such as the Palmdale California Living Trust for Husband and Wife with No Children. This type of trust can help streamline the estate process and minimize potential conflicts for surviving spouses.

Having separate living trusts can be beneficial for couples, particularly if they have different financial situations or wishes for asset distribution. A Palmdale California Living Trust for Husband and Wife with No Children allows each partner to maintain control over their assets while still providing security for the other. This setup can simplify matters in the long run, especially if one spouse passes away.

Joint trusts can create complications for married couples, especially when one spouse passes away. They may lead to unintended tax consequences and limit flexibility for the surviving partner. In Palmdale, California, a Palmdale California Living Trust for Husband and Wife with No Children can help avoid these issues by allowing for individual control and tailored asset distribution.

While a Palmdale California Living Trust for Husband and Wife with No Children can provide benefits, it also has some disadvantages. One of the primary drawbacks is that creating a trust involves upfront costs for document preparation and potentially for legal fees. Additionally, ongoing management of the trust can be time-consuming and may require more paperwork than a simple will. Lastly, if you fail to fund the trust properly, your assets may still go through probate.

To create a Palmdale California Living Trust for Husband and Wife with No Children, you need several key documents. First, prepare a trust agreement that outlines how the trust operates and what assets it holds. You will also need titles for any property being transferred into the trust, a list of assets, and a death certificate in case of a prior spouse. Additionally, having identification documents for both spouses can help clarify ownership.

Yes, a married couple with no children should consider establishing a trust. A Palmdale California Living Trust for Husband and Wife with No Children helps in managing assets, avoids probate, and maintains privacy. Additionally, it provides a clear plan for asset distribution, ensuring your intentions are respected even if circumstances change.

Yes, you can create your own living trust in California. However, it is crucial to understand the specific legal requirements to ensure its validity. Using tools from platforms like US Legal Forms can guide you through the process of establishing a Palmdale California Living Trust for Husband and Wife with No Children accurately and effectively.

Yes, having a will is still important for a married couple without children. A will ensures that your wishes are honored regarding your assets and provides clarity on how you want your property distributed. Additionally, a will can complement a Palmdale California Living Trust for Husband and Wife with No Children by outlining any assets not included in the trust.