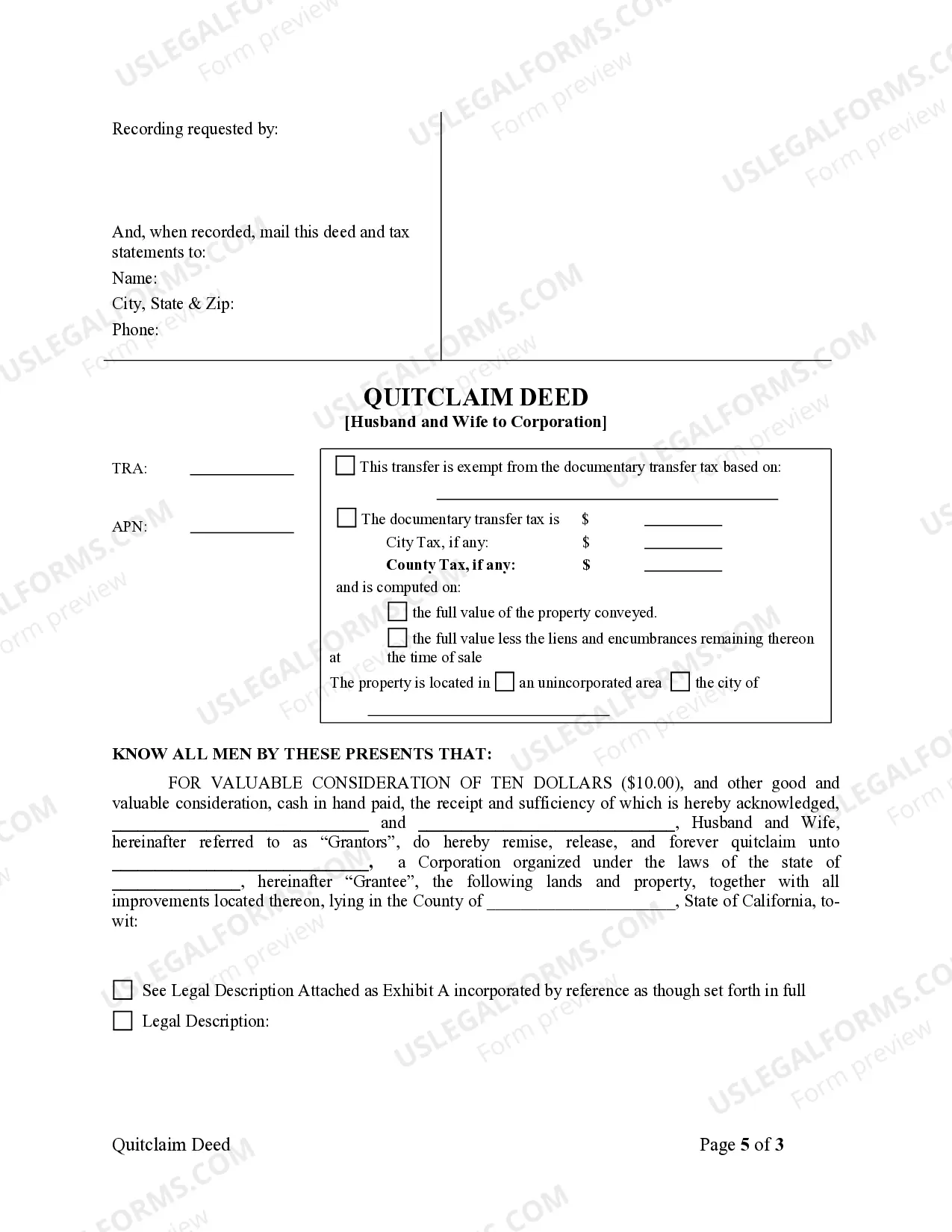

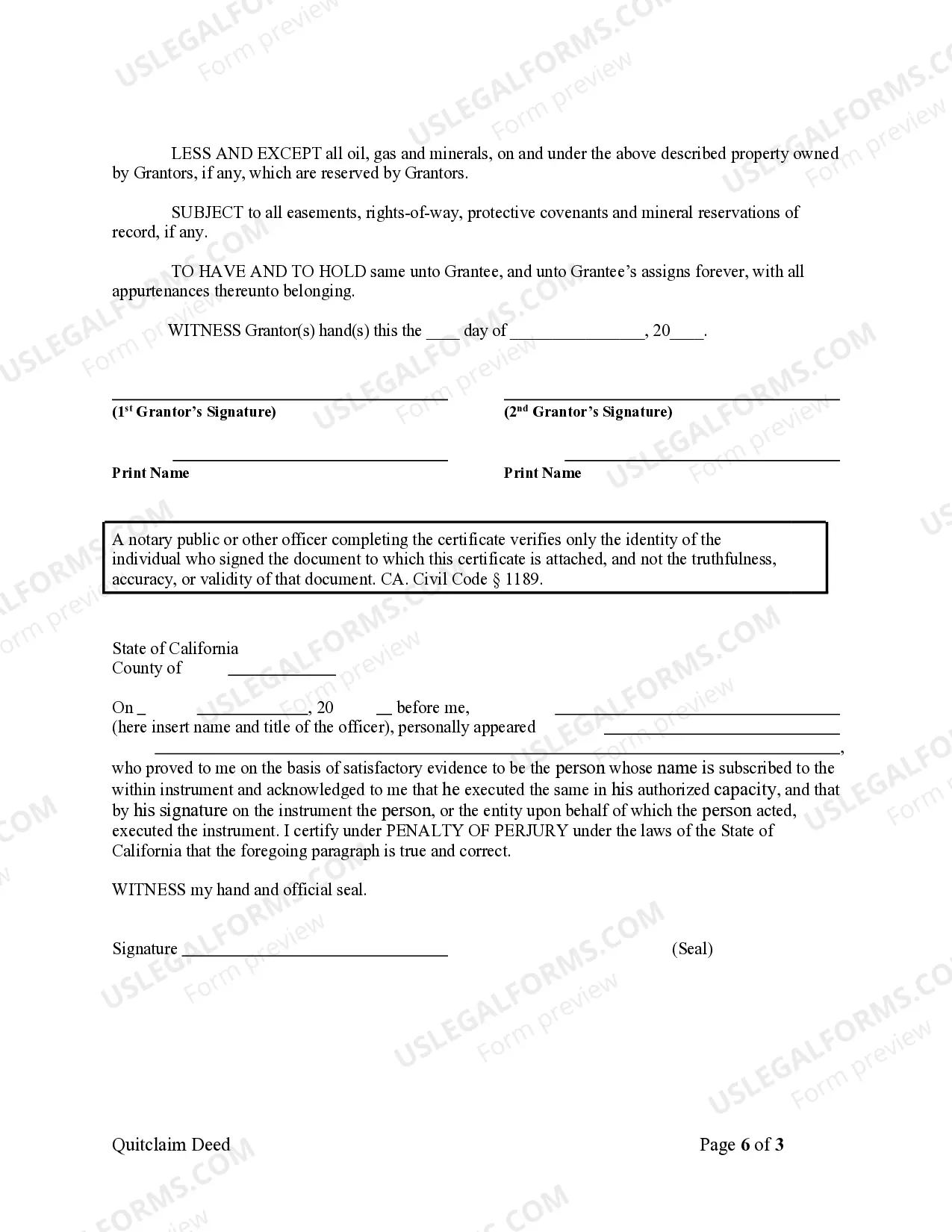

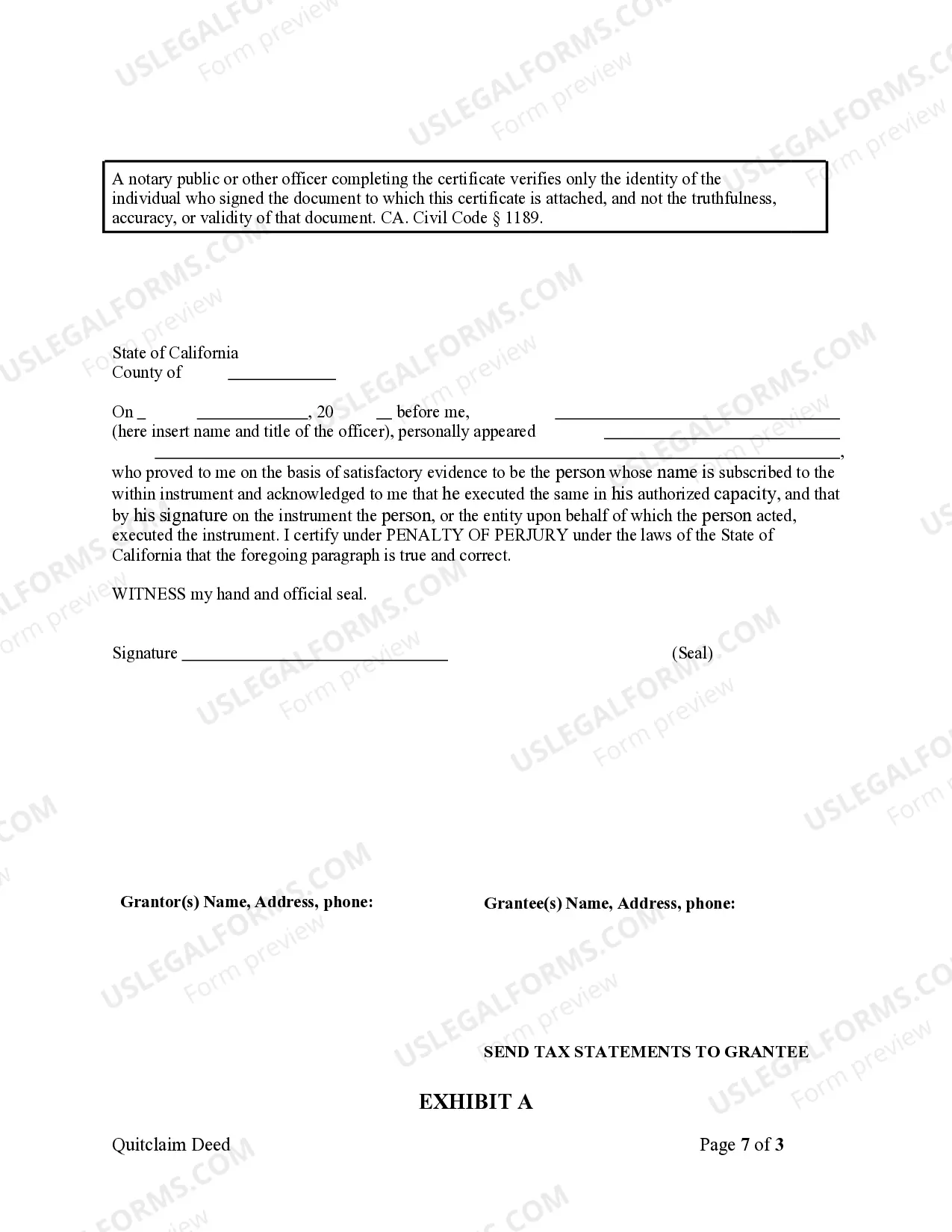

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Burbank California Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out California Quitclaim Deed From Husband And Wife To Corporation?

Finding authenticated templates that are tailored to your local laws can be challenging unless you utilize the US Legal Forms database.

This is an online repository containing over 85,000 legal documents for personal and professional requirements along with various real-world situations.

All the files are duly organized by usage area and jurisdiction types, making the search for the Burbank California Quitclaim Deed from Husband and Wife to Corporation as simple and straightforward as possible.

- Verify the Preview mode and form explanation.

- Ensure you’ve chosen the appropriate one that fulfills your requirements and aligns with your local jurisdiction standards.

- Look for another template if necessary.

- If you notice any discrepancies, use the Search tab above to find the correct one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Once a spouse signs a quitclaim deed in California, they typically relinquish any rights to the property being transferred. This deed effectively transfers ownership to the designated recipient, such as a corporation. Therefore, it is critical to understand the implications before signing. For a thorough understanding of rights and responsibilities, refer to resources like US Legal Forms while handling a Burbank California Quitclaim Deed from Husband and Wife to Corporation.

To fill out a California quitclaim deed, start by inserting the names of the current owners, followed by the name of the corporation receiving the property. Be sure to include a detailed description of the property in question. Lastly, both spouses must sign the form before a notary public to validate the transfer. For a seamless experience in creating a Burbank California Quitclaim Deed from Husband and Wife to Corporation, consider visiting US Legal Forms.

An example of a quitclaim deed could involve a couple who jointly own their home. If they decide to transfer ownership to their newly formed corporation, they would use a quitclaim deed to do so. This deed eliminates any claims they might have on the property going forward, transferring all rights to the corporation. In this context, a Burbank California Quitclaim Deed from Husband and Wife to Corporation serves as a practical solution.

The most common reason for using a quitclaim deed is to transfer ownership of property without the complexities of a sale. This can happen between family members or to streamline property ownership. When a husband and wife want to transfer property to a corporation, a quitclaim deed efficiently executes this intention. A Burbank California Quitclaim Deed from Husband and Wife to Corporation is ideal for these situations, ensuring clear transfer of ownership.

Filling out a quitclaim deed form involves several key steps. Start by entering the names of the current owners and the recipient, in this case, the corporation. Next, specify the property details, including its address and legal description. To ensure accuracy and compliance with local laws, utilizing US Legal Forms can simplify the creation of your Burbank California Quitclaim Deed from Husband and Wife to Corporation.

Yes, you can quit claim a deed to an LLC using a Burbank California Quitclaim Deed from Husband and Wife to Corporation. This transfer method is straightforward and effective for conveying ownership from spouses to the LLC. Make sure to execute the deed properly and record it to ensure legal validity. Utilizing a service like uslegalforms simplifies this process and helps maintain compliance.

Individuals often choose to place their property in an LLC for liability protection and tax benefits. This strategy can protect personal assets from business-related claims while offering pass-through taxation. When considering a Burbank California Quitclaim Deed from Husband and Wife to Corporation, it’s essential to understand how this move impacts ownership and management responsibilities. Consulting with professionals can provide valuable insights.

A quit claim deed between a husband and wife transfers property interests from one spouse to another without guaranteeing clear title. This document can be useful in various situations, such as during divorce or to add a spouse to a title. Utilizing the Burbank California Quitclaim Deed from Husband and Wife to Corporation allows partners to handle the transaction effortlessly. Always consider legal advice for clarity on implications.

To remove property from an LLC, you typically need to execute a quitclaim deed, transferring ownership back to the individuals or another entity. This deed must be correctly filled out, signed, and recorded with the county. Using the Burbank California Quitclaim Deed from Husband and Wife to Corporation can ensure a smooth transition. Platforms like uslegalforms streamline this process, providing essential guidance.

One disadvantage of placing property in an LLC involves limitations on financing options. Banks may view LLC-owned properties as higher risk, resulting in stricter lending criteria. Additionally, ongoing maintenance costs and administrative requirements can increase your expenses. It’s wise to weigh these factors when considering a Burbank California Quitclaim Deed from Husband and Wife to Corporation.