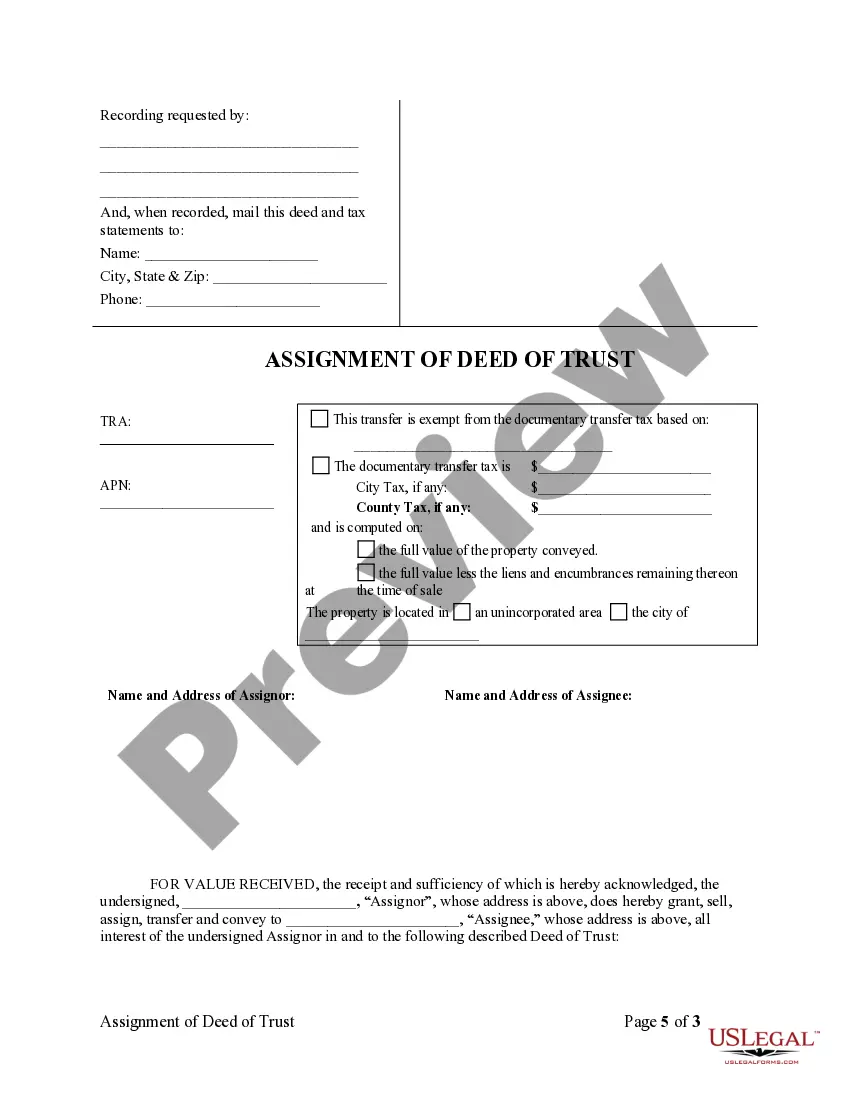

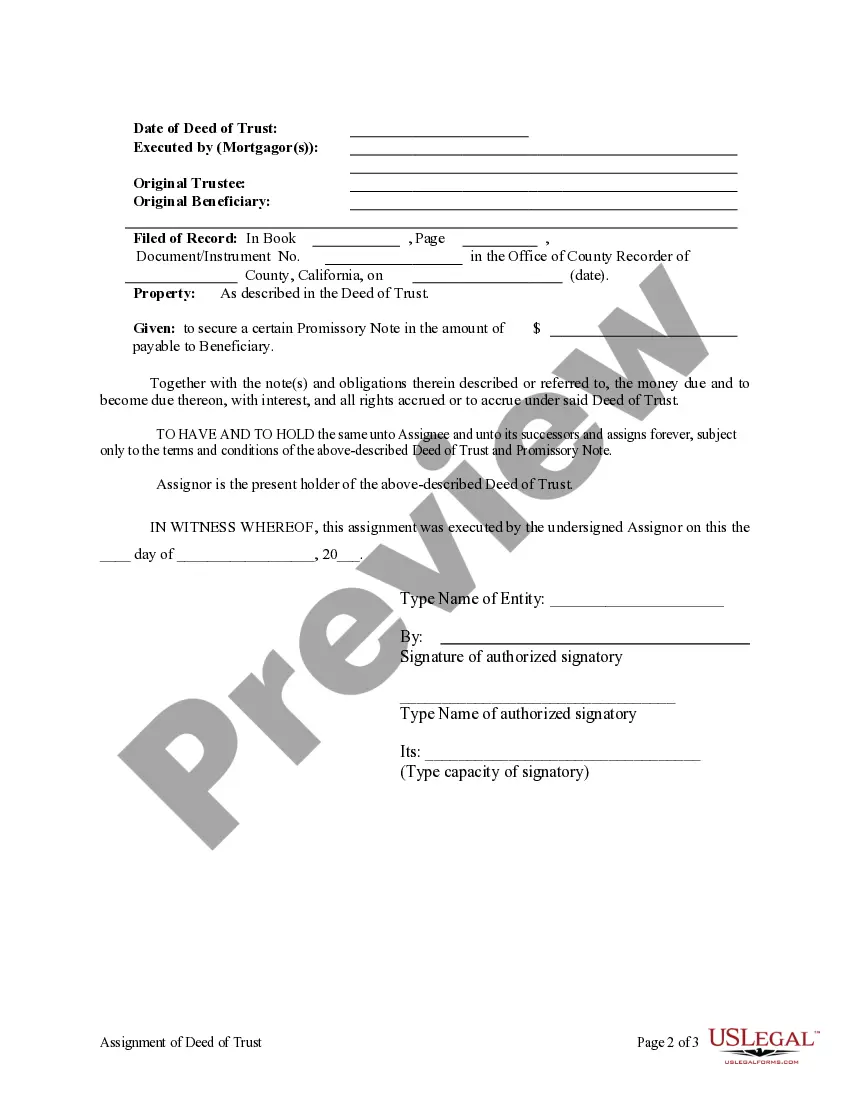

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Temecula California Assignment of Deed of Trust by Corporate Mortgage Holder

Description

How to fill out California Assignment Of Deed Of Trust By Corporate Mortgage Holder?

If you’ve previously employed our service, Log In to your account and retrieve the Temecula California Assignment of Deed of Trust by Corporate Mortgage Holder on your device by clicking the Download button. Ensure your subscription remains active. If it’s not, renew it in accordance with your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have continuous access to every document you have purchased: you can locate it in your profile under the My documents menu whenever you wish to use it again. Take advantage of the US Legal Forms service to quickly find and store any template for your personal or professional requirements!

- Ensure you’ve located the appropriate document. Review the description and utilize the Preview option, if available, to verify if it suits your requirements. If it’s unsuitable, use the Search tab above to discover the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Provide your credit card information or use the PayPal option to finalize the transaction.

- Retrieve your Temecula California Assignment of Deed of Trust by Corporate Mortgage Holder. Choose the file format for your document and store it on your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

The Assignment of trust typically refers to the transfer of beneficial interest in a trust or deed from one party to another. This process ensures that the rights and obligations associated with the trust are clearly defined and transferred. When dealing with a Temecula California Assignment of Deed of Trust by Corporate Mortgage Holder, knowing the meaning of this assignment helps clarify ownership and responsibilities.

A corporate Assignment deed of trust indicates a formal transfer of the mortgage interest from a corporation to an individual or another entity. This legal document outlines the details of the assignment and is crucial for protecting the rights of both the borrower and lender. Understanding a corporate Assignment of Deed of Trust in Temecula, California, helps ensure that all parties are aware of their responsibilities.

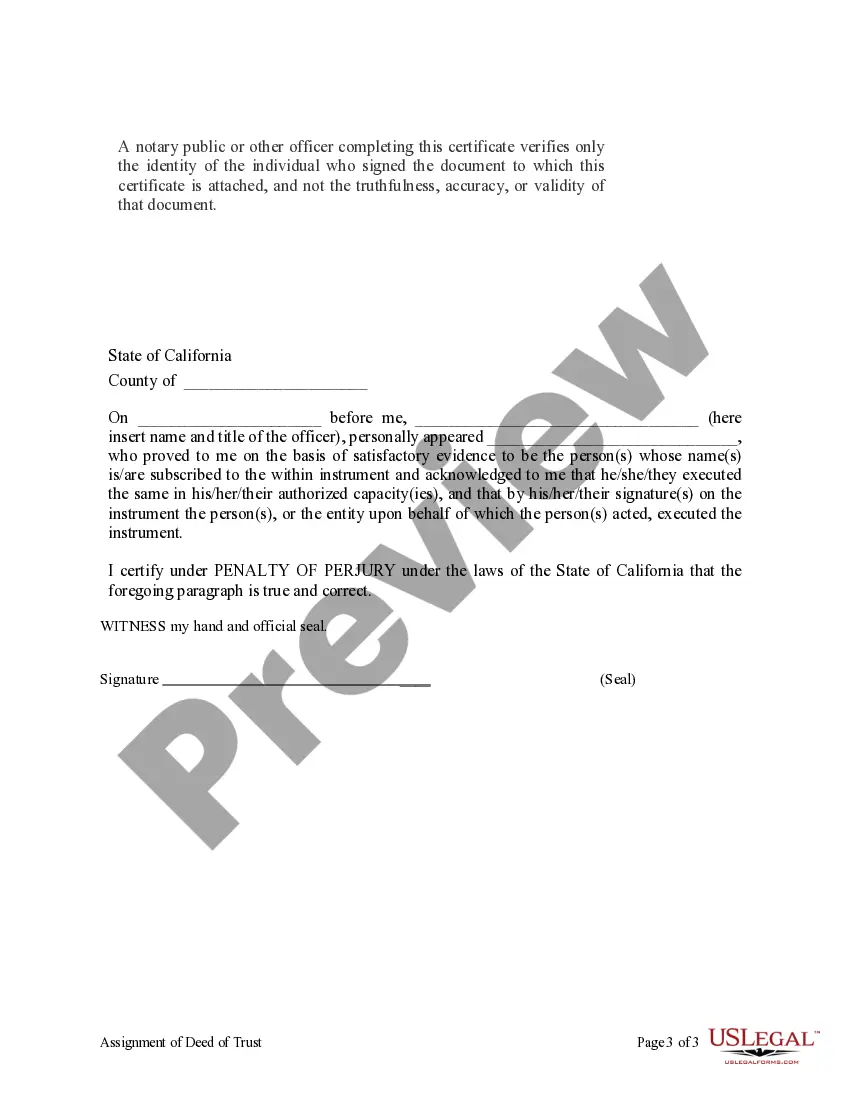

To file a deed of trust in California, you must prepare the document, which includes essential details about the property and the parties involved. After securing the necessary signatures, you need to record the deed with the county recorder's office where the property is located. This establishes the legal claim, particularly important in processes like a Temecula California Assignment of Deed of Trust by Corporate Mortgage Holder.

A corporate assignment refers to the transfer of a deed or property interest from a corporation to another party. This process is essential for maintaining accurate records when ownership changes hands. In Temecula, California, a corporate Assignment of Deed of Trust by Corporate Mortgage Holder ensures that the mortgage documents reflect the current holder of the deed.

To obtain a copy of your deed of trust in California, you can request it from the county recorder's office where the property is located. Many counties offer online access to these documents, making it easier for you to retrieve your records. When dealing with your deed, especially in relation to the Temecula California Assignment of Deed of Trust by Corporate Mortgage Holder, ensure you have the correct property details to expedite the process.

Yes, you can set up a trust without an attorney in California, but doing so requires careful attention to detail. Online resources and platforms, including uslegalforms, can guide you through creating your trust. However, remember that the Temecula California Assignment of Deed of Trust by Corporate Mortgage Holder may involve complex legal considerations that are best navigated with professional advice.

Choosing between a will and a trust in California depends on your specific needs. A trust often offers more control over your assets and can help avoid probate, which can be lengthy and expensive. Many people in Temecula California choose a trust to ensure their wishes are honored efficiently. It's wise to consider the Temecula California Assignment of Deed of Trust by Corporate Mortgage Holder for your estate planning.

To complete an Assignment of mortgage, begin by obtaining the original mortgage documents and prepare a new assignment document. This should include relevant details about the property, the parties involved, and the terms of the assignment. Utilizing the Temecula California Assignment of Deed of Trust by Corporate Mortgage Holder as a template can simplify this process. Platforms like uslegalforms provide valuable resources to help you navigate the steps, ensuring completeness and compliance.

Documents on behalf of a trust are signed by the trustee, who acts in accordance with the instructions laid out in the trust agreement. For example, in the case of the Temecula California Assignment of Deed of Trust by Corporate Mortgage Holder, the trustee holds the responsibility of signing pertinent legal documents. It is important for the trustee to understand their duties thoroughly to ensure that all actions align with the trust's objectives. This clarity helps prevent issues during property transfer.

The Assignment of a deed of trust is typically signed by the original lender or the current mortgage holder. In scenarios involving the Temecula California Assignment of Deed of Trust by Corporate Mortgage Holder, corporate representatives often execute this document. It is essential to ensure that the signing authority is correctly documented to validate the assignment. This simplifies the process, making it easier for you to navigate future transactions.