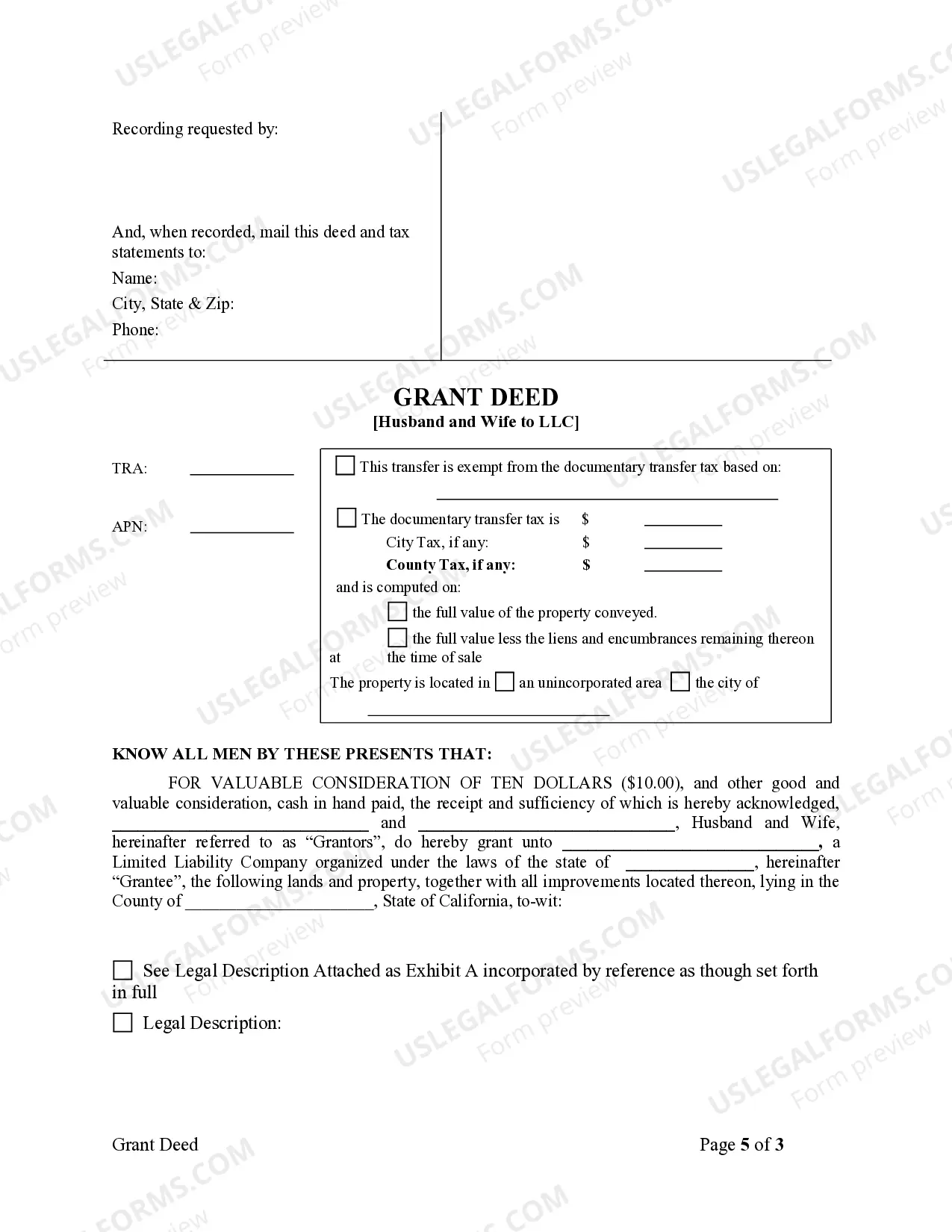

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

Irvine California Grant Deed from Husband and Wife to LLC

Description

How to fill out California Grant Deed From Husband And Wife To LLC?

Locating validated templates pertinent to your local statutes can be daunting unless you utilize the US Legal Forms repository.

It’s an online resource containing over 85,000 legal forms catering to both personal and professional requirements, as well as various real-life situations.

All documents are accurately categorized by application area and jurisdictional zones, making it simple and straightforward to find the Irvine California Grant Deed from Husband and Wife to LLC.

Maintaining documents organized and in accordance with legal standards is critically important. Take advantage of the US Legal Forms library to always have crucial document templates for any requirements readily available!

- Review the Preview mode and document description.

- Ensure you’ve selected the right one that fulfills your requirements and fully aligns with your local jurisdiction criteria.

- Search for an alternative template if necessary.

- If you detect any discrepancies, utilize the Search tab above to locate the appropriate one. If it meets your needs, proceed to the next step.

- Complete the purchase.

- Click the Buy Now button and select the subscription plan you desire. You will need to register for an account to access the repository’s features.

Form popularity

FAQ

The best tenancy for a married couple often depends on individual circumstances and future plans. Joint Tenancy is popular for its simplicity and right of survivorship, allowing automatic transfer of property to the surviving spouse. Community Property may better suit couples who want equal ownership and no additional taxes upon inheritance. Using an Irvine California Grant Deed from Husband and Wife to LLC can also be an excellent strategy, as it combines the benefits of asset protection with flexibility in property management.

In California, married couples can hold title in several ways, including Joint Tenancy, Community Property, and Community Property with Right of Survivorship. Each method has distinct legal implications, particularly when it comes to inheritance and control of the property. To secure your interests, you might consider utilizing an Irvine California Grant Deed from Husband and Wife to LLC, which can provide additional protections and simplify the transfer of ownership. This deed allows you to efficiently transfer your property into an LLC, safeguarding your assets.

People often choose to place their property in an LLC for several reasons, including protection from liabilities and ease of property management. An Irvine California Grant Deed from Husband and Wife to LLC facilitates this process, making it straightforward to separate personal assets from business risks. Furthermore, an LLC can provide tax advantages and preserve family wealth. This approach is increasingly popular among real estate investors and individuals looking to secure their assets.

Putting your house in an LLC in California can offer benefits such as asset protection and simplified management. When you transfer your property using an Irvine California Grant Deed from Husband and Wife to LLC, you safeguard your investment from potential legal claims. Additionally, an LLC may help with tax benefits and business credibility. It's essential to assess your unique situation and determine if this step aligns with your financial goals.

Yes, in California, a grant deed can be revoked, usually through creating and recording a new deed that nullifies the previous transfer. This process often involves executing a revocation deed that states your intent clearly. You may also need to notify any affected parties. For assistance with this legal process, consider accessing templates and guidance from US Legal Forms, which can provide the necessary steps.

To amend a grant deed in California, you need to create an amendment document that specifies the changes you wish to make. Be sure to include all relevant details about the property and current owners. Sign the document before a notary public and file the amendment with the county recorder's office. Again, utilizing resources from US Legal Forms can simplify this amendment process, ensuring compliance with local laws.

In California, obtaining a grant deed typically takes a few days to a couple of weeks, depending on several factors. Once you prepare the grant deed, you can file it with the county recorder’s office, where processing times may vary. However, using platforms such as US Legal Forms can help streamline the process, offering resources for quick and efficient deed preparation.

Removing a person from a grant deed requires drafting a new grant deed that reflects the change in ownership. Ensure you include the proper identification of all parties and the property. After signing the new deed in front of a notary, you will need to record it with your local county office. For ease and accuracy, consider using tools from US Legal Forms to guide you through this process.

To remove someone from a grant deed in California, you typically need to execute a new grant deed that excludes the individual in question. You should clearly identify all parties and the property details in the document. After the new grant deed is prepared, sign it in front of a notary and file it with the county recorder’s office. Utilizing the services of platforms like US Legal Forms can simplify this process, ensuring correct completion.

For married couples, holding title as community property is frequently the most beneficial method, as it recognizes both partners as equal owners and simplifies estate matters. Another option is joint tenancy with right of survivorship, which provides automatic transfer of ownership upon death. If you decide to pursue an Irvine California Grant Deed from Husband and Wife to LLC, you can further safeguard your interests and streamline asset management. Consulting with a legal professional ensures that you choose the best approach tailored to your circumstances.