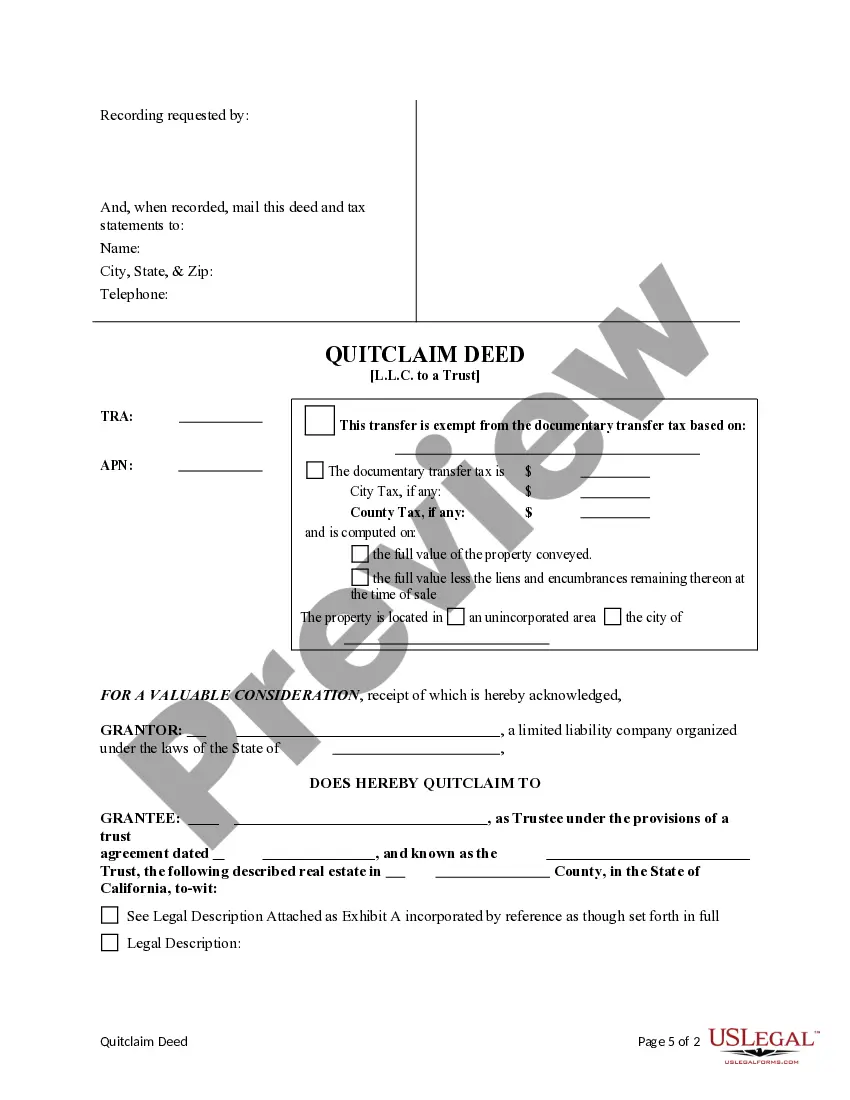

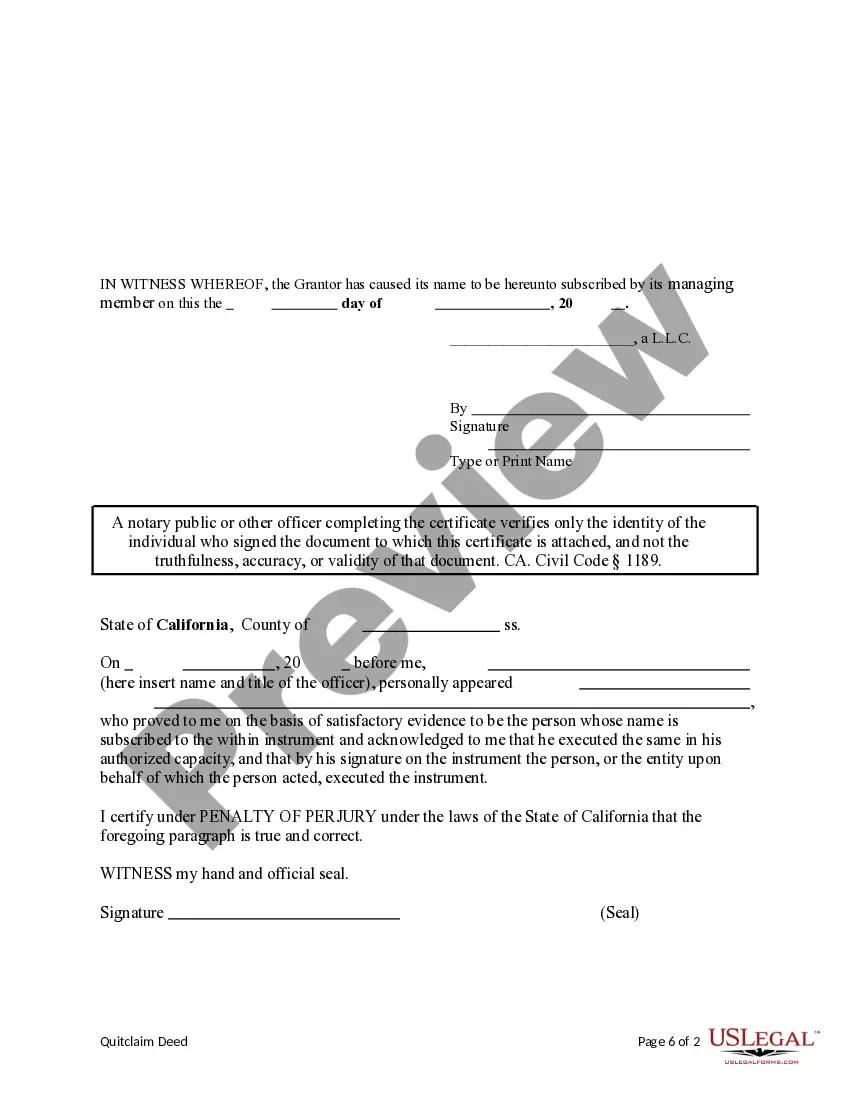

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Sunnyvale California Quitclaim Deed from a Limited Liability Company to a Trust

Description

How to fill out California Quitclaim Deed From A Limited Liability Company To A Trust?

If you are looking for a legitimate form template, it’s difficult to discover a more user-friendly platform than the US Legal Forms website – likely the most comprehensive libraries available online.

Here, you can obtain a wide variety of form samples for both business and personal needs by categories and locations, or keywords.

With our superior search capabilities, locating the most current Sunnyvale California Quitclaim Deed from a Limited Liability Company to a Trust is as simple as 1-2-3.

Obtain the form. Choose the format and save it on your device.

Make modifications. Fill out, alter, print, and sign the acquired Sunnyvale California Quitclaim Deed from a Limited Liability Company to a Trust.

- If you are already familiar with our system and possess a registered account, all you have to do to receive the Sunnyvale California Quitclaim Deed from a Limited Liability Company to a Trust is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just follow the instructions below.

- Ensure you have located the form you need. Review its description and utilize the Preview feature (if available) to verify its content. If it doesn’t fulfill your needs, use the Search field at the top of the page to find the necessary document.

- Confirm your choice. Click the Buy now button. After that, choose your desired pricing plan and provide details to register for an account.

- Complete the financial transaction. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

Placing your LLC in a trust can provide several benefits, including asset protection and ease of transfer upon your passing. A Sunnyvale California Quitclaim Deed from a Limited Liability Company to a Trust can simplify the management of your business assets and ensure they remain in line with your estate plan. Overall, this approach can enhance financial security for your heirs and provide peace of mind. If you're considering this option, uslegalforms can assist you with the necessary legal documents to make the transition smooth and compliant.

One disadvantage of placing property in a trust is the potential for increased administrative costs and complexities. When utilizing a Sunnyvale California Quitclaim Deed from a Limited Liability Company to a Trust, you may encounter ongoing legal fees and taxes. Furthermore, once property is in trust, the terms are typically less flexible, which can limit your control over the assets. It is wise to weigh these factors carefully and consider professional advice to best navigate your options.

Yes, placing an LLC into a trust can provide several benefits, such as simplifying the transfer of assets. When using a Sunnyvale California Quitclaim Deed from a Limited Liability Company to a Trust, you help ensure a smoother transition for your beneficiaries. Additionally, this strategy can offer increased privacy and protection against estate taxes. However, it’s important to consult with legal professionals to understand how this impacts your specific situation.

The primary beneficiaries of a quitclaim deed are the grantor and the recipient, in this case when transferring from a Limited Liability Company to a trust. The trust gains property, which can provide asset protection and management benefits. Additionally, this transfer can simplify estate planning and can lead to tax benefits for the beneficiaries as well. Utilizing uslegalforms can help ensure that this process is handled efficiently and in accordance with Sunnyvale regulations.

To quitclaim a deed to a trust, you must prepare a quitclaim deed that indicates the property owner is transferring their interest to the trust. Ensure you include all relevant details, such as the property description and trustee's name. After signing the deed, you must record it with the local county recorder's office in Sunnyvale, California. If you need a streamlined solution, uslegalforms can provide you with templates tailored for this purpose.

Yes, you can execute a quitclaim deed from a trust to another party, preserving the rights of the beneficiaries. This process allows the trustee to transfer property from the trust to an individual or entity without warranties. In Sunnyvale, California, this deed must be appropriately executed and recorded to ensure the transfer is legally recognized. For assistance, uslegalforms offers resources to help you create and file the deed correctly.

To transfer property from a Limited Liability Company to a trust in Sunnyvale, California, you will need to draft a quitclaim deed. This document formally shows the transfer of ownership from the LLC to the trust. It's recommended to include details about the property and the names of both the LLC and the trust for clarity. Using a platform like uslegalforms can simplify this process by providing the necessary templates and guidance.