This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

San Diego California Non-Foreign Affidavit Under IRC 1445

Description

How to fill out California Non-Foreign Affidavit Under IRC 1445?

If you are looking for a pertinent document template, it’s challenging to select a more suitable platform than the US Legal Forms website – one of the largest online repositories.

With this repository, you can access a vast array of form samples for business and individual purposes categorized by types and regions, or keywords.

With the enhanced search feature, locating the most current San Diego California Non-Foreign Affidavit Under IRC 1445 is as simple as 1-2-3.

Complete the transaction. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the document. Choose the file format and save it on your device.

- Additionally, the validity of each document is validated by a team of experienced attorneys who routinely examine the templates on our site and refresh them in line with the latest state and county requirements.

- If you are already familiar with our system and possess an account, all you need to obtain the San Diego California Non-Foreign Affidavit Under IRC 1445 is to Log In to your account and select the Download option.

- If you are utilizing US Legal Forms for the first time, just adhere to the instructions below.

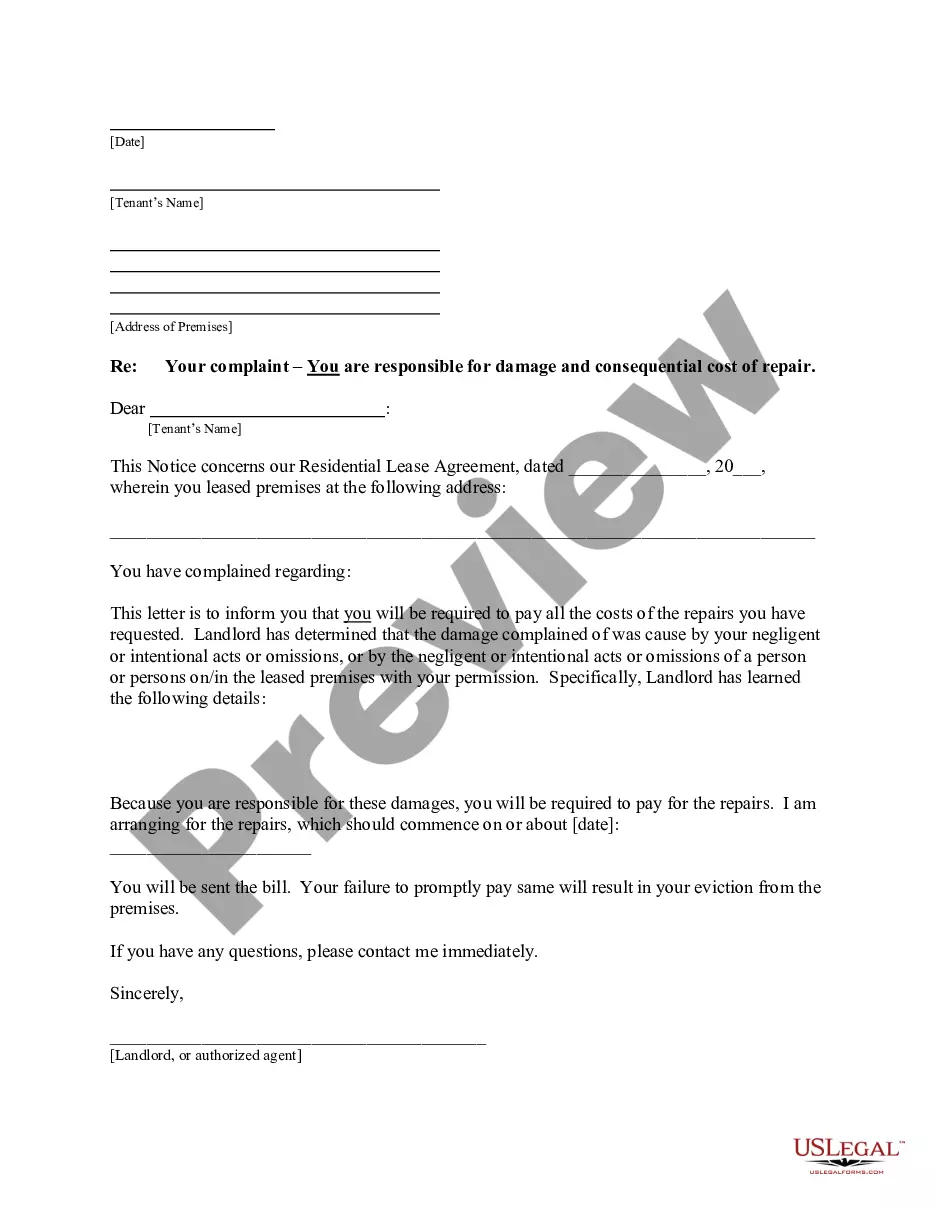

- Ensure you have located the document you need. Review its description and use the Preview feature to examine its contents. If it doesn’t satisfy your requirements, make use of the Search option at the top of the page to find the necessary document.

- Confirm your selection. Choose the Buy now option. Afterward, select your desired subscription plan and provide details to sign up for an account.

Form popularity

FAQ

Section 1445 of the Internal Revenue Code outlines the requirements for withholding tax on the sale of real estate by foreign persons. Pursuant to the San Diego California Non-Foreign Affidavit Under IRC 1445, this section mandates that buyers withhold tax if the seller is foreign. Understanding section 1445 helps ensure compliance with federal tax laws and protects buyers from future legal issues. Navigating these regulations can be simplified with the right documentation.

To mail a FIRPTA certificate in connection with a San Diego California Non-Foreign Affidavit Under IRC 1445, send it directly to the buyer or the buyer’s agent involved in the transaction. Ensure that the certificate is properly signed and dated. For added security, consider using a certified mail service, especially for valuable documents. This process helps ensure compliance and protects both parties.

affidavit, in this context, refers to a declaration or document that does not require notarization. In the realm of real estate transactions, a San Diego California NonForeign Affidavit Under IRC 1445 plays a vital role in asserting the seller's nonforeign status without the need for formal affirmation before a notary. This makes the process more accessible for parties involved in the real estate deal. Consider using US Legal Forms for an easy approach to obtaining various affidavit types.

The FIRPTA affidavit is typically provided by the seller of the property. To complete this process seamlessly, the San Diego California Non-Foreign Affidavit Under IRC 1445 is often utilized, confirming the seller’s non-foreign status. It’s crucial for property sellers to ensure they have the required documentation ready to prevent delays during the transaction. For convenience, you can access these forms through US Legal Forms to simplify your process.

To navigate around the Foreign Investment in Real Property Tax Act (FIRPTA), you can utilize the San Diego California Non-Foreign Affidavit Under IRC 1445. This affidavit serves to establish your non-foreign status, potentially exempting you from FIRPTA withholding. It’s essential to gather the right documentation and consult with a tax professional to ensure compliance with all legal requirements. Exploring platforms like US Legal Forms can ease the process by providing access to the necessary forms.

A FIRPTA statement typically includes the seller’s confirmation of non-foreign status and basic property details. For instance, the statement might declare, 'I, Seller’s Name, certify that I am not a foreign person, as defined by IRC 1445, in connection with the sale of Property Address.' This statement acts as your San Diego California Non-Foreign Affidavit Under IRC 1445. Utilizing UsLegalForms can provide templates and examples to streamline your statement creation.

The FIRPTA certificate is issued by the Internal Revenue Service (IRS) when the seller applies for withholding exemptions. This certificate is crucial as it verifies compliance with the San Diego California Non-Foreign Affidavit Under IRC 1445. Buyers often require this as proof to avoid unnecessary withholding. To navigate this process efficiently, UsLegalForms can assist you with the necessary documentation.

Typically, the seller or their real estate agent prepares the FIRPTA Affidavit. However, in some cases, an attorney or tax professional may also assist to ensure compliance with regulations. A correctly completed San Diego California Non-Foreign Affidavit Under IRC 1445 is important to prevent issues with tax withholding. You can find forms and instructions through UsLegalForms to facilitate preparation.

The FIRPTA Affidavit must be signed by the seller of the real estate property. If the seller is an entity, an authorized representative must sign on behalf of the entity. This action certifies that the seller complies with the San Diego California Non-Foreign Affidavit Under IRC 1445 requirements. Using UsLegalForms can simplify the signing process and ensure all legal standards are met.

To complete a FIRPTA Affidavit, you need to provide basic property details, seller’s identification, and a statement regarding the tax status of non-foreign ownership. This San Diego California Non-Foreign Affidavit Under IRC 1445 serves to confirm that the seller is not a foreign person, thus avoiding withholding tax. Make sure to gather these details beforehand. UsLegalForms can help guide you through the process with ease.