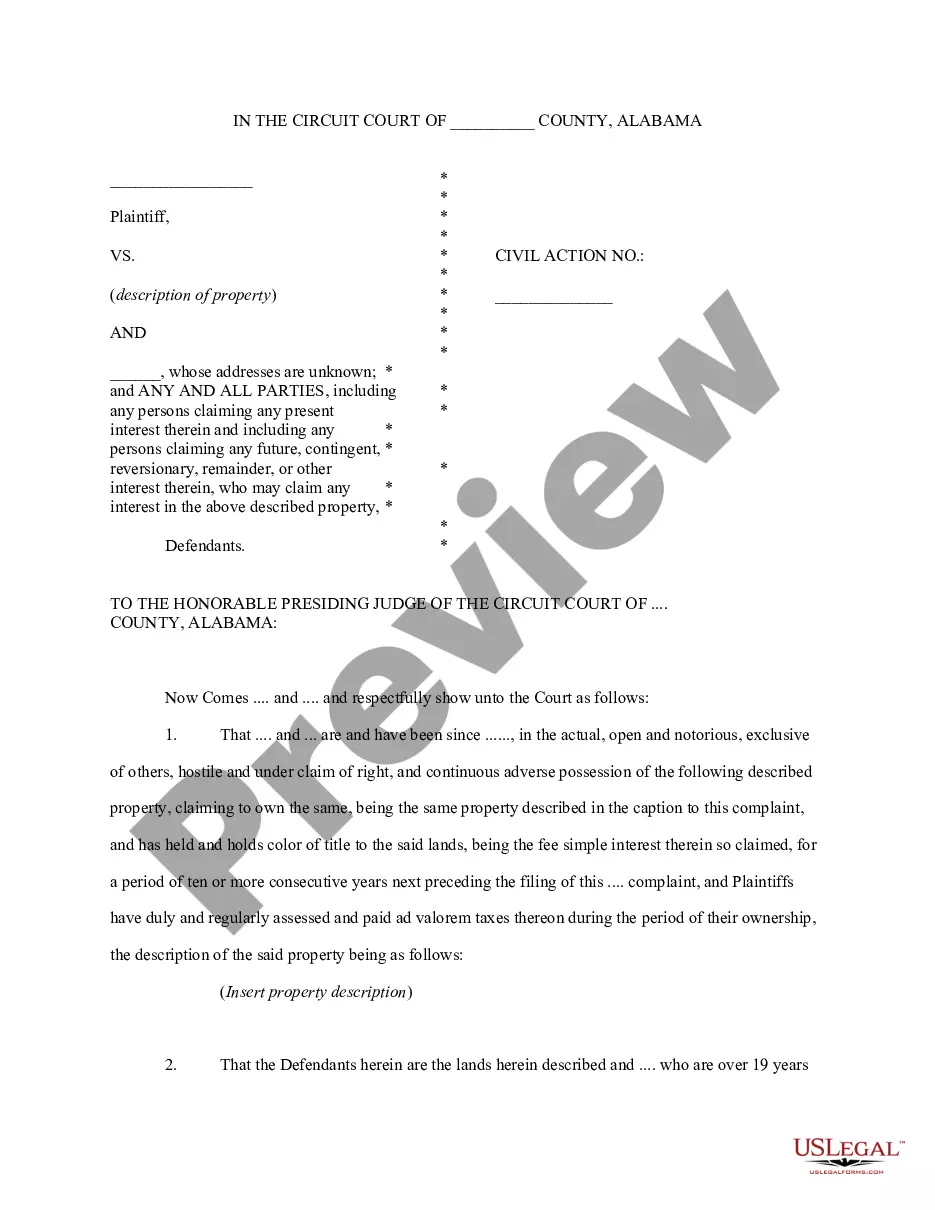

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Fontana California Non-Foreign Affidavit Under IRC 1445

Description

How to fill out California Non-Foreign Affidavit Under IRC 1445?

Regardless of social or professional standing, completing legal paperwork is a regrettable requirement in today’s business landscape.

Often, it’s nearly impossible for someone without a legal background to produce this type of documentation from scratch, largely due to the intricate vocabulary and legal subtleties they encompass.

This is where US Legal Forms proves to be beneficial.

Confirm that the template you have selected is appropriate for your jurisdiction, as the laws of one state or county may not apply to another.

Review the form and examine a brief summary (if available) of situations for which the document can be utilized.

- Our service offers a vast collection of over 85,000 ready-to-use state-specific forms suitable for almost any legal circumstance.

- US Legal Forms is additionally a valuable resource for associates or legal advisors looking to enhance their efficiency by utilizing our DIY forms.

- Whether you need the Fontana California Non-Foreign Affidavit Under IRC 1445 or any other pertinent document for your jurisdiction, US Legal Forms makes everything accessible.

- Here’s how you can obtain the Fontana California Non-Foreign Affidavit Under IRC 1445 in just minutes using our dependable service.

- If you are a returning customer, you can proceed to Log In to your account to retrieve the required form.

- If you are not acquainted with our platform, be sure to follow these steps before acquiring the Fontana California Non-Foreign Affidavit Under IRC 1445.

Form popularity

FAQ

Foreign investment in US property can significantly affect tax responsibilities during a sale. Foreign sellers need to be aware of the withholding tax obligations, which can be substantial if not properly managed. Utilizing the Fontana California Non-Foreign Affidavit Under IRC 1445 helps streamline this process and ensures proper documentation is in place, providing clarity and potentially reducing tax liabilities during the transaction.

When a foreign person sells a US property, the IRS generally withholds a portion of the sale proceeds to ensure tax compliance. This amount, typically 15%, is deducted from the gross proceeds at closing. By using the Fontana California Non-Foreign Affidavit Under IRC 1445, sellers can assert their status and possibly avoid unnecessary withholding, allowing for a smoother transaction process.

The standard withholding rate for foreign sellers of US real property is typically 15% of the gross proceeds from the sale. This withholding is mandated by the IRS to ensure that taxes are collected on any capital gains from the transaction. To simplify this process, filing a Fontana California Non-Foreign Affidavit Under IRC 1445 can help clarify that the seller is not considered a foreign person, potentially reducing or eliminating the withholding requirement.

A US real property interest refers to ownership in real estate located in the United States. This can include land, buildings, and any rights associated with the property. For foreign investors, understanding this concept is crucial, especially in relation to the Fontana California Non-Foreign Affidavit Under IRC 1445, which helps to clarify their tax obligations when selling US real estate.

Chapter 14 of the Internal Revenue Code addresses the taxation of certain transfers of property between family members. It outlines special rules related to gifting and the valuation of transferred property. Understanding these rules, especially when completing a Fontana California Non-Foreign Affidavit Under IRC 1445, can be essential in handling any tax implications effectively.

Section 1445 mandates that buyers must withhold tax when acquiring real property from foreign sellers to ensure tax compliance. This section is crucial for both parties involved in transactions. If you are dealing with a seller who is not a US citizen, the Fontana California Non-Foreign Affidavit Under IRC 1445 can assist you in fulfilling these withholding requirements.

Section 1221 defines capital assets and sets the rules concerning their taxation. Essentially, it excludes certain transactions, such as inventory or property held primarily for sale. When dealing with a Fontana California Non-Foreign Affidavit Under IRC 1445, knowing these distinctions helps you navigate your responsibilities in reporting gains and losses.

Section 32 of the Internal Revenue Code pertains to the Earned Income Tax Credit (EITC). This credit helps low to moderate-income working individuals and families to reduce their tax liability. When you apply for a Fontana California Non-Foreign Affidavit Under IRC 1445, understanding these tax credits can be beneficial for managing your overall tax responsibilities.