The dissolution of a LLC package contains all forms to dissolve a LLC or PLLC in California, step by step instructions, addresses, transmittal letters, and other information.

Inglewood California Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out California Dissolution Package To Dissolve Limited Liability Company LLC?

Finding confirmed templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms collection.

It’s an online repository of over 85,000 legal forms catering to both personal and professional requirements and various real-life situations.

All the documents are accurately organized by usage area and jurisdiction, making it as quick and simple as ABC to find the Inglewood California Dissolution Package for Dissolving Limited Liability Company LLC.

Maintaining documentation organized and compliant with legal standards holds great significance. Take advantage of the US Legal Forms library to consistently have essential document templates for any requirements right at your fingertips!

- Check the Preview mode and form description.

- Ensure you’ve chosen the right one that satisfies your needs and fully aligns with your local jurisdiction criteria.

- Search for another template, if necessary.

- Once you notice any discrepancies, use the Search tab above to locate the correct one.

- If it meets your requirements, proceed to the following step.

Form popularity

FAQ

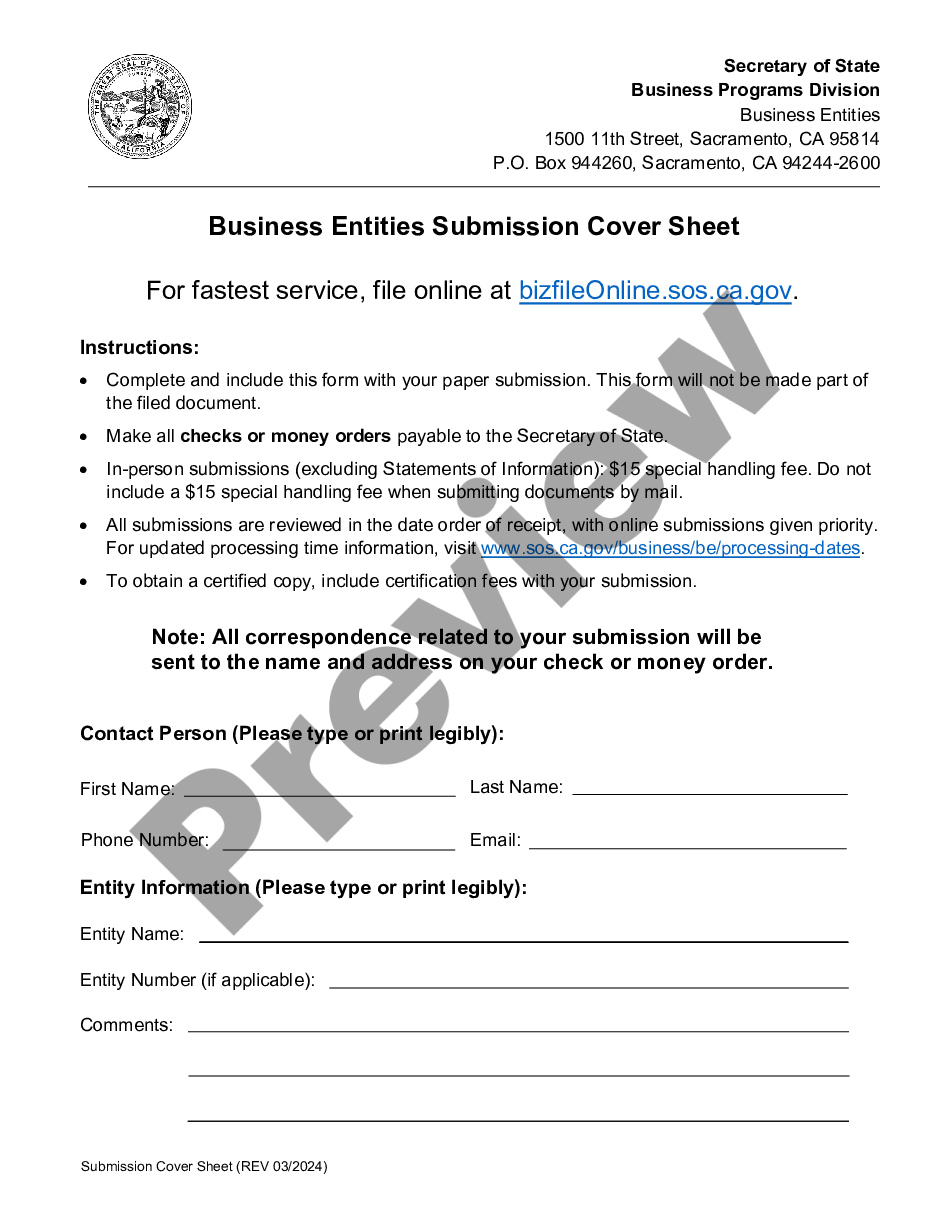

To mail the California form for dissolution of a Limited Liability Company (LLC), known as the Dissolution Certificate, you should send it to the California Secretary of State. Specifically, direct your documents to the Business Entities section. If you're utilizing the Inglewood California Dissolution Package to Dissolve Limited Liability Company LLC, remember to include a cover letter if necessary. Always check for the most current mailing address on the official website, as it can change.

Dissolving a limited liability company in California requires several key steps. First, review the operating agreement and obtain member approval for dissolution. Next, complete the necessary paperwork from the Inglewood California Dissolution Package to Dissolve Limited Liability Company LLC and submit it to the California Secretary of State. Finally, settle any outstanding debts and notify creditors to finalize the dissolution process.

To properly mail your LLC cancellation in California, you should address your documents to the California Secretary of State. It is important to ensure you include all necessary paperwork, as outlined in the Inglewood California Dissolution Package to Dissolve Limited Liability Company LLC. Once completed, send your documents to the designated office in Sacramento. This ensures that your LLC is officially dissolved in compliance with state requirements.

Dissolving an LLC means officially ending its existence while allowing time to settle debts and obligations. In contrast, terminating an LLC refers to the completion of all necessary steps to legally cease business operations. When you choose the Inglewood California Dissolution Package to Dissolve Limited Liability Company LLC, you ensure that your LLC's dissolution process follows all legal requirements, preventing potential liabilities. This comprehensive package streamlines the process, helping you navigate through both dissolution and termination efficiently.

By dissolving an LLC properly, it means that the LLC is no longer a legal business entity so you won't be expected to pay any fees or taxes, or file any more documents. Despite no longer operating, it is possible for members to create a new LLC and run it in the same way as the dissolved company.

How long does it take to dissolve a California business? The California Secretary of State's processing times vary based on traffic, but it will probably take their office around 3-4 weeks to process your dissolution.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC.